How Often Do I Need To File Sales Tax In Texas Depending on the volume of sales taxes you collect and the status of your sales tax account with Texas you may be required to file sales tax returns on a monthly semi monthly quarterly semi annual or annual basis

Quick Answer Texas offers a few different types of sales tax returns This blog gives instructions on how to file and pay sales tax in Texas using Form 01 114 Sales Use What are the due dates for filing prepayment reports and making payments The prepayment report and tax prepayment for a monthly filer are due on or before the 15th day of each month

How Often Do I Need To File Sales Tax In Texas

How Often Do I Need To File Sales Tax In Texas

https://uploads-ssl.webflow.com/5f50dfefde2d2df9368da112/60d9d21925a9056169cad7f5_6BNxCHP4_L0nE3u2cfKQF-bPTFEy-uSwozcR9rmQql1Lg4H2svZl8BfAahg9--nzGVq2K51Qk0B-Opnfz11da0Vdo8WvDdVFfxhIfr1s2PEOyKRh9XYKgnI9FvCQYA_M3ohhjqS6.png

How To Get Webfile Number For Texas Franchise Tax

https://blog.taxjar.com/wp-content/uploads/2016/10/Filing-Texas-Sales-Tax-Select-Your-Filing-Period.png

What Is The Sales Tax In Texas WorldAtlas

https://www.worldatlas.com/r/w1200/upload/41/72/bb/shutterstock-402316468.jpg

Texas Sales Tax Deadlines Once a business s sales tax application has been approved it will receive a letter with instructions on how often it must file a sales tax return Returns may be Effective October 1 2019 Texas requires that an out of state business a k a remote sellers register with the Texas Comptroller to collect and remit sales and use tax if the business has a total sales revenue in the state of more than

The state of Texas requires that every seller who owns a sales tax permit to file a sales tax return on the required day even if it is a zeroes out tax return and there is nothing to report Your business s sales tax return must be filed by the The frequency with which you ll need to file and pay sales tax in Texas is based on the total amount of tax you collect The filing frequency and dues dates are as follows Monthly Filing

Download How Often Do I Need To File Sales Tax In Texas

More picture related to How Often Do I Need To File Sales Tax In Texas

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

https://files.taxfoundation.org/20230306143844/Compare-2023-state-gross-receipts-taxes-by-state-Delaware-gross-receipts-tax-Nevada-gross-receipts-tax-Ohio-gross-receipts-tax-Oregon-gross-receipts-tax-Texas-gross-receipts-tax.png

6 Benefits Of Filing Your Taxes Early You Need To Know Sheffield

https://strcpafirm.com/wp-content/uploads/2021/05/6-Benefits-of-Filing-Your-Taxes-Early-You-Need-To-Know.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

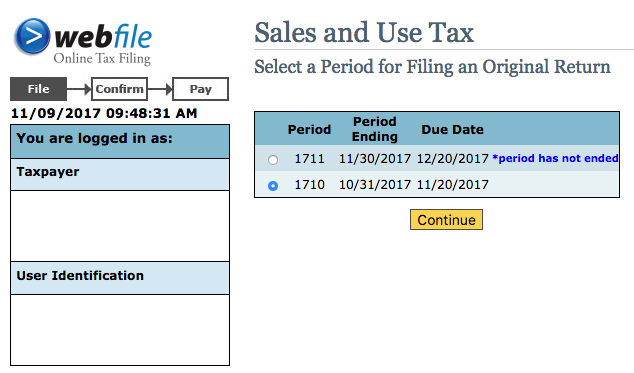

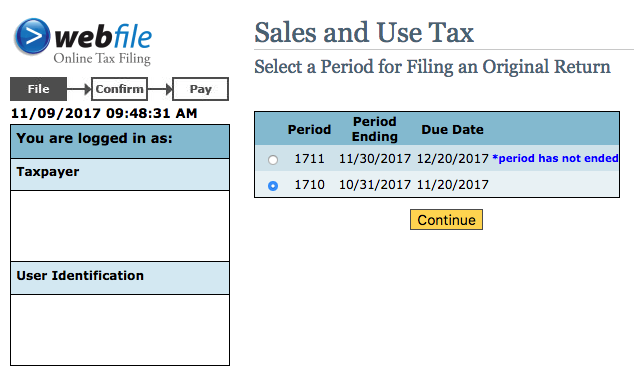

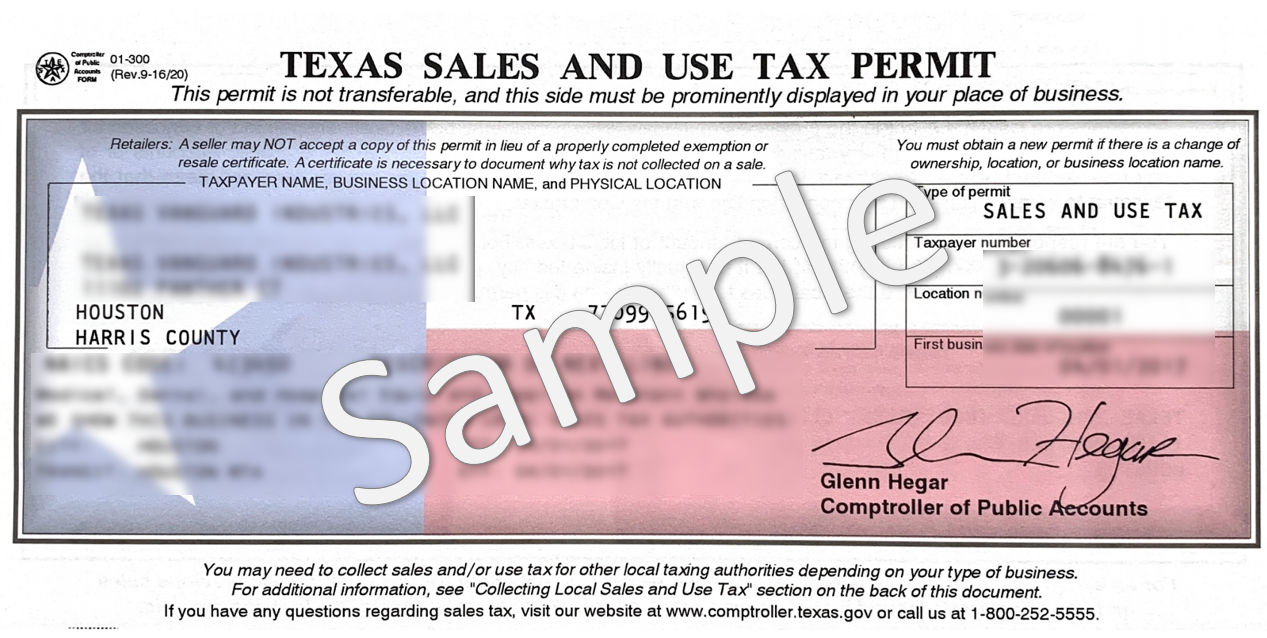

The Texas Comptroller of Public Accounts requires all sales tax filing to be completed by the 20th of the month following the assigned filing period Below we ve grouped Texas sales tax due dates by filing frequency for your To file a Texas sales and use tax return first file an application for a sales tax permit at the Texas Comptroller s Office website Once you receive your permit in the mail 2 to 3 weeks later record the due dates when you

How often your business needs to file sales tax returns is determined by the state The frequency is often based on how much you make in taxable sales and can be monthly quarterly Texas Filing Frequencies Texas uses three sales tax filing frequencies annual quarterly and monthly Your assigned frequency is noted in the letter you receive from the Texas

State And Local Public Finance Taxing Professional Services Beating

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

Sales Taxstate Are Grocery Items Taxable Texas Sales Tax Map

https://4printablemap.com/wp-content/uploads/2019/07/state-and-local-sales-tax-rates-2019-tax-foundation-texas-sales-tax-map.png

https://www.salestaxhandbook.com › texa…

Depending on the volume of sales taxes you collect and the status of your sales tax account with Texas you may be required to file sales tax returns on a monthly semi monthly quarterly semi annual or annual basis

https://thetaxvalet.com › blog › how-to-file-and-pay-sales-tax-in-texas

Quick Answer Texas offers a few different types of sales tax returns This blog gives instructions on how to file and pay sales tax in Texas using Form 01 114 Sales Use

How To File US Sales Tax Returns In Just A Few Minutes XU Hub

State And Local Public Finance Taxing Professional Services Beating

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

Texas Sales Use Tax Permit Y El Resale Certificate Todo Lo Que

Sales Taxes Per Capita How Much Does Your State Collect

Ultimate Texas Sales Tax Guide Zamp

Ultimate Texas Sales Tax Guide Zamp

What Happens If You Don t File A Tax Return CBS News

How To Calculate Sales Tax In Oklahoma

The United States Of Sales Tax In One Map The Washington Post

How Often Do I Need To File Sales Tax In Texas - Here are five very important things that you must understand before embarking on your sales tax reporting journey in Texas Your filing frequency depends on your sales tax