How To Calculate Rebate On Agricultural Income Now we will compute income Tax on INR 3 50 000 Tax slab benefit 2 50 000 Net Agricultural income 1 00 000 The amount of Tax shall be INR 10 000 Third subtract the Tax computed in Second step from the Tax computed in First step

The calculation of agriculture relief and net tax payable under the old tax regime is as follows Total taxes on Rs 9 00 000 Non agricultural income net agricultural income Rs 92 500 before education cess 4 Total taxes on Rs 4 50 000 Basic exemption limit net agricultural income Rs 10 000 before education cess Contents Rebate u s 87A for FY 2023 24 AY 2024 25 What is Total Taxable Income for Claiming Rebate u s 87A How to Claim Rebate u s 87A Eligibility to Claim a Rebate from Section 87A Rebate Against Various Tax Liabilities FAQs on Rebate u s 87A Rebate u s 87A for FY 2023 24 AY 2024 25

How To Calculate Rebate On Agricultural Income

How To Calculate Rebate On Agricultural Income

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

Agricultural Income Eligibility Calculation And Rebate

https://saral.pro/wp-content/uploads/2023/01/Agricultural-Income-Applicability-Calculation-Rebate.png

Computation Of Net Agricultural Income

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/Assessment/Agricultural-Income/Assessment Agricultural Income.jpg

The tax calculation done here is in accordance with the fact that the income from agricultural sources is falling under Section 2 1A of the IT Act Formula for calculating tax Total amount of tax due Agricultural income Non agricultural income X Net agricultural income basic exemption limit Y 19 1 5Y CAGR What is Agricultural Income Section 2 1A of the Income Tax Act 1961 provides the meaning of the agricultural income for the purpose of taxation The following types of income are included within the definition of agricultural income Rent or Revenue Any rent or revenue received from the land

Agricultural income is exempt under Section 10 1 of the Act so long as the income is derived from agricultural land situated in India This income is however included merely for rate purposes and rebate is allowed on In India one of the main sources of income is agriculture and its related industries According to data gathered by the Food and Agriculture Organisation FAO over 70 of rural households in India still rely primarily on agriculture for their income Therefore through programmes regulations and tax breaks for agricultural revenue the

Download How To Calculate Rebate On Agricultural Income

More picture related to How To Calculate Rebate On Agricultural Income

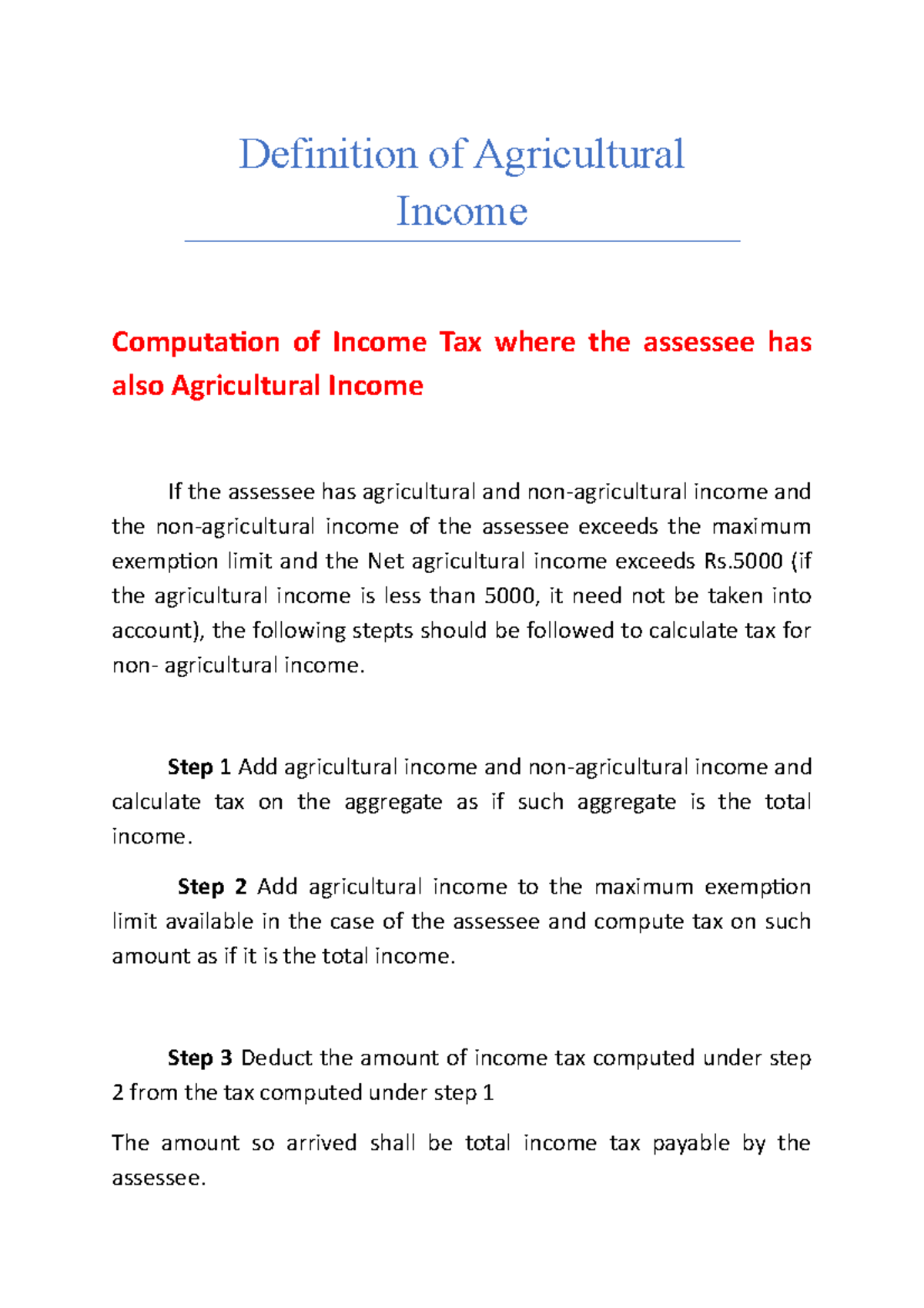

Definition Of Agricultural Income Computation Of Income Tax Where The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/92e62d3b82e4a83ae26163214c0017af/thumb_1200_1698.png

How To Calculate Revenue For A Startup

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/10/How-to-Calculate-Revenue-for-a-Startup.png

How To Calculate Excavation Work or Volume Of Excavation Quantity

https://i.pinimg.com/originals/3b/76/9e/3b769ea8d926e5efb50604601a3cdd20.jpg

Tax rebate on agricultural income is Income tax computed on a total of agricultural Income basic exempt slab limit Step 3 Subtract the amount computed in Step 2 from the amount computed in Step 1 to get the amount for total tax payable by the Individual Tax calculation in such cases is as follows Step 1 Add non agricultural income with net agricultural income Compute tax on the aggregate amount Step 2 Add net agricultural income and the maximum exemption limit available to the assessee i e Rs 2 50 000 Rs 3 00 000 Rs 5 00 000 Compute tax on the aggregate amount

How to calculate income tax on Agricultural income for FY 2023 24 What are the tax implications on sale of agriculture land in AY 2024 25 How to save capital gain taxes on sale of Agricultural land under Section 54 What is an Agricultural land Any land used for agricultural purpose shall be treated as agricultural land Agriculture income and non agriculture income added Calculate tax on total income Add basic exemption limit to net agriculture income Calculate income tax on step 3 Deduct the amount of tax calculated in step 4 from the amount calculated in step 2 Subtract rebate under 87A Add health cess

How To Calculate Rebate Formula Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Calculate-Rebate-Formula-768x736.png

Recovery Rebate Credit Line 30 Form 1040 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

https://taxguru.in/income-tax/calculate-tax...

Now we will compute income Tax on INR 3 50 000 Tax slab benefit 2 50 000 Net Agricultural income 1 00 000 The amount of Tax shall be INR 10 000 Third subtract the Tax computed in Second step from the Tax computed in First step

https://cleartax.in/s/agricultural-income

The calculation of agriculture relief and net tax payable under the old tax regime is as follows Total taxes on Rs 9 00 000 Non agricultural income net agricultural income Rs 92 500 before education cess 4 Total taxes on Rs 4 50 000 Basic exemption limit net agricultural income Rs 10 000 before education cess

How To Calculate Rebate On Bills Discounted Or Unexpired Discount YouTube

How To Calculate Rebate Formula Printable Rebate Form

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

What Is Product Adoption Rate How To Calculate This Sales KPI

Do You Know How To Calculate The regular Rate Of Pay For Your

Do You Know How To Calculate The regular Rate Of Pay For Your

What Is The Profit Margin How To Calculate It And Why Does It Matter

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

How To Calculate Labor Cost A Comprehensive Guide Truein

How To Calculate Rebate On Agricultural Income - Step 2 Calculation of tax on net agricultural income maximum exemption limit as per slab rates Step 3 Calculation of the final tax as a difference of the figures derived in Steps 1 and 2 This step derives the following Deduction of a rebate if available