How Much Tax Deduction For Child Care The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated

For purposes of the child and dependent care credit net earnings from self employment generally means the amount from Schedule SE Form 1040 line 3 minus any The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care for

How Much Tax Deduction For Child Care

How Much Tax Deduction For Child Care

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to school or carry on research under

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child For 2021 you can deduct a maximum of 8 000 of expenses for one child or dependent or 16 000 for two or more children Taxpayers may qualify for the tax credit up to 50 of qualified

Download How Much Tax Deduction For Child Care

More picture related to How Much Tax Deduction For Child Care

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

https://onecargroup.com.au/wp-content/uploads/2018/08/Files-1200x938.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more dependents Your applicable percentage

If you paid for babysitting day care or even a summer camp you might be eligible to receive up to 8 000 in credits during this year s tax season depending on how many dependents you have Parents with one child can claim 50 of their child care expenses up to 8 000 That means parents with one child can get a maximum tax credit of 4 000 on their taxes this

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Income Tax Calculator Canada 2024 Image To U

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

https://www.irs.gov/newsroom/child-and-dependent...

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated

https://www.irs.gov/publications/p503

For purposes of the child and dependent care credit net earnings from self employment generally means the amount from Schedule SE Form 1040 line 3 minus any

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Your First Look At 2023 Tax Brackets Deductions And Credits 3

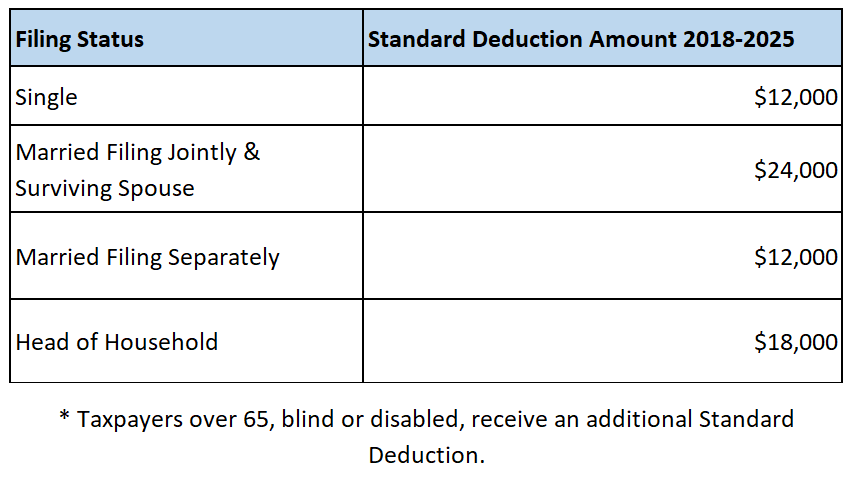

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction Vs Itemizing YR TAX COMPLIANCE LLC

Credits Vs Deductions Carpenter Tax And Accounting

Record High Inflation Brings Changes To Your Tax Bill And Tax Bracket

Record High Inflation Brings Changes To Your Tax Bill And Tax Bracket

Easily Calculate Your Business Mileage Tax Deduction YouTube

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

How Much Tax Deduction For Child Care - Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child