How To Calculate Mileage Allowance Relief Web 2 Okt 2023 nbsp 0183 32 Let s go through a quick example of how to calculate mileage reimbursement at the advisory rate In one year you drive 5000 miles for work purposes and your employer uses HMRC s advisory rate To calculate your reimbursement you simply follow the below miles x rate 5 000 x 0 45 2250 GBP

Web 12 Juli 2022 nbsp 0183 32 Using the standard mileage allowance rates for 2022 you d calculate the total relief you can claim as follows 10 000 x 163 0 45 163 4 500 4 000 the number of business miles driven over 10 000 x 163 0 25 163 1 000 Web 3 Okt 2023 nbsp 0183 32 How to use this mileage claim calculator Use the provided HMRC mileage claim calculator to determine how much you can receive in reimbursement for your business driving To calculate this you will need the number of miles you have driven for business purposes and then multiply it by HMRC s standard rates

How To Calculate Mileage Allowance Relief

How To Calculate Mileage Allowance Relief

https://www.tripcatcherapp.com/wp-content/uploads/2021/03/james-feaver-qvF9JeHUbv4-unsplash_CROP.jpg

Mileage Allowance Relief What It Is And How To Calculate It Tide

https://web.uploads.tide.co/2022/06/09141406/EXPENSES-Large-Banner-Mobile-V2.png

What Is Mileage Allowance Relief Find Out The Easy Way To Make A Claim

https://www.tripcatcherapp.com/wp-content/uploads/2021/03/hannah-wright-8IT6_HGH0Kc-unsplash_CROP-1024x576.jpg

Web 27 Apr 2023 nbsp 0183 32 The flat rate is calculated as follows each kilometer between your home and your first place of business is charged at 0 30 As of this year you can also claim 0 35 per kilometer for tax purposes from the 21st kilometer onwards Web 14 M 228 rz 2021 nbsp 0183 32 The relief calculation is based on your business mileage and the HMRC approved mileage allowance payment AMAP rates This all sounds good so far who wouldn t want to reduce their tax bill after all But what exactly do we mean by business journeys And what are the AMAP rates Let s explain these technical details

Web To use our calculator just input the type of vehicle and the business miles you ve travelled in it for work Don t worry if you use multiple vehicles Calculate them individually and then add them together we ll let you know what you can claim for each What is Web 25 Juni 2021 nbsp 0183 32 Electricity Road tax Repairs To work out how much you can claim you need to keep records of the dates and mileage of your business journeys Be sure to add up the mileage for each vehicle you ve used for work as you ll need to claim for each one We ll explain the approved mileage allowance rates AMAP later in this article Using a

Download How To Calculate Mileage Allowance Relief

More picture related to How To Calculate Mileage Allowance Relief

How To Calculate Mileage Reimbursement By Kliks App Issuu

https://image.isu.pub/220918080949-f524349900ee3b282cf1482b3ee29945/jpg/page_1.jpg

Mileage Allowance Relief Calculator UK Property Accountants

https://www.ukpropertyaccountants.co.uk/wp-content/uploads/2023/02/featureimage.jpg

What Is Mileage Allowance Relief Find Out The Easy Way To Make A Claim

https://www.tripcatcherapp.com/wp-content/uploads/2021/03/adam-birkett-yb-284xbTpo-unsplash_CROP-1024x576.jpg

Web To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need help Tax rates Web You are entitled to tax relief for travel costs that you are obliged to incur in order to do your job if your employer does not pay or reimburse these expenses at all or fully you may be able to claim a deduction from your income You will only be able to claim tax back if

Web Guidance Travel mileage and fuel rates and allowances Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per Web 6 M 228 rz 2023 nbsp 0183 32 Your employer fully reimburses you with MAPs You have been paid more than the approved amount of MAP In this case your business mileage will be taxed through PAYE You earn less than the Personal Allowance which is 163 12 570 for the 2022 23 tax year meaning you do not pay Income Tax and cannot therefore claim relief

How To Claim Mileage Allowance Relief VSP Accountancy

https://vspaccountancy.co.uk/wp-content/uploads/2019/11/How-To-Claim-Mileage--1024x683.jpg

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

https://www.driversnote.co.uk/hmrc-mileage-guide/mileage-allowance-re…

Web 2 Okt 2023 nbsp 0183 32 Let s go through a quick example of how to calculate mileage reimbursement at the advisory rate In one year you drive 5000 miles for work purposes and your employer uses HMRC s advisory rate To calculate your reimbursement you simply follow the below miles x rate 5 000 x 0 45 2250 GBP

https://www.tide.co/blog/business-tips/mileage-allowance-relief

Web 12 Juli 2022 nbsp 0183 32 Using the standard mileage allowance rates for 2022 you d calculate the total relief you can claim as follows 10 000 x 163 0 45 163 4 500 4 000 the number of business miles driven over 10 000 x 163 0 25 163 1 000

Mileage Allowance Relief Everything You Need To Know UK Salary Tax

How To Claim Mileage Allowance Relief VSP Accountancy

Mileage Allowance Relief Explained YouTube

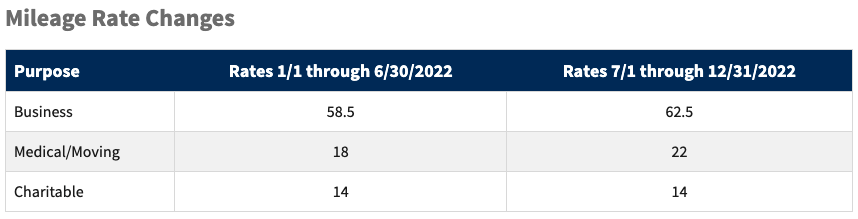

Mileage Rate Changes 2022 CPA Nerds

Canada Revenue Agency Mileage Rate 2024 Mora Tabbie

Business Mileage Deduction How To Calculate For Taxes

Business Mileage Deduction How To Calculate For Taxes

HMRC Mileage Rates What Are They And How Do They Work Tide Business

How To Claim Mileage Allowance Relief On Self Assessment Countingup

Comprehensive Guide To Mileage Tax Relief Fastaccountant co uk

How To Calculate Mileage Allowance Relief - Web Your company can choose to pay the exact amount of mileage allowance as stated by HMRC less or more than it If you pay more per mile than the approved rate the excess sum will be considered as personal benefits for your employee and