How To Calculate Capital Gains Taxes In Alberta To calculate how much tax you will be paying as a result of your capital gains over the year determine your personal income for the year and then add 50 of

Calculate the Annual tax due on your Capital Gains in 2024 25 for Federal Provincial Capital Gains tax Select Province and enter your Capital Gains Press Calculate How Do You Calculate Tax on Capital Gains To calculate a capital gain you first need to know the proceeds of the disposition the adjusted cost base ACB and the expenses incurred to sell the

How To Calculate Capital Gains Taxes In Alberta

How To Calculate Capital Gains Taxes In Alberta

https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2020/02/Canadian-Investor.png

How To Calculate Capital Gains Tax On Real Estate Investment Property

https://rwncdn.s3.amazonaws.com/wp-content/uploads/Long-term-Capital-Gains-Tax-Rates-Infographic-1024x536.png

How To Calculate Capital Gain Tax On Shares In The UK Eqvista

https://eqvista.com/app/uploads/2022/01/When-Should-You-Pay-your-Capital-Gain-Tax-in-the-UK-1024x1024.png

To calculate your capital gain or capital loss subtract the total of your property s adjusted cost base ACB and any outlays and expenses you incurred to sell it from the How to calculate capital gains and losses You can calculate whether you have a capital gain or loss by subtracting the asset s net cost of acquisition from the net proceeds of its

Estimate your provincial taxes with our free Alberta income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax Use Schedule 3 Capital Gains or Losses to calculate and report your taxable capital gains or net capital loss If the property you sold is a flipped property see Property flipping

Download How To Calculate Capital Gains Taxes In Alberta

More picture related to How To Calculate Capital Gains Taxes In Alberta

How To Calculate Your 2023 Taxes PELAJARAN

https://www.taxestalk.net/wp-content/uploads/how-to-disclose-capital-gains-in-your-income-tax-return.jpeg

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

https://uploads-ssl.webflow.com/629b1dcd203ede574e478a11/62e2671a8d153e9b5be366c3_Jordensky_Tax One person company to private (1).png

Capital Gain Tax On Sale Of Property Short Term And Long Term Capital

https://i.ytimg.com/vi/V7in_nzsYh4/maxresdefault.jpg

TurboTax s free Alberta income tax calculator Estimate your 2023 tax refund or taxes owed and check provincial tax rates in Alberta How to calculate tax on a capital gain Before you calculate your capital gains you re going to need to find something called your adjusted cost base or ACB It s there to help

To calculate capital gains you first need to determine the asset s adjusted cost base ACB The ACB is the price you paid for the asset plus any commission or legal fees If you don t want to pay capital gains on your stocks bonds mutual funds ETFs or real estate holdings there are ways capital gains tax can be reduced or

How Is Agricultural Income Tax Calculated With Example Updated 2022

https://curchods.com/wp-content/uploads/3020/12/Porposed-Capital-Gains-Tax-Changes-01.jpg

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

https://assets-prod.ageras.com/assets/frontend/upload/resources/lt-capital-gains-tax-brackets.png

https://turbotax.intuit.ca/tips/capital-gains-tax-in-alberta-11040

To calculate how much tax you will be paying as a result of your capital gains over the year determine your personal income for the year and then add 50 of

https://www.icalculator.com/canada/finance/capital...

Calculate the Annual tax due on your Capital Gains in 2024 25 for Federal Provincial Capital Gains tax Select Province and enter your Capital Gains Press Calculate

Capital Gains On Land Sale Calculator JodhShahzain

How Is Agricultural Income Tax Calculated With Example Updated 2022

How To Calculate Capital Gain On House Property Yadnya Investment

2022 Va Tax Brackets Latest News Update

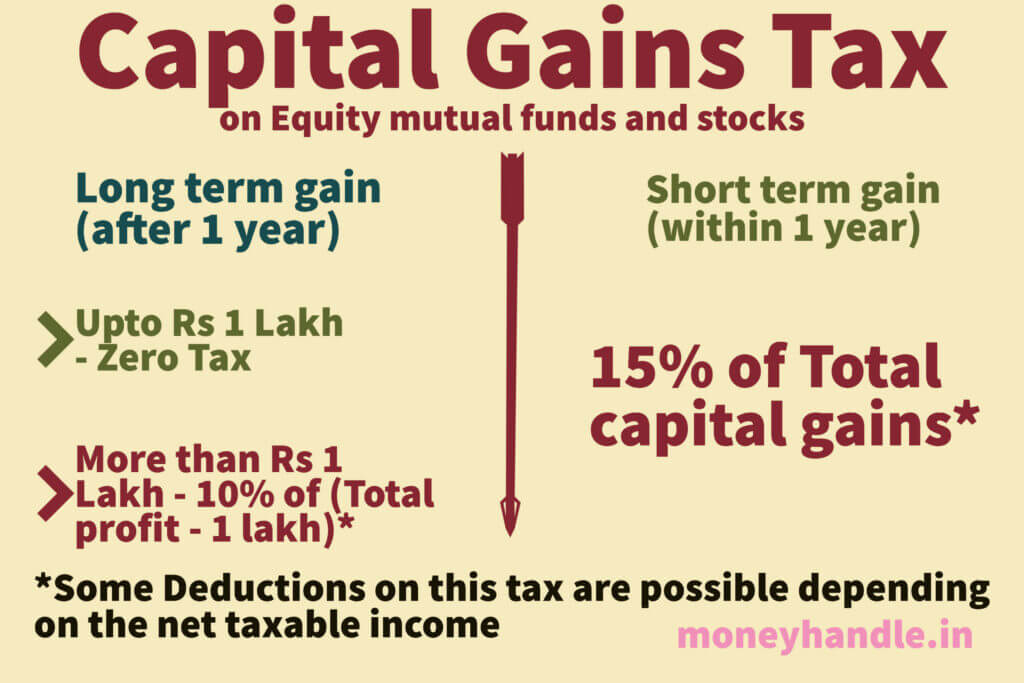

Capital Gains Tax India Simplified Read This If You Invest In Stocks

2021 Short Term Capital Gains Tax Rate Cryptocurrency Mining Taxes

2021 Short Term Capital Gains Tax Rate Cryptocurrency Mining Taxes

How To Avoid Capital Gains Tax On Real Estate Sales Shared Economy Tax

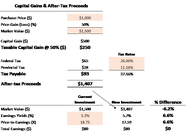

Understanding The Capital Gains Tax A Case Study

Adjusted Cost Basis Calculator Real Estate Real Estate Spots

How To Calculate Capital Gains Taxes In Alberta - To calculate your capital gain or capital loss subtract the total of your property s adjusted cost base ACB and any outlays and expenses you incurred to sell it from the