How Much Vat Refund In Uk Repayments are usually made within 30 days of HMRC getting your VAT Return Contact HMRC if you have not heard anything after 30 days Your repayment will go direct to

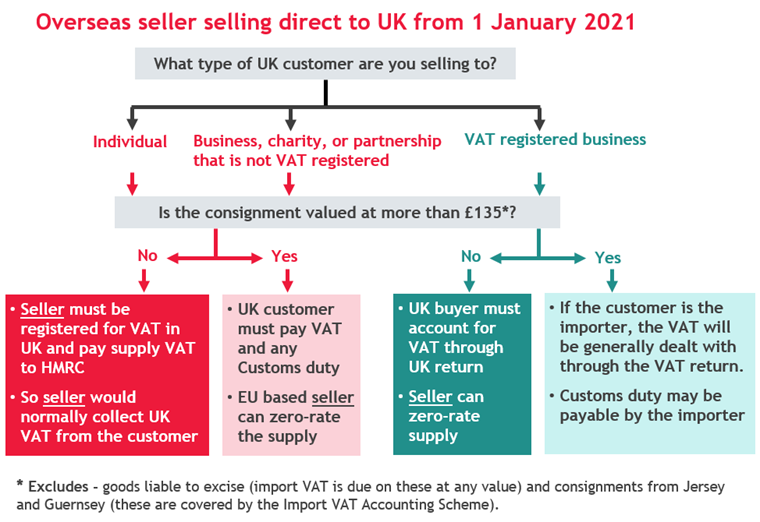

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can Up until 1 January 2021 if you lived outside the EU and travelled to the UK for leisure or business you were eligible for a VAT refund The VAT

How Much Vat Refund In Uk

How Much Vat Refund In Uk

https://i.pinimg.com/736x/c5/28/1c/c5281c867db2558527372a69fc2ab8b4.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

How To Claim A VAT Refund Everything You Need To Know

https://www.claimcompass.eu/blog/content/images/2020/05/How-to-Claim-a-VAT-Refund.png

Getty Business Money As a tourist to the UK can I still claim a VAT refund on goods purchased when I leave The VAT Retail Export Scheme was cancelled on January 1 when the UK officially left The rules surrounding VAT refunds have somewhat changed in recent years so it s important to read up on the latest rules including the U K s discontinuation of VAT refunds for international

VAT value added tax is the tax payable on all goods and services in London and the rest of the United Kingdom The 2019 standard rate of 20 percent VAT means if Until January 2021 visitors to the UK from outside the EU were able to get a VAT refund on their shopping VAT which stands for value added tax is a 20 per cent

Download How Much Vat Refund In Uk

More picture related to How Much Vat Refund In Uk

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

Full Details About The VAT Refund Available In The UAE

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/03/28/16484854422575.jpg

VAT Refund Belgian VAT Desk

https://www.vatdesk.be/wp-content/uploads/2021/04/VAT-refund-1.png

The UK s Value Added Tax VAT contained in the advertised price of most goods and services is currently at a whopping 20 But if you re thinking of doing some shopping in London with the Use our VAT calculator to see how much you can reclaim on your business travel and see all other VAT rates in United Kingdom Last updated 01 02 22

How much is VAT refund in the UK VAT is charged as a percentage rate of the net price which is the price before the tax is applied In the UK VAT is 20 of the How Much Is VAT in the UK The VAT on most taxable goods in the UK is 20 percent since 2011 though the government can raise or lower the rate from time to time

VAT Refund In UK For Non established Businesses FastVAT

https://fastvat.com/wp-content/uploads/2022/12/Vat-refund-in-UK-Fastvat.png

VAT Refund Save Money In Europe Unseen Footprints

https://i0.wp.com/www.unseenfootprints.com/wp-content/uploads/2016/10/VAT-h-pin.jpg?resize=1024%2C683

https://www.gov.uk/vat-repayments

Repayments are usually made within 30 days of HMRC getting your VAT Return Contact HMRC if you have not heard anything after 30 days Your repayment will go direct to

https://www.gov.uk/guidance/refunds-of-uk-vat-for...

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can

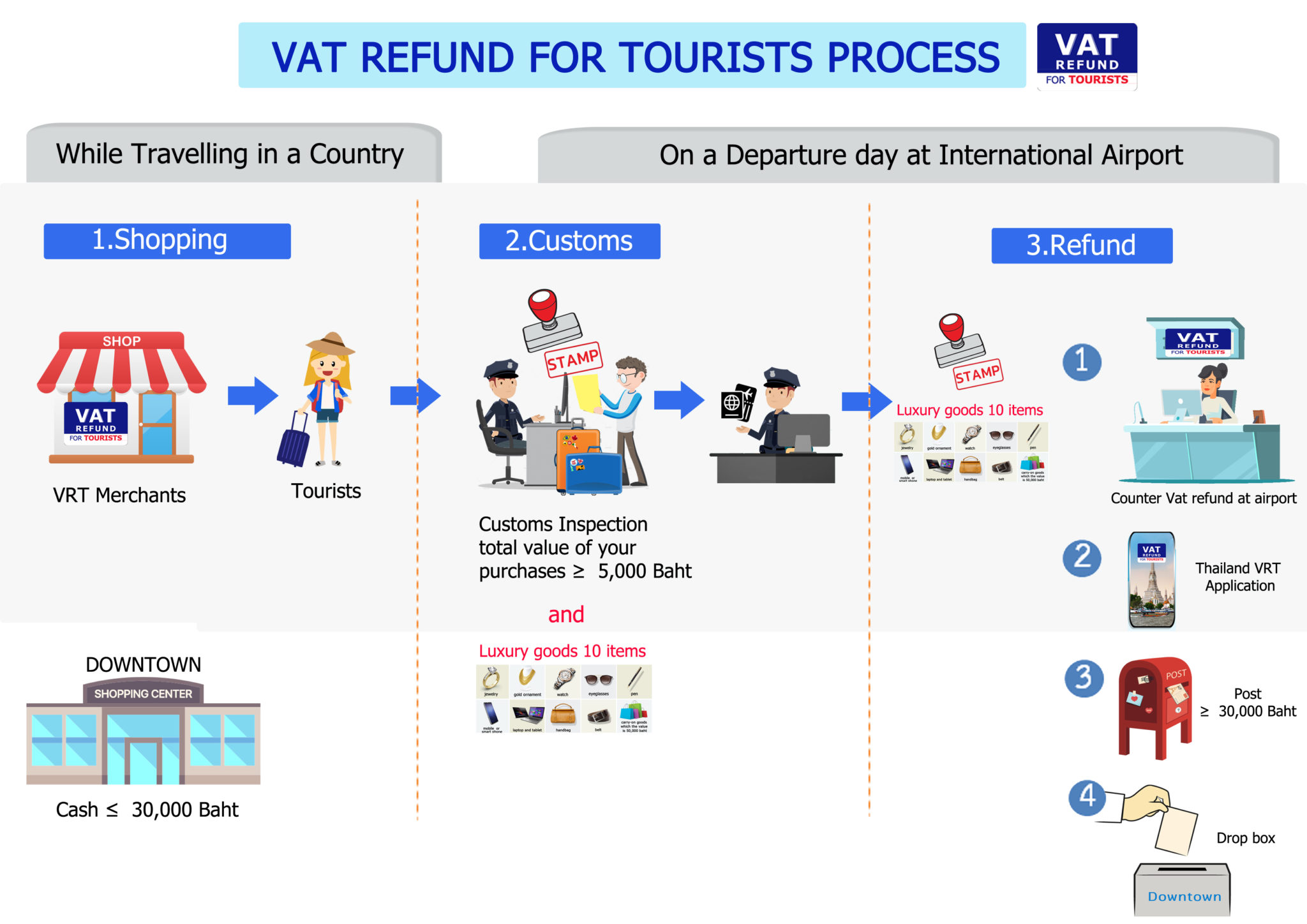

Thailand Offers VAT Refund For Tourists Thailand Insider

VAT Refund In UK For Non established Businesses FastVAT

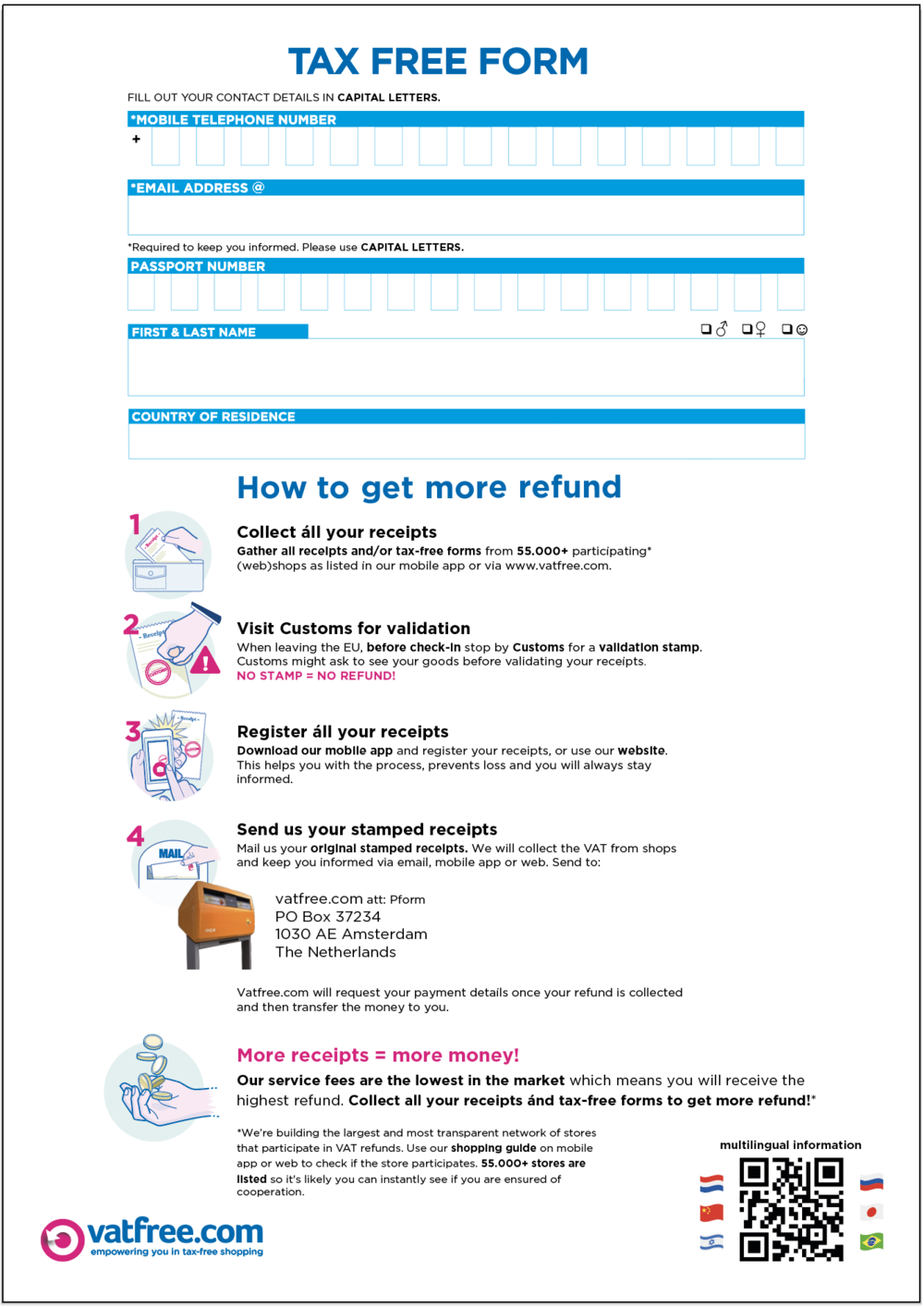

How To Apply For The EU VAT Refund In France France Travel Tips

Download A VAT Refund Form Vatfree Vatfree

VAT Refund For Tourists Royal Thai Consulate General Vancouver

VAT Refund In Dubai For Tourists 2024 Gudie

VAT Refund In Dubai For Tourists 2024 Gudie

Hmrc Vat Registration Foreign Company

Can I Receive The VAT Tax Refund In The UK With Brexit Petite In Paris

Inflation Fell To 14 3 In October Amsterdam Daily News Netherlands

How Much Vat Refund In Uk - Until January 2021 visitors to the UK from outside the EU were able to get a VAT refund on their shopping VAT which stands for value added tax is a 20 per cent