How Much Tax Can You Claim Back On Donations If you plan to claim itemized deductions for charitable contributions on your tax return the deduction limit has reverted back to a maximum of 60 of your AGI

If certain criteria are met you as an individual can claim a donation tax credit on a donation of 5 or more You cannot claim a donation tax credit on behalf of a company The most you can claim in an income year is 1 500 for contributions and gifts to political parties 1 500 for contributions and gifts to independent candidates and

How Much Tax Can You Claim Back On Donations

How Much Tax Can You Claim Back On Donations

https://i.ytimg.com/vi/P4tVp8mqFrQ/maxresdefault.jpg

What Tax Can You Claim Back On A Rental Property CIA Landlords

https://www.datocms-assets.com/50462/1643028077-shutterstock_581002882.jpg?auto=format&crop=focalpoint&dpr=0.5&fit=crop&fp-x=0.5&fp-y=0.5&h=540&w=1280

HOW MUCH TAX CAN YOU CLAIM BACK ON A VAN SELF EMPLOYED SPECIAL YouTube

https://i.ytimg.com/vi/DlfpBCtbO10/maxresdefault.jpg

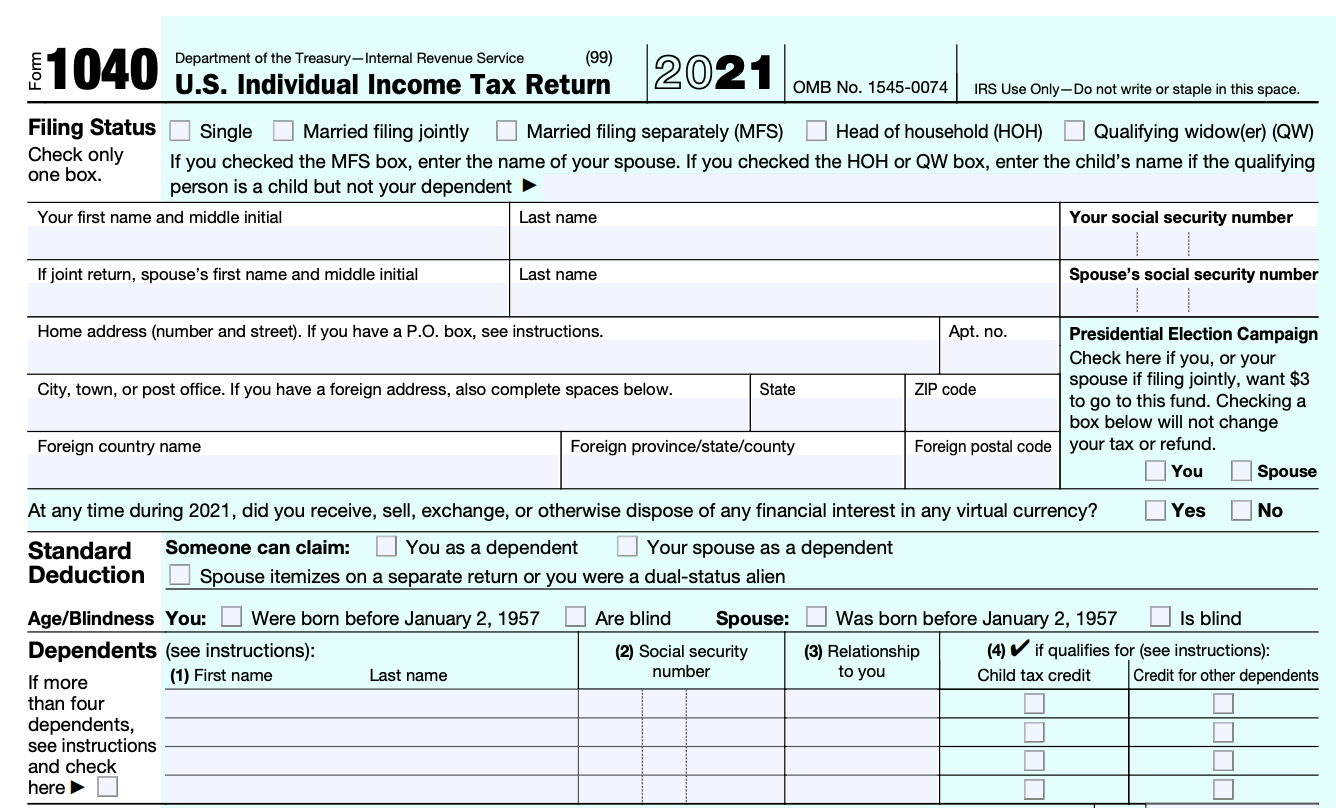

The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions Generally you may deduct up to

Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions These individuals If you weren t aware you could claim additional tax relief on charity donations then you can make a claim for overpayment relief going back four tax years We re currently in the

Download How Much Tax Can You Claim Back On Donations

More picture related to How Much Tax Can You Claim Back On Donations

How Much Tax Can You ACTUALLY Save Within A Tax Free Savings Account

https://i.ytimg.com/vi/KVbaJ_zuFtY/maxresdefault.jpg

How Much Tax Can You Save On House Rent Allowance Income Tax Filing

https://www.bankingminutes.com/wp-content/uploads/2023/02/HRA-tax-saving-thumb-1024x576.png

What Tax Deductions Can You Claim Back On Your Studies

https://res.cloudinary.com/upskilled/image/fetch/w_600,h_400,c_crop,c_fill,g_face:auto,f_auto/https://www.upskilled.edu.au/getmedia/7a9baa53-8cac-45f9-8f9d-7b3b27c392fc/tax-deductions-claim-on-studies-HERO.jpg%3b.aspx%3fwidth%3d1000%26height%3d667%26ext%3d.jpg

If you have donated to an NFP you may be able to claim a tax deduction The following information will help you determine if you can claim how much you can claim when you In that case you d claim charitable donations on Schedule A Form 1040 As a general rule you can deduct donations totaling up to 60 of your adjusted gross

However in some cases the IRS may limit the amount you can claim on your taxes You can generally claim charitable contributions if they re less than 60 of You should keep records of all tax deductible gifts donations and contributions you make However if you made one or more small cash donations each

How Much Can You Claim In Charitable Donations Without Receipts Help

https://irs-taxes.org/wp-content/uploads/2021/06/Signing-charitable-donation-check-768x481.jpg

What Tax Can You Claim Back On A Rental Property

https://d2ypxhkb4lw69u.cloudfront.net/wp-content/uploads/2022/11/07155654/shutterstock_1601693080-768x512.jpeg

https://www.nerdwallet.com/article/taxes/tax...

If you plan to claim itemized deductions for charitable contributions on your tax return the deduction limit has reverted back to a maximum of 60 of your AGI

https://www.ird.govt.nz/.../individual-tax-credits/tax-credits-for-donations

If certain criteria are met you as an individual can claim a donation tax credit on a donation of 5 or more You cannot claim a donation tax credit on behalf of a company

Lost Deposits How Much Can You Claim Back On Vimeo

How Much Can You Claim In Charitable Donations Without Receipts Help

What VAT Can I Claim Back To Reduce My Vat Bill Comerford Foley

What Tax Can You Claim Back On A Rental Property

Amazon Flex Take Out Taxes Augustine Register

How Much Tax Can I Claim Back 2024 Updated RECHARGUE YOUR LIFE

How Much Tax Can I Claim Back 2024 Updated RECHARGUE YOUR LIFE

How To Claim Medical Expenses On Your Tax Return

How Much Tax You Pay Which

How Much Tax Can You Claim Without Receipts

How Much Tax Can You Claim Back On Donations - You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions Generally you may deduct up to