How Much Tax Do You Pay In Belgium Who pays tax in Belgium Both residents and non residents pay taxes in Belgium Residents pay tax on their worldwide income including rent and capital gains while non residents only pay income tax on anything they earn from Belgium

The tax free allowance is EUR 10 160 tax year 2024 income 2023 tax year 2025 income 2024 EUR 10 570 This tax free allowance may increase depending on personal circumstances for example if dependent children Residents of Belgium are taxable on their worldwide income while non residents are only taxable on Belgian source income Personal income tax PIT is calculated by determining the tax base and assessing the tax due on that base Taxation is charged on a sliding scale to successive portions of net taxable income

How Much Tax Do You Pay In Belgium

How Much Tax Do You Pay In Belgium

https://gg.myggsa.co.za/1661758842261.png

How Much Tax Do You Pay In The U K Guidelines

https://www.expatustax.com/wp-content/uploads/2023/03/How-much-tax-do-you-pay-UK.jpg

Quanto Paga Un Datore Di Lavoro In Tasse Sui Salari Payroll Tax Rate

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Calculate your income tax in Belgium and salary deduction in Belgium to calculate and compare salary after tax for income in Belgium in the 2024 tax year The Belgium Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Belgium This includes calculations for Employees in Belgium to calculate their annual salary after tax

The amount of taxes you pay will depend on the level of your income and is calculated in percentages per installment For residents this tax applies to all worldwide sources of income including salary and employment benefits interest from To obtain your net taxable professional income professional expenses must be deducted There are two possible methods the legal fixed rate or your actual expenses If you failed to mention any expenses in your tax declaration you will automatically receive the legal fixed rate allowance

Download How Much Tax Do You Pay In Belgium

More picture related to How Much Tax Do You Pay In Belgium

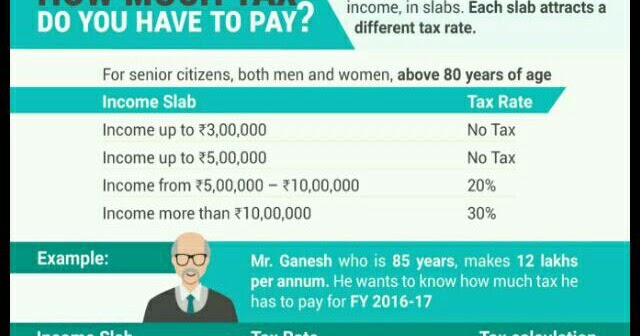

Nrinvestments How Much Tax Do You Have To Pay

https://3.bp.blogspot.com/-GbqZzj5p_D8/WIMGYBDBbbI/AAAAAAAAAGw/zJH3WWEf9DwYEpcdY4mTQHrRJJXrT5i-gCLcB/w1200-h630-p-k-no-nu/WhatsApp%2BImage%2B2017-01-21%2Bat%2B12.23.08%2BPM.jpeg

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Tax rates how much tax will I pay in Belgium in 2024 The Belgian government sets income tax rates on an annual basis These are usually 25 40 45 and 50 Calculate you Annual salary after tax using the online Belgium Tax Calculator updated with the 2024 income tax rates in Belgium Calculate your income tax social security and pension deductions in seconds

Estimate your take home pay after income tax in Belgium with our easy to use salary calculator Income tax must be paid by all people who have settled in Belgium or made it their centre of financial interest regardless of their nationality The tax authorities calculate the amount of tax payable based on the annual income tax declaration

How Much Tax Do You Pay On A 1000 Lottery Ticket In California 09 2021

https://www.couponxoo.com/photos/5d972323f6ace67cdc7f00da/old-second-hand-books-store.jpg

How Much Tax Do Aussies Pay Aussie Infographic Tax

https://i.pinimg.com/736x/b0/fa/47/b0fa47912224455cc0a42b236048e276--aussies-infographics.jpg

https://www.expatica.com/be/finance/taxes/taxes-in-belgium-100073

Who pays tax in Belgium Both residents and non residents pay taxes in Belgium Residents pay tax on their worldwide income including rent and capital gains while non residents only pay income tax on anything they earn from Belgium

https://finance.belgium.be/.../tax-rates

The tax free allowance is EUR 10 160 tax year 2024 income 2023 tax year 2025 income 2024 EUR 10 570 This tax free allowance may increase depending on personal circumstances for example if dependent children

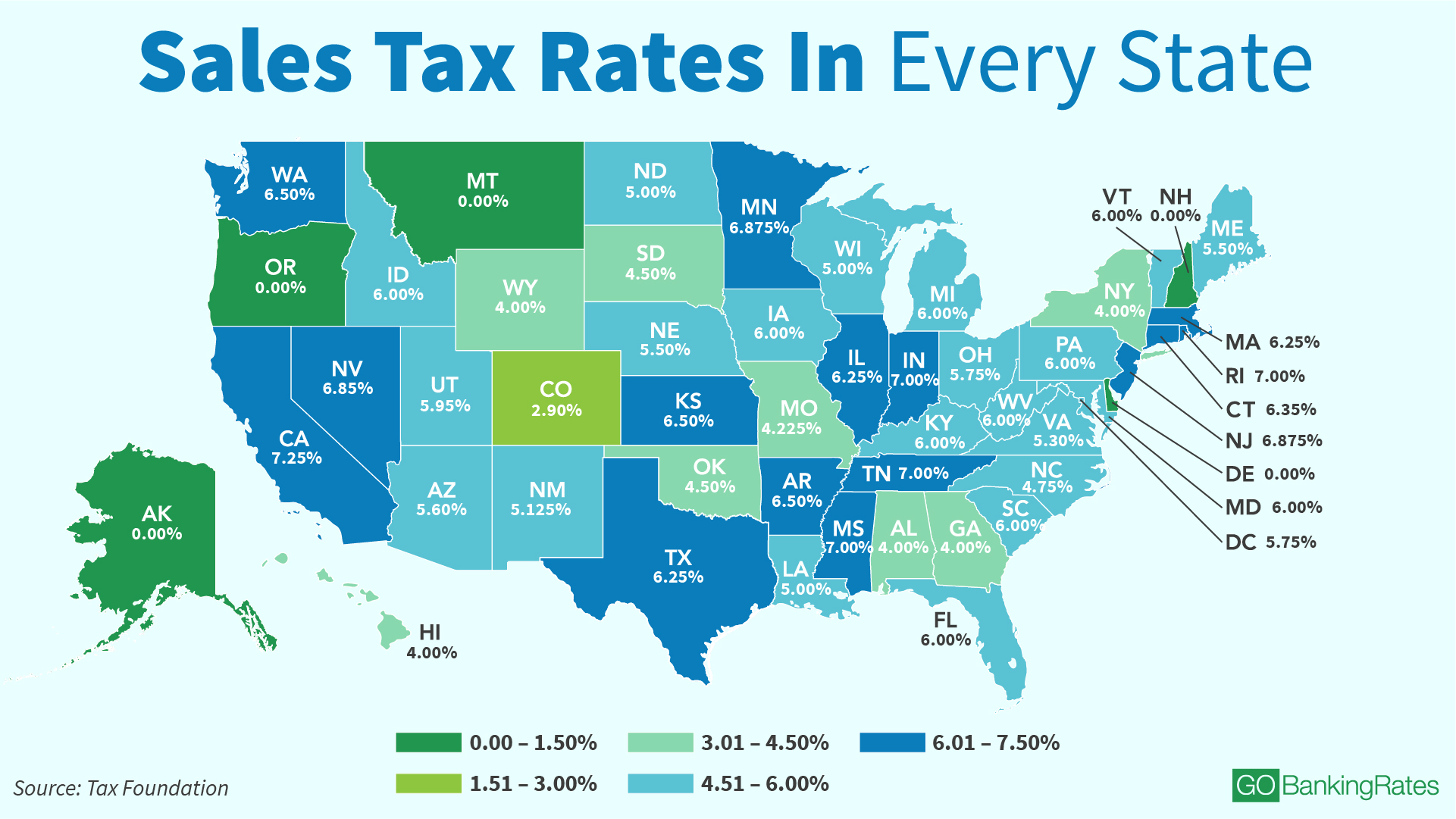

Salesx Tax In Ca Vancouverbezy

How Much Tax Do You Pay On A 1000 Lottery Ticket In California 09 2021

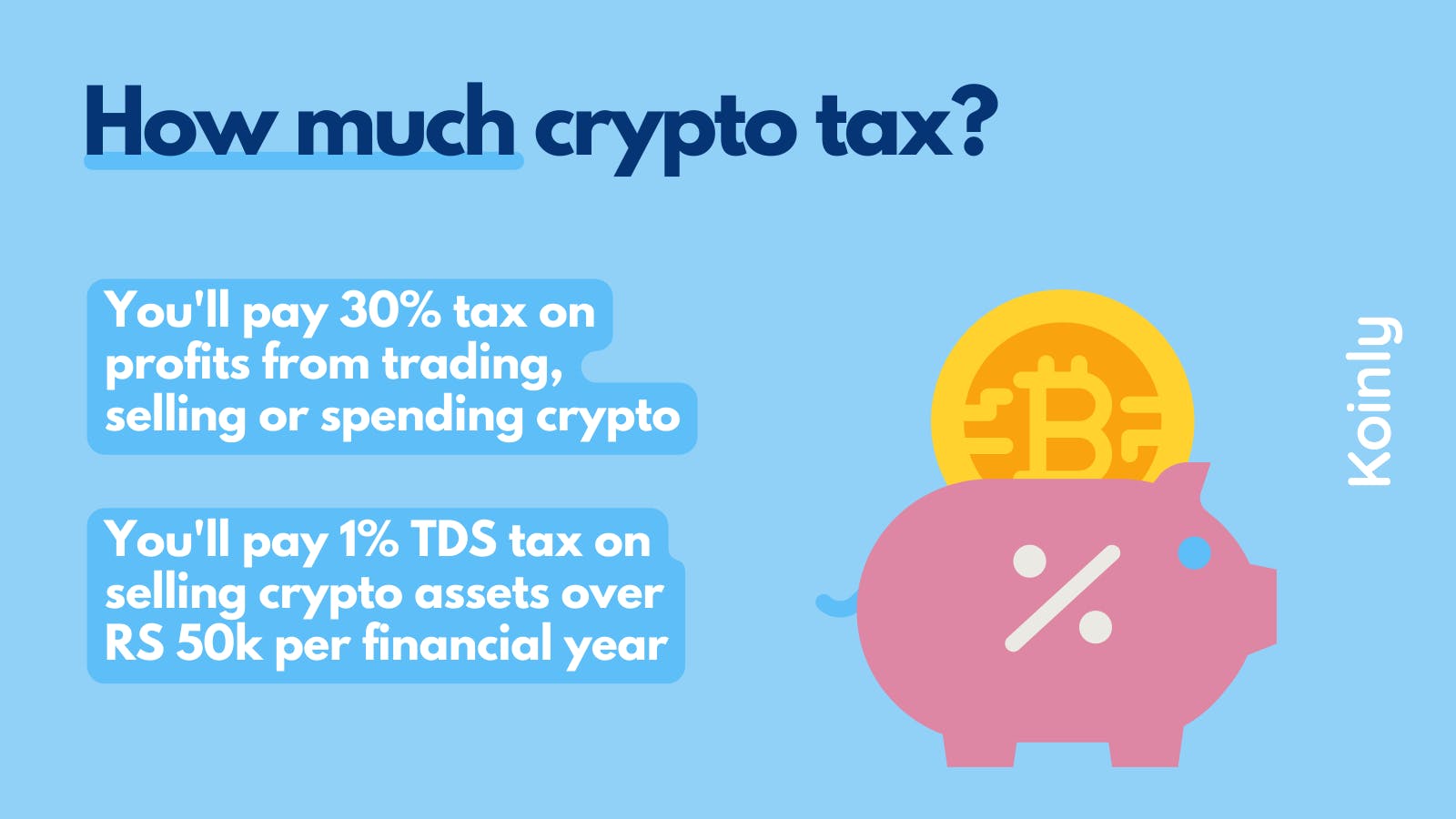

Crypto Taxes India Ultimate Guide 2023 CPA Reviewed Koinly

The Tax System For Companies In Ireland AccountsIreland

How Do I Claim VAT Back From Belgium

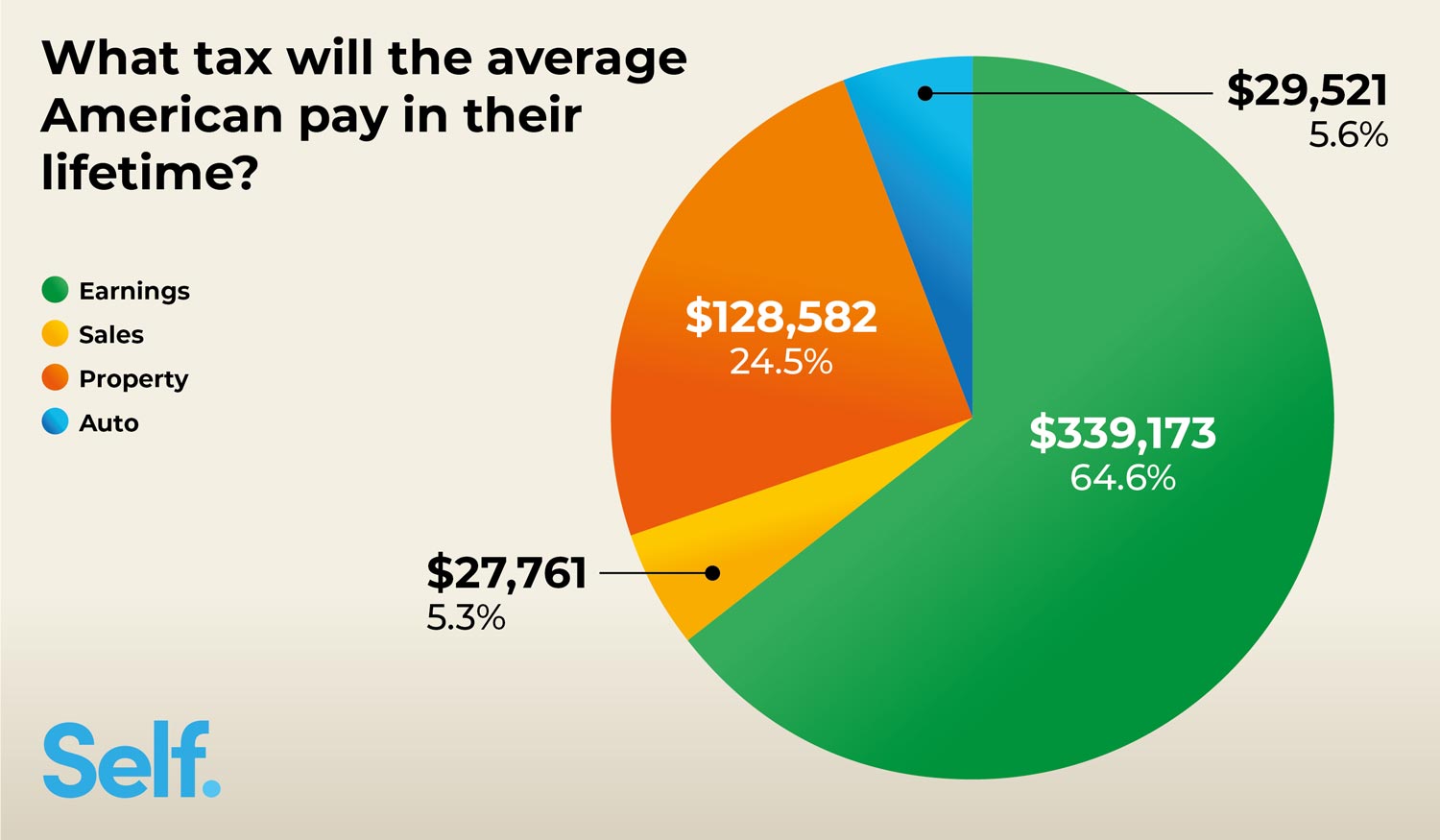

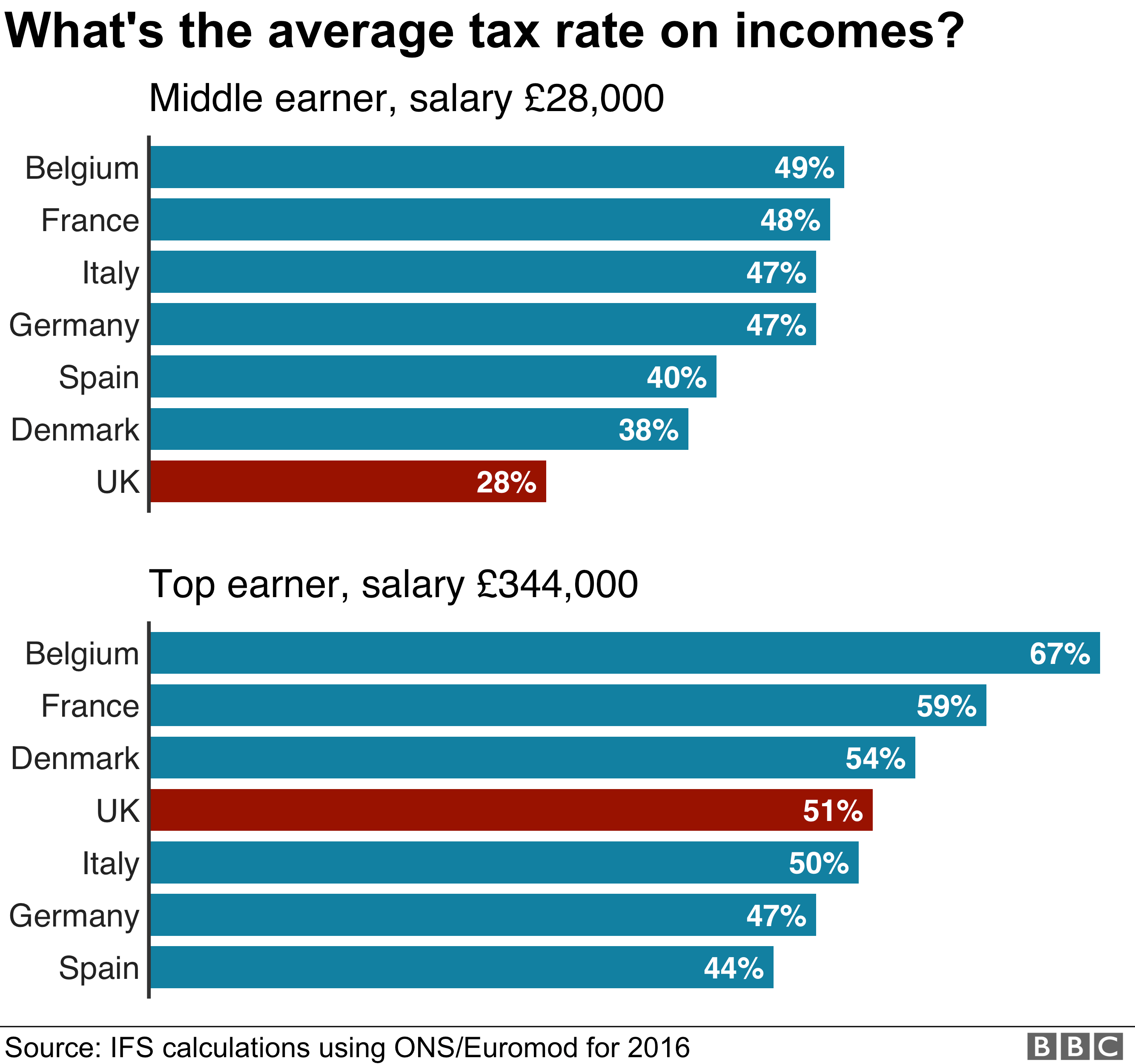

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

How Much Tax Do You Pay On Bond Investments Mint

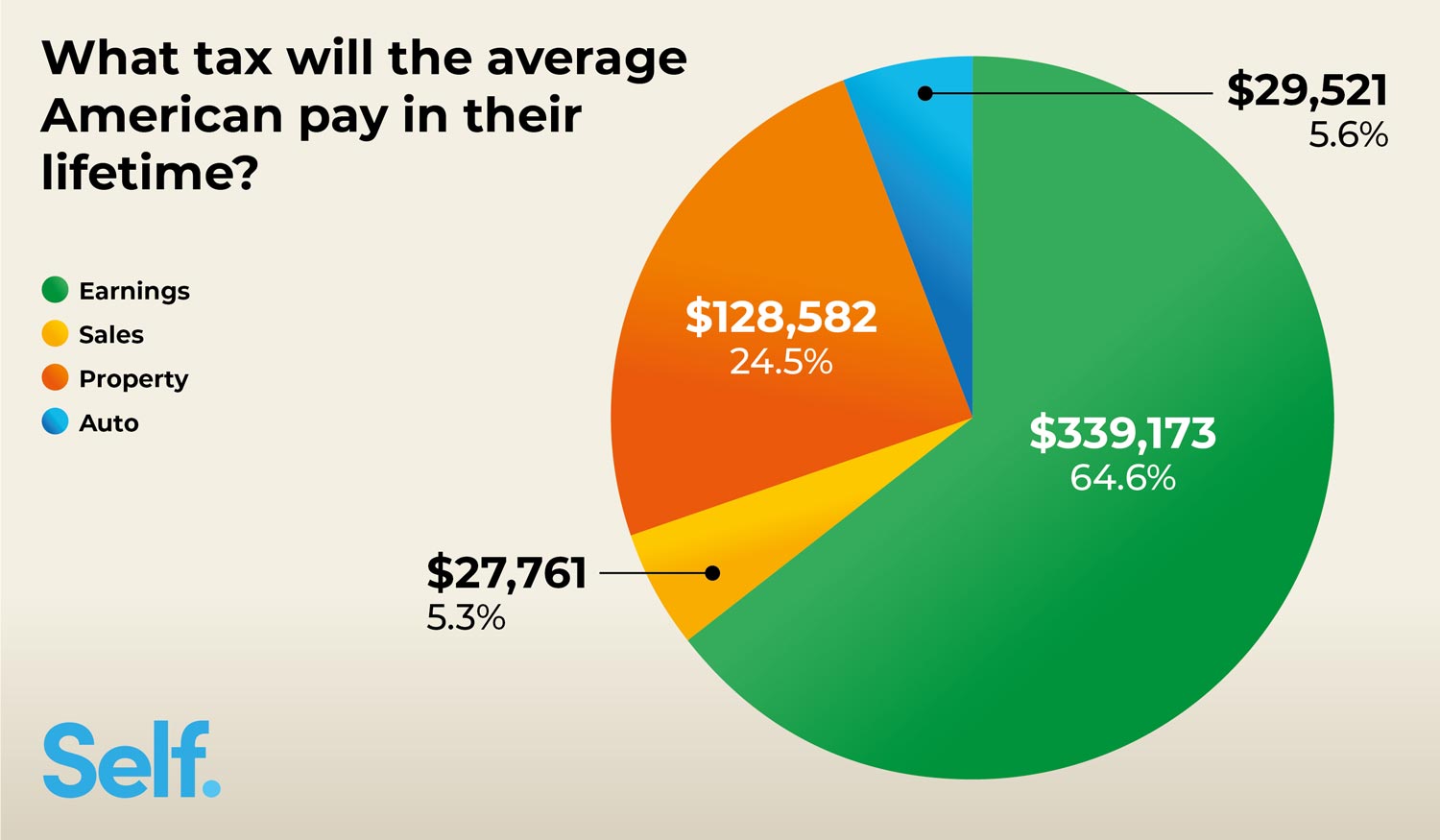

General Election 2019 How Much Tax Do British People Pay BBC News

How Much Tax Do You Pay In Belgium - In Belgium you ve to pay a flat tax of 15 on income from your interest on a savings account Your bank withholds this tax off your interest payment However everyone has a tax free allowance of 980 as an individual or 1 960 as a married or officially cohabiting couple