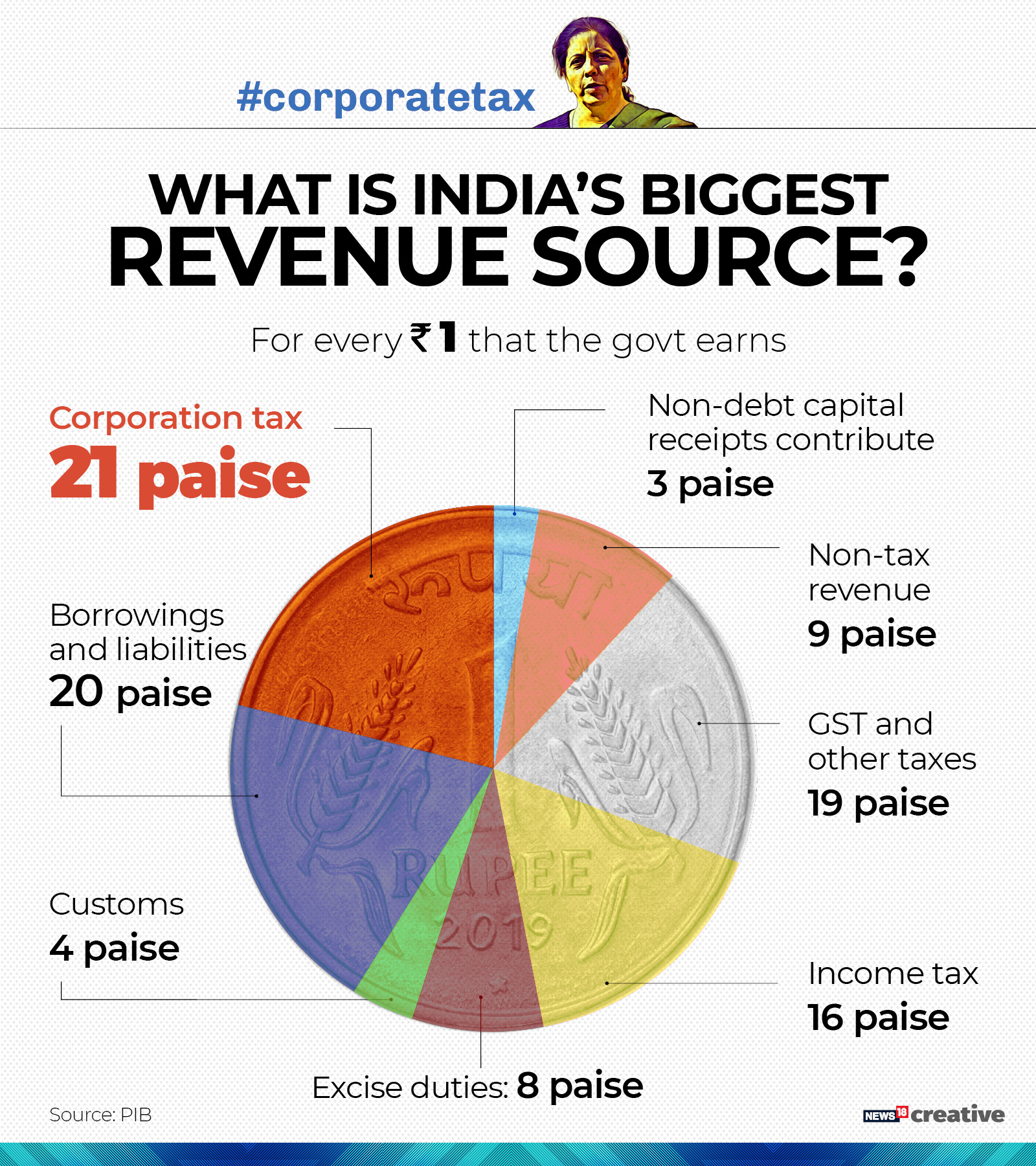

How Much Total Tax Collected In India Revised Estimate of Corporation Tax for 2023 2024 is 9 22 675 crore as against Budget Estimate of 9 22 675 crore Budget Estimate for 2024 2025 is 10 20 000 crore Taxes on Income This is a tax on the income of individuals firms etc other than Companies under the Income tax Act 1961

The provisional figures of Direct Tax collections for the Financial Year FY 2023 24 show that Net collections are at Rs 19 58 lakh crore compared to Rs 16 64 lakh crore in the preceding Financial Year i e FY 2022 23 representing an increase of 17 70 As per Indian Union Budget estimates for financial year 2023 direct taxes accounted for 51 5 percent and indirect taxes accounted for 48 5 percent of total central tax collection in India

How Much Total Tax Collected In India

How Much Total Tax Collected In India

https://taxguru.in/wp-content/uploads/2022/04/Rise-in-Total-Revenue-Collection-.jpg

State wise Goods And Services Tax GST Collections For 2019 20 In

https://external-preview.redd.it/_I2L_XBFyY8lFahdkFFulhA0nwp_ve7RhPmbJVy8JE8.jpg?auto=webp&s=9e3bd15dfe265e3020beb153f3545acb18ab146b

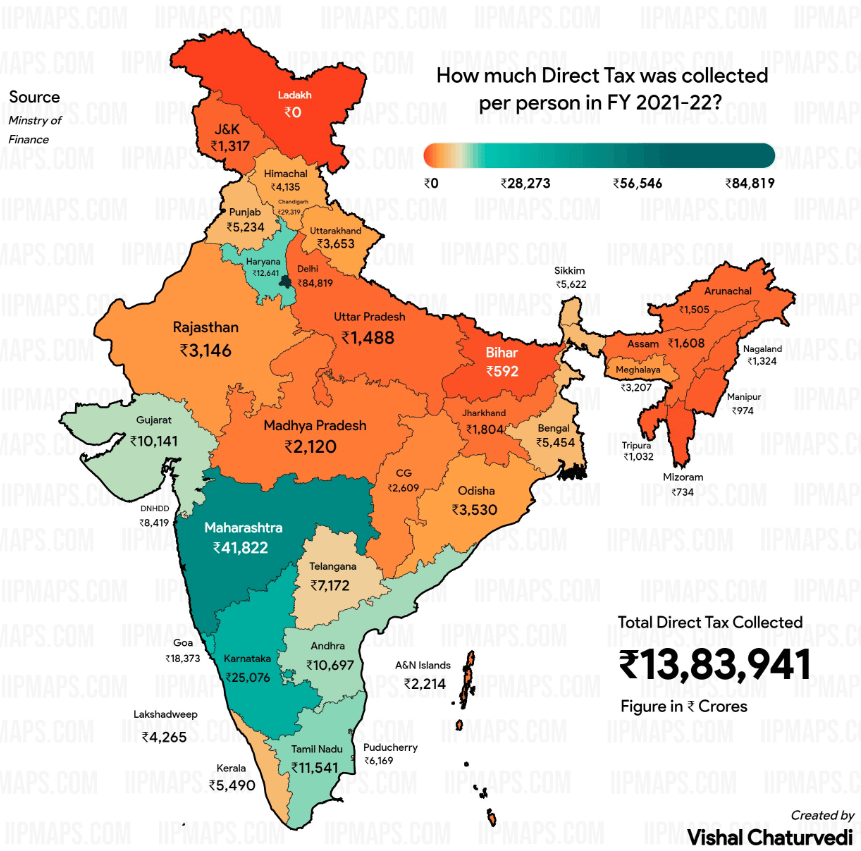

Direct Tax Collected In India Per Person For FY 2021 22 ExamArc

https://guide.examarc.com/wp-content/uploads/2023/02/image-2.png

The Minister gave further details of amount of Central taxes which have been collected till 31st December 2020 for financial year 2020 21 as under The releases of States Share Tax Devolution is as per the accepted recommendations of Finance Commission for its award period the Minister stated The provisional figures of Direct Tax collections for the Financial Year FY 2022 23 show that Net collections are at Rs 16 61 lakh crore compared to Rs 14 12 lakh crore in the preceding Financial Year i e FY 2021 22 representing an increase of 17 63

World Bank Open Data Data Taxes on Income This is a tax on the income of individuals firms etc other than Companies under the Income tax Act 1961 This head also includes other taxes mainly the Securities Transaction Tax which is levied on transaction in listed securities

Download How Much Total Tax Collected In India

More picture related to How Much Total Tax Collected In India

India s Direct Tax Collection

https://fingfx.thomsonreuters.com/gfx/editorcharts/INDIA-TAX/0H001QXY7BLE/images/share-card.png

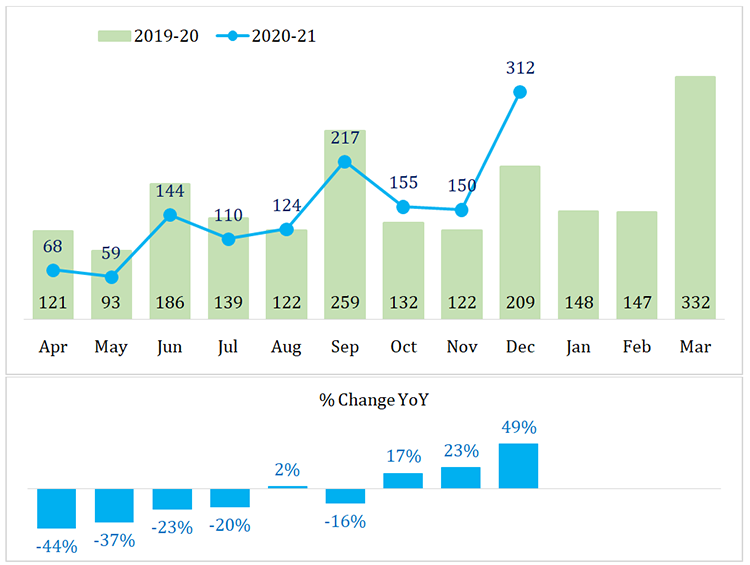

Unpacking The Government s Revised Tax Revenue Projections For 2020 21

https://www.cbgaindia.org/wp-content/uploads/2021/02/fig-2-monthly-tax-collection.png

State wise Per Capita Goods And Services Tax Collection In India via

https://preview.redd.it/qg7gk3ntep681.jpg?auto=webp&s=007f5f9af2a54cc74a507f9d5ad3059301bc77c6

India Tax revenue of GDP data is updated quarterly averaging 7 4 from Jun 1997 to Jun 2024 with 109 observations The data reached an all time high of 10 8 in Mar 2015 and a record low of 3 0 in Jun 2003 The Income Tax Department is the central government s largest revenue generator total tax revenue increased from 1 392 26 billion US 17 billion in 1997 98 to 5 889 09 billion US 71 billion in 2007 08 3 4 In 2018 19 direct tax collections reported by the CBDT were about 11 17 lakh crore 11 17 trillion

[desc-10] [desc-11]

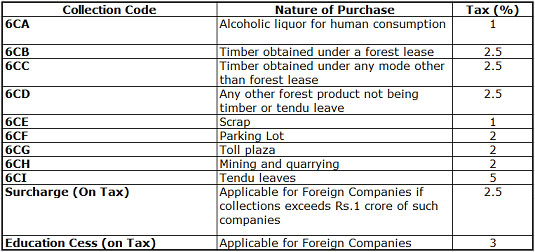

Tax Collected At Source Latest TCS Rates In India Complete Details

https://caknowledge.com/wp-content/uploads/2017/08/Tax-Collected-at-Source.jpg

Tax Collected At Source In India Updates Dezan Shira Associates

https://www.india-briefing.com/news/wp-content/uploads/2011/12/India-Tax-Chart.jpg

https://www.indiabudget.gov.in/doc/rec/tr.pdf

Revised Estimate of Corporation Tax for 2023 2024 is 9 22 675 crore as against Budget Estimate of 9 22 675 crore Budget Estimate for 2024 2025 is 10 20 000 crore Taxes on Income This is a tax on the income of individuals firms etc other than Companies under the Income tax Act 1961

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2018373

The provisional figures of Direct Tax collections for the Financial Year FY 2023 24 show that Net collections are at Rs 19 58 lakh crore compared to Rs 16 64 lakh crore in the preceding Financial Year i e FY 2022 23 representing an increase of 17 70

Govt Exceeds 2016 17 Tax Collection Target Revenue Jumps 18 Livemint

Tax Collected At Source Latest TCS Rates In India Complete Details

Direct Tax Collection In FY22 Grew 49 Indirect Tax Collection 30

Corporation Tax Revenue As A Of Total Gross Tax Revenue In India

All About Corporate Tax In India For Your Business SME Infoline

Top 10 Highest Tax Paying States In India 2001 2018 YouTube

Top 10 Highest Tax Paying States In India 2001 2018 YouTube

How India Earns Each Rupee Where It Goes Caliber Az

Types Of Taxes UPSC Taxes In India UPSC Types Of Taxes In India UPSC

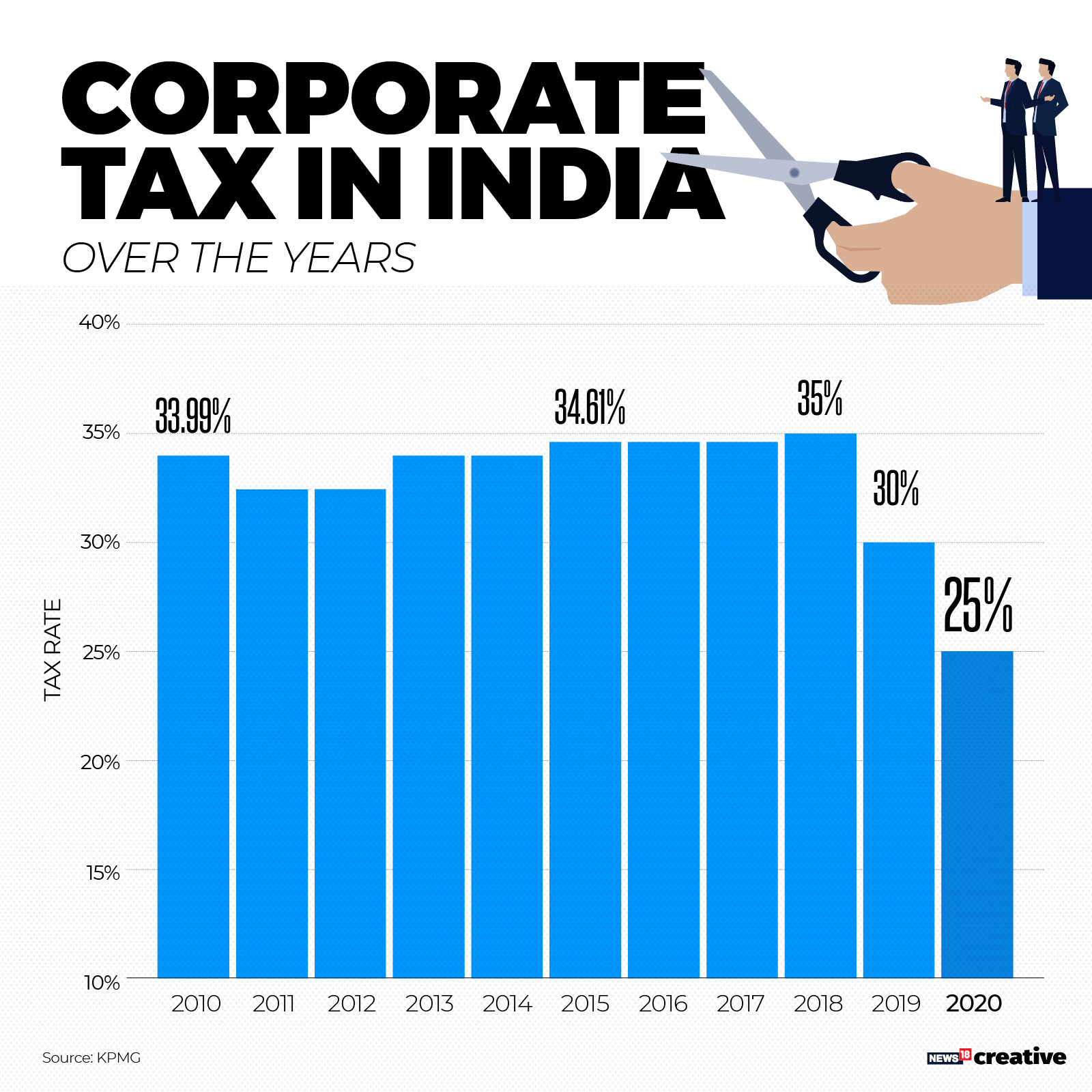

What The Corporate Tax Cuts Mean For India In Four Charts Forbes India

How Much Total Tax Collected In India - The Minister gave further details of amount of Central taxes which have been collected till 31st December 2020 for financial year 2020 21 as under The releases of States Share Tax Devolution is as per the accepted recommendations of Finance Commission for its award period the Minister stated