How Much Tax Do You Pay On Your Nhs Pension The P60 includes information about the pension we have paid you and the tax deducted during the tax year You will typically receive your P60 by the end of May The amount before tax shown on your P60 is usually different from the yearly rate paid for most of

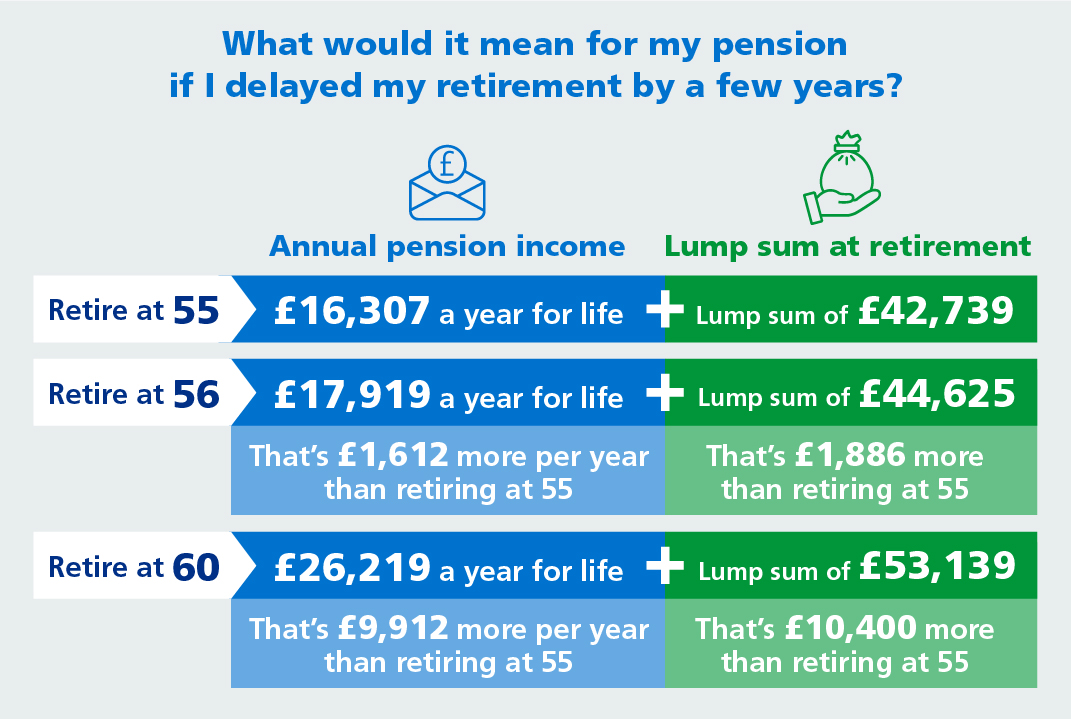

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if Then you may be able to have your pension and retirement lump sum from us paid as a one off payment subject to HMRC conditions The capital value is calculated by multiplying your pension by 20 and adding any retirement lump sum This however is not the amount that will actually be paid

How Much Tax Do You Pay On Your Nhs Pension

How Much Tax Do You Pay On Your Nhs Pension

https://resources.wiseadvice.co.nz/hubfs/Rental Income Tax Calculator.png#keepProtocol

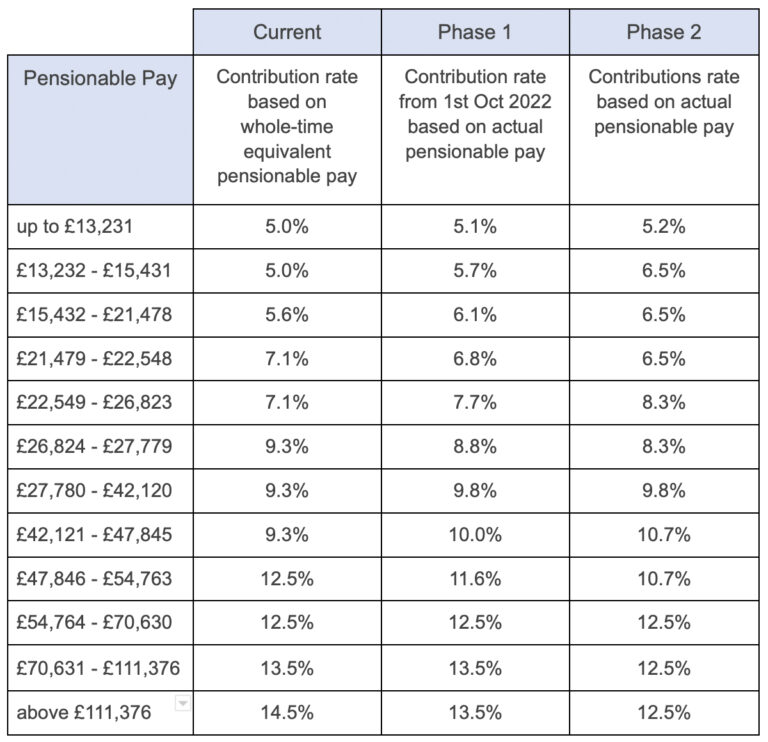

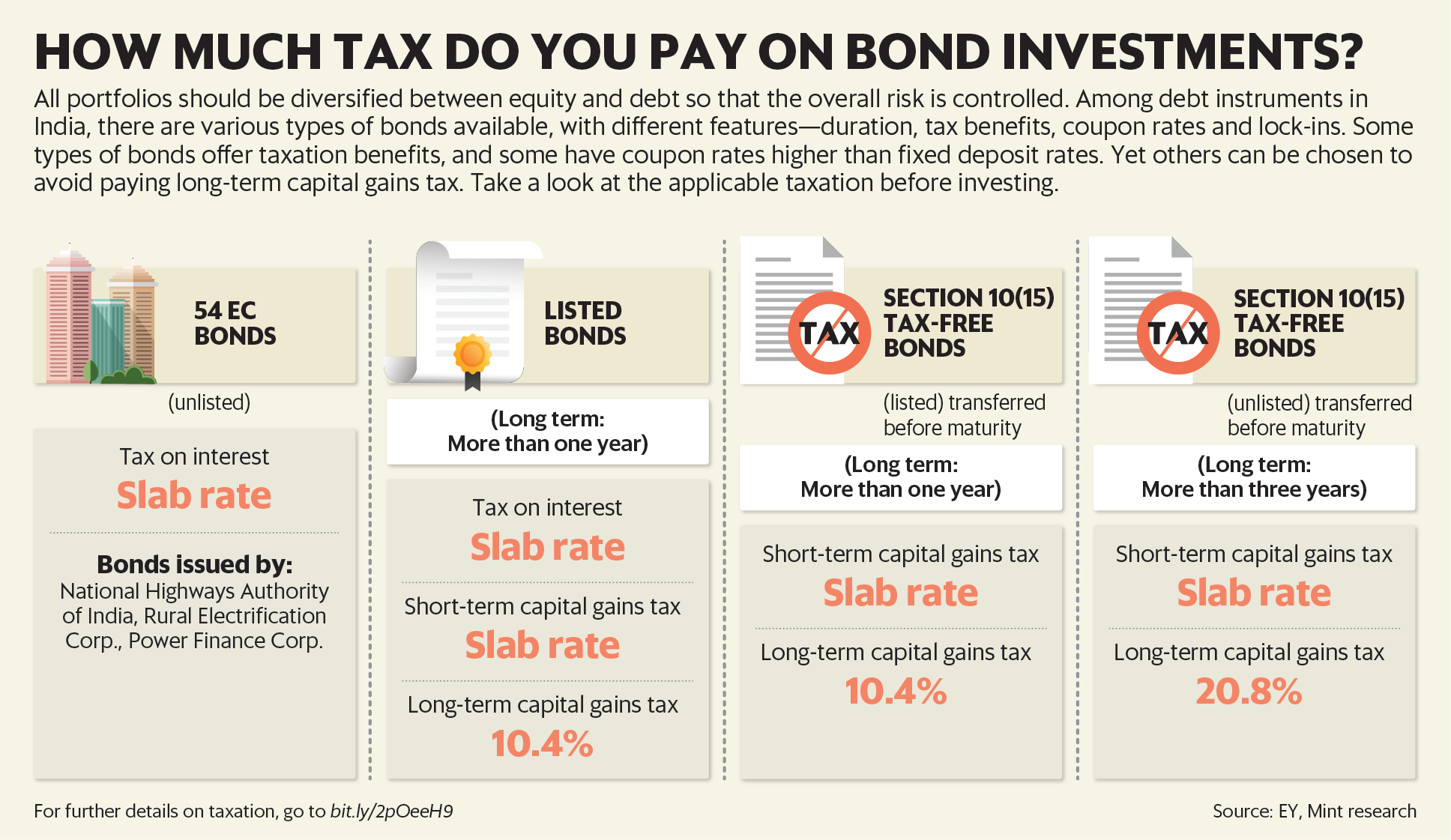

Changes In NHS Pension Contributions Are You A Winner Or Loser

https://www.legalandmedical.co.uk/wp-content/uploads/2022/07/Pensionable-pay1-768x742.jpg

NHS England Delayed Retirement 1 And 5 Years

https://www.england.nhs.uk/wp-content/uploads/2022/06/delaying-retirement.jpg

Income tax payers get tax relief Your employer pays in too Payable on healthy retirement or in ill health Pension payable for life Tax free cash Life cover when in service Benefits for adult dependants and children You re responsible for paying any tax you owe on income other than money from your pensions You might have to fill in a Self Assessment tax return If you owe any tax on investment income

You take 15 000 tax free Your pension provider takes tax off the remaining 45 000 When you can take your pension depends on your pension s rules It s usually 55 at the earliest You Doctors are being excessively taxed on their pensions This guidance informs you about your annual allowance statement and your options should you be charged

Download How Much Tax Do You Pay On Your Nhs Pension

More picture related to How Much Tax Do You Pay On Your Nhs Pension

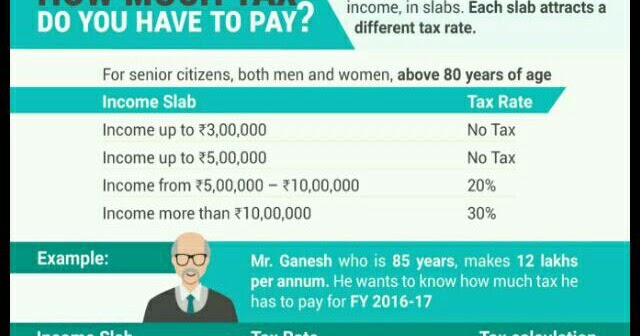

Nrinvestments How Much Tax Do You Have To Pay

https://3.bp.blogspot.com/-GbqZzj5p_D8/WIMGYBDBbbI/AAAAAAAAAGw/zJH3WWEf9DwYEpcdY4mTQHrRJJXrT5i-gCLcB/w1200-h630-p-k-no-nu/WhatsApp%2BImage%2B2017-01-21%2Bat%2B12.23.08%2BPM.jpeg

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01-923x1024.png

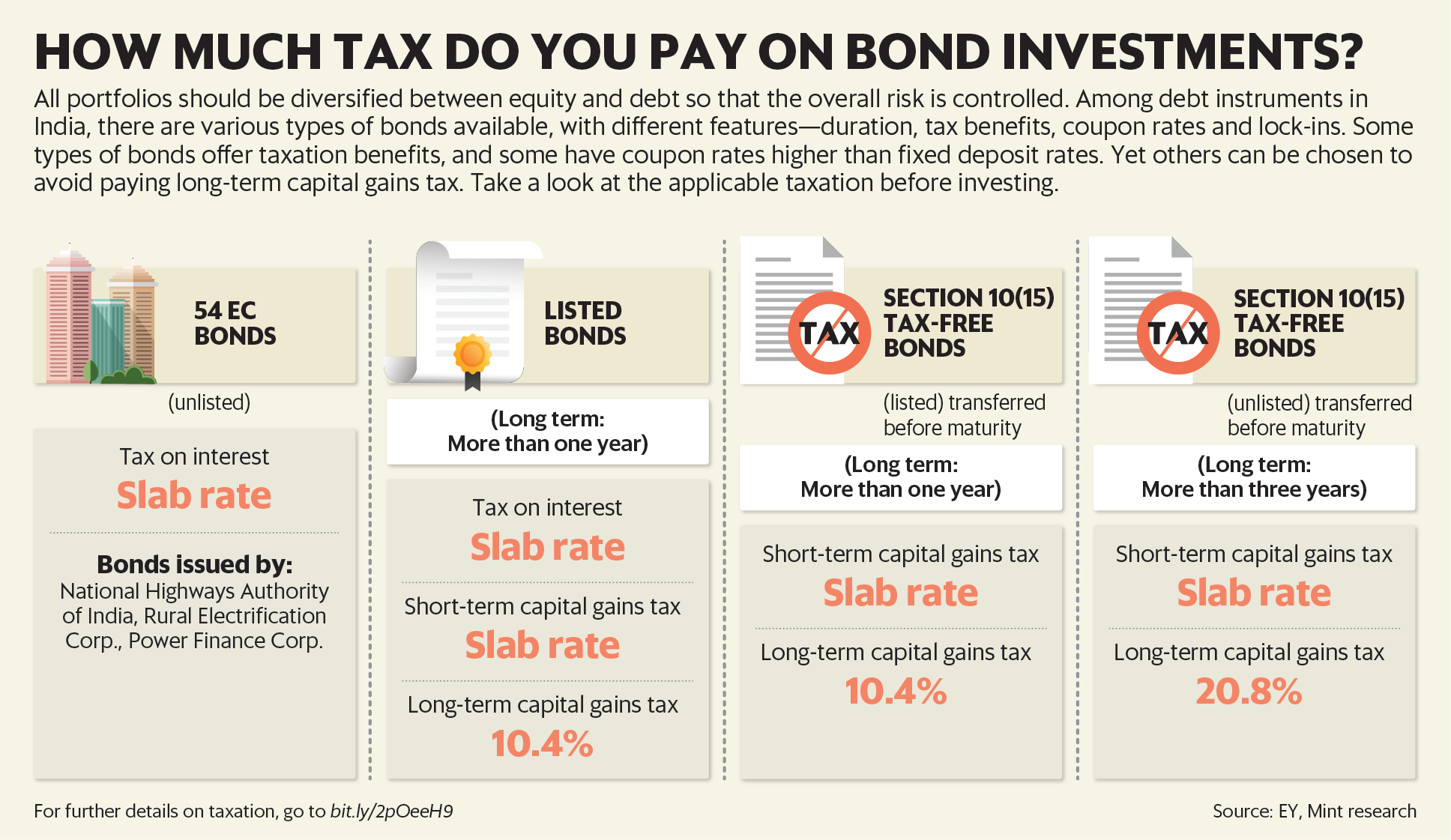

How Much Tax Do You Pay On Your Investments Mint

https://images.livemint.com/rf/Image-621x414/LiveMint/Period2/2018/09/13/Photos/Processed/[email protected]

NHS Pension Scheme members receive tax relief on their pension contributions This is because contributions are taken from pay before tax is taken off therefore contributions reduce the amount of pay subject to tax Your pension benefits are treated as earned income and are taxed before being paid to you We ll deduct tax under a temporary code until we re given the correct code from HM Revenue Customs HMRC This can take up to 3 months If you want to query your tax code contact HMRC

NHS Tax Calculator NHS Take Home Pay Calculator Nhs Salary Calculator Allowing NHS staff to estimate their take home pay as well as their tax pension and student loan liabilities simply and clearly Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2024 25 2023 24 and 2022 23 tax years

Your State Pension Forecast Explained Which

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

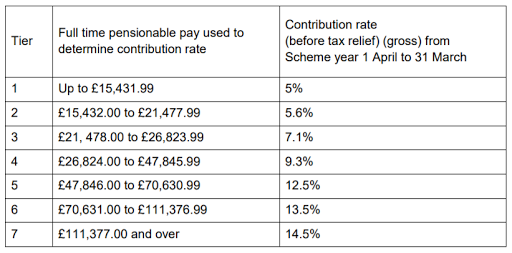

How Much Tax Do You Pay On Your Equity Investment Mint

https://images.livemint.com/img/2019/10/29/original/taxchart_1572375655046.png

https://www.nhsbsa.nhs.uk/pensioner-hub/useful-information-pensioners

The P60 includes information about the pension we have paid you and the tax deducted during the tax year You will typically receive your P60 by the end of May The amount before tax shown on your P60 is usually different from the yearly rate paid for most of

https://www.gov.uk/tax-on-pension

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if

How Much Tax Do You Pay On Your Bond Investments Mint

Your State Pension Forecast Explained Which

How Much Tax Do You Pay On Your Equity Investments

How Much Tax Do You Pay On Your Investments Mint

How Much Tax Do You Pay On Your Equity Investment Mint

How Much Tax Do You Pay On Bond Investments Mint

How Much Tax Do You Pay On Bond Investments Mint

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

NHS Pension The Basics

How Much Tax Do You Pay On Your Investments Mint

How Much Tax Do You Pay On Your Nhs Pension - You take 15 000 tax free Your pension provider takes tax off the remaining 45 000 When you can take your pension depends on your pension s rules It s usually 55 at the earliest You