Tax Rebate U S 87a For Ay 2024 23 Currently this limit stands at Rs 3 00 000 under the new regime for FY 2023 2024 However if your total income is upto Rs 7 00 000 under the new tax regime then you are entitled to get the benefit of tax rebate u s 87A of Rs 25 000 or 100 of the tax amount whichever is lower

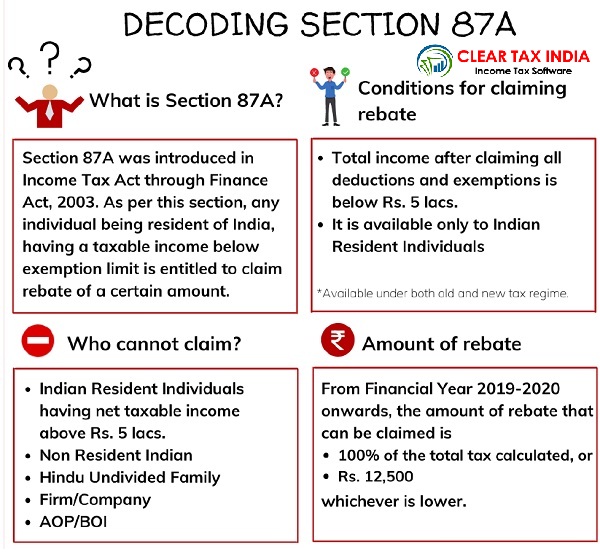

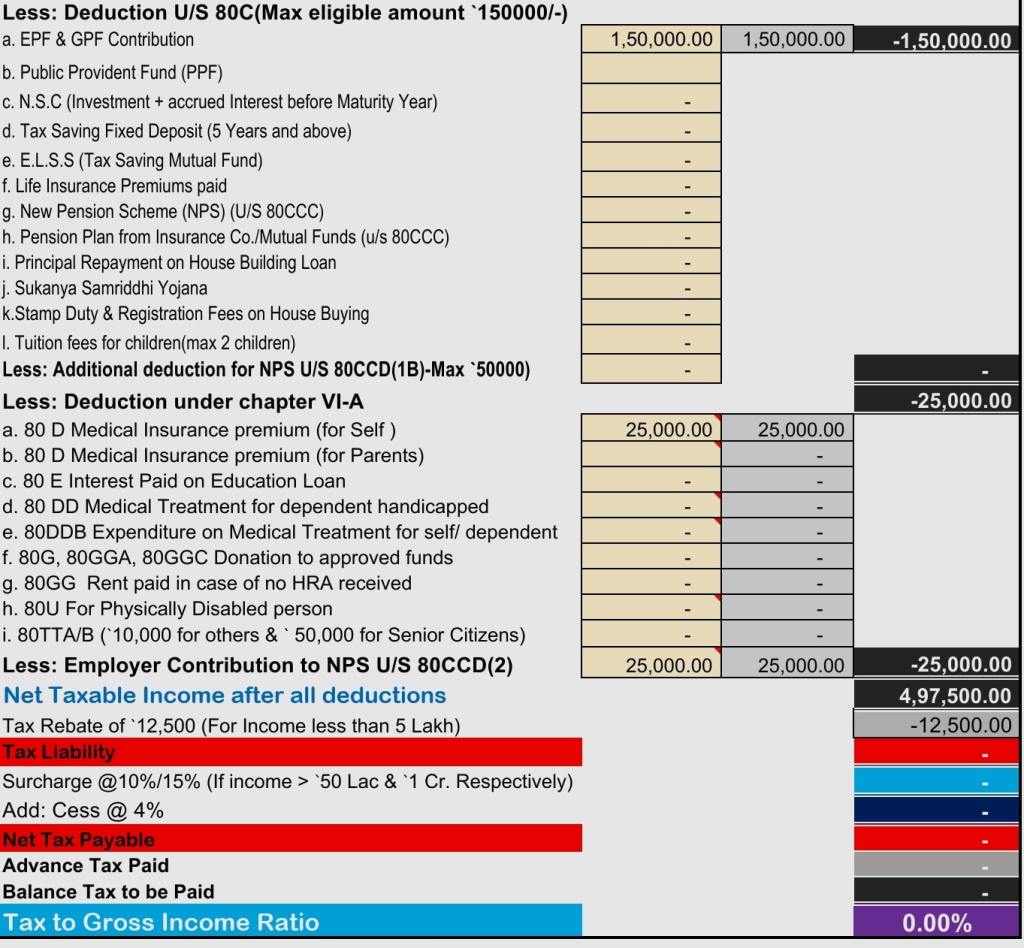

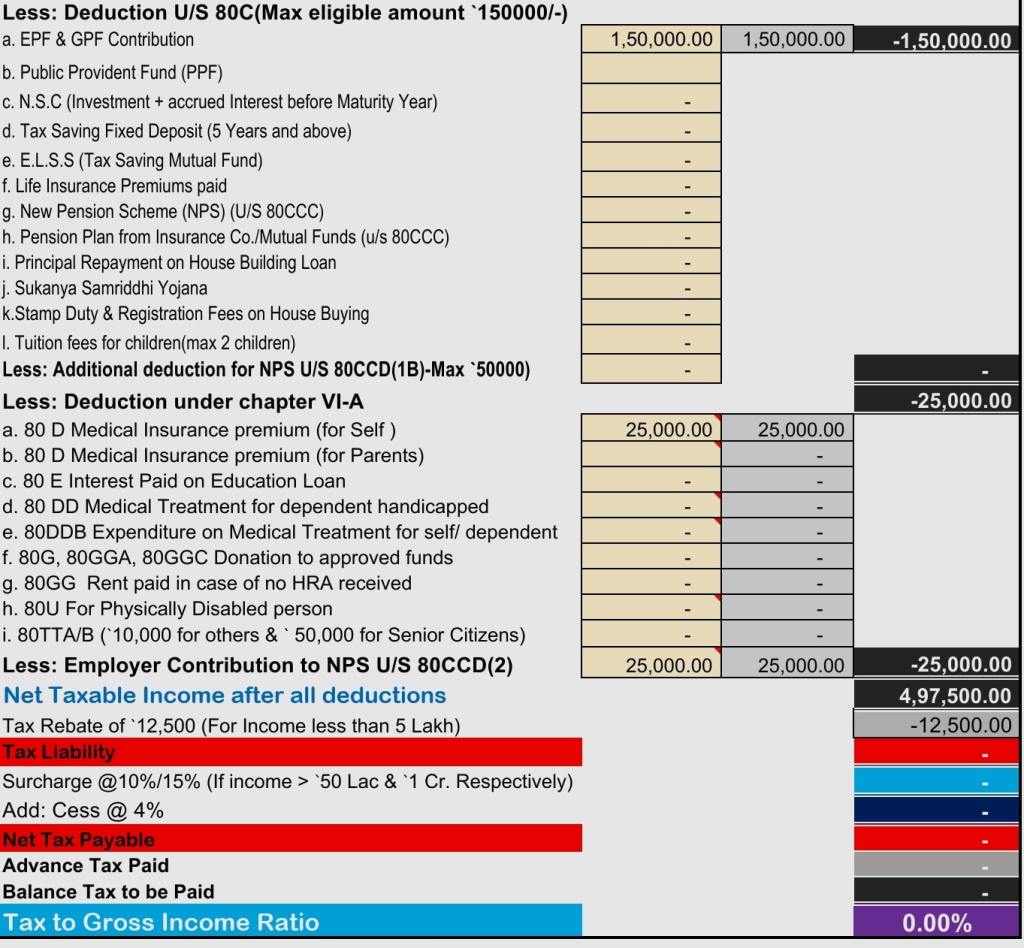

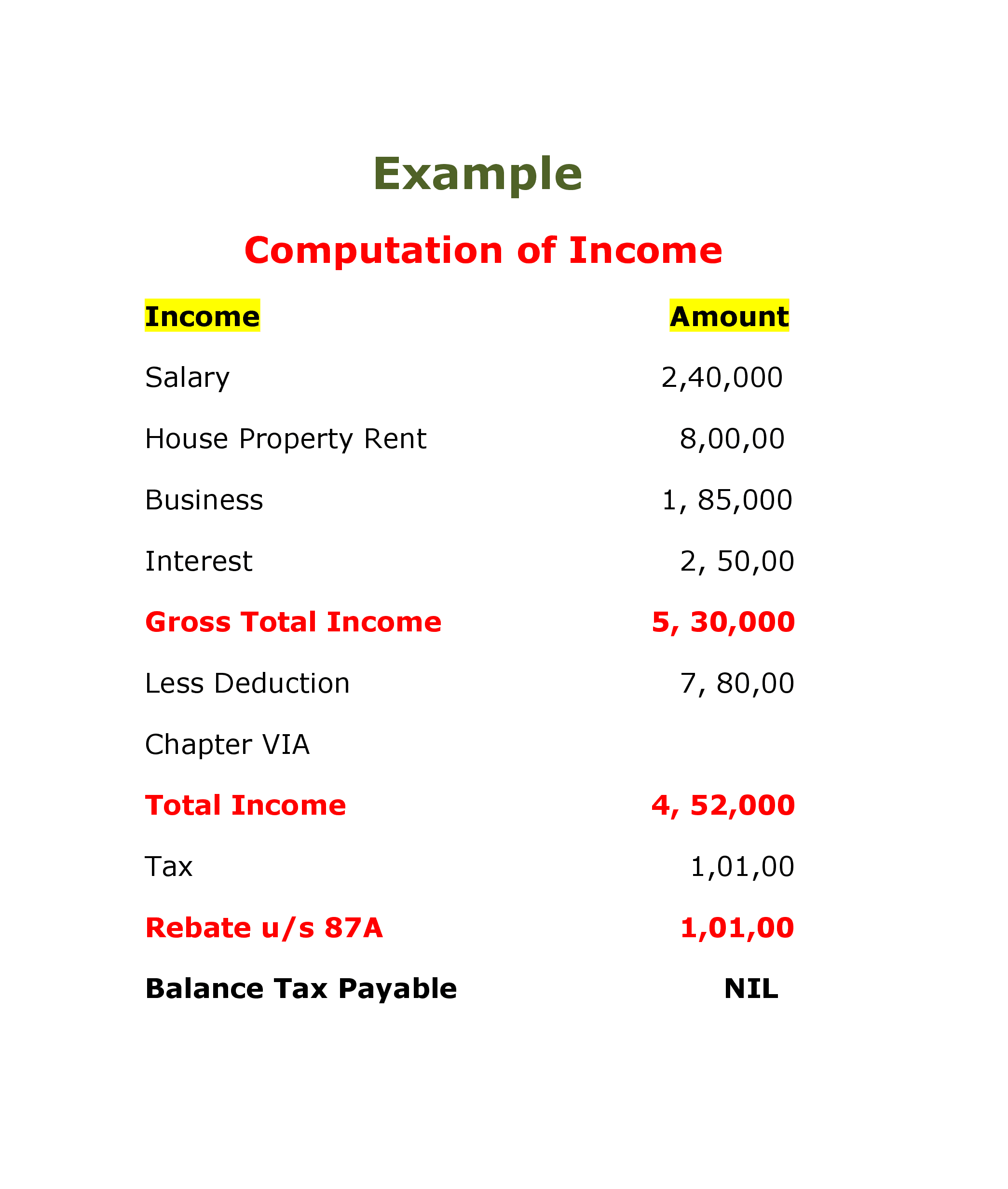

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A Contents hide Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

Tax Rebate U S 87a For Ay 2024 23

Tax Rebate U S 87a For Ay 2024 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

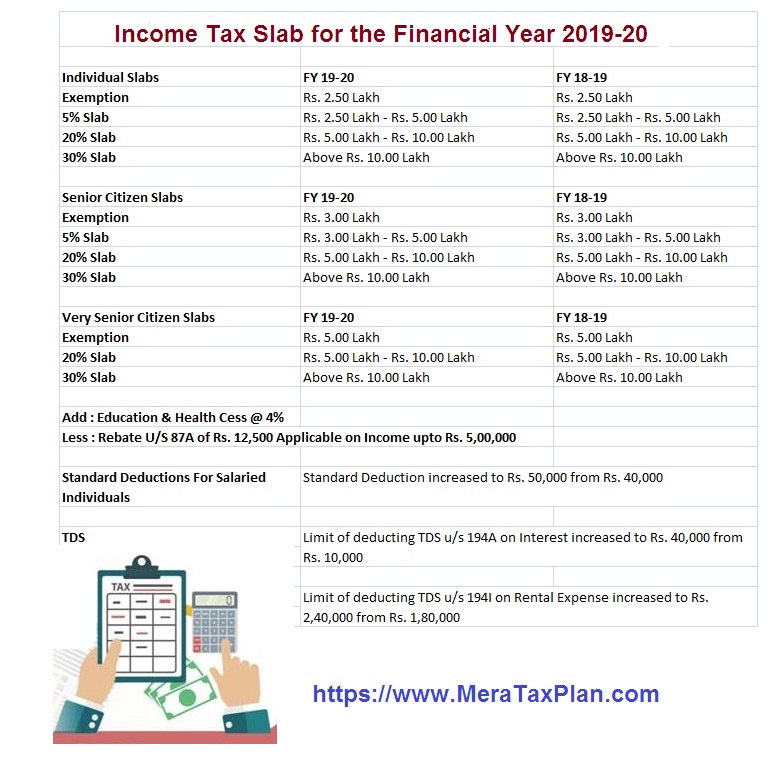

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh The Section 87A rebate limit for AY 2023 24 is Rs 5 00 000 under the old tax regime and Rs 7 00 000 under the new tax regime making individuals eligible for the rebate if their taxable income is within the specified limit

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident individual whose taxable income is up to INR 7 00 000 then you can avail of

Download Tax Rebate U S 87a For Ay 2024 23

More picture related to Tax Rebate U S 87a For Ay 2024 23

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?resize=1024%2C576&ssl=1

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/income-tax-rebate-u-s-87a-for-the-fy-2020-21-ay-2021-22-fy-2019.jpg?fit=1280%2C720&ssl=1

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/Screenshot_20230524_084225_Microsoft-365-Office.jpg

According to the Income tax Act the rebate under section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided Family HUF and firms are not eligible for the rebate under Section 87A Section 87A of the Income Tax Act specifies eligibility guidelines and rebates for qualified taxpayers When the income exceeds the threshold limit the tax will become zero The following blog will explain who qualifies for an income tax rebate under Section 87A and how to claim it

This article aims to demystify the rebate under Section 87A especially for non government employees and introduce an Excel based automatic income tax calculator designed for the financial year 2024 25 following the latest Budget 2024 provisions From assessment year 2024 25 onwards an assessee being an individual resident in India whose income is chargeable to tax under the proposed sub section 1A of section 115BAC shall now be entitled to a rebate of 100 per cent of the amount of income tax payable on a total income not exceeding Rs 7 lakh

Income Tax Sec 87A Amendment Rebate YouTube

https://i.ytimg.com/vi/sg50vzyjXQY/maxresdefault.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim Rebate U s 87A YouTube

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

https://tax2win.in/guide/section-87a

Currently this limit stands at Rs 3 00 000 under the new regime for FY 2023 2024 However if your total income is upto Rs 7 00 000 under the new tax regime then you are entitled to get the benefit of tax rebate u s 87A of Rs 25 000 or 100 of the tax amount whichever is lower

https://taxconcept.net/income-tax/income-tax...

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A Contents hide

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Sec 87A Amendment Rebate YouTube

Rebate U s 87A Of I Tax Act Income Tax

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Union Budget 2023 Rebate U s 87A Enhanced For New Income Tax Regime TaxCharcha

Income Tax Rebate Under Section 87A

87A Rebate Rebate U s 87A How To Get Income Tax Rebate

Tax Rebate U S 87a For Ay 2024 23 - The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident individual whose taxable income is up to INR 7 00 000 then you can avail of