How Much Vat Refund In Italy Keep in mind that there s a minimum amount required in order to claim a VAT refund which varies depending on the country but as this is being written the minimum purchase amount to submit a VAT refund in Italy is 154 94 and that s money spent at one time at

Decline VAT refunds can be a tricky subject especially when you re traveling to a foreign country In Europe the rules and regulations regarding tax refunds vary from country to country To help you out we ve put together a complete guide to tax refunds in Europe so you can get your money back without any hassle To be able to claim a refund the taxpayer s VAT credit must be not less than EUR 2 582 28 the refund claimed must be greater than EUR 10 33 Deadline for claiming a refund The annual VAT return in which the annual VAT refund can be claimed must be submitted between 1 February and 30 April of each year

How Much Vat Refund In Italy

How Much Vat Refund In Italy

https://d3adw1na09u8f7.cloudfront.net/2022/08/23211519/08_19_header01.jpg

How To Get A VAT Refund Italy The Step By Step Process

https://d3adw1na09u8f7.cloudfront.net/2022/08/23211532/08_19_product01-1024x586.jpg

Can You Get A VAT Refund From Italy

https://images.squarespace-cdn.com/content/v1/626a3e2c3e96e84c4b6db2fb/e2b088d6-895e-422c-8171-9cf3ca9ccad7/italy-VAT-IVA-3.jpg

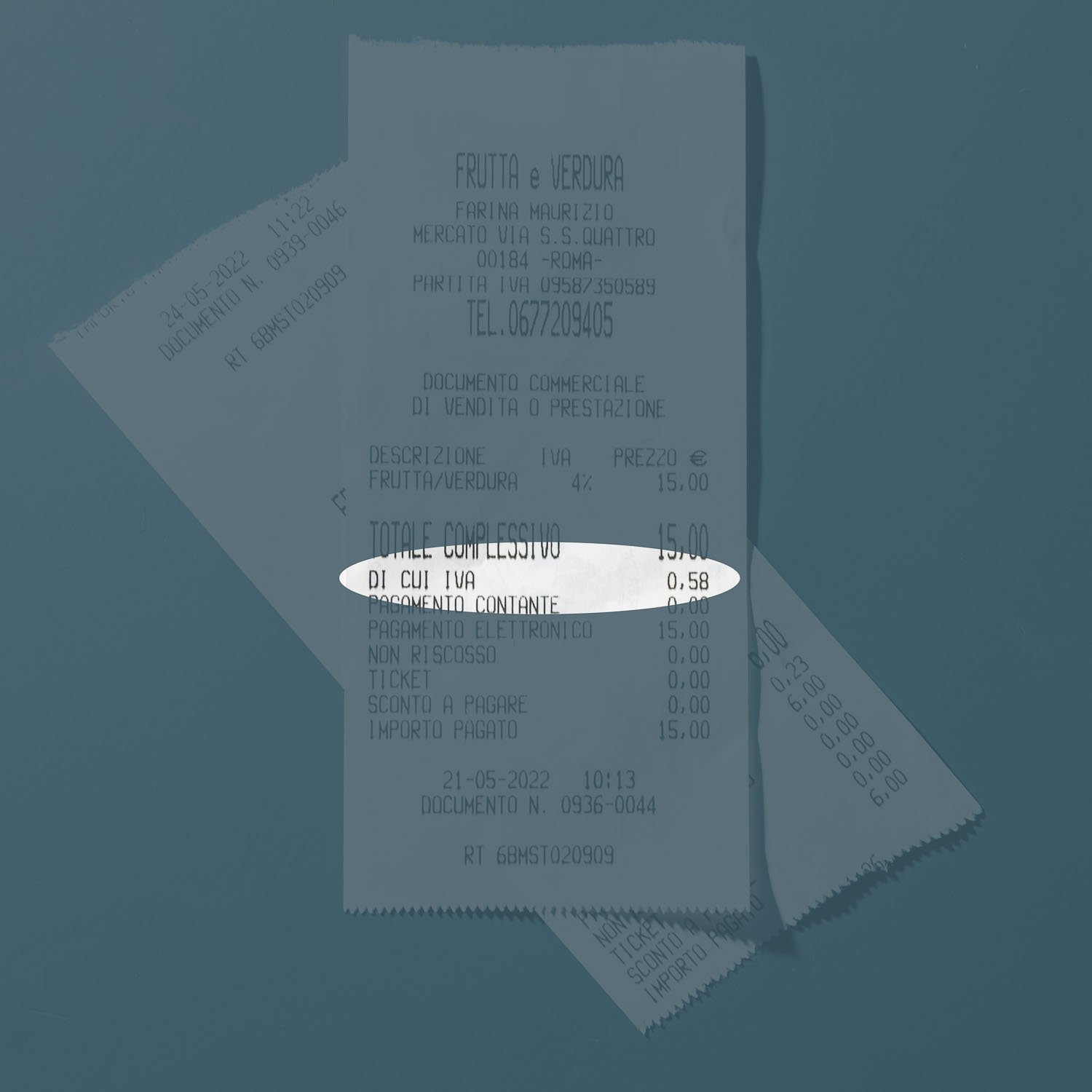

Italy will reimburse between 13 and 15 of the amount you spend during your trip on products subject to standard VAT rates The minimum purchase threshold is 154 95 EUR On this page by entering the amount you spent you can find out approximately how much of a VAT refund you can get You must pay the full VAT inclusive price for the goods in the shop you will get the VAT refunded once you have complied with the formalities and can show proof of export How do I go about this When you are in the shop ask the shop assistant in advance whether they provide this service

Th standard VAT rat in Italy is 22 although th r ar r duc d rat s for sp cific goods and s rvic s such as food books and public transportation Prop rty Tax Imposta Municipal Unica IMU In order to qualify to request a VAT refund in Italy you must make at least 154 95 Euros worth of qualifying purchases How is my Italy VAT Refund Calculated Your total gross purchase amounts will be summed and rounded down to the nearest 0 50 Euro

Download How Much Vat Refund In Italy

More picture related to How Much Vat Refund In Italy

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

HOW TO GET A TAX REFUND IN ITALY THE ULTIMATE GUIDE Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/photo-1556741533-411cf82e4e2d-ixlib-rb-1-2-1_orig.jpg

How To Get A VAT Refund In Italy Italy Travel Guide Italy Travel

https://i.pinimg.com/736x/83/a7/2d/83a72da2af9fe0c883a76ec5a7765126.jpg

The overall value of the goods purchased exceeds 154 94 Euro VAT included the purchase is certified by an invoice This invoice should include a description of the goods purchased your personal information as well as the details of VAT ranges from 5 to 25 depending on the country and on the product though 21 is the average Check out the VAT rates of all European countries When travelling back to the US you can get that money back But how Here we walk you through the process of getting a VAT refund Italy step by step At the boutique

As of my last update in July 2023 the standard VAT rate in Italy was 22 with reduced rates for specific items like food and non alcoholic drinks and hotel accommodations If you are a non EU resident you could be eligible for a VAT refund on eligible purchases made during your stay In order to claim a VAT refund in Italy there are 4 important conditions You should not be European resident so you should not live inside Italy or any other European countries You should spend at least 175 more or less from a single shop This means that you are able to purchase one or more items from a shop but will not be able to get

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

In Italy The VAT Rate Is 22 But There Are Also Reduced Rates For

https://i.pinimg.com/originals/fc/6d/b5/fc6db555d4ed6fecf3ca91100eeb112f.jpg

https://www.italylogue.com/planning-a-trip/how-to...

Keep in mind that there s a minimum amount required in order to claim a VAT refund which varies depending on the country but as this is being written the minimum purchase amount to submit a VAT refund in Italy is 154 94 and that s money spent at one time at

https://www.wevat.com/blog-articles-en/tax-free...

Decline VAT refunds can be a tricky subject especially when you re traveling to a foreign country In Europe the rules and regulations regarding tax refunds vary from country to country To help you out we ve put together a complete guide to tax refunds in Europe so you can get your money back without any hassle

How To Get A VAT Refund Italy The Step By Step Process

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

How To Get A VAT Refund In Italy For Travellers Vatcalonline

How To Get A VAT Refund In The UK With An App London Tips Travel

YouTrip s Guide On How To Get A VAT Refund In Italy Blog YouTrip

How To Get A VAT Refund Italy The Step By Step Process

How To Get A VAT Refund Italy The Step By Step Process

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

How To Apply For The EU VAT Refund In France France Travel Tips

VAT Refund Belgian VAT Desk

How Much Vat Refund In Italy - Italy will reimburse between 13 and 15 of the amount you spend during your trip on products subject to standard VAT rates The minimum purchase threshold is 154 95 EUR On this page by entering the amount you spent you can find out approximately how much of a VAT refund you can get