Colorado Sales Tax Rebate 2024 The Department of Revenue DOR is administering the following 2023 TABOR refund mechanism primarily through the Colorado Individual Income Tax Return DR 0104 Sales Tax Refund Eligible 2023 full year residents may claim this refund by filing in the manner described below by the appropriate deadline The refund is 800 for one qualifying taxpayer or 1 600 for two qualifying taxpayers

On January 2 2024 the Colorado Department of Revenue Division of Taxation adopted the Buyer s Claims for Refund of Sales or Use Tax Paid rule The adoption was based on the public rulemaking hearing held on November 2 2023 About Colorado Cash Back On May 23 2022 Gov Jared Polis signed a new law Senate Bill 22 233 to give Coloradans a tax rebate of 750 for individual filers and 1 500 for joint filers this summer This law will provide immediate relief to Coloradans by sending you a check this summer instead of spring of 2023 and we at the Colorado Department of Revenue are working hard to make sure that

Colorado Sales Tax Rebate 2024

Colorado Sales Tax Rebate 2024

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

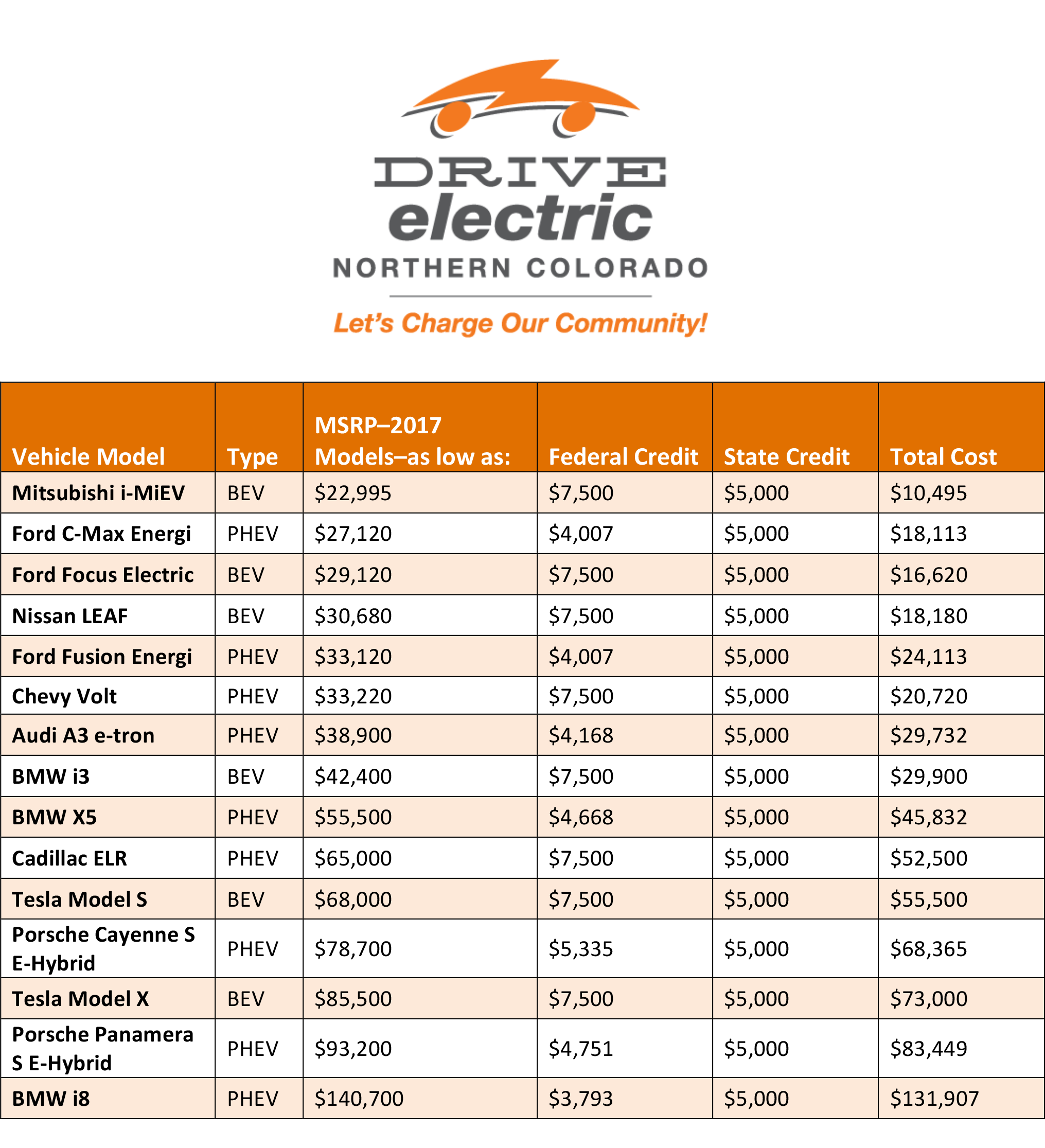

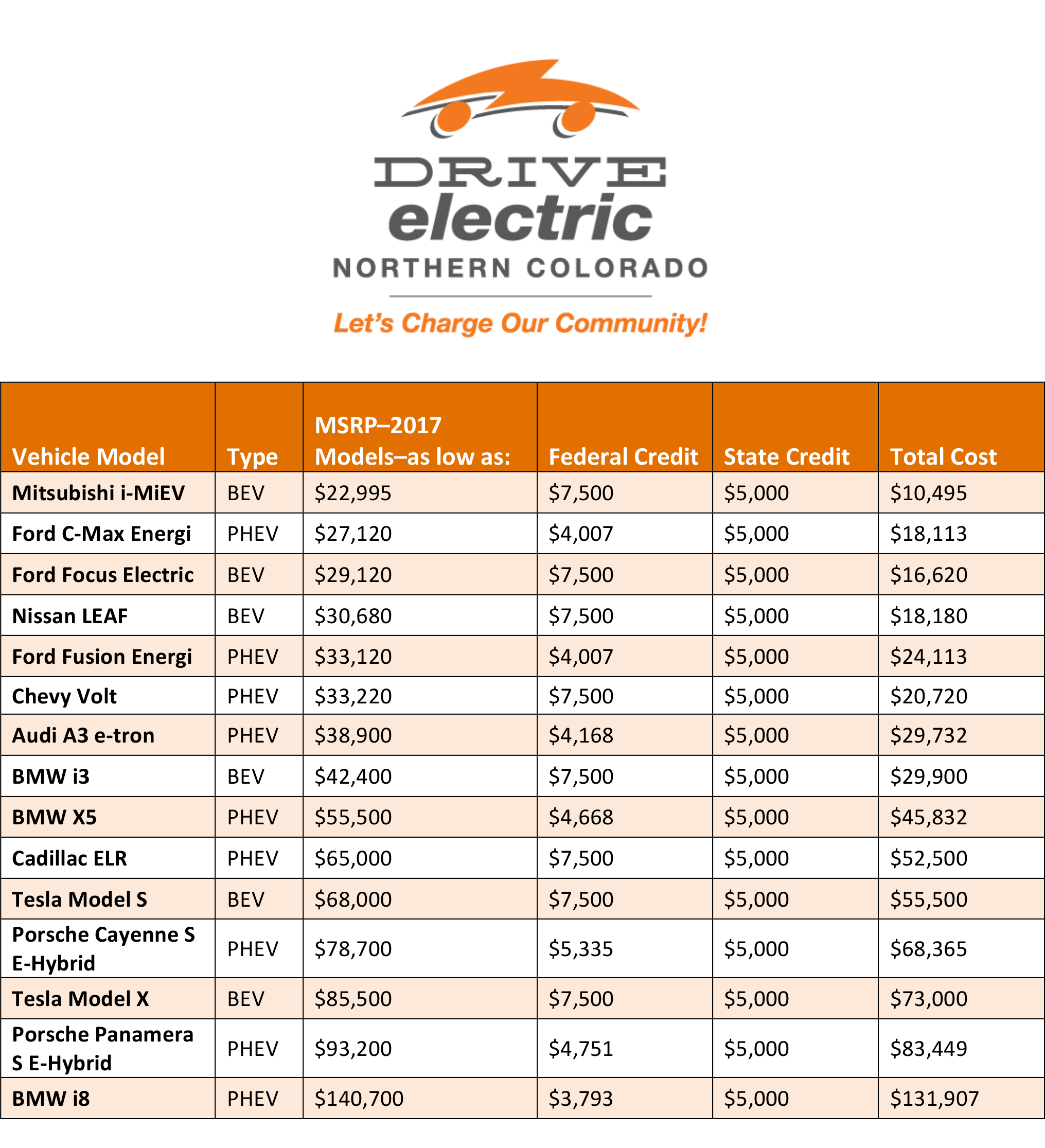

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Short Term Rental Tax Information Summit County CO Official Website

http://summitcountyco.gov/ImageRepository/Document?documentId=26676

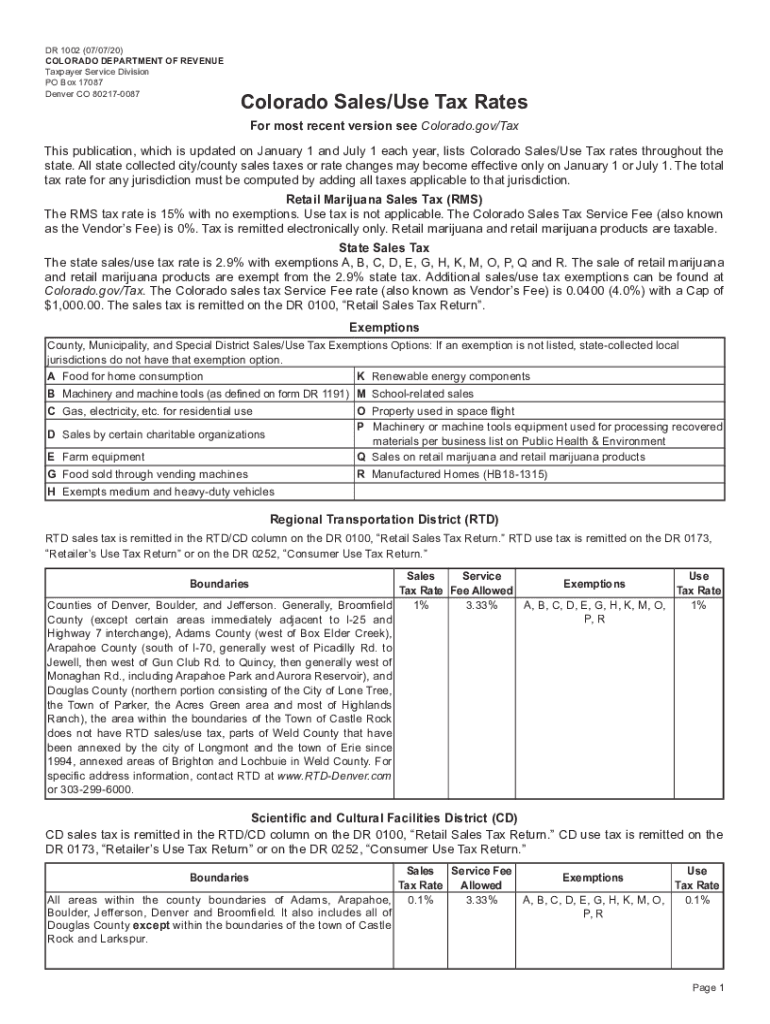

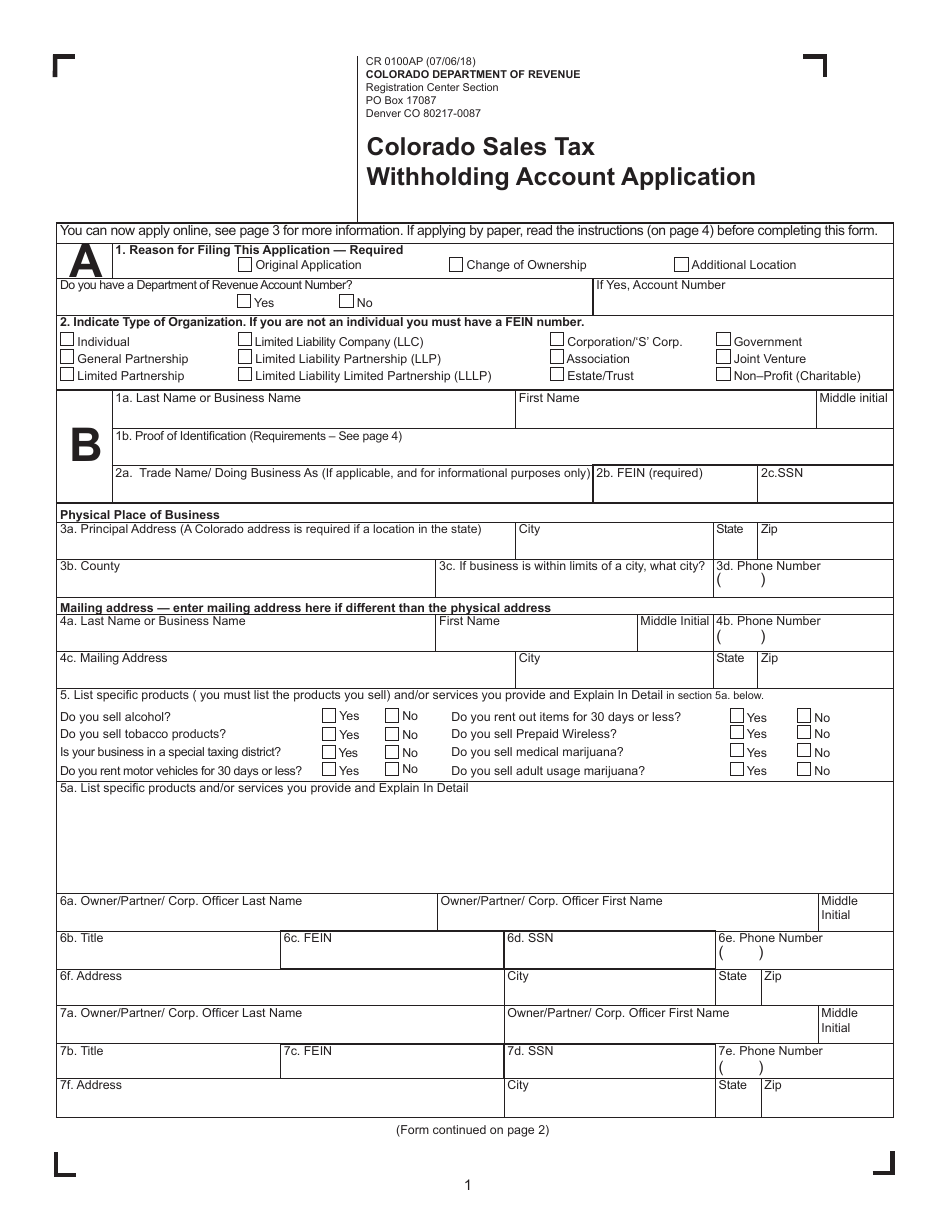

Colorado imposes sales tax on retail sales of tangible personal property In general the tax does not apply to sales of services except for those services specifically taxed by law 2024 8 11 Items removed from inventory Any claim for credit must be made with the Colorado Retail Sales Tax Return DR 0100 and any refund claim To be eligible to claim a sales and use tax rebate a taxpayer is required to obtain certification from the Colorado office of economic development office stating that the data center is an eligible data center and that the taxpayer may claim a rebate of state sales and use tax certification 01 24 2024 Senate Introduced In Senate

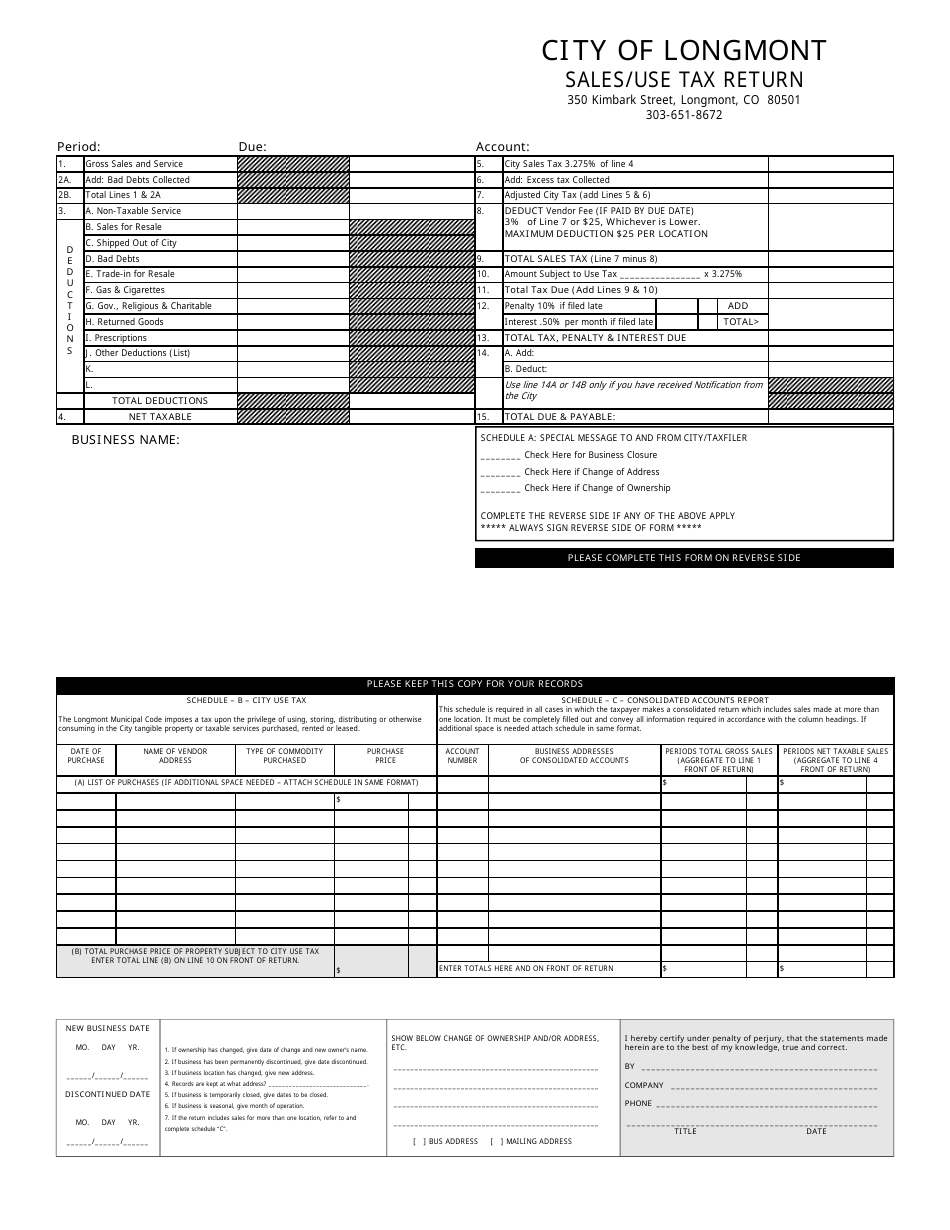

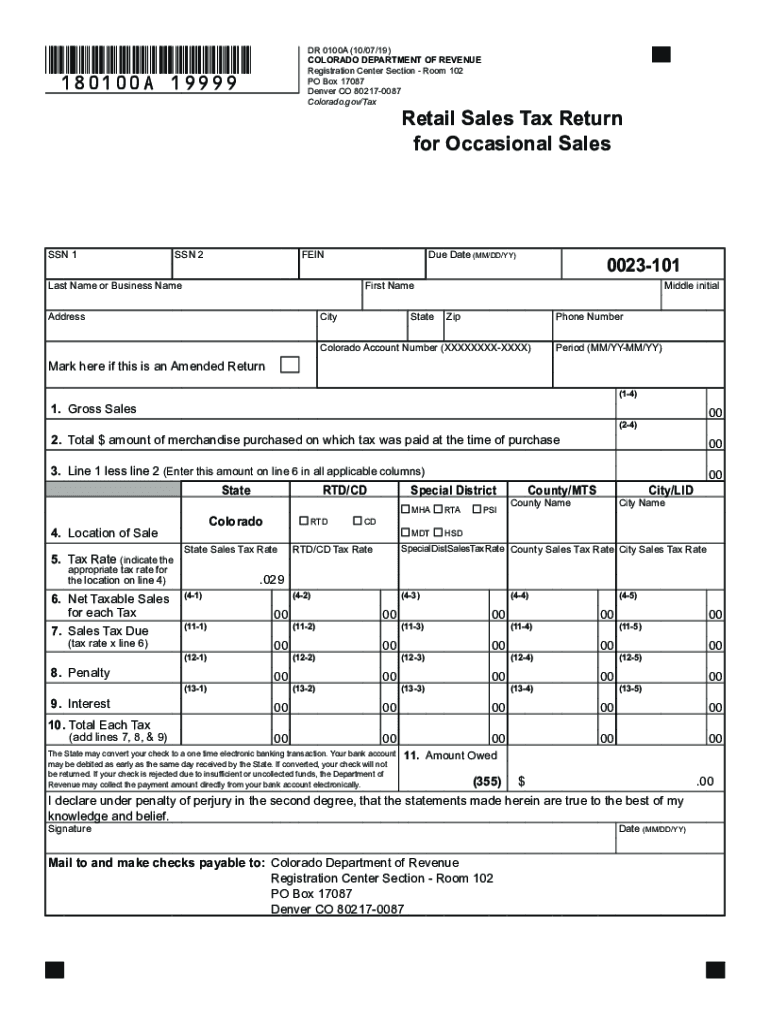

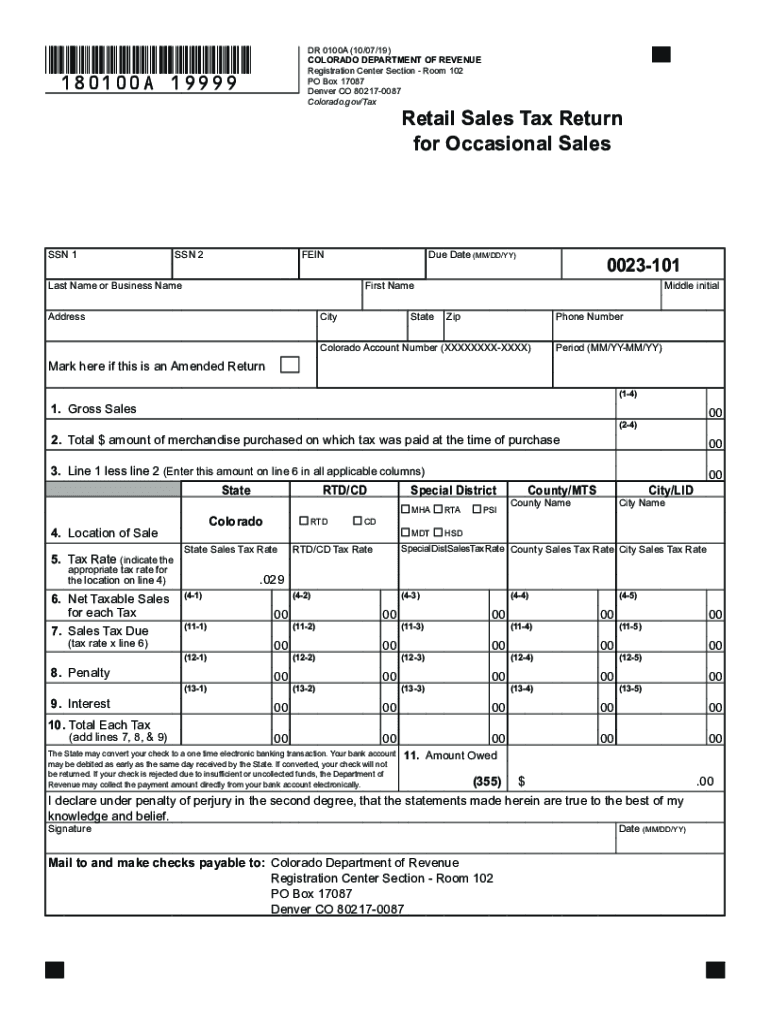

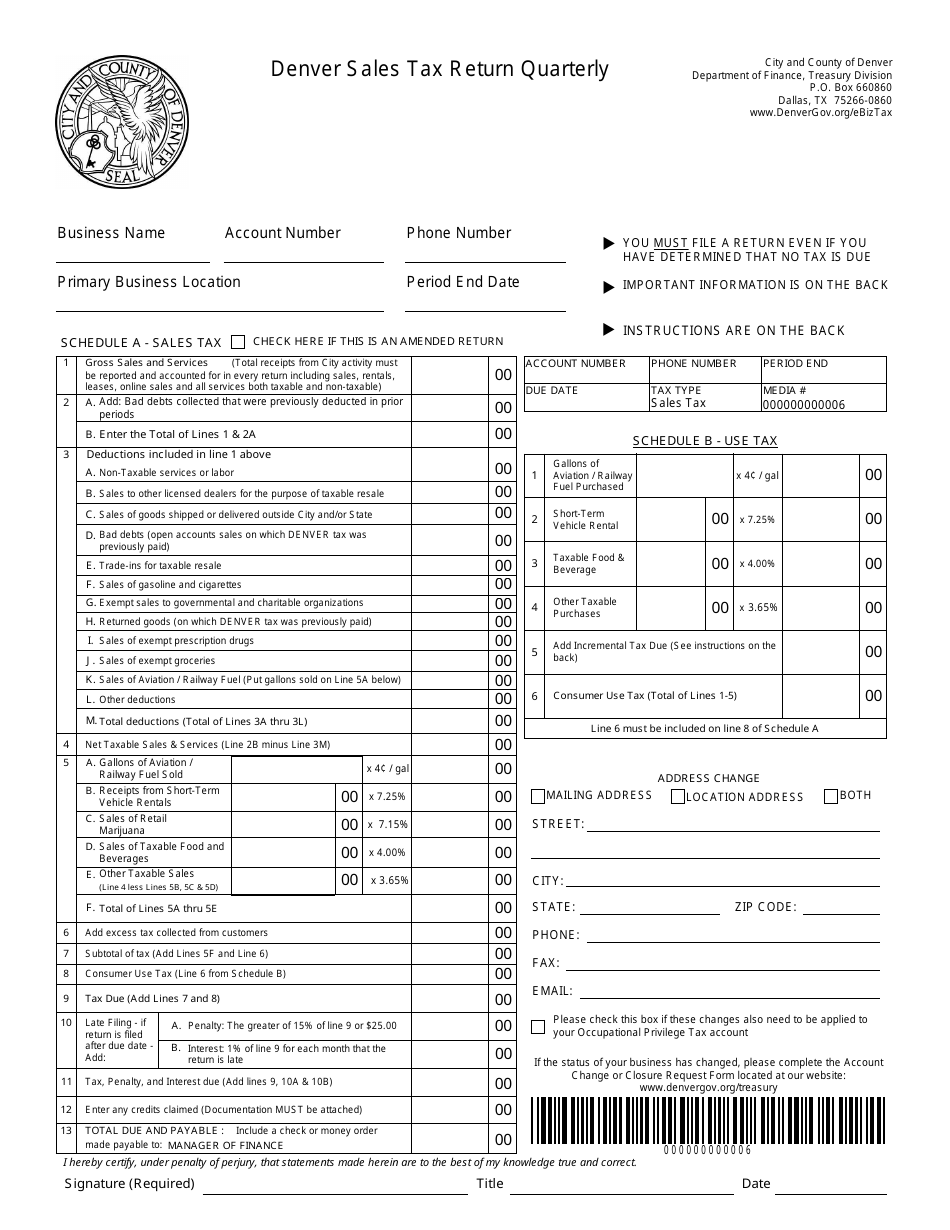

The Colorado Retail Sales Tax Return DR 0100 is used to report not only Colorado sales tax but also sales taxes administered by the Colorado Department of Revenue for various cities counties and special districts in the state The sales taxes for different local jurisdictions are calculated and reported in separate columns of the DR 0100 DR 0594 opens in new window Renewal Application for Sales Tax License DR 1290 opens in new window Certification of Registered Marketplace Facilitator DR 1465 opens in new window Retail Food Establishment Computation Worksheet for Sales Tax Deduction for Gas and or Electricity

Download Colorado Sales Tax Rebate 2024

More picture related to Colorado Sales Tax Rebate 2024

LONGMONT Colorado Sales Use Tax Return Form Download Printable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/308/3088/308824/sales-use-tax-return-form-longmont-colorado_print_big.png

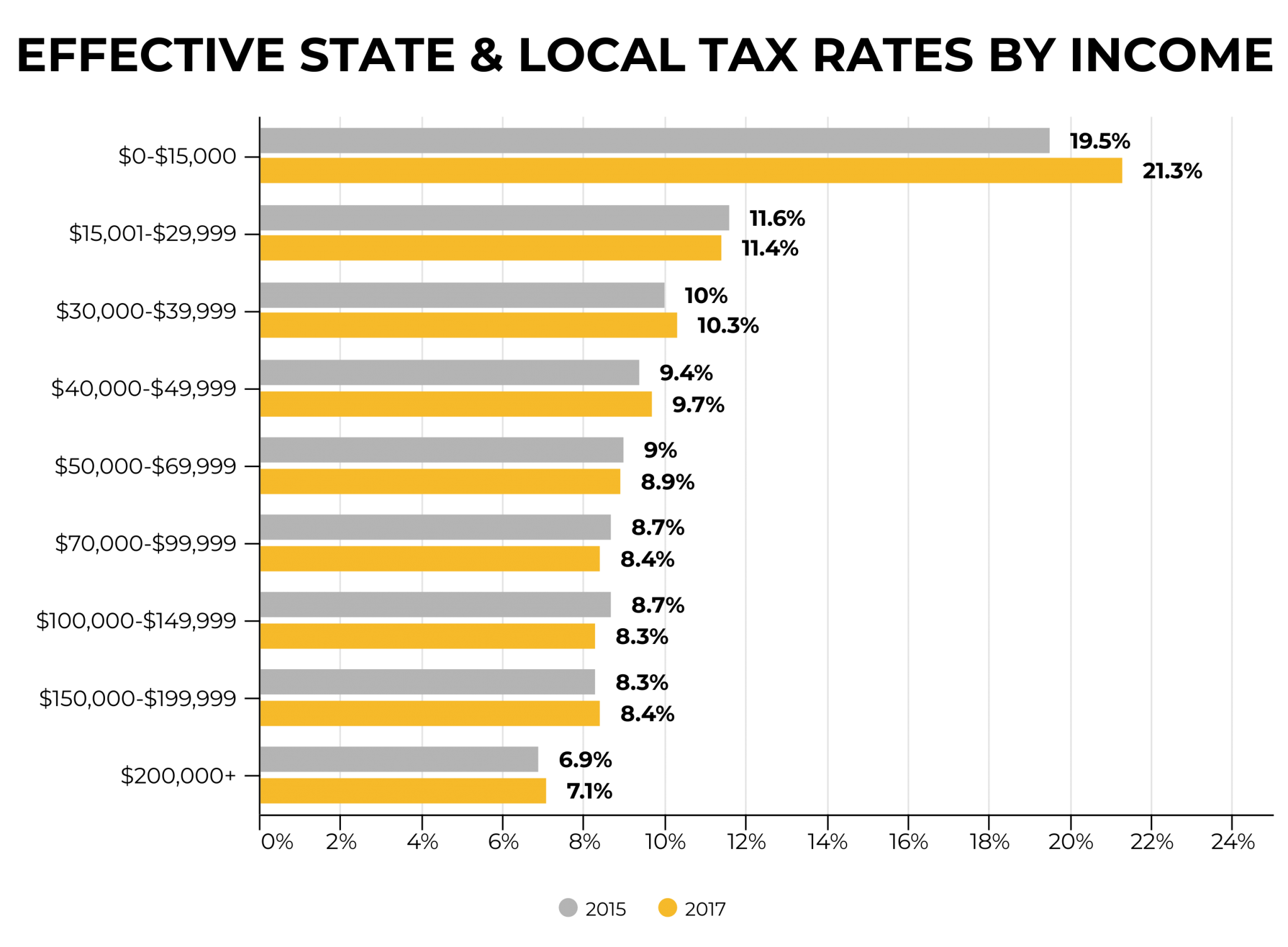

Headlines From The Colorado Tax Report The Bell Policy Center

https://www.bellpolicy.org/wp-content/uploads/1-1-2048x1506.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Under the default refund system called the six tier sales tax refund mechanism people who make more money get bigger refund checks based on which of six income tiers they fall into People in the lowest tier who make up to 50 000 a year were expected to receive refund checks of 454 for single filers or 908 for joint filers If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Federal and State Colorado Tax Credits are separate You may qualify for a federal credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or FCV

Prior to tax year 2022 the Colorado income tax rate could be temporarily reduced to 4 50 if there was enough TABOR surplus However starting with tax year 2022 voters permanently reduced the income tax rate to 4 40 as specified in Sections 39 22 104 1 7 c and 39 22 301 1 d I K of the Colorado Revised Statutes To this however can be added several additional tax changes adopted in 2023 with effective dates prior to 2024 Colorado Colorado citizens voted down Proposition HH in November 2023 prompting the governor to call a special legislative session to address the impending statewide increases in property taxes

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Co Dr 1002 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/533/339/533339066/large.png

https://tax.colorado.gov/TABOR

The Department of Revenue DOR is administering the following 2023 TABOR refund mechanism primarily through the Colorado Individual Income Tax Return DR 0104 Sales Tax Refund Eligible 2023 full year residents may claim this refund by filing in the manner described below by the appropriate deadline The refund is 800 for one qualifying taxpayer or 1 600 for two qualifying taxpayers

https://tax.colorado.gov/news-article/adopted-house-bill-22-1118-buyers-claims-for-refund-of-sales-or-use-tax-paid-rule

On January 2 2024 the Colorado Department of Revenue Division of Taxation adopted the Buyer s Claims for Refund of Sales or Use Tax Paid rule The adoption was based on the public rulemaking hearing held on November 2 2023

Property Tax Rebate Pennsylvania LatestRebate

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

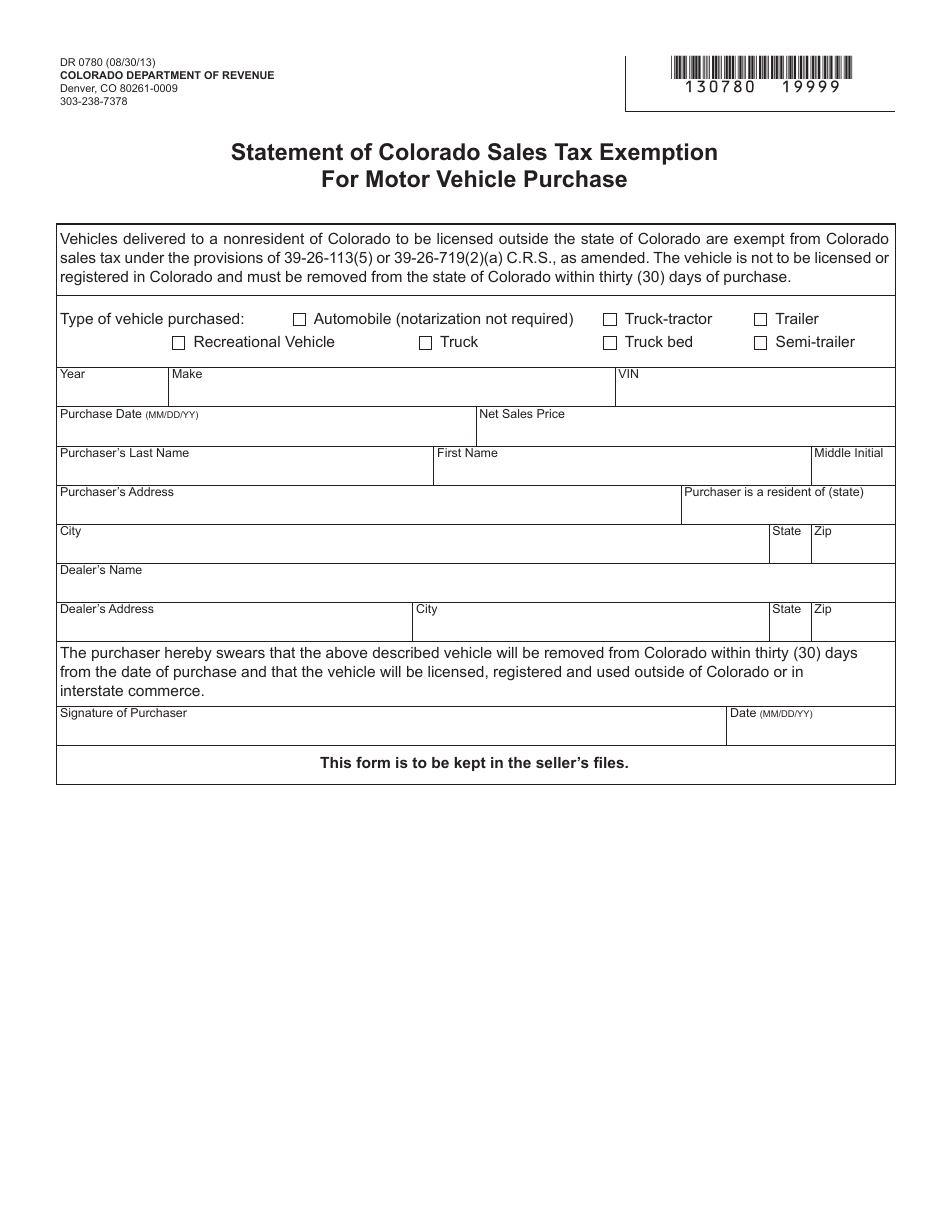

Form DR0780 Fill Out Sign Online And Download Fillable PDF Colorado Templateroller

New Income Tax Regime Will Be Default Citizens Union Budget 2023 Live Updates Income

Colorado Sales Tax Form Dr 0100 Fill Online Printable Fillable Blank

Co Sales Tax Return Fill Out And Sign Printable PDF Template SignNow

Co Sales Tax Return Fill Out And Sign Printable PDF Template SignNow

Form CR0100AP Fill Out Sign Online And Download Fillable PDF Colorado Templateroller

How To File Colorado Sales Tax Using An E file Spreadsheet YouTube

City And County Of Denver Colorado Sales Tax Return Quarterly Form Fill Out Sign Online And

Colorado Sales Tax Rebate 2024 - To be eligible to claim a sales and use tax rebate a taxpayer is required to obtain certification from the Colorado office of economic development office stating that the data center is an eligible data center and that the taxpayer may claim a rebate of state sales and use tax certification 01 24 2024 Senate Introduced In Senate