How Much Tax Credit For Working From Home If your employer pays you a working from home allowance towards these expenses you can get up to 3 20 per day without paying any tax PRSI or USC on it If

For example if you own your home use 20 of it as a home office and deduct depreciation 20 of your profit on the home s sale may be subject to capital gains tax Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as

How Much Tax Credit For Working From Home

How Much Tax Credit For Working From Home

https://www.gannett-cdn.com/-mm-/3eb9009c1a9366e33a28c376eca11ea26824544a/c=0-44-580-370/local/-/media/2018/04/22/USATODAY/usatsports/MotleyFool-TMOT-33d5f547-taxes_large.jpg?width=3200&height=1680&fit=crop

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home There are two ways that eligible taxpayers can calculate the home office deduction In the simplified version you can take 5 per square foot of your home

Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year OVERVIEW Since the 2018 tax reform at home expense deductions for employees have been reduced but remain for self employed workers TABLE OF CONTENTS Can you claim work from

Download How Much Tax Credit For Working From Home

More picture related to How Much Tax Credit For Working From Home

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

What Is The Advancing Support For Working Families Act And Why Doesn t

https://1.bp.blogspot.com/-AXfYfXaHUkA/XjqkPCLrtOI/AAAAAAAAvCY/4CMldR4o3qsgBZ1pZWFU_8hHCUrkqygCACNcBGAsYHQ/s1600/aditya-romansa-5zp0jym2w9M-unsplash.jpg

If I m an employee and my job is fully remote and I have working from home can I deduct my work from home expenses Although there has been an increase in employees working at home To qualify for the home office deduction you must use part of your home regularly and exclusively for business You can take the simplified or the standard option for calculating the deduction

So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work Since the 2018 tax reform generally only self employed people can claim tax deductions for remote work That means remote employees can no longer claim tax

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

New Child Tax Credit Explained When Will Monthly Payments Start

https://media.9news.com/assets/KUSA/images/6401c0ff-2eae-43ab-87f9-5318969aa0f5/6401c0ff-2eae-43ab-87f9-5318969aa0f5_1920x1080.jpg

https://www.citizensinformation.ie/en/money-and...

If your employer pays you a working from home allowance towards these expenses you can get up to 3 20 per day without paying any tax PRSI or USC on it If

https://www.nerdwallet.com/article/taxes/…

For example if you own your home use 20 of it as a home office and deduct depreciation 20 of your profit on the home s sale may be subject to capital gains tax

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Claiming From Tax For Working From Home YouTube

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Working From Home Here Are Some Tax Tips

Working From Home Here Are Some Tax Tips

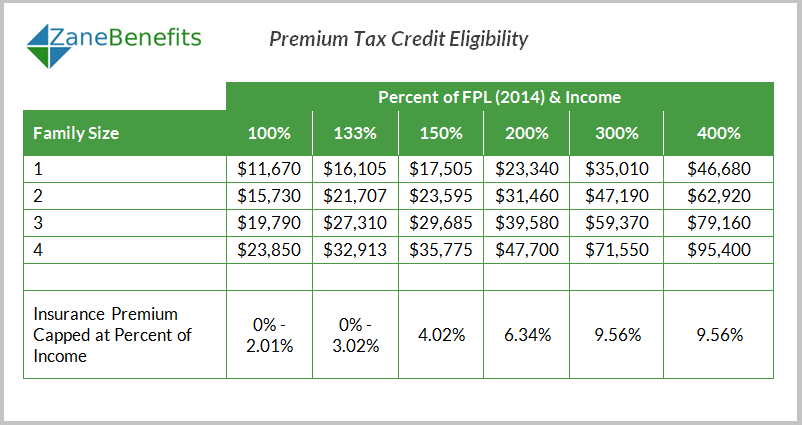

Premium Tax Credit Charts 2015

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

How Much Tax Credit For Working From Home - Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year