How Much Tax Do You Pay In The Netherlands Everyone residing or conducting business within the Dutch borders must pay taxes on their income wealth and assets The tax revenue funds public spending in the Netherlands including healthcare education and social security benefits In 2024 the Dutch government is projected to raise around 402 9 billion in taxes Most of this will

Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands Check the I enjoy the 30 ruling and find the maximum amount of tax you can save with the 30 percent ruling Sole traders self employed receive additional tax credits lowering The 30 reimbursement ruling is a tax advantage for certain expat employees in the Netherlands The most significant benefit is that the taxable amount of your gross Dutch salary is reduced from 100 to 70 So 30 of your wage is tax free Visit the 30 ruling page for more information

How Much Tax Do You Pay In The Netherlands

How Much Tax Do You Pay In The Netherlands

https://www.iamexpat.nl/sites/default/files/styles/ogimage_thumb/public/dutch-tax-system.jpg

Crypto Tax In The Netherlands Ultimate Guide 2022 Koinly

https://images.prismic.io/koinly-marketing/79a1fac7-363a-450f-bb70-d3f7f8ed9643_Koinly+Netherlands+Crypto+Tax+Guide.png?auto=compress,format

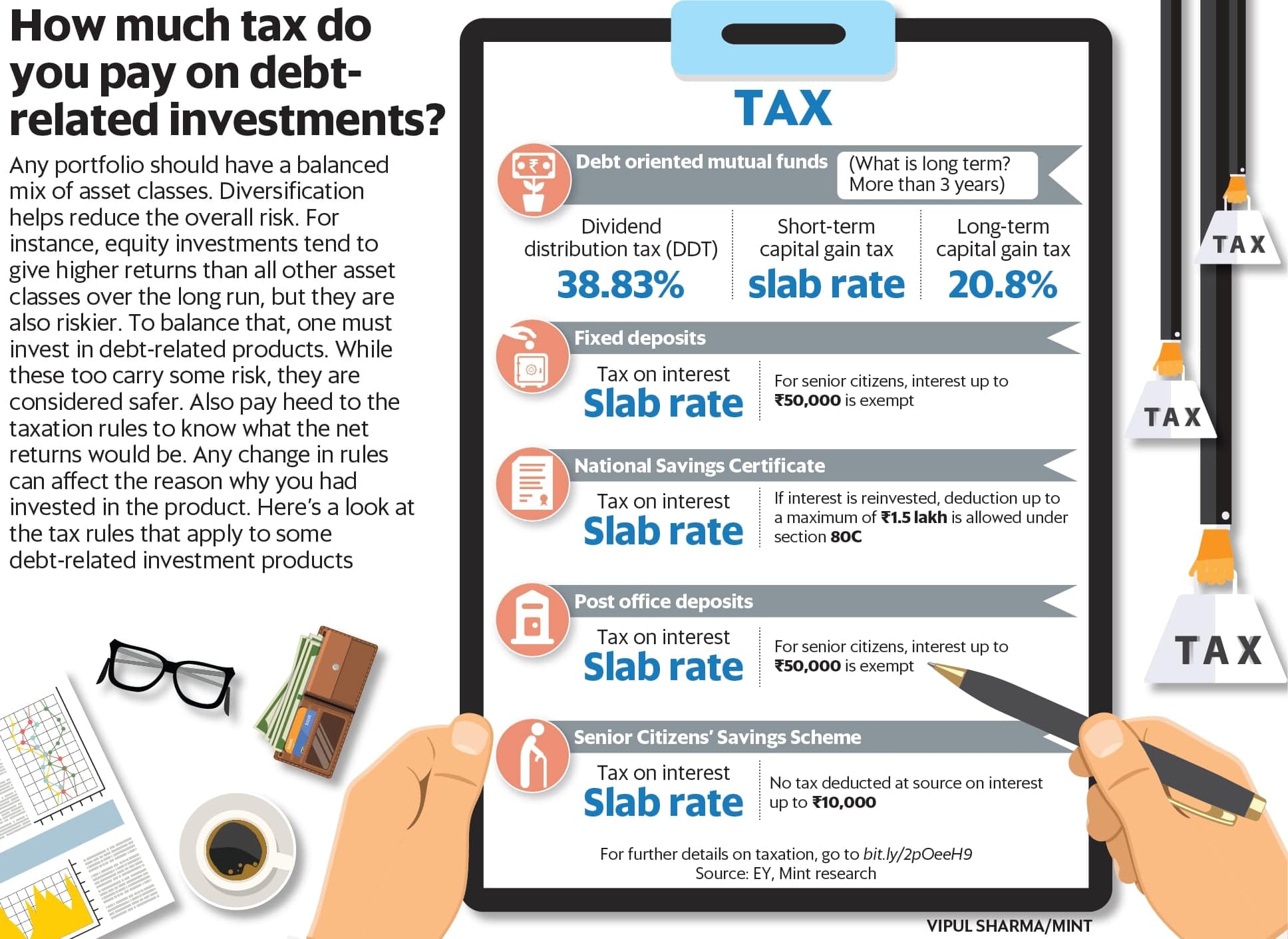

How Much Tax Do You Pay On Your Income Mint

https://images.livemint.com/img/2020/02/02/original/taxchart_1580665978559.png

Box 2 income is taxed at a rate of 24 5 for the first 67 000 euro income in Box 2 and a rate of 31 for the income above Box 3 income deemed return on savings and investments is taxed at a flat rate of 36 Local taxes on income There are no local taxes on income in the Netherlands Dutch salary calculator with 30 ruling option Learn how much tax you pay on your income in Netherlands

Income Tax If you live in the Netherlands or receive income from the Netherlands you will be subjected to pay income tax in the Netherlands You pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments Tax brackets in the Netherlands vary depending on the type of income box 1 2 or 3 For box 1 tax on income from employment including home ownership there is a 37 07 tax rate for income from 0 69 397 Above this the tax rate is 49 5

Download How Much Tax Do You Pay In The Netherlands

More picture related to How Much Tax Do You Pay In The Netherlands

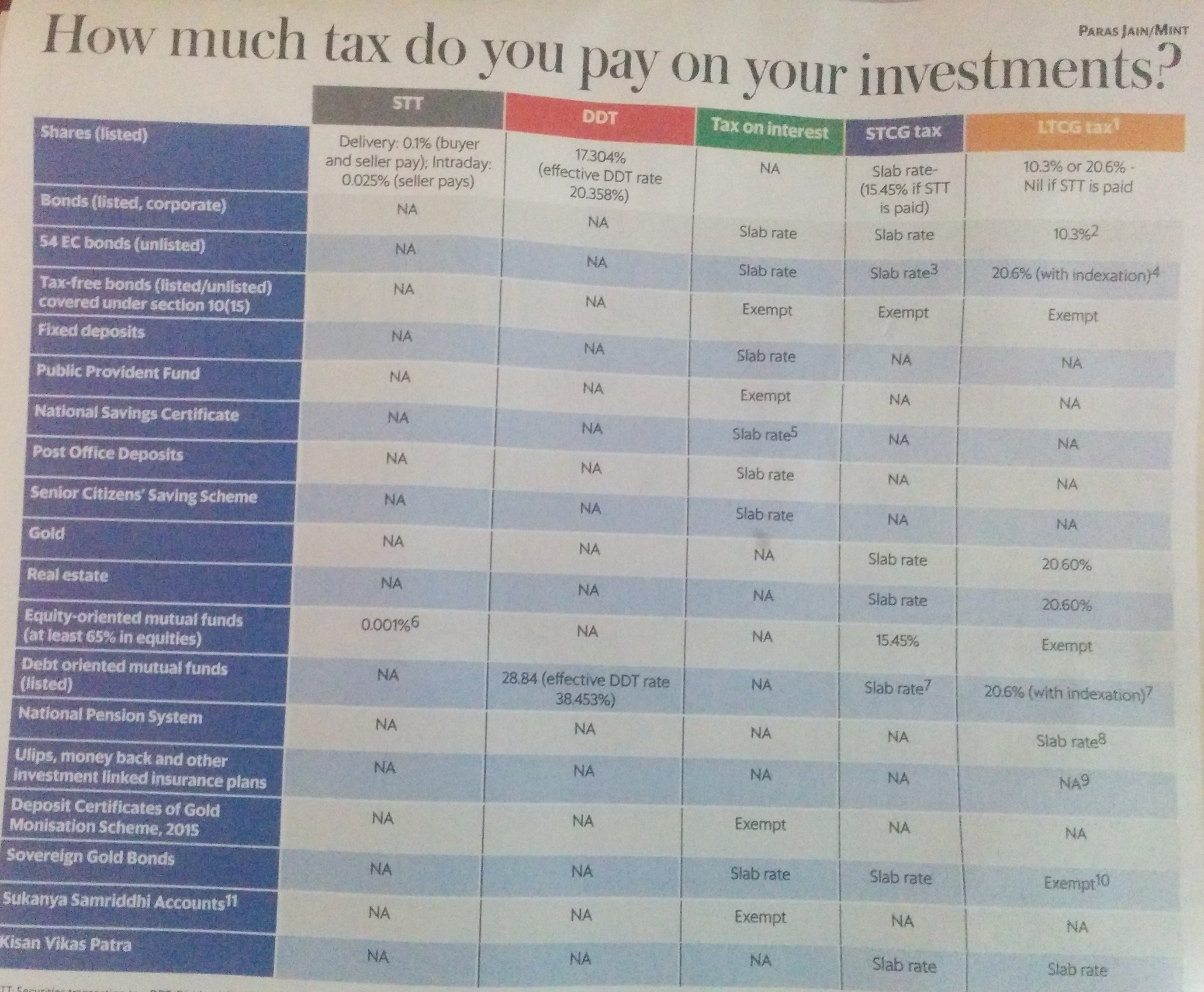

How Much Tax Do You Pay On Your Investments Livemint

http://www.livemint.com/r/LiveMint/Period2/2017/03/01/Photos/Processed/w_tax-investment_1_mar_wednesday.jpg

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

https://www.19fortyfive.com/wp-content/uploads/2021/06/FBIP-SOCIAL-04-994x800.jpg

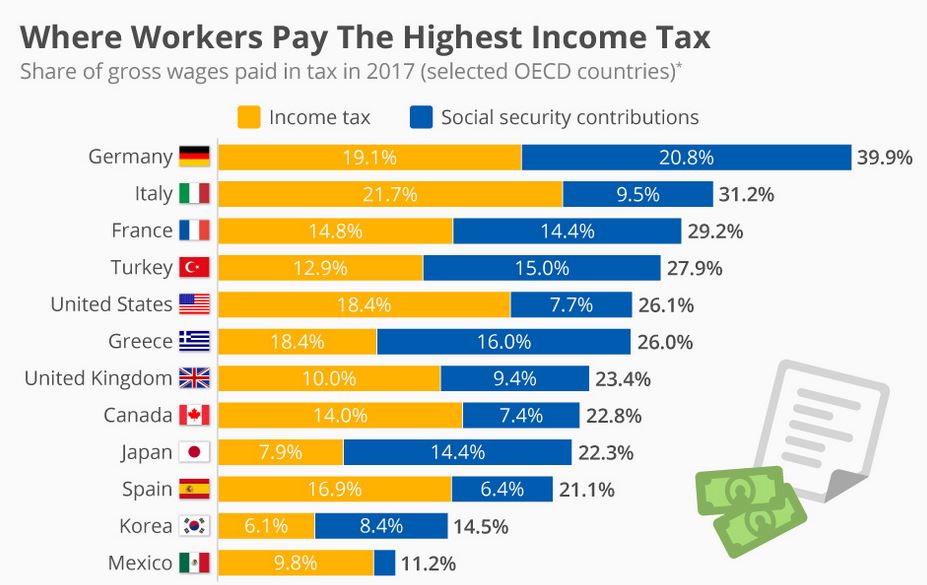

Where Workers Pay The Highest Income Tax The Sounding Line

https://thesoundingline.com/wp-content/uploads/2018/05/Payroll-Taxes-by-country.jpg

Income tax rate The income tax you pay is the total amount of tax calculated on your income your financial interests in a company and your savings and investments less deductible items Tax credits are deducted from the total tax payable If you live in the Netherlands you are subjected to pay tax on your income Some of your expenditures may be tax deductible deductible items For tax purposes income is divided into three categories known as boxes

[desc-10] [desc-11]

Free Calculator How Much Tax Do You Pay On Rental Income

https://resources.wiseadvice.co.nz/hubfs/Rental Income Tax Calculator.png#keepProtocol

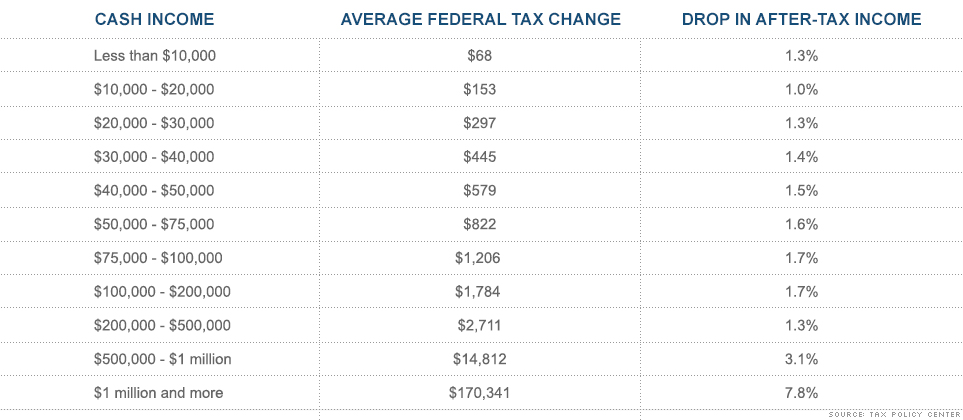

How Much More Tax You ll Pay CNNMoney

https://i2.cdn.turner.com/money/infographic/news/economy/fiscal-cliff-tax/chart-fiscal-cliff-tax-changes_v2.jpg

https://www.expatica.com/nl/finance/taxes/...

Everyone residing or conducting business within the Dutch borders must pay taxes on their income wealth and assets The tax revenue funds public spending in the Netherlands including healthcare education and social security benefits In 2024 the Dutch government is projected to raise around 402 9 billion in taxes Most of this will

https://www.blueumbrella.nl/dutch-tax-calculator

Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands Check the I enjoy the 30 ruling and find the maximum amount of tax you can save with the 30 percent ruling Sole traders self employed receive additional tax credits lowering

15 DeZember The One With Your Take Home Pay

Free Calculator How Much Tax Do You Pay On Rental Income

What Are Payroll Taxes Types Employer Obligations More

How Much Tax Do You Pay On Your Investments Mint

Income Tax Hello Grads

1031 Exchange Flipping Houses Durabrandhometheatersystem

1031 Exchange Flipping Houses Durabrandhometheatersystem

How Much Tax Do You Pay On Your Investments Alpha Ideas

How Much Tax Do You Pay On Your Investments Mint

How Much Tax Do You Pay On Your Investments Mint

How Much Tax Do You Pay In The Netherlands - Tax brackets in the Netherlands vary depending on the type of income box 1 2 or 3 For box 1 tax on income from employment including home ownership there is a 37 07 tax rate for income from 0 69 397 Above this the tax rate is 49 5