How Much Union Fees Can You Claim On Tax You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions However if the taxpayer is self employed and pays union dues those dues are deductible as a business expense If you pay dues to a professional union you might wonder if they re tax deductible If you re a freelancer the answer is likely yes with some exceptions

How Much Union Fees Can You Claim On Tax

How Much Union Fees Can You Claim On Tax

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

It s Tax Time What Can You Claim IEUSA

https://ieusa.org.au/wp-content/uploads/2022/05/220527-ATO-Teacher-Claim2.jpg

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned societies if Did you know union membership fees are tax deductible That means at the end of every financial year you can claim your union fees as a tax deduction Union fees are often in the list of most overlooked tax deductions each year so make sure you include them when you finalise your tax return

The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44 You may claim a tax deduction on line 21200 of your tax return and if your employer is a GST HST registrant you may be able to claim a refund for a portion of your union dues More than 800 000 taxpayers claimed tax refunds for work expenses during the 2021 to 2022 tax year but while the average claim was 125 over 70 of claimants missed out on getting the

Download How Much Union Fees Can You Claim On Tax

More picture related to How Much Union Fees Can You Claim On Tax

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

Guide Australia s GST Tourist Refund Scheme TRS Point Hacks

https://i.pointhacks.com/2023/03/30024802/TRS-Claim-Point-Hacks-by-Brandon-Loo1-1024x576.jpg

How Much Can You Claim On Your 2019 Return Paris Financial

https://www.parisfinancial.com.au/wp-content/uploads/2019/07/Untitled-design-5.jpg

Under current federal law union dues are generally not deductible However there are a few exceptions and if your union dues meet one of them you are in luck Union fees are 100 tax deductible reducing the amount you pay in taxes if you re a union member The deductible portion of union fees depends on your individual taxable income and assets You can claim the entire amount of union fees as a

Union fees are claimed under the Other work related expenses section of your tax return You can also keep a regular record of your dues paid throughout the year using the myDeductions section of the ATO app Download for Apple Download for Android Hi You can claim union fees in your tax return The amount claimed as a deduction will reduce your taxable income shown on your Notice of Assessment and therefore the amount of tax assessed It would not show as a separate item on the Assessment that you get refunded

What Can You Claim On Tax Without Receipts In Australia

https://creditte.com.au/wp-content/uploads/2023/02/blog-what-can-you-claim-on-tax-without-receipts.jpg

What Can You Claim On Tax As A Student College Aftermath

https://collegeaftermath.com/wp-content/uploads/2023/01/kelly-sikkema-xoU52jUVUXA-unsplash-scaled.jpg

https://www.gov.uk/government/publications/...

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned

https://www.hrblock.com/tax-center/filing/...

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions However if the taxpayer is self employed and pays union dues those dues are deductible as a business expense

17 Things You Can t Claim In Your Tax Return Platinum Accounting

What Can You Claim On Tax Without Receipts In Australia

Comparing The Union And Confederacy

Doola On Twitter Are You Ready For Tax Season Join Us On 3 1 For

5 Ways To Make Your Tax Refund Bigger The Motley Fool

How Many Business Miles Can You Claim Mariajanedesign

How Many Business Miles Can You Claim Mariajanedesign

Pin By Tamara Bass On Teaching Ideas Teacher Tax Deductions Teacher

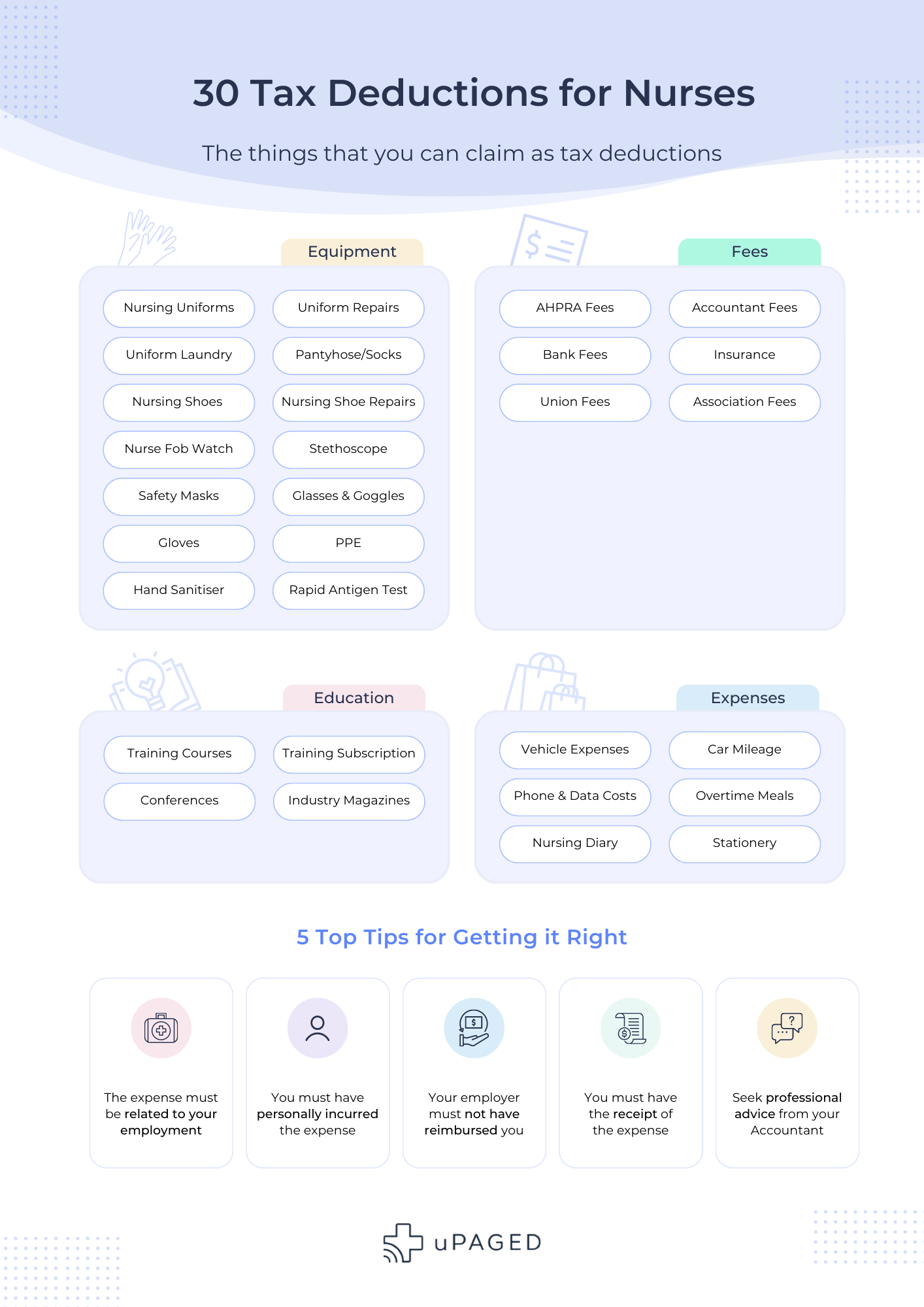

30 Things Nurses Can Claim As Tax Deductions In 2023 UPaged

In Acht Nehmen Verf hren Milchig Wei Western Union Fees Aufgabe Mark Fahrt

How Much Union Fees Can You Claim On Tax - You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned societies if