How To Calculate Corporate Tax In Alberta The following table shows the income tax rates and business limits for provinces and territories except Quebec and Alberta which do not have corporation tax collection

How the Corporate Tax Income of Businesses in Alberta is Calculated and Filed Starting July 1 2018 the Alberta Corporate Income Tax Rate is 12 Previously Corporate income tax Corporations doing business in Alberta are generally required to pay Alberta corporate income tax and file a corporate income tax return with Alberta Tax and

How To Calculate Corporate Tax In Alberta

How To Calculate Corporate Tax In Alberta

https://hr-software.ae/blog/wp-content/uploads/2023/01/image-30-edited.png

How To Calculate Corporate Investment Income Tax In Canada EDM Chicago

https://www.edmchicago.com/wp-content/uploads/2022/12/Investment-in-canada-640x366.jpg

Do You Know How To Calculate The regular Rate Of Pay For Your

https://1.bp.blogspot.com/-ilWpx4HcYuw/XeecQtwdNmI/AAAAAAAAuF4/c6r3ufYn56IUXyRZgICIhYkiWmnew-ikQCNcBGAsYHQ/s1600/sharon-mccutcheon-rItGZ4vquWk-unsplash.jpg

Canadian Provinces Tax Comparison Chart This chart shows how much tax is paid for the current income in each province Calculate your Corporate Income Tax in Canada for Submit an enquiry There are two levels of federal corporate tax rates in Canada also known as the dual tax rate The federal small business tax rate also

ALBERTA FEDERAL COMBINED CORPORATE TAX RATES Note All posted rates are subject to change by Canada Revenue Agency or other government departments Provinces and territories legislate their corporation income tax provisions but the CRA administers them except for Quebec and Alberta If the corporation has a permanent

Download How To Calculate Corporate Tax In Alberta

More picture related to How To Calculate Corporate Tax In Alberta

How To Calculate Your Retail Price

https://static.wixstatic.com/media/81f326_843b67b91aa4449ca5b520da3f17d0bd~mv2.gif

Webinar Digitalized Tax Management For Multinationals Practical

https://blika.com/wp-content/uploads/2021/10/TPA-Teaser_1080x1080.png

How To Calculate Debt to Income DTI Ratios YouTube

https://i.ytimg.com/vi/9mZ4lim6gC0/maxresdefault.jpg

Taxable income is the base used to calculate the amount of tax a business owes in a given tax year Generally it is determined by subtracting expenses and other deductions from Basic Alberta Tax Payable for a particular taxation year is calculated as the Amount Taxable in Alberta as explained above multiplied by the respective tax rate less the

This Information Circular provides an overview of the corporate income tax program in Alberta including information on how Alberta Taxable Income is calculated and how it This Information Circular provides an overview of the corporate income tax program in Alberta including information on how Alberta Taxable Income is calculated and how it

Free Images Black And White Business Count B W Solar Calculator

https://c.pxhere.com/photos/5a/04/calculator_solar_calculator_count_how_to_calculate_business_black_white_b_w-1349034.jpg!d

Stockholders Equity What It Is How To Calculate It Examples InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600287914.jpeg

https://www.canada.ca/en/revenue-agency/services...

The following table shows the income tax rates and business limits for provinces and territories except Quebec and Alberta which do not have corporation tax collection

https://albertataxservices.ca/complete-guide-to...

How the Corporate Tax Income of Businesses in Alberta is Calculated and Filed Starting July 1 2018 the Alberta Corporate Income Tax Rate is 12 Previously

How Should LLCs Handle Corporate Tax On Retained Earnings

Free Images Black And White Business Count B W Solar Calculator

Calculating Your Net Worth GreenSky Wealth

What Is The Profit Margin How To Calculate It And Why Does It Matter

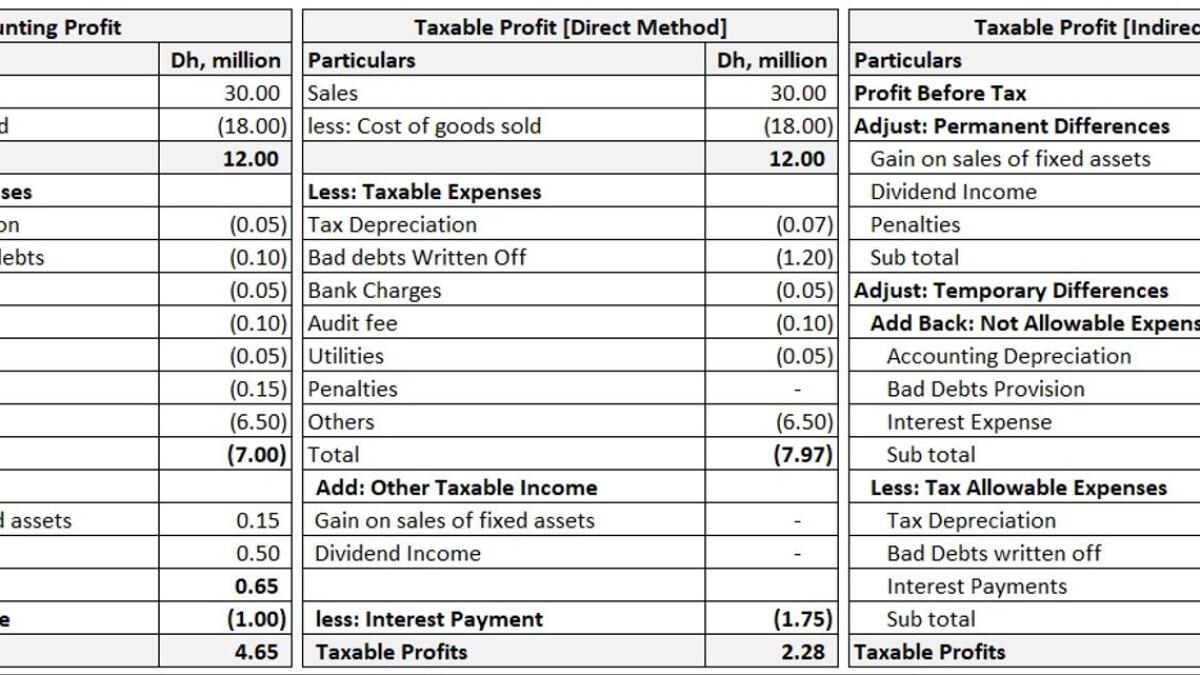

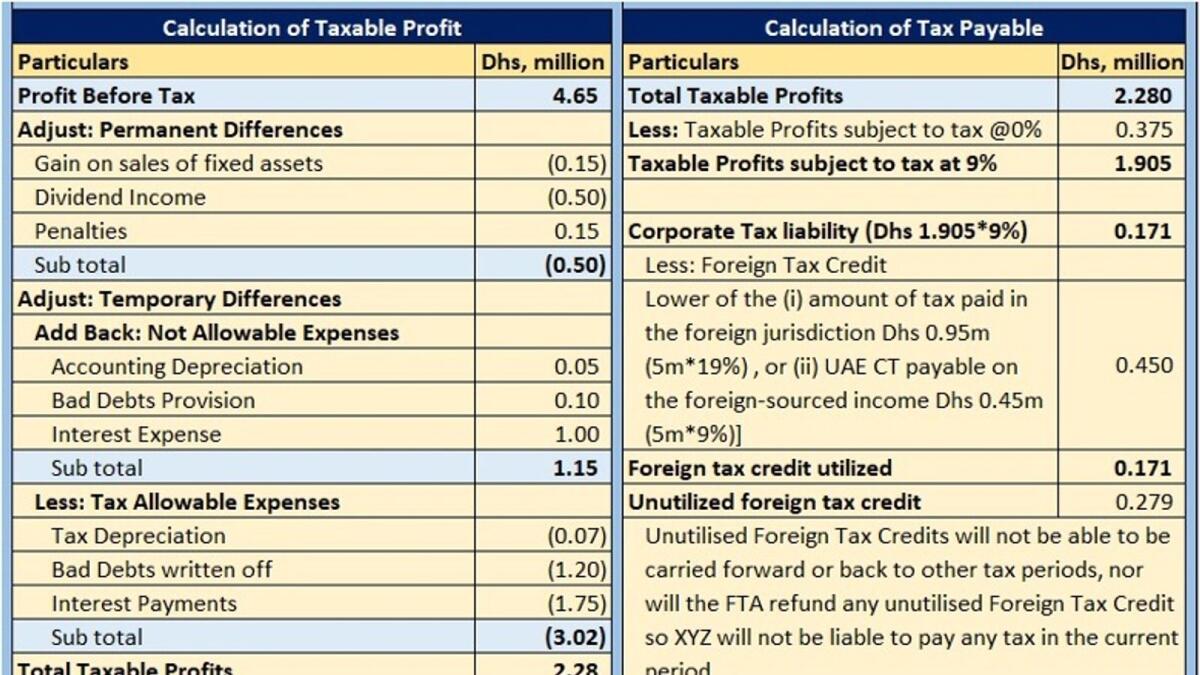

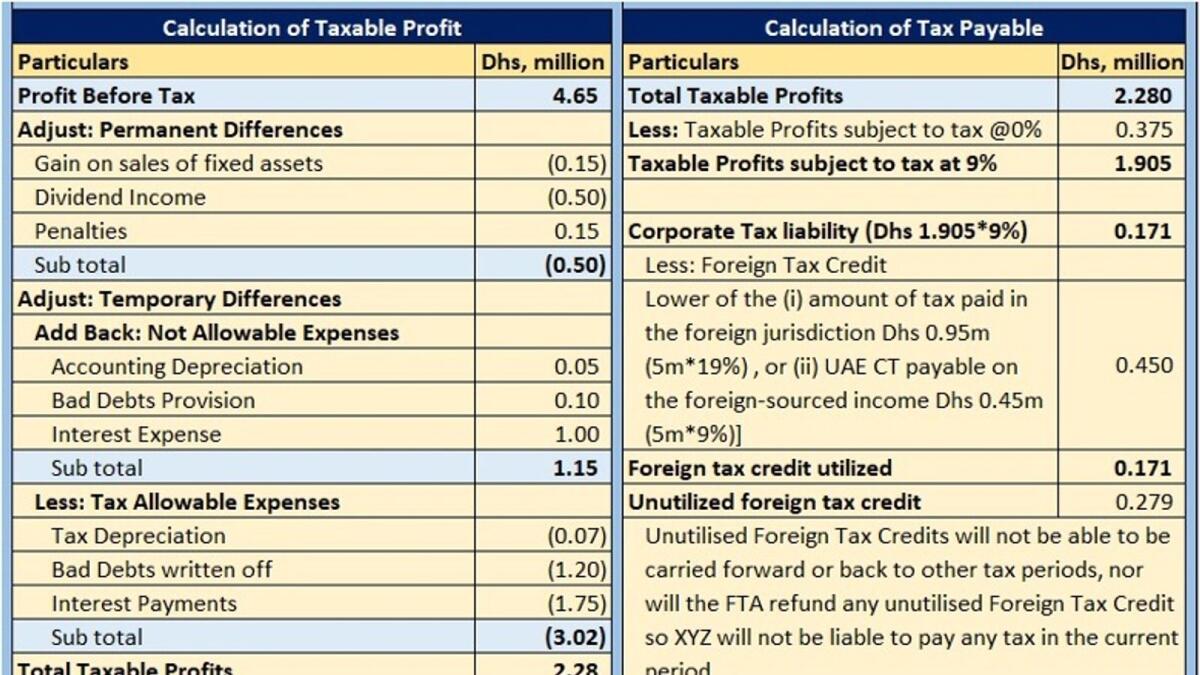

How To Compute Taxable Profits In The UAE Integrity Consulting

How To Calculate Corporate Tax Payable And Adjust Foreign Tax Credit

How To Calculate Corporate Tax Payable And Adjust Foreign Tax Credit

What Are The Benefits Of Corporate Tax In UAE

Everything You Need To Know About Corporate Tax In UAE QuickBooks UAE

Corporate Tax Compliance And Financial Reporting National Tax Journal

How To Calculate Corporate Tax In Alberta - Business tax Learn about Alberta s corporate income tax and its business related programs grants and credits like the Film and Television Tax Credit