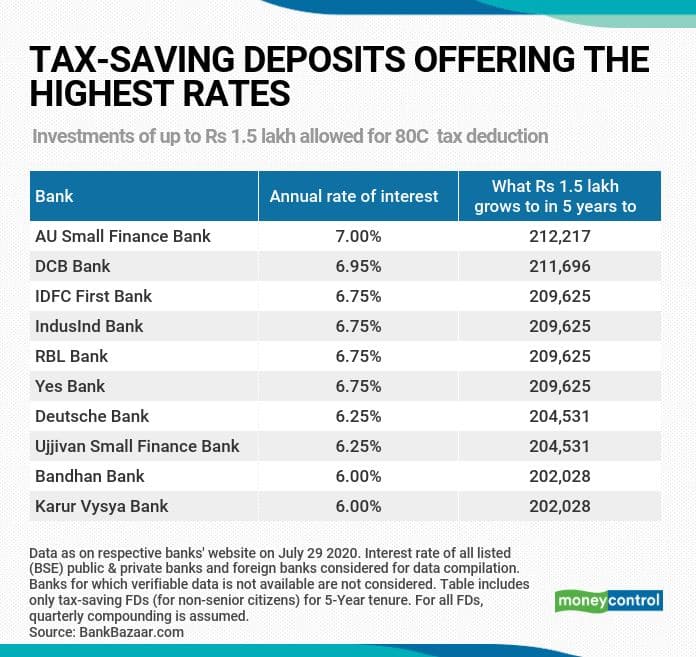

Tax Rebate On Interest Of Fd Web 6 avr 2022 nbsp 0183 32 A five year fixed deposit with SBI is currently yielding 5 50 per cent per annum Though opening a tax saving fixed deposit is one of the most popular and easiest ways

Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period You will get Web 12 nov 2020 nbsp 0183 32 The interest income you earn from an FD is fully taxable The interest earnings form a part of your total tax liability You must also know that when you earn

Tax Rebate On Interest Of Fd

Tax Rebate On Interest Of Fd

https://i.ytimg.com/vi/iGLCsL4pEMw/maxresdefault.jpg

Best Interest Rates On Tax Saving FD In India Jan 2013

https://myinvestmentideas.com/wp-content/uploads/2012/12/Best-interest-rates-on-tax-saving-FD-in-India–Jan-2013.png

Fed Rate Hike 2023 January

https://www.basunivesh.com/wp-content/uploads/2022/12/Latest-Post-Office-Interest-Rates-January-March-2023-scaled-1280x720.jpg

Web 17 avr 2022 nbsp 0183 32 Yes the banks and financial institutions are liable to deduct TDS at the rate of 10 on the FDR interest paid by them to the depositors However the threshold limit of Web The interest an individual earns on his her fixed deposit is subject to Tax Deducted at Source or TDS provided the interest is more than Rs 10 000 in a year Banks deduct

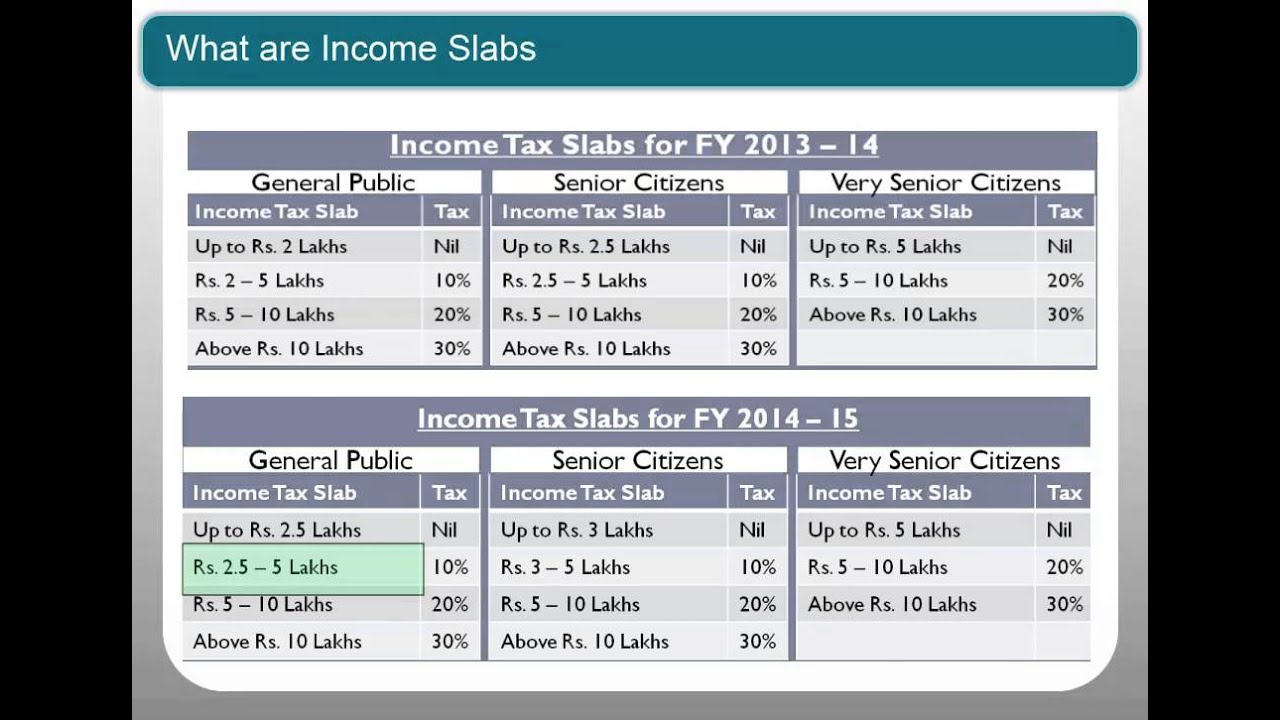

Web 8 sept 2023 nbsp 0183 32 Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers to income that are excluded Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Rs 1 5 lakh in a financial year

Download Tax Rebate On Interest Of Fd

More picture related to Tax Rebate On Interest Of Fd

The Advantages Of FD Are Many But The Disadvantages Are Not Less It Is

https://images.tv9hindi.com/wp-content/uploads/2022/10/fd5.jpg

10 Tax saving Fixed Deposits That Offer The Best Interest Rates 10 Tax

https://images.moneycontrol.com/static-mcnews/2020/07/FD-July-31.jpg

Tax Saving FD FD Tax Saving Fixed Deposit Banking Bank

https://images.bhaskarassets.com/web2images/521/2020/09/13/save-tax1_1599963005.jpg

Web 8 d 233 c 2022 nbsp 0183 32 What is TDS on Interest Earned From FD The interest income on FD is subject to TDS deduction under section 194A Every payer of FD interest must deduct Web 3 sept 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

Web 2 FD interest gained over Rs 5 lakh or 10 lakh is eligible for extra tax deductions of 10 and 20 respectively in addition to TDS as per the Income Tax Act 1961 3 For NRI citizens TDS on FD rate is 30 Web A tax saving FD gives you access to tax rebates of up to 1 5 Lakhs annually under Section 80C of the Income Tax Act 1961 However to enjoy such fixed deposit tax

Fixed Deposit Interest Income Taxation For FY 2020 21 AY 2021 22

https://www.relakhs.com/wp-content/uploads/2018/03/TDS-and-income-tax-slab-rate-tax-liability-refund-claim-for-extra-tds-paid.jpg

20 New Fed Interest Rate Chart

https://windwardwealthstrategies.com/wp-content/uploads/2015/12/P1_Windward_Fed_Interest_Rates_Chart.jpg

https://www.valueresearchonline.com/stories/50686/fixed-deposits...

Web 6 avr 2022 nbsp 0183 32 A five year fixed deposit with SBI is currently yielding 5 50 per cent per annum Though opening a tax saving fixed deposit is one of the most popular and easiest ways

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period You will get

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Fixed Deposit Interest Income Taxation For FY 2020 21 AY 2021 22

2007 Tax Rebate Tax Deduction Rebates

Can I Claim Ppi Back From My Catalogue

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Military Journal Nm State Rebate 2022 According To The Department

Military Journal Nm State Rebate 2022 According To The Department

Fed Interest Rate Projections Through 2022 Decker Retirement Planning

FD TDS On Fixed Deposit In Bank

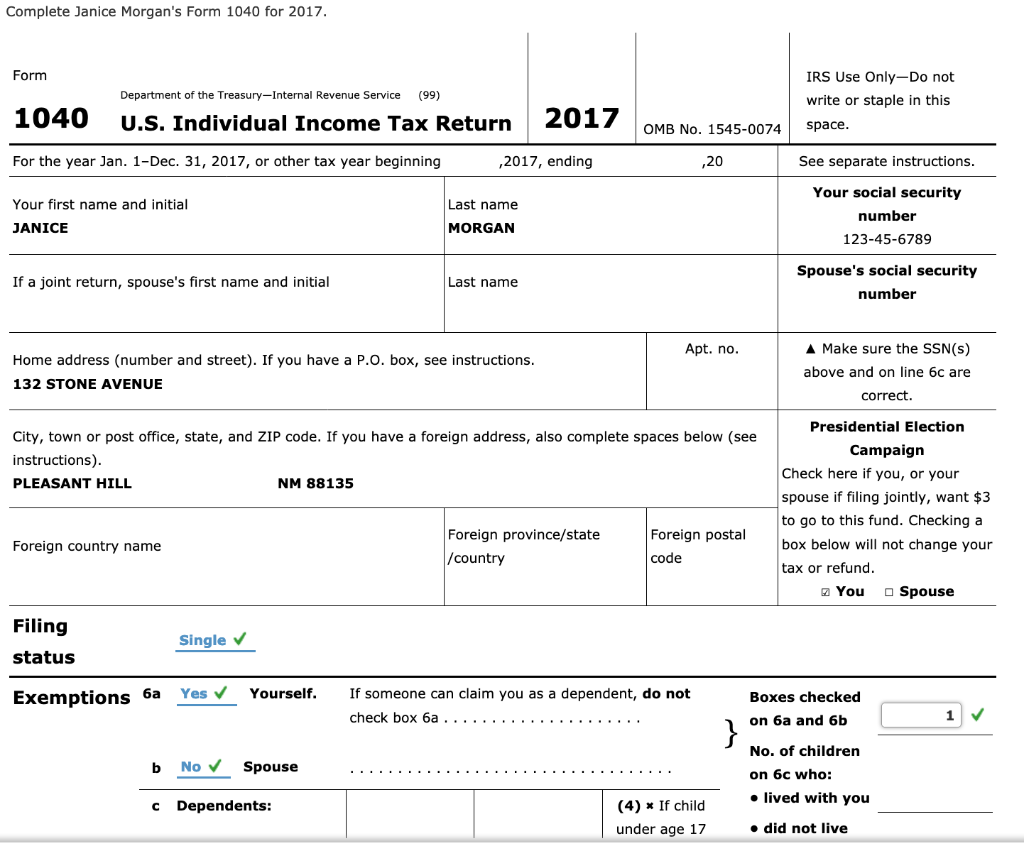

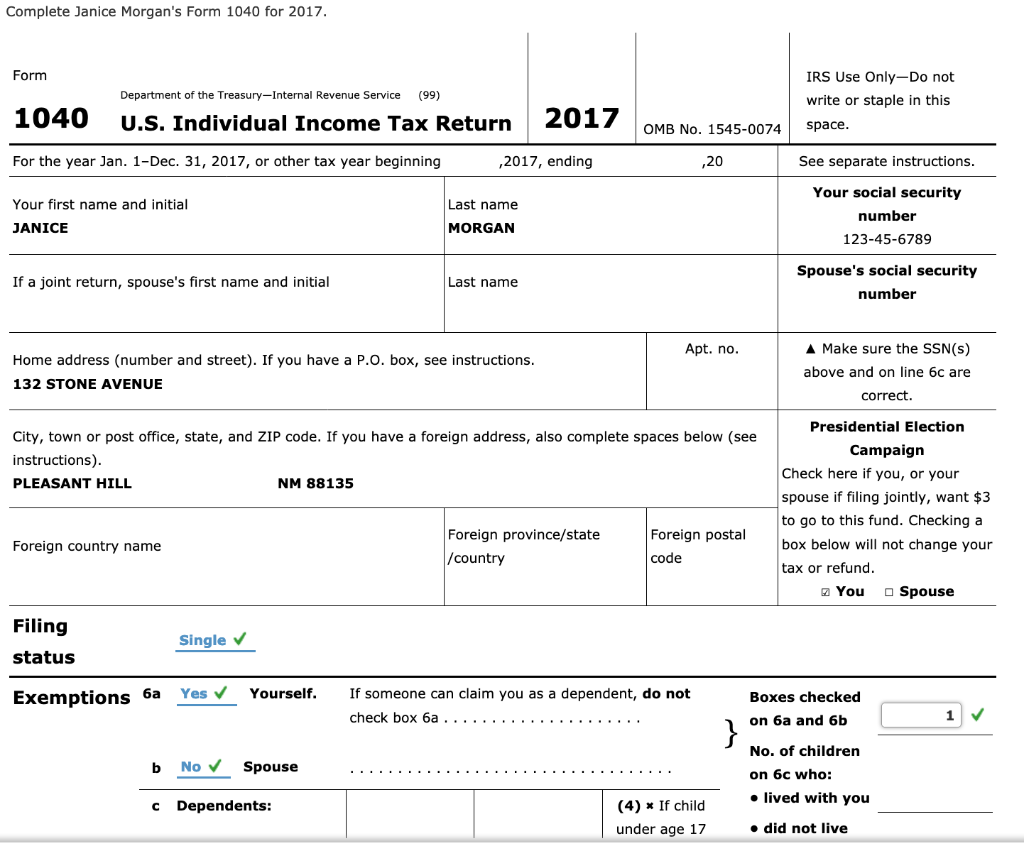

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Tax Rebate On Interest Of Fd - Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Rs 1 5 lakh in a financial year