How Much Tax Do You Pay On Pension Fund Withdrawal Web 24 Dez 2022 nbsp 0183 32 Tax on pension withdrawals The way you withdraw from your pension changes how much tax you ll need to pay We ve outlined how this works for a few

Web 17 Apr 2023 nbsp 0183 32 In this case you d be in the basic rate tax band so you d pay tax on your pension withdrawals at a rate of 20 And if you have a personal allowance of Web 13 Mai 2022 nbsp 0183 32 How Pension Income Is Taxed Learn what to expect in taxes if you receive a pension in retirement By Rachel Hartman Reviewed by Emily Brandon May 13 2022 at 2 56 p m It s important

How Much Tax Do You Pay On Pension Fund Withdrawal

How Much Tax Do You Pay On Pension Fund Withdrawal

https://www.completefrance.com/wp-content/uploads/2022/04/how-much-tax-do-you-pay-on-uk-.jpg

Overpaying Tax On Pension Pot Withdrawals In Retirement

https://icfp.co.uk/wp-content/uploads/2018/05/money-256312_960_720.jpg

How Much Tax Do You Pay On A Life Insurance Payout Life Settlement

https://www.lsa-llc.com/wp-content/uploads/2022/06/How-Much-Tax-Do-You-Pay-on-a-Life-Insurance-Payout-1536x1024.jpg

Web Pension withdrawal Enter the cash lump sum amount you want to take from your pension pot within the tax year 06 Apr 2023 to 05 Apr 2024 163 Other taxable income Web You could withdraw your whole pension pot withdraw smaller cash sums pay in but you ll pay tax on contributions over the money purchase annual allowance When you

Web If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance If you hold lifetime Web How much tax will you pay on a pension lump sum withdrawal Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2020 21 2021 22

Download How Much Tax Do You Pay On Pension Fund Withdrawal

More picture related to How Much Tax Do You Pay On Pension Fund Withdrawal

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Low Pension Coverage Affecting Contribution Growth The Vaultz News

https://thevaultznews.com/wp-content/uploads/2021/01/2E676220-D00F-4452-8335-5536A80F76D3.jpeg

Samples Retirement Letters Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332474/large.png

Web If you leave your pot invested and take out smaller amounts ad hoc you ll get 25 of each withdrawal tax free You can also withdraw up to a quarter of your pension s value as a one off tax free lump sum but if Web 23 Aug 2023 nbsp 0183 32 You received all of your contributions tax free in prior years If you contributed after tax dollars to your pension your pension will be partially taxable You won t owe taxes on the amount you contributed in

Web 11 Dez 2023 nbsp 0183 32 If you have a defined contribution pension you can usually take up to 25 from your pension free of income tax the remaining 75 is taxed as earnings Web 29 Aug 2023 nbsp 0183 32 that mandatory income tax withholding of 20 applies to the majority of lump sum distributions from employer retirement plans However this default rate may

How Much Tax Do I Pay As A Self Employed Person Artists Union England

https://www.artistsunionengland.org.uk/wp-content/uploads/2023/10/how-much-tax-do-i-pay-self-emloyed-featured-image.png

How Much Tax Will I Pay On My Pension And How Can I Avoid It LG

https://lgembrey.co.uk/wp-content/uploads/2022/07/How-Much-Tax-Pay-on-Pension.jpg

https://getpenfold.com/pension-guides/how-much-tax-will-i-pay-when-i...

Web 24 Dez 2022 nbsp 0183 32 Tax on pension withdrawals The way you withdraw from your pension changes how much tax you ll need to pay We ve outlined how this works for a few

https://www.standardlife.co.uk/.../article-page/tax-on-pension-withdrawals

Web 17 Apr 2023 nbsp 0183 32 In this case you d be in the basic rate tax band so you d pay tax on your pension withdrawals at a rate of 20 And if you have a personal allowance of

Employee Pension Scheme Fund Withdraw EPS Fund Withdrawal

How Much Tax Do I Pay As A Self Employed Person Artists Union England

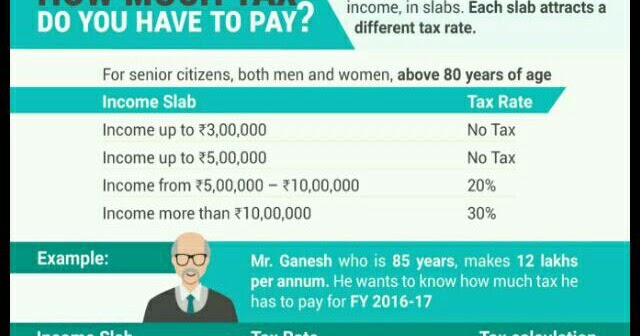

Nrinvestments How Much Tax Do You Have To Pay

Is Someone Earning 80 000 A Year In The Top 5 And How Much Tax Do

How Much Tax Do You Pay On Pension Retire Gen Z

How Much Money Does The Government Collect Per Person

How Much Money Does The Government Collect Per Person

Do You Pay Tax On Pension Income 2023

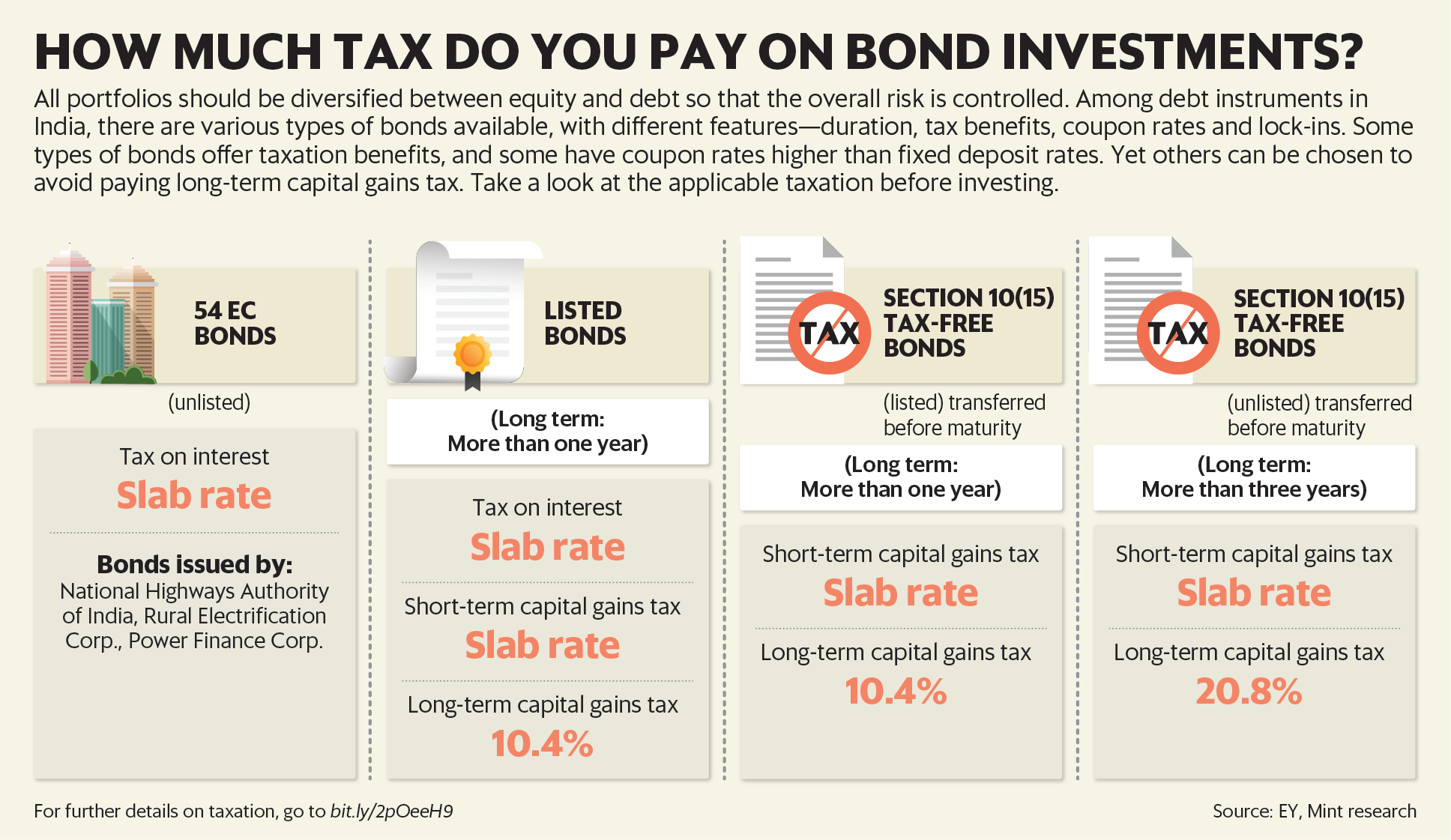

How Much Tax Do You Pay On Bond Investments Mint

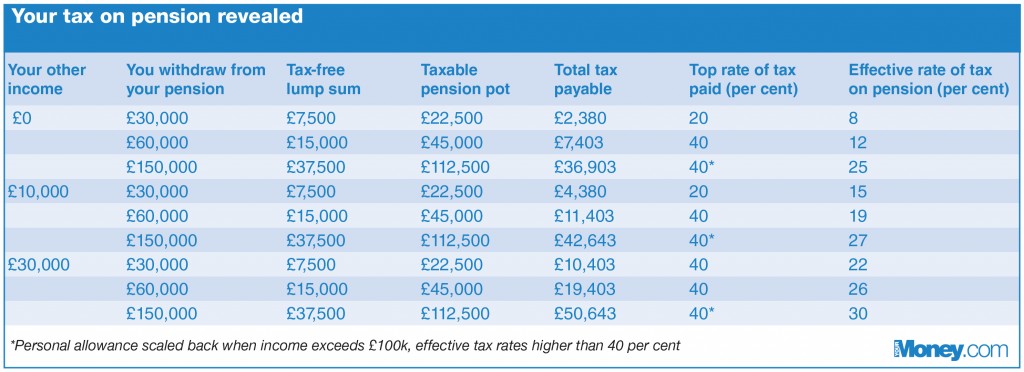

INFOGRAPHIC Your Pension Tax Bill Exposed

How Much Tax Do You Pay On Pension Fund Withdrawal - Web 21 Apr 2022 nbsp 0183 32 Usually you can take up to 25 of your pension as tax free cash once you reach age 55 rising to 57 in 2028 You can take this as a single payment or in stages