Claim Tax Rebate Union Subscriptions Web 27 mars 2012 nbsp 0183 32 note that with qualifying union subs it is common that only part of the sub is allowable for the tax relief your union website should provide the relevant for

Web The NASUWT offers special subscription rates for students newly qualified teachers and members on maternity adoption leave as well as rewards when you recruit new Web Subscriptions Rebate Services Specialist tax rebate company getting tax back for teachers on union and subscription fees 0161 370 6555 info srs teachers co uk

Claim Tax Rebate Union Subscriptions

Claim Tax Rebate Union Subscriptions

http://www.dnsassociates.co.uk/assets/img/blog/how-to-fill-the-form-p87.png

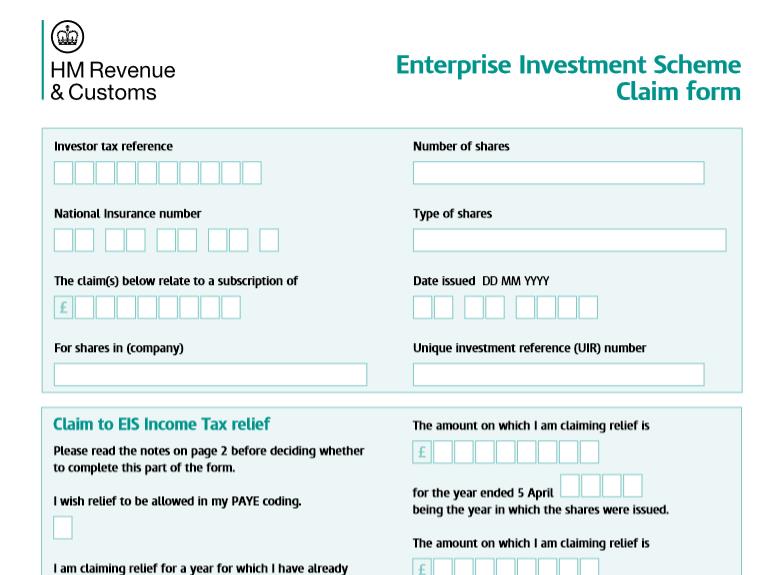

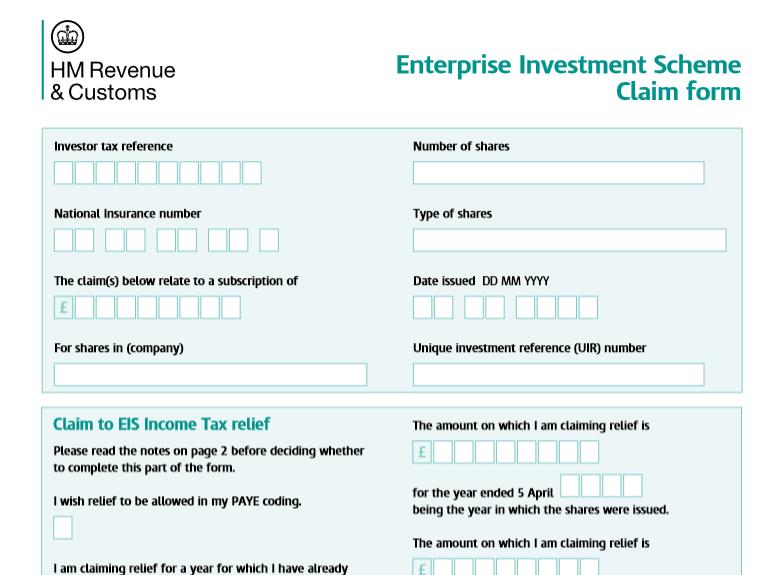

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.syndicateroom.com/images/EIS3-claim-form.jpg

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

https://gstguntur.com/wp-content/uploads/2021/07/Section-87A-Rebate-Income-Tax-Act-768x432.png

Web Claiming Tax Back On Union Subscriptions If you are in a profession where you must pay a subscription or a professional fee it is highly likely that you are entitled to tax relief Web 19 ao 251 t 2019 nbsp 0183 32 As you can claim tax relief going back 4 years see below a 20 taxpayer could possibly receive a tax refund worth around 163 96 for their union fee You would

Web 12 6 UNISON Subs The Inland Revenue has agreed that Nursing sector Ambulance sector Voluntary sector Professional and Technical A sector Professional and Technical B Web Tax relief on subscriptions UCU members are entitled to offset a proportion of subscriptions paid against tax paid less any voluntary contribution made to the

Download Claim Tax Rebate Union Subscriptions

More picture related to Claim Tax Rebate Union Subscriptions

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/P800_Calculation.jpeg

Bupa Tax Exemption Form Private Health Insurance Rebate On Your Tax

https://i1.wp.com/www.yumpu.com/en/image/facebook/38734313.jpg

Bupa Tax Exemption Form Private Health Insurance Rebate On Your Tax

https://lh3.googleusercontent.com/blogger_img_proxy/AByxGDQS8nmwG6ouztF308jEfSySrXYw0H8N1idhlnA24WvKdZAhrfTE_xwJMrigw2IGKfN5etN4a65cLKNhM-sGysO_D_NlfBJve5pjRkHDzMtN-B-c6FH1Zu9UNXTIF6_iUpK194ythQZo2HF7JcV1Cq23zqCm8aUyA-Tb8FAXTFbT1olqOOwzzQIF4rdUmdnBi_uRvcwzmA=w1200-h630-p-k-no-nu

Web You are able to claim for the last four years and claims may only be made where you pay the fee yourself You can also claim tax relief for subscriptions to some professional Web Members of most teaching unions are entitled to make a rebate claim on the subscription fees they have paid over the past 4 years which could be worth between 163 150 and 163 250 Your tax free allowance will also

Web If you are a member of a teaching union e g NEU NASUWT you are entitled to claim tax relief on your union subscription fees You can back claim for up to 5 years expenses Web 24 nov 2022 nbsp 0183 32 Every professional body on the list has a unique agreement with HMRC for the amount of tax relief their members can claim Check on their website or email them

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Union Budget 2019 Full Tax Rebate For Annual Income Up To Rs 5 Lakhs

https://www.livelaw.in/h-upload/2019/02/01/750x450_piyush-goyal.jpg

https://forums.moneysavingexpert.com/discussion/3821733

Web 27 mars 2012 nbsp 0183 32 note that with qualifying union subs it is common that only part of the sub is allowable for the tax relief your union website should provide the relevant for

https://www.nasuwt.org.uk/about-us/subscriptions/subscriptions...

Web The NASUWT offers special subscription rates for students newly qualified teachers and members on maternity adoption leave as well as rewards when you recruit new

Union Budget 2023 New Tax Regime Explained Tax Rebate Hiked To 7

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Choosing The New Tax Regime You Can t Claim Tax Rebate For THESE 7

How To Claim Tax Back Online Revenue Refund Your Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Can I Claim Ppi Back From My Catalogue

Can I Claim Ppi Back From My Catalogue

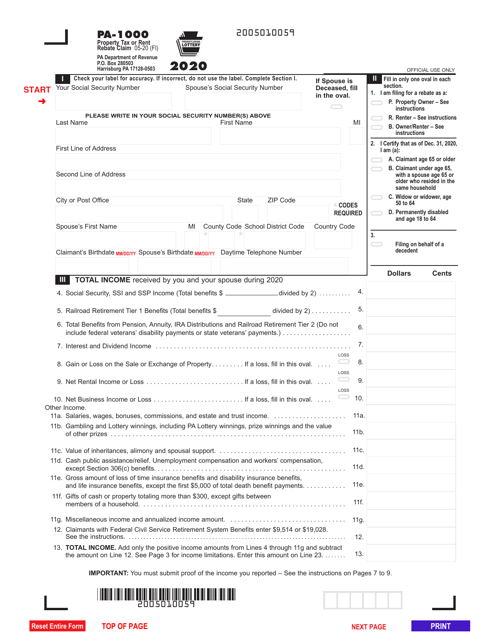

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

R D Tax Rebate Check Who Qualifies Business Owners 95 Of Eligible

Stamp Duty Claims Claim Your Stamp Duty Rebate TODAY

Claim Tax Rebate Union Subscriptions - Web Information on claiming back overpayments on your subscription Tax relief Following approval from HM Revenue and Customs HMRC UCU members can claim tax relief