Nyc Homeowner Tax Rebate Web The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients

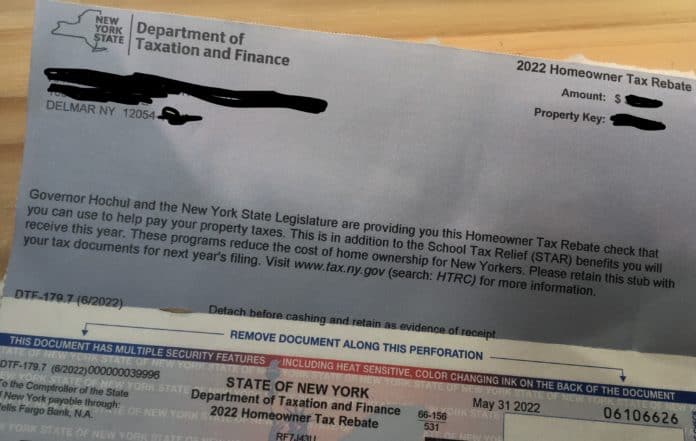

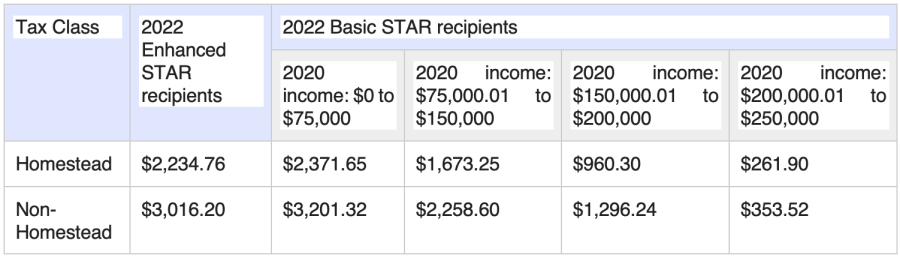

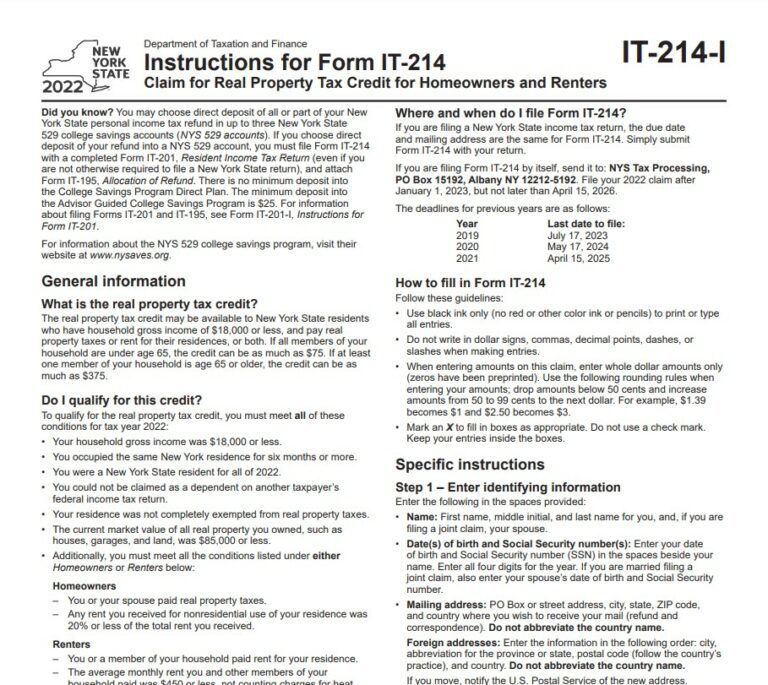

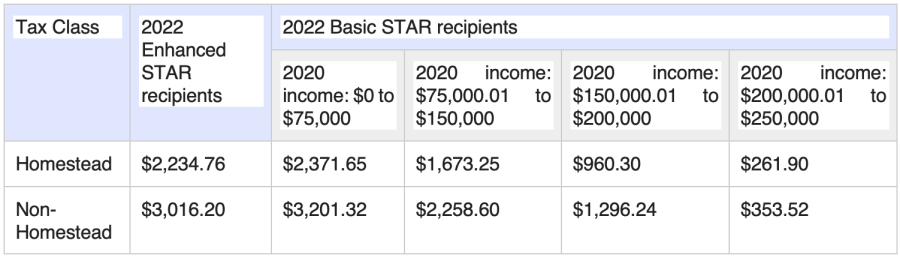

Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for Web New York City and New York State offer homeowners property tax relief in the form of exemptions abatements and credits Eligibility criteria for each program is different You

Nyc Homeowner Tax Rebate

Nyc Homeowner Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?w=1046&h=765&ssl=1

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

Web 24 ao 251 t 2022 nbsp 0183 32 NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of Web The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners These benefits can lower your

Web 7 nov 2022 nbsp 0183 32 Instructions You can use this application to apply for the FY 2022 property tax rebate The property tax rebate is for homeowners whose New York City property is Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three million

Download Nyc Homeowner Tax Rebate

More picture related to Nyc Homeowner Tax Rebate

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-696x441.jpg

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/2023-Homeowner-Tax-Rebate.jpg?resize=990%2C787&ssl=1

New York State Agrees To Waive Fines For Businesses That Miss Sales Tax

https://www.newyorkupstate.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

Web 15 nov 2022 nbsp 0183 32 2022 Property Tax Rebate Form You can use this page to provide information so that the Department of Finance can determine your eligibility for the Web 13 juin 2022 nbsp 0183 32 A 101 billion budget deal between Mayor Eric Adams and City Council members includes 90 million for a property tax rebate for roughly 600 000 eligible city

Web 24 ao 251 t 2022 nbsp 0183 32 STATEN ISLAND N Y Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible New York homeowners Web 15 mars 2023 nbsp 0183 32 Some New York City homeowners will be eligible to receive a 150 property tax rebate The deadline to apply for the property tax rebate was March 15 2023

From Town Assessor State Sending Letter On New Homeowner Tax rebate

https://pelhamexaminer.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-23-at-4.37.55-PM-900x258.png

Promotions Service Chauffage Climatisation Confort Expert

https://www.confortexpert.com/wp-content/uploads/2023/03/York-Homeowner-Rebates_March-December2023FR.jpg

https://www.nyc.gov/site/finance/taxes/property-tax-rebate-faqs.page

Web The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

Ny Homeowner Tax Rebate 2023 Tax Rebate

From Town Assessor State Sending Letter On New Homeowner Tax rebate

Star Rebate Check Eligibility StarRebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

City Of Watertown New York NYS Homeowner Tax Rebate Credit

Ny Homeowner Tax Rebate 2023 Tax Rebate

Ny Homeowner Tax Rebate 2023 Tax Rebate

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

South Dakota Homeowner Tax Credits Rebates And Savings Pierre SD

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

Nyc Homeowner Tax Rebate - Web 27 mai 2022 nbsp 0183 32 Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality If the check amount field for your school district is Not