How Much Property Tax And Interest Can I Deduct In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10 000 or

How Much Property Tax And Interest Can I Deduct

How Much Property Tax And Interest Can I Deduct

https://www.nj.com/resizer/hxhZ3w0hAZ_ZERP8_th70nVL_jU=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/N72K62JNPFB4FI64QGLJIU67ZU.jpg

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

You can deduct the interest on mortgages of up to 1 million that you use to buy construct or improve your first or second home You can also deduct the interest on up to 100 000 of home equity debt regardless of how you use the loan proceeds You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return

How much mortgage interest can I deduct from my taxes You can deduct the interest you paid during the tax year on the first 750 000 of your mortgage according to the IRS For married couples Fully deductible interest In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage

Download How Much Property Tax And Interest Can I Deduct

More picture related to How Much Property Tax And Interest Can I Deduct

Preparing House For Sale Tax Deduction How To Get Benefits Tax

https://i.pinimg.com/originals/dc/b4/4f/dcb44f4207d6c494ab1ed28d943b00e1.jpg

Can You Deduct Mortgage Interest On Investment Property Commercial

https://aurumsharpe.com/wp-content/uploads/2022/09/hh.jpg

What Types Of Interest Can I Deduct For Taxes

https://blog.bakerave.com/hubfs/What Interest Can You Deduct for Taxes.jpg#keepProtocol

Homeowners can deduct the interest paid on up to 750 000 in mortgage debt The TCJA also nearly doubled the standard tax deduction while eliminating the personal exemption from the tax code You can deduct up to 10 000 of property taxes as a married couple filing jointly or 5 000 if you are single or married filing separately Depending on your location the property tax deduction can be very

You can deduct up to 10 000 or 5 000 if married filing separately of state and local taxes including personal property taxes Where to Report Personal Property on Your Key Takeaways Interest is the amount of money you pay a lender to borrow money The Internal Revenue Service IRS allows taxpayers to deduct several interest

Can I Deduct Health Insurance Premiums If I m Self Employed The

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=1200%2C800&ssl=1

Should You Take Out A Mortgage To Deduct The Interest RHS Financial

https://rhsfinancial.com/wp-content/uploads/2016/04/house-and-percent-sign-means-investment-or-discount_zkVgNVw_.jpg

https://www.nerdwallet.com › article › taxe…

In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

https://www.nerdwallet.com › article › taxes › mortgage...

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are

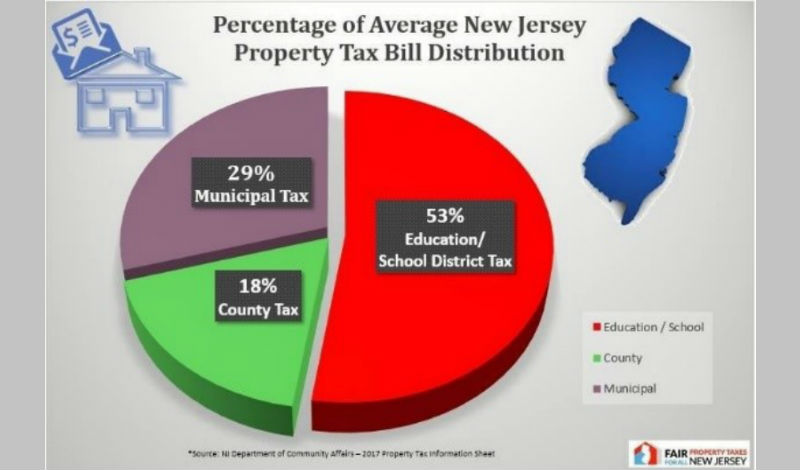

Percentage Of Property Tax That Goes To School Funding School Walls

Can I Deduct Health Insurance Premiums If I m Self Employed The

How Much Student Loan Interest Can I Deduct UnderstandLoans

Can I Deduct My Monthly Internet Bill On My Taxes Kingdom Financial

How To Easily Add Deduct Or Calculate Percentage YouTube

How Much Mortgage Interest Can I Deduct In 2022 The Enlightened Mindset

How Much Mortgage Interest Can I Deduct In 2022 The Enlightened Mindset

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

List Of Tax Deductions Here s What You Can Deduct

How Much Mortgage Interest Can I Deduct In 2023 Leia Aqui Is Mortgage

How Much Property Tax And Interest Can I Deduct - You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return