How Much Rebate For Solar Panels Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Find more on who can claim the credit Qualified expenses include the costs of new clean energy property including Solar electric panels Solar water heaters Wind turbines Geothermal heat pumps

How Much Rebate For Solar Panels

How Much Rebate For Solar Panels

https://www.powersmartsolutions.com.au/wp-content/uploads/2019/06/Business-Insider.jpg

The Best Rebates And Credits For Solar Panels Topic Answers

https://storage.googleapis.com/topicanswers-content/2020/10/bigstock-Solar-Panel-On-A-Red-Roof-14532428.jpg

5 Essential Questions To Consider Before Going Solar Energy For A

https://cloudenergy.com.ng/wp-content/uploads/2021/09/solar-panels.jpg

For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill On average a typical EnergySage Marketplace shopper saves an extra 9 716 on their solar costs when they claim the ITC

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total

Download How Much Rebate For Solar Panels

More picture related to How Much Rebate For Solar Panels

Solar Panels Other DIY Electricity Solutions Rethink Green

https://re-thinkgreen.com/wp-content/uploads/2016/03/Solar_Panels_square-1024x1024.jpg

How Solar Panels Work

https://www.driftwind.com.au/uploads/9/6/3/7/9637971/6ty5ymxgc_orig.gif

Calculate A Rebate YouTube

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

States utility companies and solar panel manufacturers offer rebates that in most cases immediately reduce the cost to install solar panels Rebates are a dollar for dollar reduction in the cost of solar usually paid directly to installers and passed along as savings to the consumer With a little extra paperwork during tax season you can effectively recover 30 of the total cost of your solar system with no maximum limit So you can claim a 6 000 credit on a 20 000 solar system or a 15 000 credit on a 50 000 system as long as you meet the eligibilty critera

The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for Per the Inflation Reduction Act the ITC is 30 of the solar system cost until 2033 and will gradually reduce until it expires in 2035 Property tax exemptions SREC markets and utility rebates

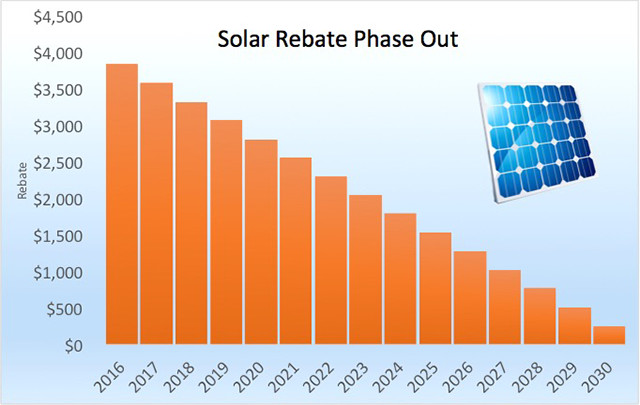

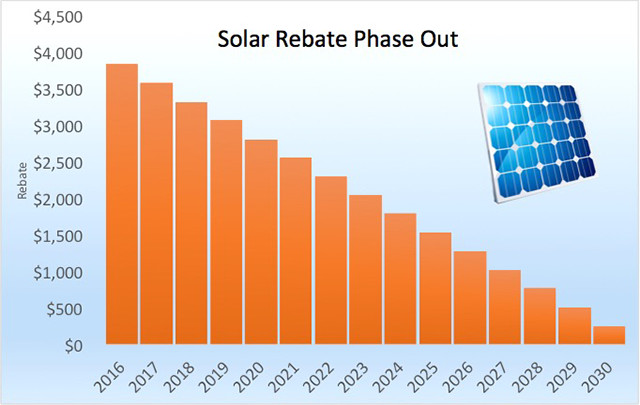

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

https://www.solarquotes.com.au/blog/wp-content/uploads/2016/05/solar-rebate-phase-out.jpg

How To Apply For A Rebate On Your Solar Panels REenergizeCO

https://www.reenergizeco.com/wp-content/uploads/2021/07/applying-for-solar-panel-rebate.jpg

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.solar.com/learn/federal-solar-tax-credit

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more

Rooftop Revolution Meet The Startup Providing A New Way To Pay For

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

Federal Solar Tax Credit What It Is How To Claim It For 2024

Y Branch Connector For Solar Panels Installation To Solar PV Panels

Going Solar A Comprehensive Overview Of The Benefits And Challenges

How Much Does A Solar Roof Cost 2023 Cost Estimates

How Much Does A Solar Roof Cost 2023 Cost Estimates

Applying For A Solar Panel PV Rebate Post Puff

Solar Panel Rebate Melbourne Government Rebate Solar Panels

How To Determine The Best Angle For Solar Panels Wolf Track Energy

How Much Rebate For Solar Panels - For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates