How Much Rent Amount Is Exempted From Income Tax The part of your salary you receive to cover house rent and accommodation expenses is exempted from taxation However a few exceptions are included in

HRA exemption calculator helps you determine how much of the house rent allowance HRA in your salary gets exempted from tax Many employers offer house The house rent allowance exemption calculator will help determine how much tax you need to pay in a financial year HRA slabs also depend on the city you stay in For example if

How Much Rent Amount Is Exempted From Income Tax

How Much Rent Amount Is Exempted From Income Tax

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

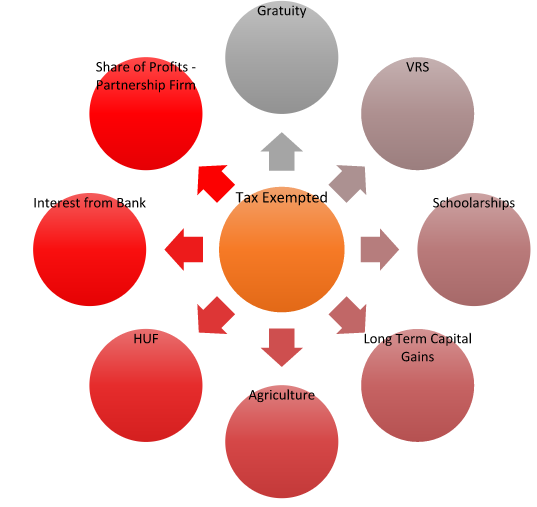

9 Types Of Income Exempted From Tax Lifeberrys

https://www.lifeberrys.com/img/article/exempted-from-tax-1517333585-lb.jpg

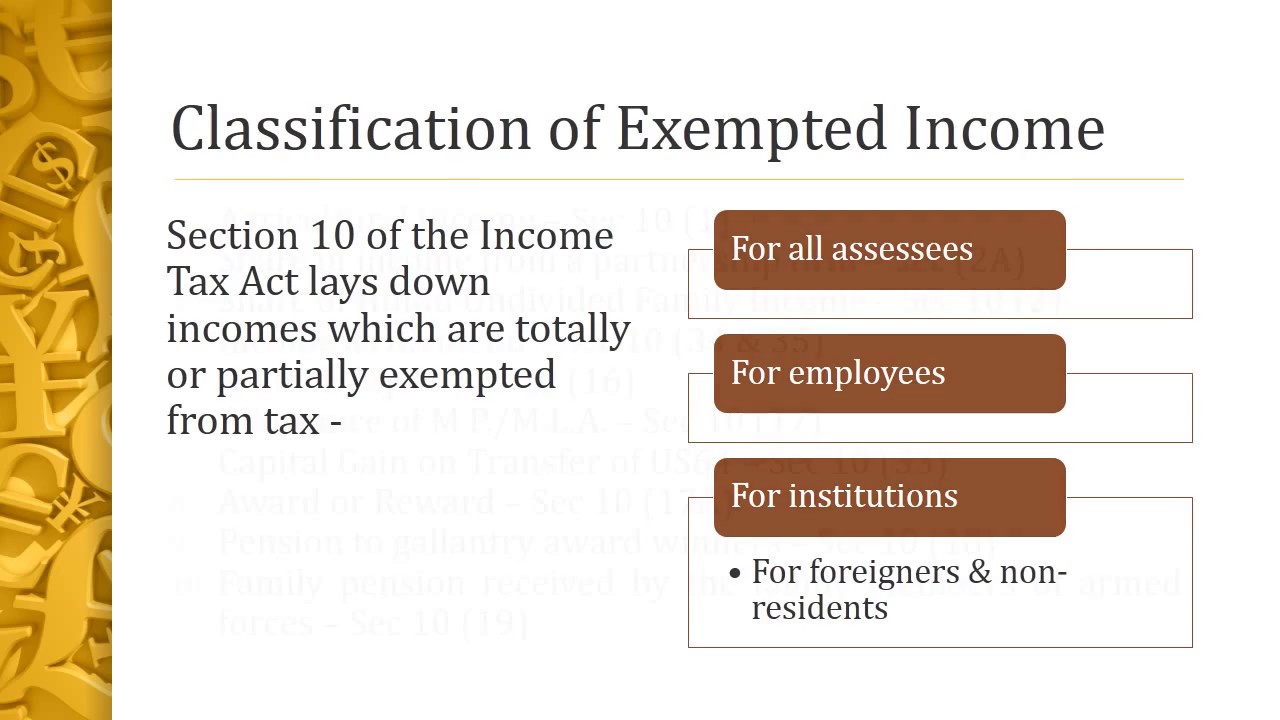

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied From FY 2020 21 onwards House Rent Allowance Exemption is only available if an employee opts for the Old Tax Regime Exemption Rules and

As per Section 80GG of income tax rules self employed individuals who do not receive a house rent allowance from the employer can claim a deduction for the rent The House Rent Allowance HRA is a portion of your salary that is not fully taxable unlike your basic salary Subject to specific conditions a portion of the HRA is

Download How Much Rent Amount Is Exempted From Income Tax

More picture related to How Much Rent Amount Is Exempted From Income Tax

Exempt Income Income Exempt From Tax As Per Section 10

https://www.wintwealth.com/blog/wp-content/uploads/2022/11/Exempt-Income.jpg

Exempt Incomes And Allowances For Income Tax Filing

http://bemoneyaware.com/wp-content/uploads/2015/08/income-exempted-from-taxation.png

Income Exempted Business Tax Deductions Income Tax Return Tax

https://i.pinimg.com/originals/da/a4/11/daa41151f5a8a0c1fcf98686bc23747b.jpg

Under the old tax regime House Rent Allowance HRA is exempted under section 10 13A for salaried individuals Yes Standard deduction of Rs 50 000 or the amount Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both

So if you re a person who earns an income from a single employer usually the income statement the employer provides at the end of the financial year is enough How much of HRA is tax exempt as per income tax laws The tax exemption for HRA is the minimum of i Actual HRA received ii 50 of salary if living

This Is The Portion Of Your Salary Exempted Deductible From Tax

https://nairametrics.com/wp-content/uploads/2018/06/Income-e1553592439695.jpg

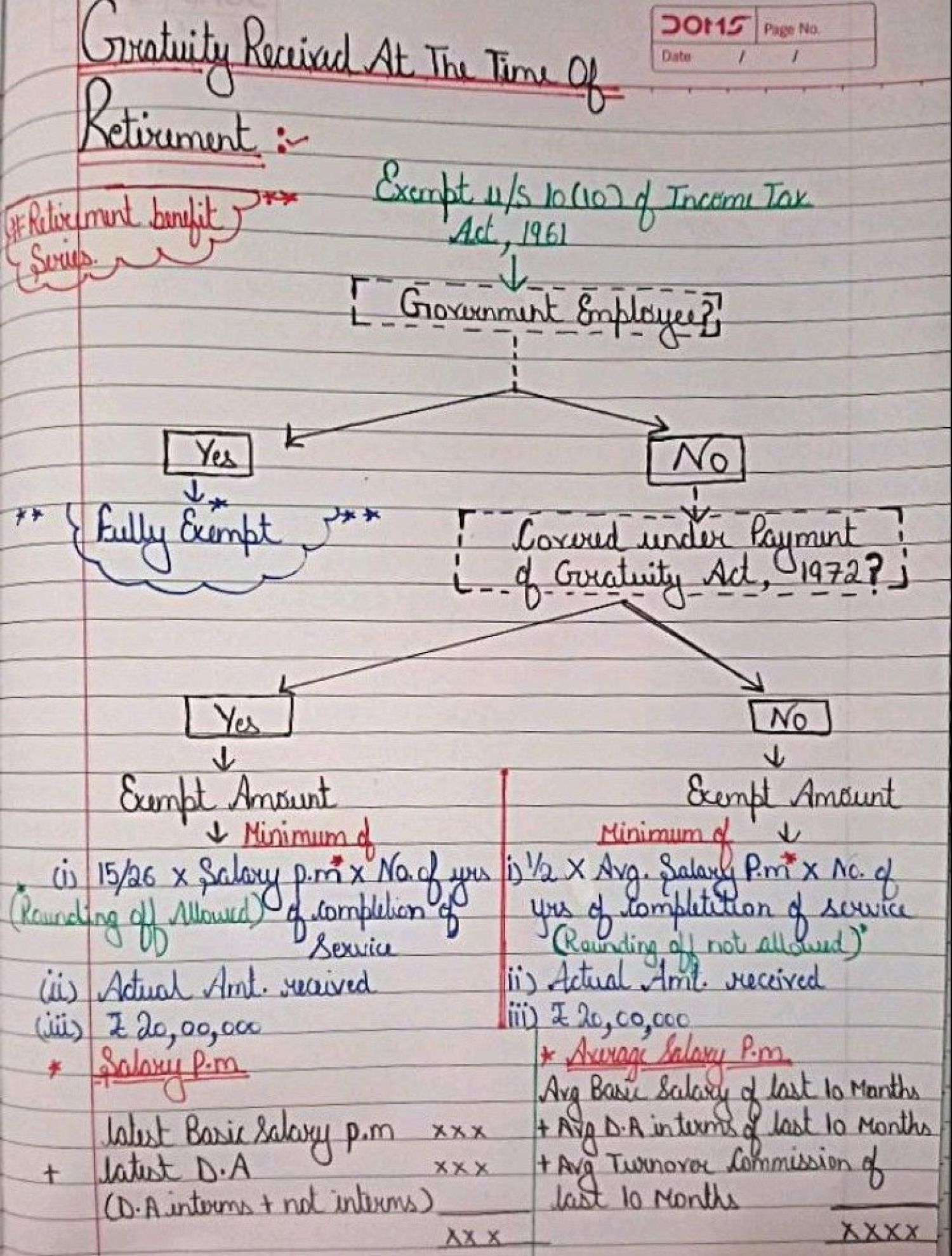

Calculation Of The Gratuity Amount Exempted From Income Tax Gratuity

https://carajput.com/art_imgs/how-to-calculation-of-the-gratuity-amount-exempted-from-income-tax.jpg

https://cleartax.in/s/section-10-of-income-tax-act

The part of your salary you receive to cover house rent and accommodation expenses is exempted from taxation However a few exceptions are included in

https://www.omnicalculator.com/finance/hra-exemption

HRA exemption calculator helps you determine how much of the house rent allowance HRA in your salary gets exempted from tax Many employers offer house

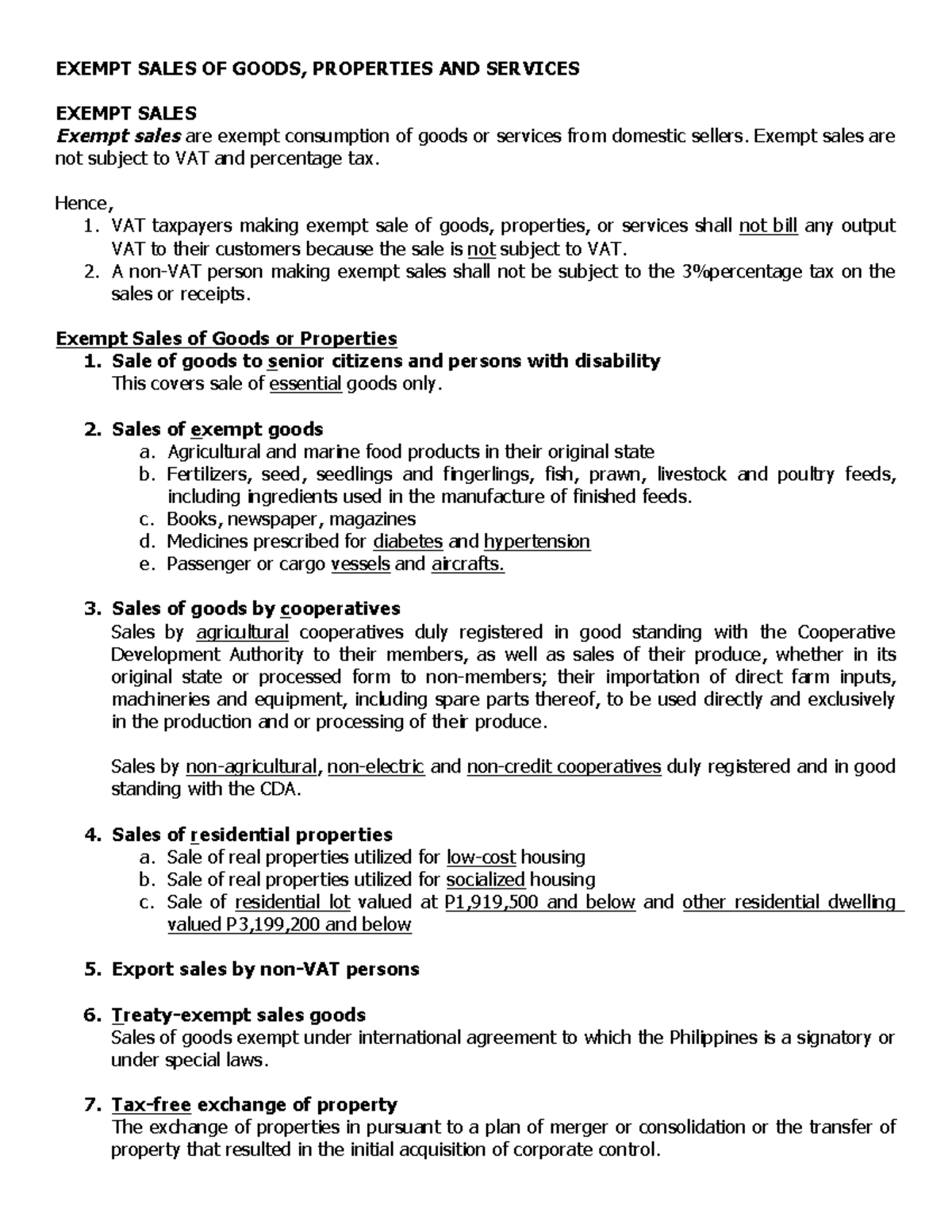

Chap 4 Tax EXEMPT SALES OF GOODS PROPERTIES AND SERVICES EXEMPT

This Is The Portion Of Your Salary Exempted Deductible From Tax

What Is Taxable Income Explanation Importance Calculation Bizness

All You Need To Know On Exempted Income In Income Tax Ebizfiling

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

AskTheTaxWhiz VAT Exemptions Discounts For PWDs

AskTheTaxWhiz VAT Exemptions Discounts For PWDs

Exempted Income INCOME EXEMPTED FROM TAX IN INDIA Income Tax Ppt

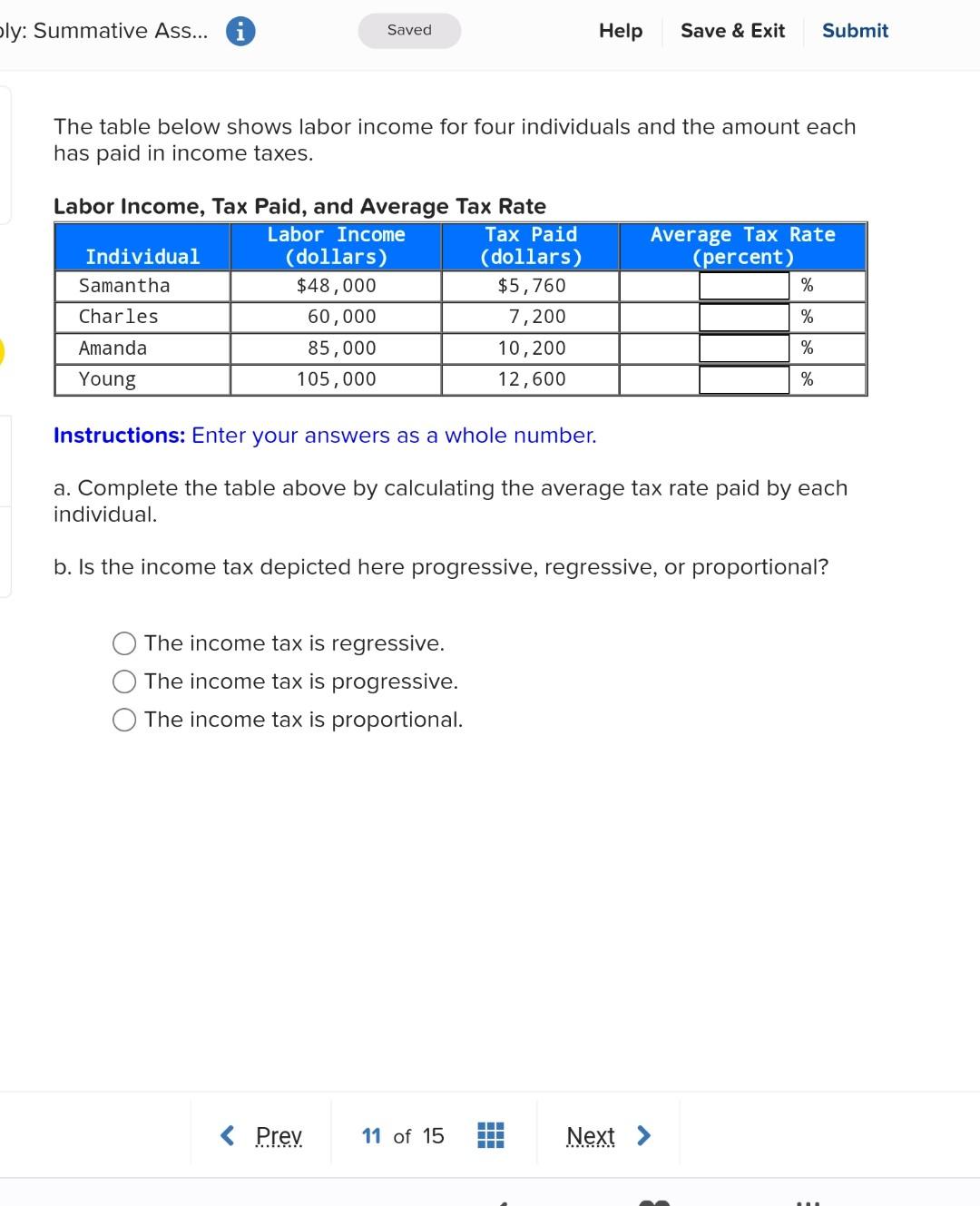

Solved The Table Below Shows Labor Income For Four Chegg

What Is Disposable Income Role Of Disposable Income

How Much Rent Amount Is Exempted From Income Tax - The House Rent Allowance HRA is a portion of your salary that is not fully taxable unlike your basic salary Subject to specific conditions a portion of the HRA is