How Much Tax Benefit For Home Loan In Usa The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home Tax Benefits of Home Ownership in 2024 When a consumer considers purchasing or selling a home they should consider the fact that there are many tax benefits that could potentially make owning a home quite profitable By far the buying of a home can be one of a consumers biggest investments

How Much Tax Benefit For Home Loan In Usa

How Much Tax Benefit For Home Loan In Usa

https://i.ytimg.com/vi/mUnlkRJhsTg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYciBAKEAwDw==&rs=AOn4CLABmndZQ7AQ6DKArfj6A-zhG3-gWQ

Benefits Of A VA Home Loan In The USA 2023 WellTerned

https://wellterned.com/wp-content/uploads/2023/03/The-Benefits-of-A-VA-Home-Loan-In-USA-2023-1.jpg

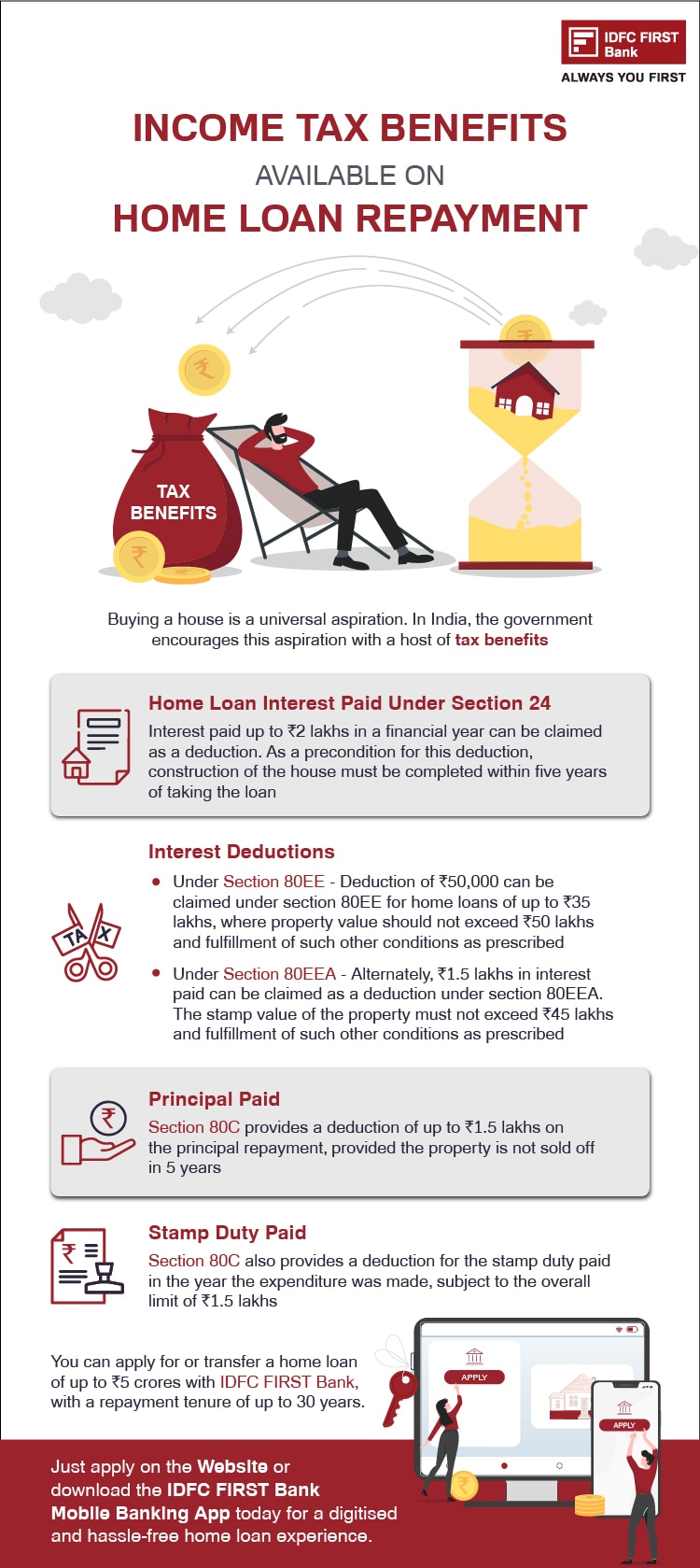

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

8 Tax Breaks For Homeowners The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI

If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one

Download How Much Tax Benefit For Home Loan In Usa

More picture related to How Much Tax Benefit For Home Loan In Usa

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/income-tax-benefit-on-home-loan-repayment.jpg

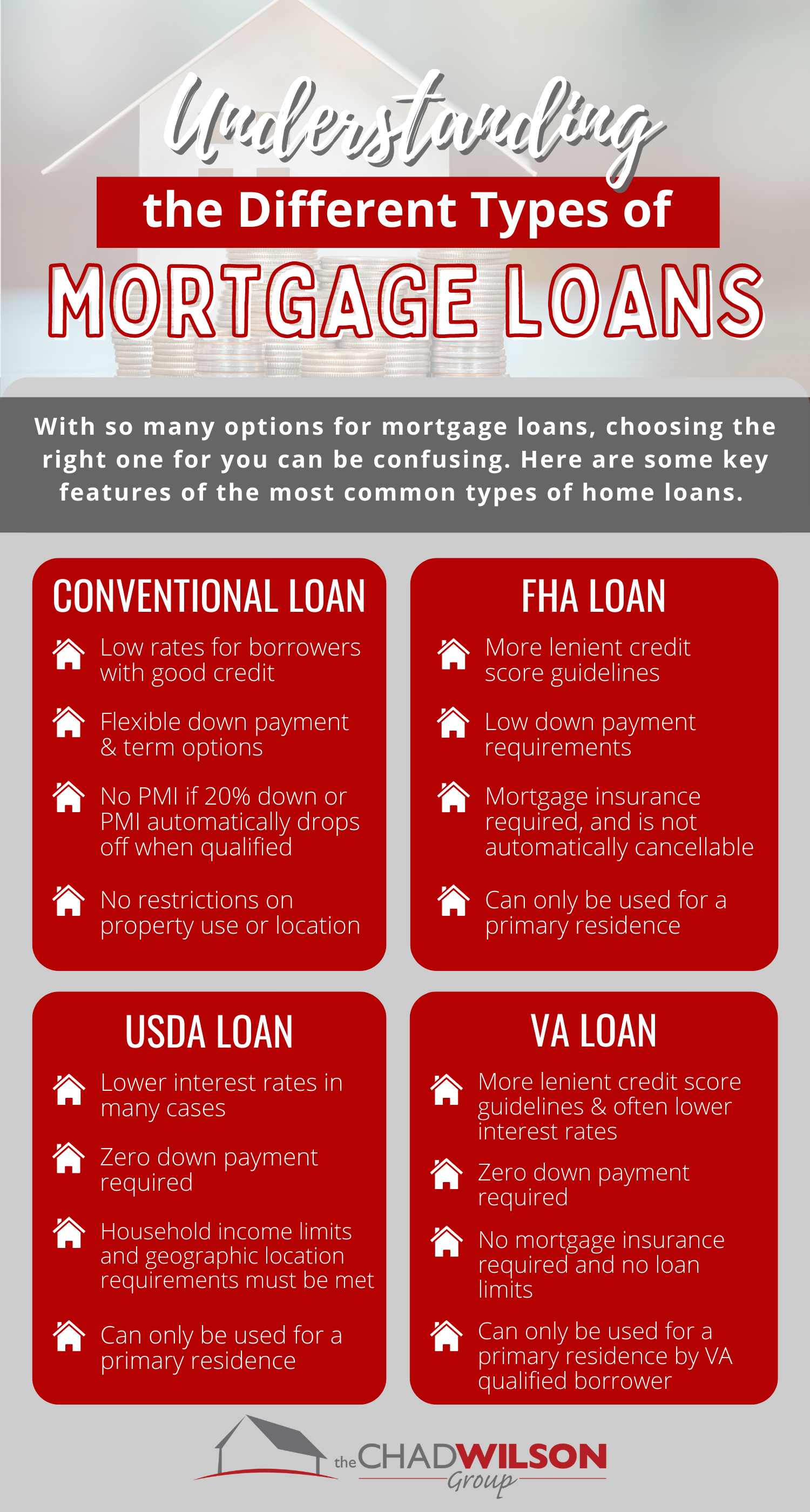

Understanding The Different Types Of Mortgage Loans INFOGRAPHIC

https://assets.site-static.com/userFiles/1688/image/Blog/Infographics/Understanding_the_Types_of_Mortgage_Loans_CWG.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

When you repay a mortgage loan you typically can deduct the interest part of your payments This is true if the loan meets IRS mortgage rules You can usually deduct mortgage interest on your tax return The loan must be secured by your home Because the interest on a mortgage is deductible when you itemize deductions you can save quite a bit in taxes for your primary residence or second home Use this mortgage tax deduction calculator to determine your potential tax savings with a mortgage

Whether someone is a current homeowner or buying a new home this summer owning a home can be expensive There are tax benefits that can help taxpayers save money and offset some of the costs that come with homeownership This section explains what expenses you can deduct as a homeowner It also points out expenses that you can t deduct There are three primary discussions state and local real estate taxes sales taxes and home mortgage interest Generally your real estate taxes and home mortgage interest are included in your house payment

Quantifying The Value Of Tax Loss Harvesting Retirement Prof

https://i0.wp.com/retirementprof.com/wp-content/uploads/2023/01/image-jpeg.webp?resize=642%2C563&ssl=1

Home Loan In Budget Tax Benefits For FY2023 24

https://www.nobroker.in/blog/wp-content/uploads/2022/01/Expected-Home-Loan-Tax-Benefit-In-New-Budget.jpg

https://www.forbes.com/advisor/mortgages/tax...

The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Quantifying The Value Of Tax Loss Harvesting Retirement Prof

What Are The Tax Benefit On Home Loan FY 2020 2021

Buying Your First HOME Together Visit Here Http www srghousing

Tax Benefit How Much Tax Benefit Can You Claim On Donations

How To Claim Tax Benefit On Home Loan For Under Construction Property

How To Claim Tax Benefit On Home Loan For Under Construction Property

Commercial Underwriter Cover Letter Examples QwikResume

Where Are Interest Rates Headed This Year Keeping Current Matters

Tax Benefits Of Home Loan

How Much Tax Benefit For Home Loan In Usa - The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one