How Much Tax Do I Pay Nz Income tax rates are the percentages of tax that you must pay The rates are based on your total income for the tax year Your income could include salary or wages a Work and Income benefit schedular payments interest from a bank account or investment earnings from self employment money from renting out property

5 minutes Income tax calculator This calculator will work out tax on your annual income using rates from 2010 to the current year Other ways to do this Print Last updated 13 May 2024 Use this calculator to work out your basic yearly tax for any year from 2011 to the current year Taxable income can include income from working including salary wages or self employed income benefits and student allowances assets and investments including KiwiSaver and rental income overseas income Some income is not taxable so we will not include it in your end of year automatic calculation If you file an individual tax return

How Much Tax Do I Pay Nz

How Much Tax Do I Pay Nz

https://resources.wiseadvice.co.nz/hubfs/Rental Income Tax Calculator.png#keepProtocol

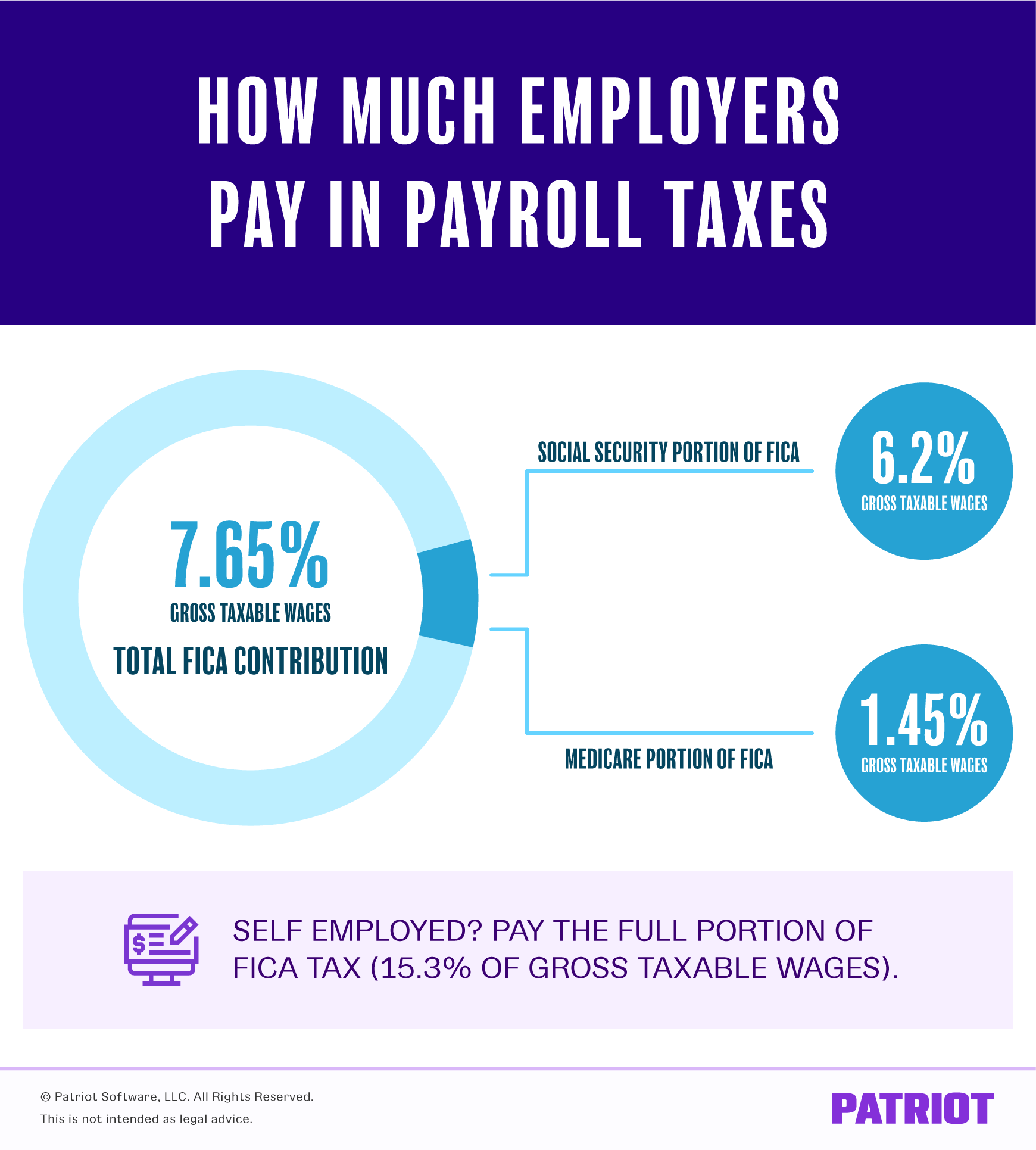

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Your Complete Guide On How To Pay Income Tax In Singapore

https://www.instantloan.sg/wp-content/uploads/2022/03/how-to-pay-income-tax-singapore.jpg

Pay As You Earn PAYE is a withholding income tax for employees in New Zealand In most cases it is deducted from the pay that you will receive before you receive it and is taxed via a series of tiered tax rates depending on the amount you earn and your tax code The incremental tax rates increase as the salary increases How to use the New Zealand Income Tax Calculator Just enter your gross annual salary into the box and click Calculate then we ll show you a breakdown of how much PAYE tax you ll pay and what your kiwisaver and student loan contributions will be You can vary the kiwisaver contribution rate to see the effect on your net pay

Updated 12 May 2024 Important the calculator below uses the 2023 24 rates which is what you need to understand your tax obligations Wondering how much difference that pay rise or a new job would make Our PAYE calculator shows you in seconds If you make 50 000 a year living in New Zealand you will be taxed 8 715 That means that your net pay will be 41 285 per year or 3 440 per month Your average tax rate is 17 4 and your marginal tax rate is 31 4 This marginal tax rate means that your immediate additional income will be taxed at this rate

Download How Much Tax Do I Pay Nz

More picture related to How Much Tax Do I Pay Nz

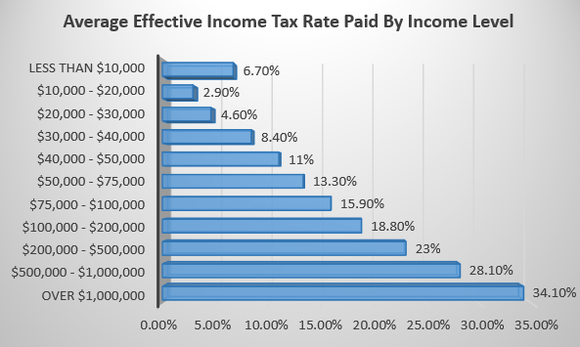

How Much Income Tax Do I Pay TAX

https://i2.wp.com/images.livemint.com/img/2020/02/02/original/taxchart_1580665978559.png

Types Of Taxes In The UK Techno Hardware

https://technohardware.net/wp-content/uploads/2022/12/sTART-aN-llc-1.jpg

How Much Tax Do I Pay Find The Resources You Need

https://www.pherrus.com.au/wp-content/uploads/2023/01/01_cover_How-Much-Tax-Do-I-Pay-Find-the-Resources-You-Need-100.jpg

0 Calculate how much income tax and government deductions you are obliged to pay with our easy to use Income Tax Calculator Financial Summary Complete and save all five steps of the financial toolbox to see a summary of your finances View Profile Calculate your take home pay KiwiSaver Secondary Income Tax Tax Code net worth Create budgets savings goals and

Our online calculator is a user friendly tool that allows you to quickly calculate your estimated taxes based on your level of earnings whether or not you are eligible for any deductions or credits and the applicable withholding tax rate Tax Year 2024 2025 If you live in New Zealand and earn a gross annual salary of 82 576 or 6 881 per month your monthly take home pay will be 5 257 This results in an effective tax rate of 24 as estimated by our NZ salary calculator

How Much Tax Will I Pay The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2023/04/How-Much-Tax-Will-I-Pay_-1.png

Online Salary Tax Calculator MckenzyJoani

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

https://www.ird.govt.nz/income-tax/income-tax-for...

Income tax rates are the percentages of tax that you must pay The rates are based on your total income for the tax year Your income could include salary or wages a Work and Income benefit schedular payments interest from a bank account or investment earnings from self employment money from renting out property

https://www.ird.govt.nz/income-tax/income-tax-for...

5 minutes Income tax calculator This calculator will work out tax on your annual income using rates from 2010 to the current year Other ways to do this Print Last updated 13 May 2024 Use this calculator to work out your basic yearly tax for any year from 2011 to the current year

How Much Money Does The Government Collect Per Person

How Much Tax Will I Pay The Accountancy Partnership

The Average American Pays This Much In Federal Income Taxes Fox Business

Weekly Tax Calculator 2021 Tax Withholding Estimator 2021

Understanding Your Forms W 2 Wage Tax Statement Tax Refund Tax

How Much Tax Do You Pay For 100 Worth Of Petrol R india

How Much Tax Do You Pay For 100 Worth Of Petrol R india

What Are The Income Tax Rates 2022 23 In The UK Countingup

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

New Year No Tax Stress 5 Tips For Tracking Miles Expenses

How Much Tax Do I Pay Nz - Calculate NZ Income Tax How much tax will I pay on 110 000 salary On 110 000 annual salary you will pay 27 220 00 PAYE tax and 1 683 00 ACC Tax composition After paying tax and ACC the amount of income from a 110 000 00 annual salary is 81 097 00 per annum 6 758 08 per month 3 119 12 per fortnight 1 559 56 per week