How Much Vpf Can Be Deducted Verkko 2 tammik 2023 nbsp 0183 32 How much can be deducted In 2022 and 2023 the maximum deduction is 3 570 The deduction is 51 if the amount of income that entitles you to

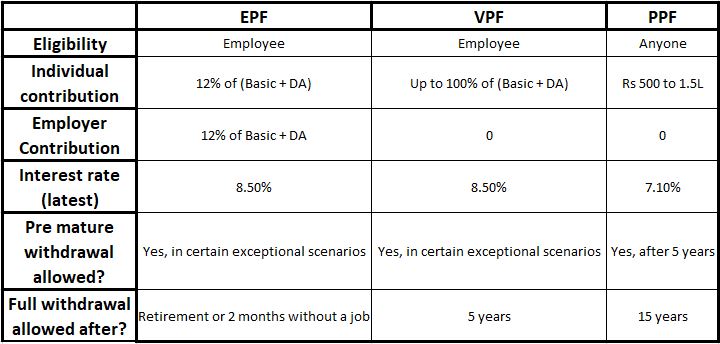

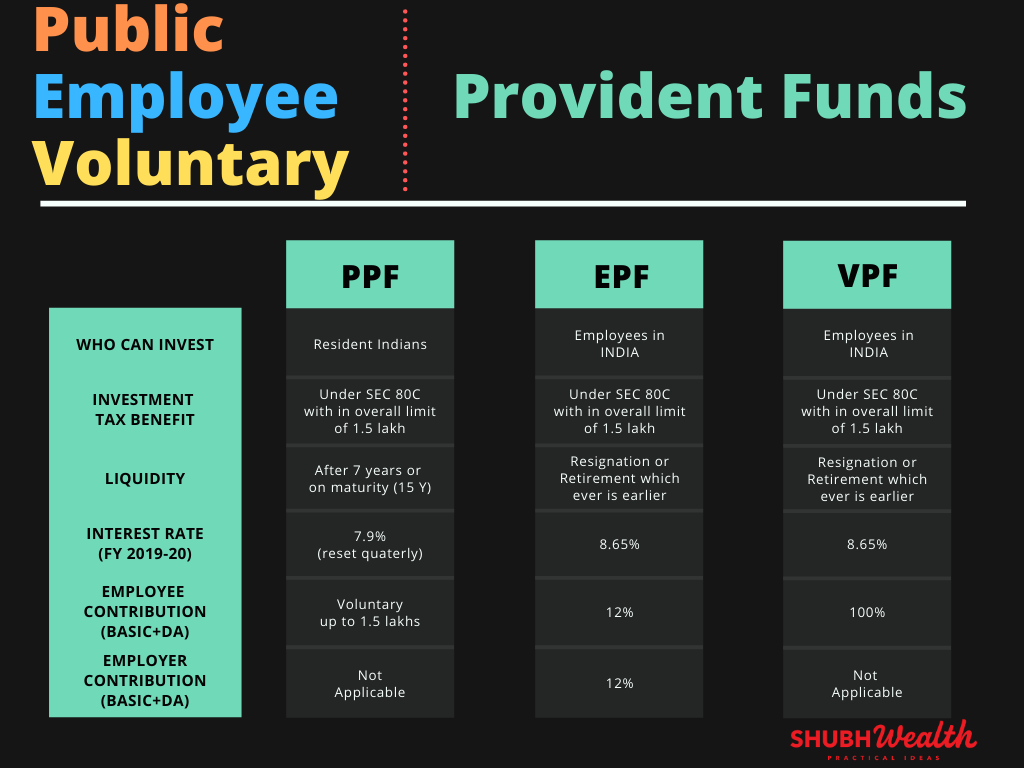

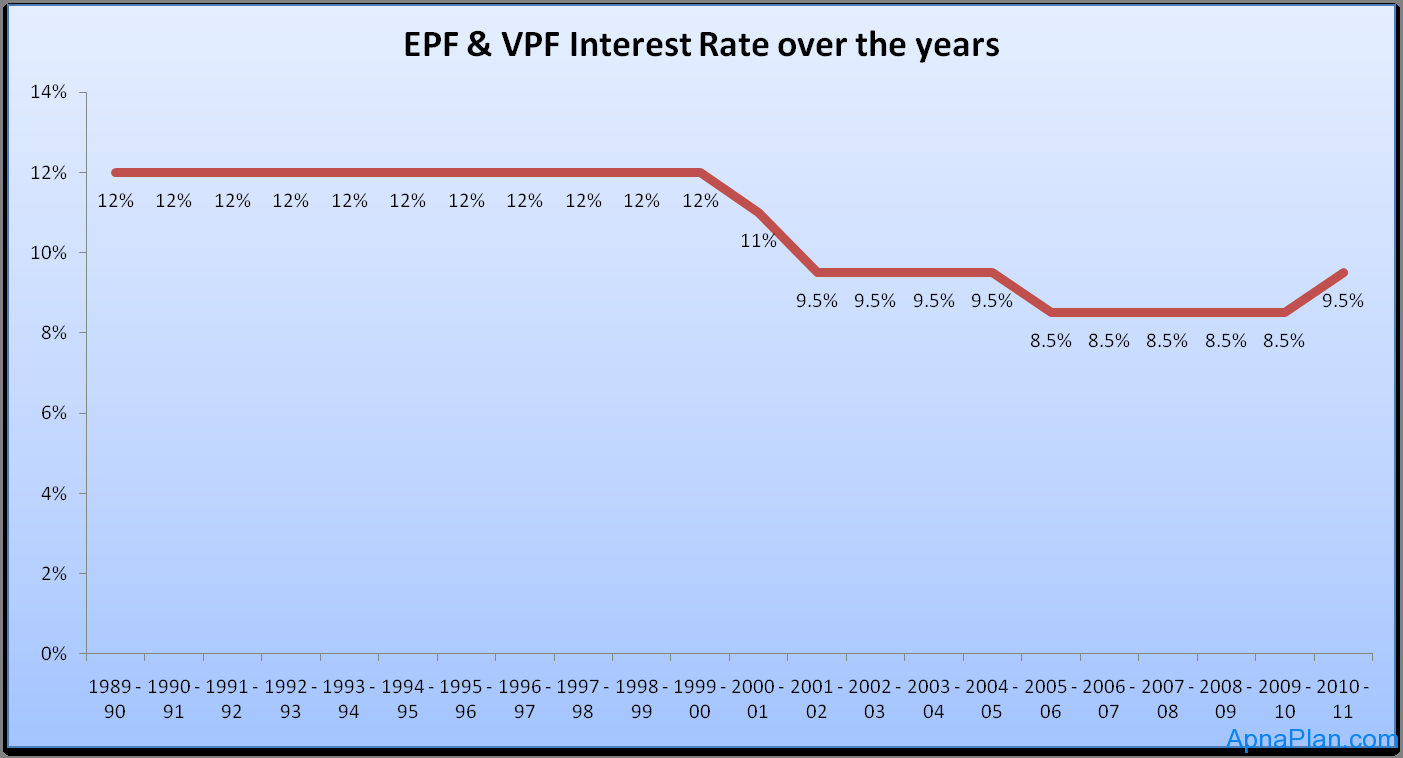

Verkko How much can be deducted The maximum deduction is 1 400 For more information see instructions and a formula based calculation table for claiming medical expenses Verkko 29 maalisk 2023 nbsp 0183 32 How does VPF Scheme Works Under VPF the employee can contribute beyond the normal mandatory deduction of

How Much Vpf Can Be Deducted

How Much Vpf Can Be Deducted

https://shubhwealth.com/wp-content/uploads/2020/01/VPF.png

All You Need To Know About Voluntary Provident Fund

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/all-you-need-to-know-about-voluntary-provident-fund.jpg

Provident Fund EPS VPF PPF FinanceNerd

https://financenerd.in/wp-content/uploads/FinanceNerd-EPF-PPF-VPF-Comparison.jpg

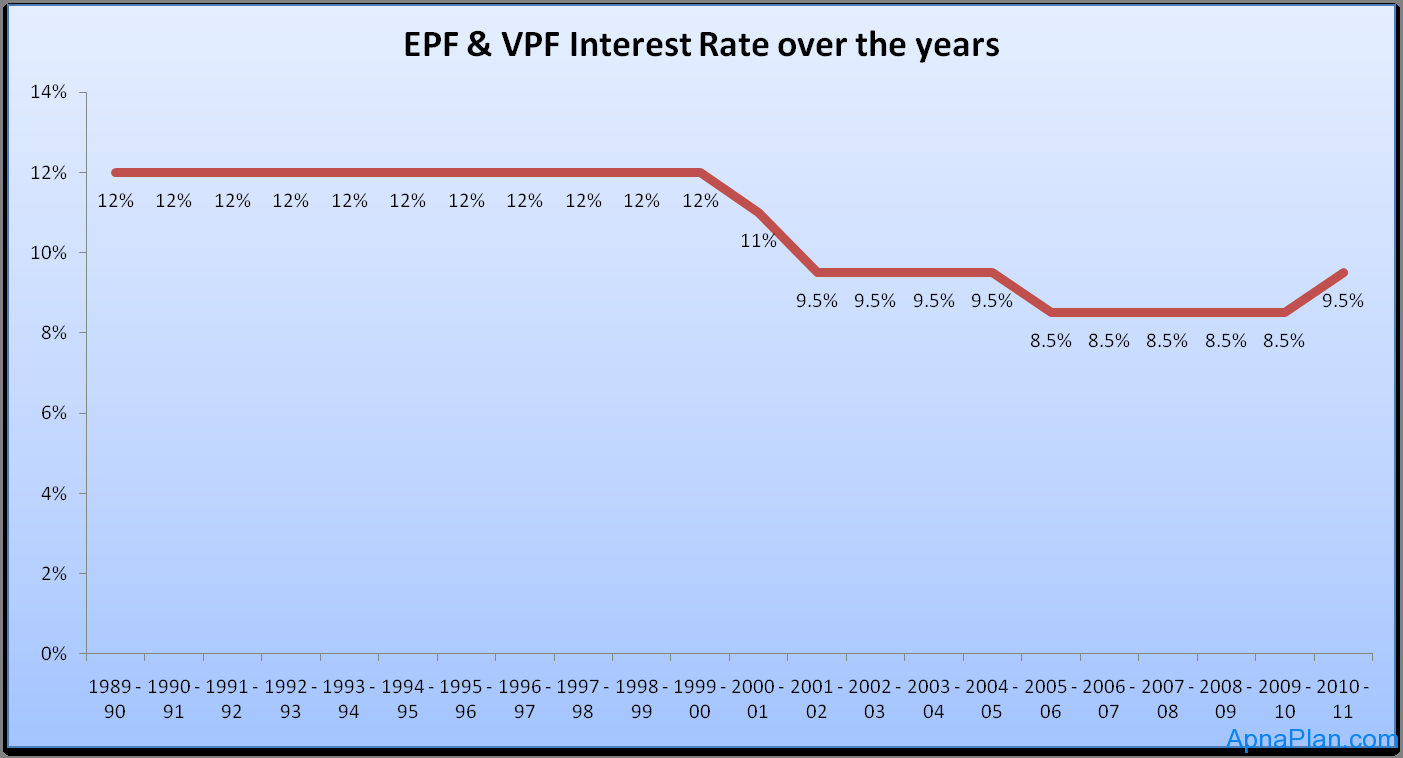

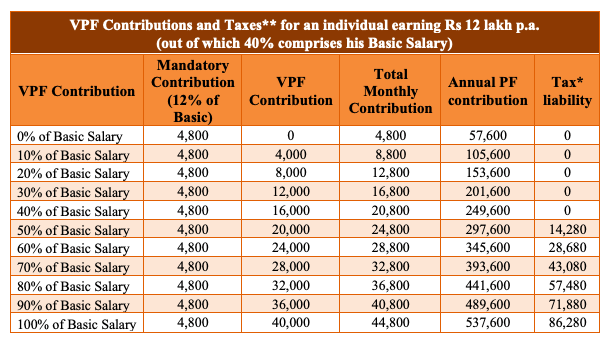

Verkko 2 huhtik 2021 nbsp 0183 32 It may be noted that the individual can still avail tax deduction subject to a ceiling of Rs 150 000 under section 80C on PF Verkko 9 helmik 2022 nbsp 0183 32 How much Only the interest earned on the amount that is in excess of Rs 2 5 lakh So let s say your contribution is Rs 3 lakh then the interest on the amount

Verkko VPF contributions made towards the EPF accounts are eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1951 Hence you can contribute Verkko 9 helmik 2023 nbsp 0183 32 With respect to the tax benefits under section 80C the employees can claim deductions up to INR 1 50 000 In addition to this the interest that is generated

Download How Much Vpf Can Be Deducted

More picture related to How Much Vpf Can Be Deducted

VPF Or Voluntary Provident Fund Meaning Interest Rate Rules Fintrakk

https://blogassets.fintrakk.com/uploads/2017/05/Voluntary-Provident-Fund-or-VPF.jpg

EPF Calculator How To Calculate PF Amount For Salaried Employers

https://epfindia.net/wp-content/uploads/2019/02/calculate-epf.jpg

The Difference Between VPF PPF Rupiko

https://rupiko.in/wp-content/uploads/2021/04/VPF-PPF.png

Verkko Tax Benefits The contributions made to the voluntary provident fund are tax deductible up to a certain limit This is stated under the provisions of Section 80C of the Income Tax Verkko 5 syysk 2019 nbsp 0183 32 1 The option of a VPF is available to only those who all salaried individuals and receive monthly salary through a specific salary account Self

Verkko FAQs Select Category and Subcategory to know your FAQ s Solutions 1 Whether an employer can deduct employer s share of contribution from the wages of employees 2 Can the wages be reduced by the Verkko 23 elok 2023 nbsp 0183 32 Under VPF an employee can contribute beyond the normal mandatory deduction of 12 of his her salary This 12 stands for the amount which their

EPF VPF Employee Voluntary Provident Fund Interest Rates

https://www.apnaplan.com/wp-content/uploads/2012/03/EPF-VPF-Interest-Rate-historical-trend.png

VPF Voluntary Provident Fund MALAYALAM VPF PPF PF Benefits Of

https://i.ytimg.com/vi/XZN0KeB99oA/maxresdefault.jpg

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko 2 tammik 2023 nbsp 0183 32 How much can be deducted In 2022 and 2023 the maximum deduction is 3 570 The deduction is 51 if the amount of income that entitles you to

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko How much can be deducted The maximum deduction is 1 400 For more information see instructions and a formula based calculation table for claiming medical expenses

What Is VPF Voluntary Provident Fund Should I Opt For It

EPF VPF Employee Voluntary Provident Fund Interest Rates

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

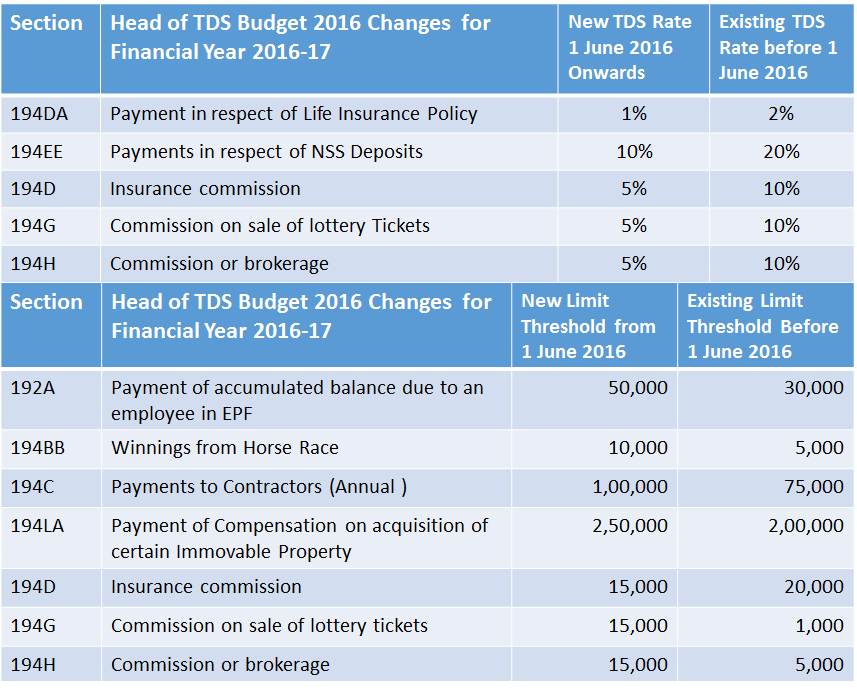

WELCOME TO CA GROUPS Revised And Latest TDS Tax Deducted At Source

Have Voluntary Provident Funds Lost Their Sheen After Budget Scripbox

CPF Contributions Got Limit What Singaporeans Need To Know About

CPF Contributions Got Limit What Singaporeans Need To Know About

Tax On PF Interest Should You Stop Investing In VPF How Bank FDs RBI

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

Tax Deductions You Can Deduct What Napkin Finance

How Much Vpf Can Be Deducted - Verkko 27 jouluk 2023 nbsp 0183 32 Voluntary Provident Fund Guidelines and Rules The following is a list of the VPF account s rules and guidelines Employees are permitted to contribute 100