How Much Tax Is Deducted On Hra Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

CALCULATOR Some components of your salary can be tax exempt without the need of investing in any tax saving instruments One of them is House Rent Allowance commonly referred to as HRA and to find out the amount of HRA House Rent Allowance HRA Calculator is to help calculate HRA exemption rebate for the salaried individual from the HRA received from your Employer Salary Also consider special rebate for Metro residents such as Delhi explains the method of calculation and deduction under 80GG

How Much Tax Is Deducted On Hra

How Much Tax Is Deducted On Hra

https://www.coursehero.com/qa/attachment/18920165/

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp

This calculator shows you on what part of your HRA you have to pay taxes i e how much of your HRA is taxable and how much is exempt from tax Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

The HRA House Rent Allowance allowance you receive from your employer is not always fully tax exempt It may be fully or partially exempt from tax depending on certain condtions Out of the HRA received the least of the following three amounts is taken to be exempt from tax A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA exemption is deducted from the overall income which

Download How Much Tax Is Deducted On Hra

More picture related to How Much Tax Is Deducted On Hra

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

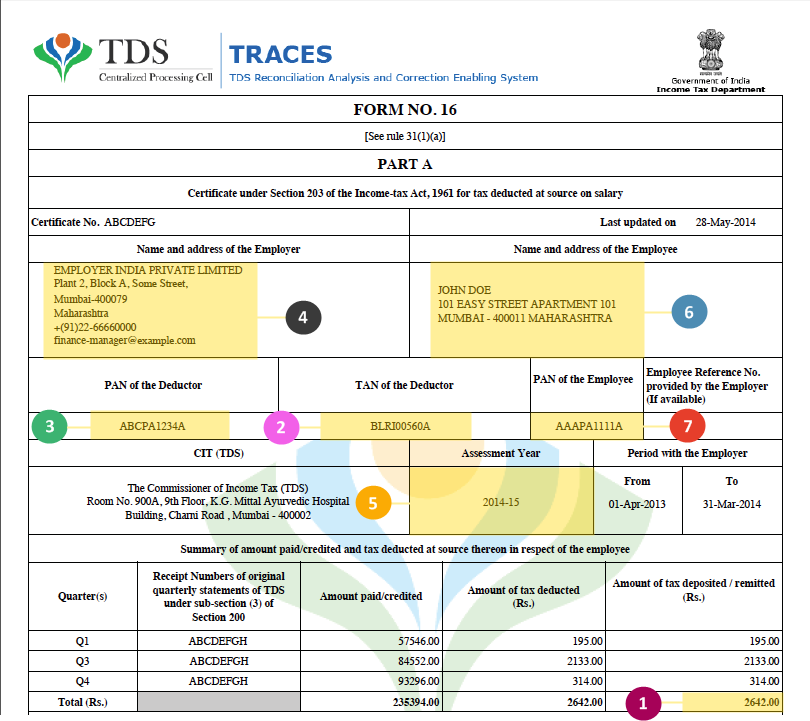

Form16 parta E filing Of Income Tax Return

https://etaxadvisor.com/wp-content/uploads/2016/08/form16_parta.png

HRA Exemption Calculator For Salaried Employees FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2021/12/how-to-calculate-hra-to-save-income-tax-1024x576.webp

House Rent Allowance HRA Calculator helps in calculating house rent if you receive HRA as part of your salary and you live in a rented house Get more details of HRA Calculation Rules for HRA Claim Claim benefits on HRA at Coverfox HRA deduction leads to a reduction in the tax that taxpayers have to pay Who is eligible for HRA As per the Income Tax Act 1961 only salaried employees can claim HRA and self employed individuals can claim their rent payment under Section 80GG

Calculate your HRA Exemption with Tax2win s House Rent Allowance HRA Calculator easily and maximize your tax benefits Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable income This

Tax Deducted At Source TDS Rates In Nepal For 2080 2081 UPDATED

http://bizsewa.com/wp-content/uploads/2020/06/tds22-1.jpg

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://assets-news.housing.com/news/wp-content/uploads/2021/03/15192807/All-you-need-to-know-about-HRA-exemptions-FB-1200x700-compressed.jpg

https://cleartax.in/paytax/hracalculator

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

https://economictimes.indiatimes.com/wealth/calculators/hra_calculator

CALCULATOR Some components of your salary can be tax exempt without the need of investing in any tax saving instruments One of them is House Rent Allowance commonly referred to as HRA and to find out the amount of HRA

How Much Tax Is Deducted From Salary In India Vakilsearch

Tax Deducted At Source TDS Rates In Nepal For 2080 2081 UPDATED

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Visualizing Taxes Deducted From Your Paycheck In Every State

Ouida Minor

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

How To Deduct TDS On GST Bill 2023

How Much Tax Is Deducted From A PayCheck In WA

Tax Deducted At Source TDS Under Goods And Service Tax Taxes In

How Much Tax Is Deducted On Hra - Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons