Tax Rebate Nigeria Web 1 sept 2023 nbsp 0183 32 As a result of the consolidated relief allowance of at least 21 of gross income the top marginal tax rate is 18 96 for income above NGN 20 million as only

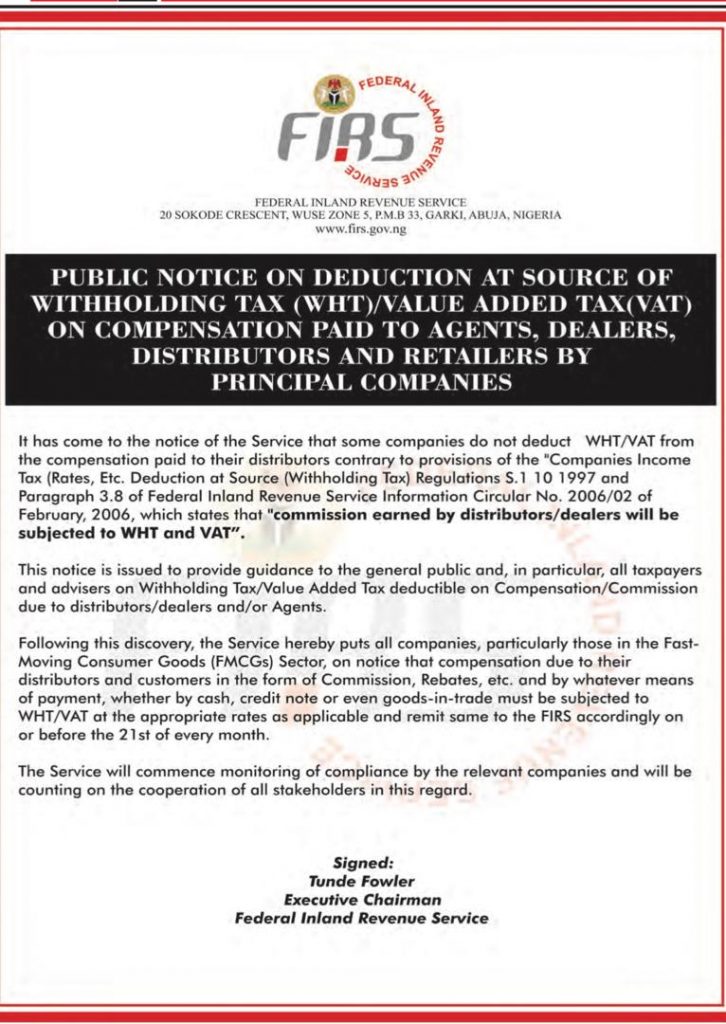

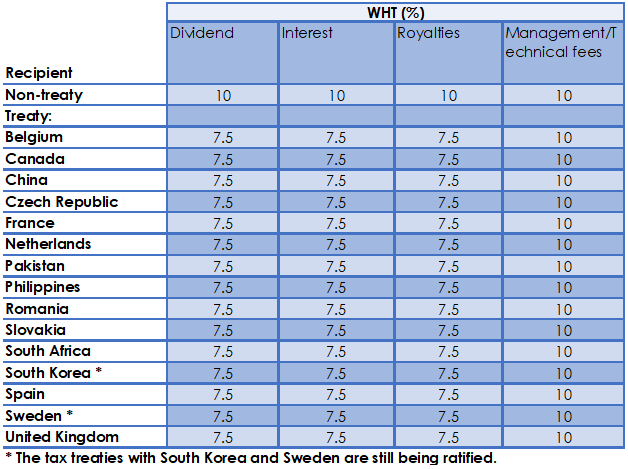

Web 11 October 2019 Taxing trade incentives in Nigeria a conundrum Introduction Trade incentives ranging from commissions to volume discounts and rebates are one of the Web 22 sept 2022 nbsp 0183 32 The PITA imposes a tax on the total income of taxable persons subject to a few exemptions which may be found under the Third Schedule to the PITA Third

Tax Rebate Nigeria

Tax Rebate Nigeria

https://www.hyndburnbc.gov.uk/wp-content/uploads/2022/03/council-tax-rebate.png

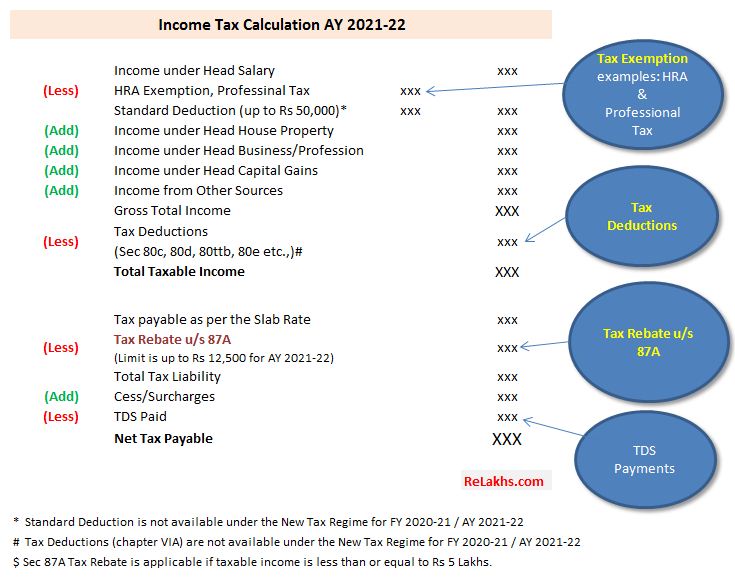

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Public Notice On Deduction And Remittance Of WHT And VAT AA TAX

https://aataxmanagement.com/blog/wp-content/uploads/2019/08/WHT-VAT-PUBLIC-NOTICE-726x1024.jpg

Web Tax revenue collected from the oil sector from January to June 2023 stood at N1 73 trillion as against a target of N2 3 trillion while non oil tax collection stood at N3 76 trillion as against a target of N2 98 trillion The Web 11 f 233 vr 2019 nbsp 0183 32 The above notwithstanding tax authorities in Nigeria usually view discounts and rebates with skepticism Sometimes they seek to adjust the income tax

Web 17 sept 2021 nbsp 0183 32 INTRODUCTION Nigeria faces a critical infrastructure deficit projected at over 3 trillion in the next 26 years 1 with an average annual budget of approximately Web 1 sept 2023 nbsp 0183 32 The table below shows a summary of the taxable income tax bands and applicable rates of tax on an annual basis Nigerian naira Note that employees who

Download Tax Rebate Nigeria

More picture related to Tax Rebate Nigeria

Have You Received Your 150 Council Tax Rebate

https://s3-eu-west-1.amazonaws.com/creditladder-cdn/images/c459b3e3-4982-464e-8b4b-dd006b127354/Council_Tax_rebate.JPG

Rebate Under Section 87A AY 2021 22 CapitalGreen

https://capitalgreen.in/wp-content/uploads/2021/01/Income-Tax-Rebate-Vs-Tax-Exemption-Vs-Tax-Deduction-FY-2020-21-AY-2021-22.jpg

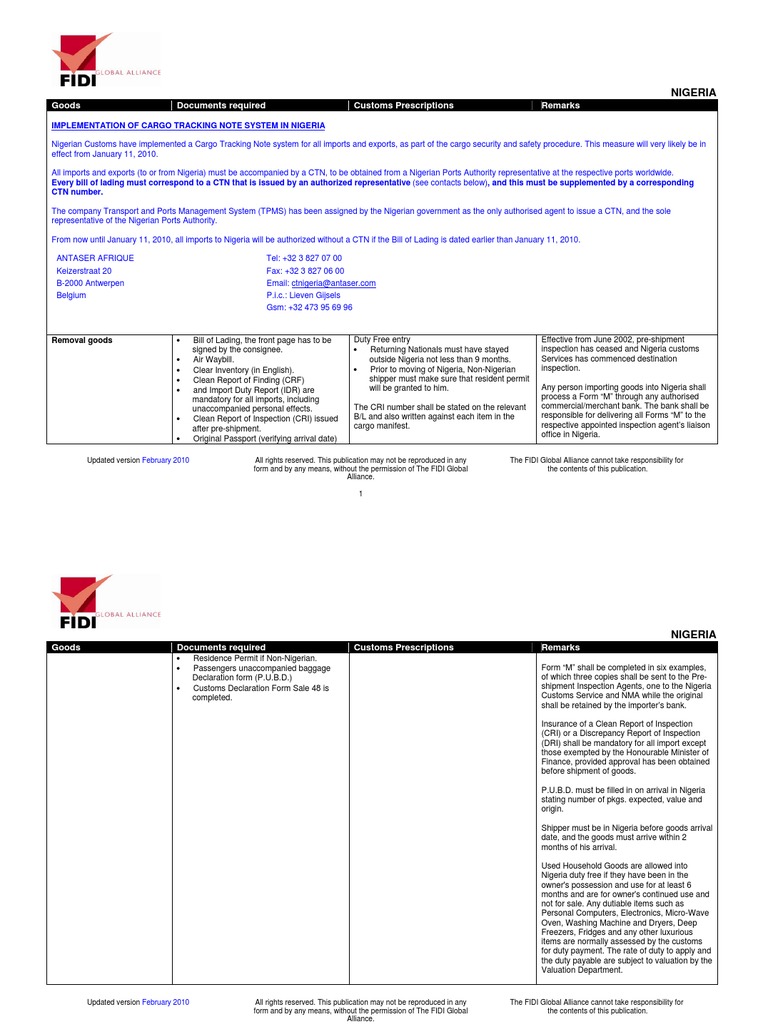

Nigeria Ad Valorem Tax Customs

https://imgv2-1-f.scribdassets.com/img/document/66472620/original/7a331921ba/1580167998?v=1

Web 27 janv 2022 nbsp 0183 32 Nigeria s tax receipts in 2021 rose by 29 4 to 6 41 trillion naira 15 5 billion the head of Federal Inland Revenue Service FIRS Muhammad Nami said on Web Four years after the rapidly changing commercial environment and persistent low tax to Gross Domestic Product GDP ratio among other developments demand new

Web 1 f 233 vr 2020 nbsp 0183 32 Value added tax VAT The standard VAT rate is 7 5 increased from 5 on 1 February 2020 Zero rated items include goods and services purchased by diplomats Web new subsection 3 introduced under Section 33 provide that there shall be allowed a deduction of the annual amount of any premium paid by the individual during the

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

https://i2.wp.com/nairametrics.com/wp-content/uploads/2016/07/Take-home.jpg?ssl=1

WITHHOLDING TAXES IN NIGERIA Unlike The Value Added Tax VAT Or By

https://miro.medium.com/max/1256/1*hGyRlFSzBtnSm0rYG7Z2mw.png

https://taxsummaries.pwc.com/nigeria/individual/deductions

Web 1 sept 2023 nbsp 0183 32 As a result of the consolidated relief allowance of at least 21 of gross income the top marginal tax rate is 18 96 for income above NGN 20 million as only

https://www2.deloitte.com/content/dam/Deloitte/ng/Documen…

Web 11 October 2019 Taxing trade incentives in Nigeria a conundrum Introduction Trade incentives ranging from commissions to volume discounts and rebates are one of the

What Are The Best Ways To Manage Tax Rebates

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Nigeria Corporate Tax Rate 2022 Take profit

Pin On Tigri

How To Calculate Tax Returns In Nigeria Tax Walls

How To Calculate Tax Returns In Nigeria Tax Walls

Paulding County Homestead Exemption

Nigeria Tax System And Taxes In Nigeria Introducing Lagos

9 Types Of Taxes In Nigeria How Each Works Oasdom

Tax Rebate Nigeria - Web 1 sept 2023 nbsp 0183 32 The table below shows a summary of the taxable income tax bands and applicable rates of tax on an annual basis Nigerian naira Note that employees who