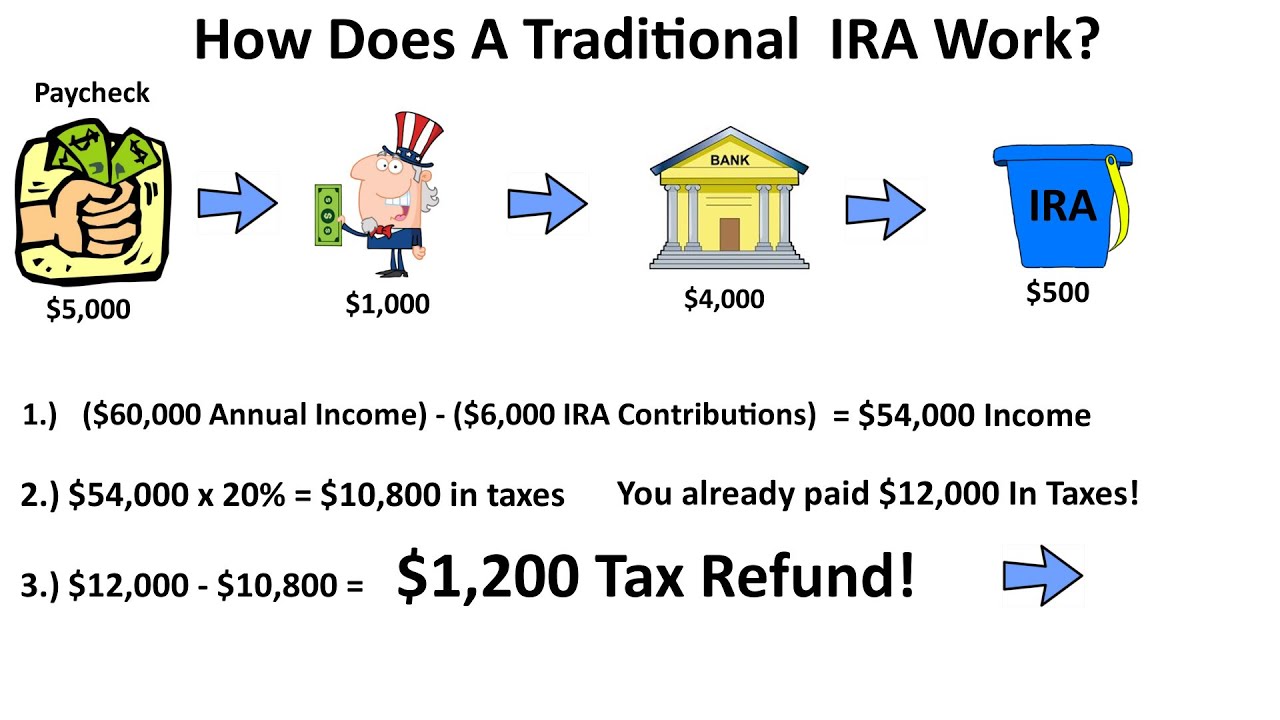

Should You Do Traditional Ira For Tax Rebate Web A traditional IRA is known as a tax deferred account This means that the money you contribute to a traditional IRA can be tax deductible in the year the contributions are

Web 30 avr 2018 nbsp 0183 32 Contributions to traditional IRAs are tax deductible but withdrawals in retirement are taxable In comparison contributions to Web 30 nov 2022 nbsp 0183 32 A traditional IRA acts in a similar way However traditional IRA contributions are tax deductible when made The downside to this is that investments are

Should You Do Traditional Ira For Tax Rebate

Should You Do Traditional Ira For Tax Rebate

https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2020/07/b190p6.png

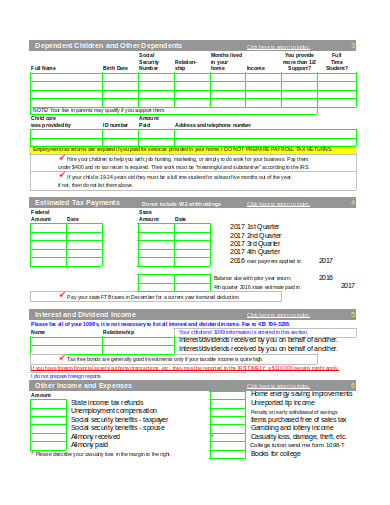

Ways You Can Still Lower Your Taxes For 2021 Entrepreneur

https://due.com/wp-content/uploads/2021/02/Due-Traditional-IRA-Phase-Out-Table-1024x576.png

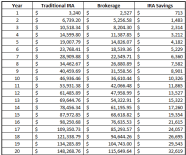

6 Traditional IRA Calculator Templates In XLS

https://images.template.net/wp-content/uploads/2019/09/Printable-Traditional-IRA-Calculator-Template.jpg

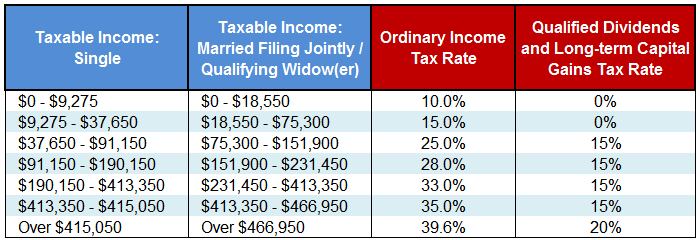

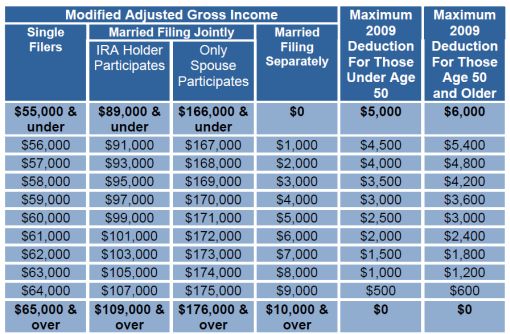

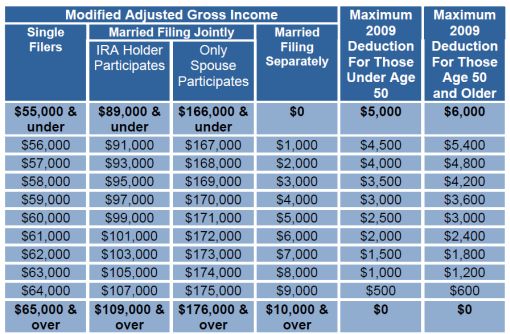

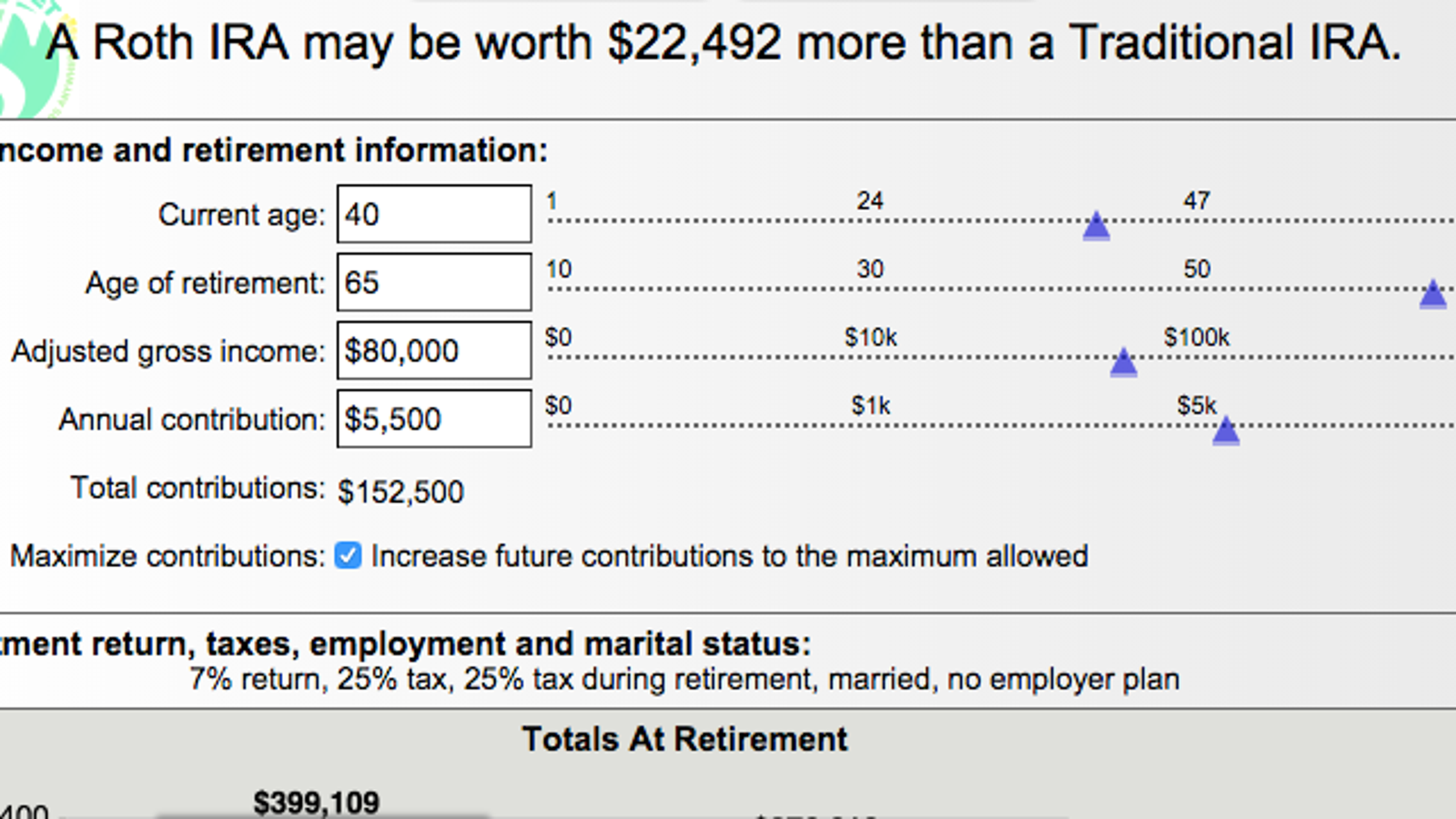

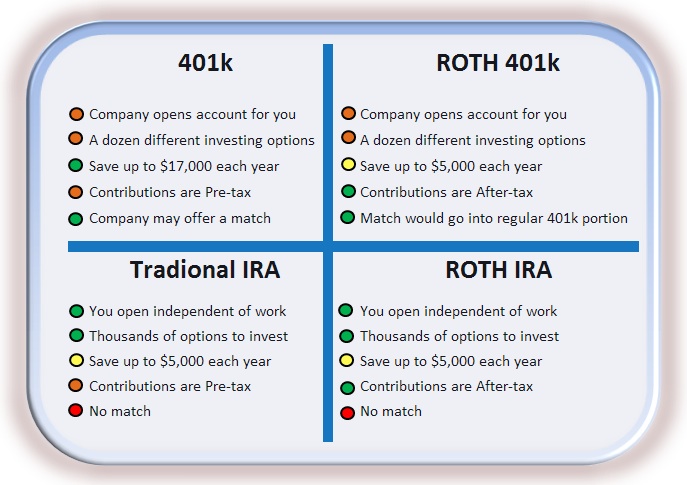

Web Traditional IRAs come in two varieties deductible and nondeductible Whether you qualify for a full or partial tax deduction depends mostly on your income and whether you have Web 4 ao 251 t 2021 nbsp 0183 32 By Rob Williams Trying to choose between a traditional individual retirement account IRA and a Roth IRA They both offer tax advantaged ways to save for

Web 18 juil 2023 nbsp 0183 32 A traditional IRA is a way to save for retirement that gives you tax advantages Contributions you make to a traditional IRA may be fully or partially Web 9 mars 2023 nbsp 0183 32 Traditional IRA contributions can save you a decent amount of money on your taxes If you re in the 24 income tax bracket for instance a 6 500 contribution to an IRA would equal a

Download Should You Do Traditional Ira For Tax Rebate

More picture related to Should You Do Traditional Ira For Tax Rebate

Traditional Ira Withdrawal Tax Calculator BelleKhalari

https://msofficegeek.com/wp-content/uploads/2022/03/Traditional-IRA-Calculator-2021.png

How Much Can You Contribute To A Traditional Ira For 2019 Turbo Tax

https://turbo-tax.org/wp-content/uploads/2021/03/image-UAHSyg4z6LwtTb8m.jpeg

RE403 IRA Account Fundamentals

https://i1.wp.com/www.makingyourmoneymatter.com/wp-content/uploads/2017/01/Deductible-Contributions-to-a-Traditional-IRA-Account.png?resize=783%2C427

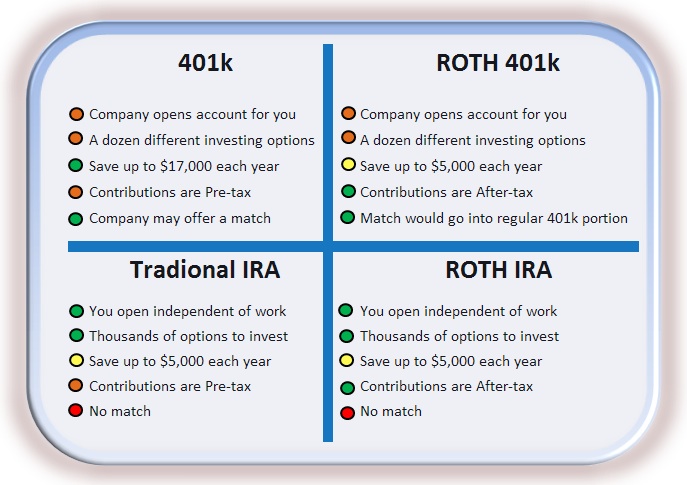

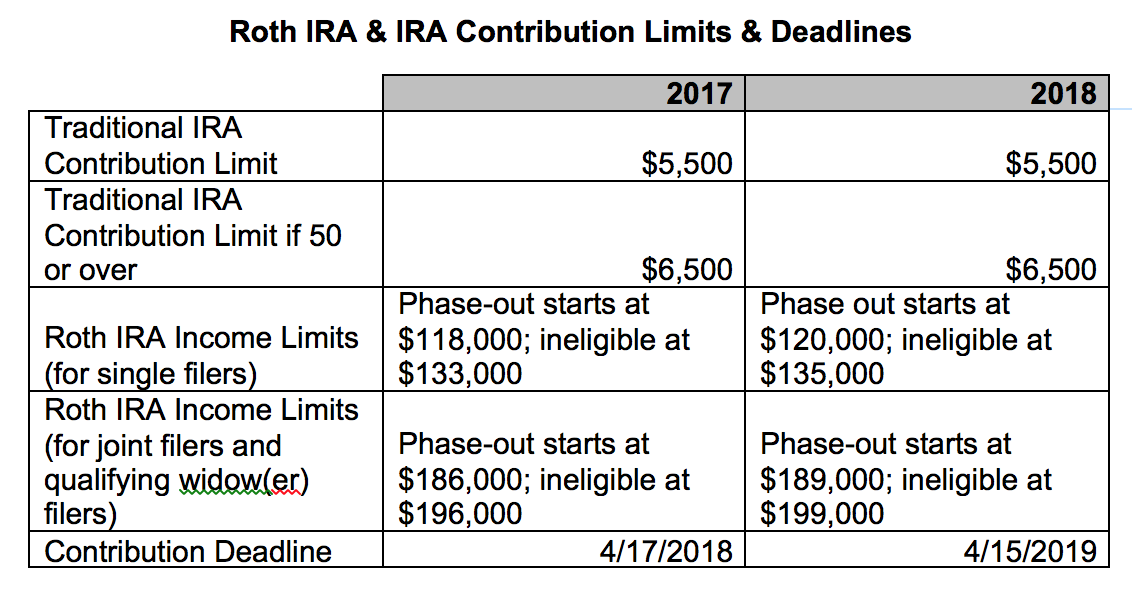

Web 6 d 233 c 2022 nbsp 0183 32 Traditional IRAs offer an up front tax deduction and defer taxes until you take withdrawals in the future Roth IRAs allow you to contribute after tax money in exchange for tax free distributions down Web 2 juin 2023 nbsp 0183 32 Take the deduction for a traditional IRA which is limited to 6 000 as of tax year 2022 or 7 000 for filers ages 50 and up Other retirement accounts also qualify

Web 23 oct 2022 nbsp 0183 32 How much can I contribute The maximum amount you can contribute in 2022 across all your IRAs traditional or Roth is 6 000 7 000 if you re age 50 or Web 27 f 233 vr 2023 nbsp 0183 32 A traditional IRA is a type of individual retirement account that allows owners to make pre tax contributions While annual contributions could result in a tax

Rules To Qualify For A Traditional IRA Tax Deduction

https://www.goodfinancialcents.com/wp-content/uploads/2009/10/2009-traditional-ira-rules1.jpg

IRA Basics PlanMember Retirement Solutions

https://images.planmember.com/Uploads/ImageLibrary/Broker_Front_Ends/IRALRG.png

https://www.fool.com/retirement/plans/ira/benefits

Web A traditional IRA is known as a tax deferred account This means that the money you contribute to a traditional IRA can be tax deductible in the year the contributions are

https://www.nerdwallet.com/article/investing/r…

Web 30 avr 2018 nbsp 0183 32 Contributions to traditional IRAs are tax deductible but withdrawals in retirement are taxable In comparison contributions to

Traditional Ira Withdrawal Tax Calculator BelleKhalari

Rules To Qualify For A Traditional IRA Tax Deduction

Traditional Ira Flowchart Inflation Protection

The Homeowner s Guide To The Inflation Pearl Certification

This Calculator Will Help You Decide Between A Roth Or Traditional IRA

Open Enrollment Part 3 Of 3 401k Or IRA

Open Enrollment Part 3 Of 3 401k Or IRA

Reminder IRA Contribution Deadlines

Ira Rollover Form Fidelity Universal Network

Roth 401k Paycheck Calculator KiriHayleigh

Should You Do Traditional Ira For Tax Rebate - Web 4 ao 251 t 2021 nbsp 0183 32 By Rob Williams Trying to choose between a traditional individual retirement account IRA and a Roth IRA They both offer tax advantaged ways to save for