How Much Redundancy Is Tax Free In Ireland If you get a lump sum as compensation for losing your job part of it may be tax free Read more about how lump sum payments on redundancy are taxed More information

Redundancy lump sum payments You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each completed year of

How Much Redundancy Is Tax Free In Ireland

How Much Redundancy Is Tax Free In Ireland

https://investmentsforexpats.com/wp-content/uploads/2022/04/makarios-tang-a-hCmlnehyU-unsplash-scaled.jpg

Get More Tax free Savings With A Backdoor Roth IRA

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1kndw8.img?w=2048&h=1365&m=4&q=88

What Is Employee Redundancy UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2022/06/what-is-employee-redundancy-scaled.jpeg

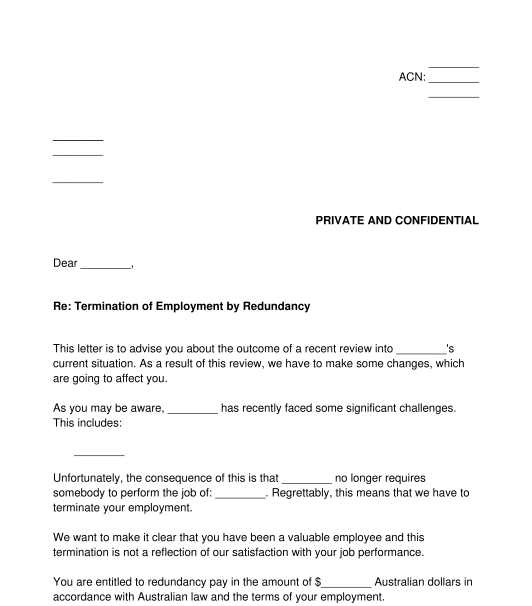

Lump sum payments on a redundancy or retirement are eligible for special tax treatment and may be partially or totally exempt from income tax PRSI and USC Note A lump sum paid Do I have a right to redundancy pay If you lose your job you may be eligible for redundancy pay This page summarises the rules on qualifying for a redundancy payment How much

If you have been made redundant you may qualify for a lump sum payment under the Redundancy Payments Act 1967 This payment is exempt from Income Tax and Universal The statutory redundancy payment is two week s gross pay per year of service up to a ceiling of 600 per week plus one week s pay which is also subject to the ceiling of 600 This payment

Download How Much Redundancy Is Tax Free In Ireland

More picture related to How Much Redundancy Is Tax Free In Ireland

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Redundancy Calculator How Much Are Employees Entitled To Factorial

https://factorialhr.co.uk/wp-content/uploads/2022/04/27174159/InfographicRedundancyPay.-scaled.jpg

Most payments from employers to employees are taxable but there is a special tax treatment for lump sum payments on a redundancy or retirement Statutory redundancy First up is the basic exemption of 10 160 plus 765 for each complete year of service which includes time worked before and after a career break but not the actual career break a period

You pay no tax on your redundancy payment if it is statutory up to a maximum lifetime limit of 200 000 You are also entitled to basic and increased tax exemptions for redundancy and retirement payments At the Up to March 2013 your redundancy lump sum may be completely tax free provided 75 or more of your entire period of employment ending on the date of

Income Tax On Gift Money How Much Money Is Tax Free In Gift Section

https://i.ytimg.com/vi/mO036He-RM4/maxresdefault.jpg

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

https://www.citizensinformation.ie/en/employment/...

If you get a lump sum as compensation for losing your job part of it may be tax free Read more about how lump sum payments on redundancy are taxed More information

https://www.revenue.ie/.../redundancy-lump-sum-payments.aspx

Redundancy lump sum payments You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief

Voluntary Redundancy Agreement

Income Tax On Gift Money How Much Money Is Tax Free In Gift Section

Does The Cost Of Living Payment Affect Universal Credit What The CoL

Tax Free Weekend Hours Guide

What Tax Do I Pay On Redundancy Payments Accounting Firms

Difference Between Tax Brackets And Tax Rates In India

Difference Between Tax Brackets And Tax Rates In India

What Can You Buy During Tax free Weekend Here s A Complete List The

Form 1040 U S Individual Income Tax Return 2015 MbcVirtual Income

Rates For Hosting Students English School St Brelade s College

How Much Redundancy Is Tax Free In Ireland - The statutory redundancy payment is two week s gross pay per year of service up to a ceiling of 600 per week plus one week s pay which is also subject to the ceiling of 600 This payment