How To Calculate Tax On Clothes Verkko Calculate import duty and taxes in the web based calculator It s fast and free to try and covers over 100 destinations worldwide

Verkko 28 syysk 2023 nbsp 0183 32 To calculate clothing donations for taxes calculate the fair market value which is the price the item would currently sell for in its present state To make this process easier some donation centers have valuation guides on their websites Verkko 23 marrask 2023 nbsp 0183 32 Method 1 Calculating Total Cost Download Article 1 Multiply the cost of an item or service by the sales tax in order to find out the total cost The equation looks like this Item or service cost x sales tax in decimal form total sales tax Add the total sales tax to the Item or service cost to get your total cost 1 Calculating Sales Tax

How To Calculate Tax On Clothes

How To Calculate Tax On Clothes

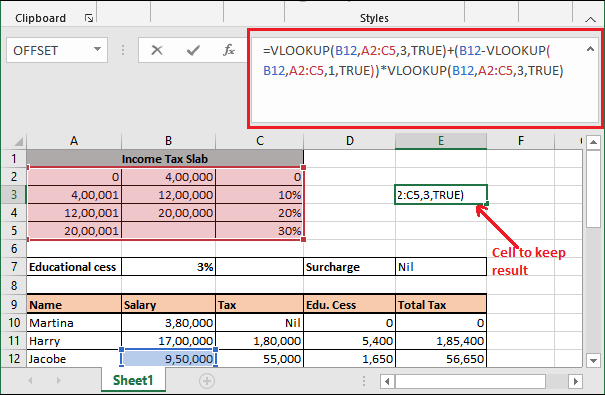

https://static.javatpoint.com/ms/excel/images/income-tax-calculating-formula-in-excel32.png

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

Tax Calculating Program In Python Report By Rahul

https://1.bp.blogspot.com/-wsawyF37dF0/XkQxX_Ca0hI/AAAAAAAAA4Q/-UC89kus6L86kDHuMBV1jnnbJ8yF4bUCACLcBGAsYHQ/s1600/tax_calculating_program.PNG

Verkko 31 elok 2023 nbsp 0183 32 How to Calculate Sales Tax Multiply the price of your item or service by the tax rate If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal Then use this number in the multiplication process Find list price and tax percentage Divide tax percentage by 100 to get tax rate as a decimal Verkko 18 hein 228 k 2019 nbsp 0183 32 In this video I break down Paying Sales Tax and Paying Income Tax While owning and operating a clothing brand from home Support the channel and learn a lit

Verkko 6 maalisk 2023 nbsp 0183 32 These are Connecticut imposes a 7 75 luxury tax on sales of apparel handbags luggage umbrellas wallets and watches with a sales price exceeding 1 000 This is significantly higher than the state s general rate of 6 35 The sales and use tax on clothes is subject to limited exceptions in several states For Verkko Doesn t mean overalls are In Virginia both corsets and choir robes are considered tax exempt during specified dates whereas in some counties in New York State these items would only be exempt if they cost less than 110 Whether a clothing item is tax exempt relates to state and local rules about blanket product exemptions

Download How To Calculate Tax On Clothes

More picture related to How To Calculate Tax On Clothes

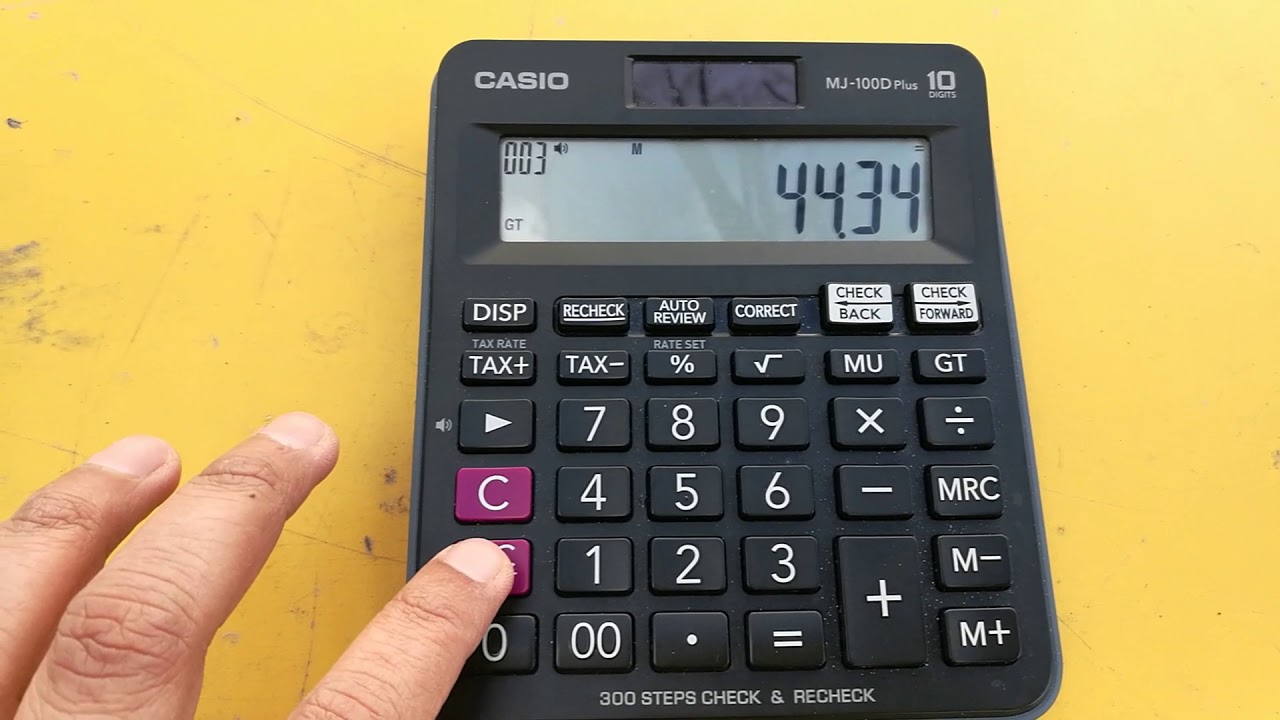

How To Calculate Sales Tax On Calculator Easy Way YouTube

https://i.ytimg.com/vi/4nEvG0uyTK0/maxresdefault.jpg

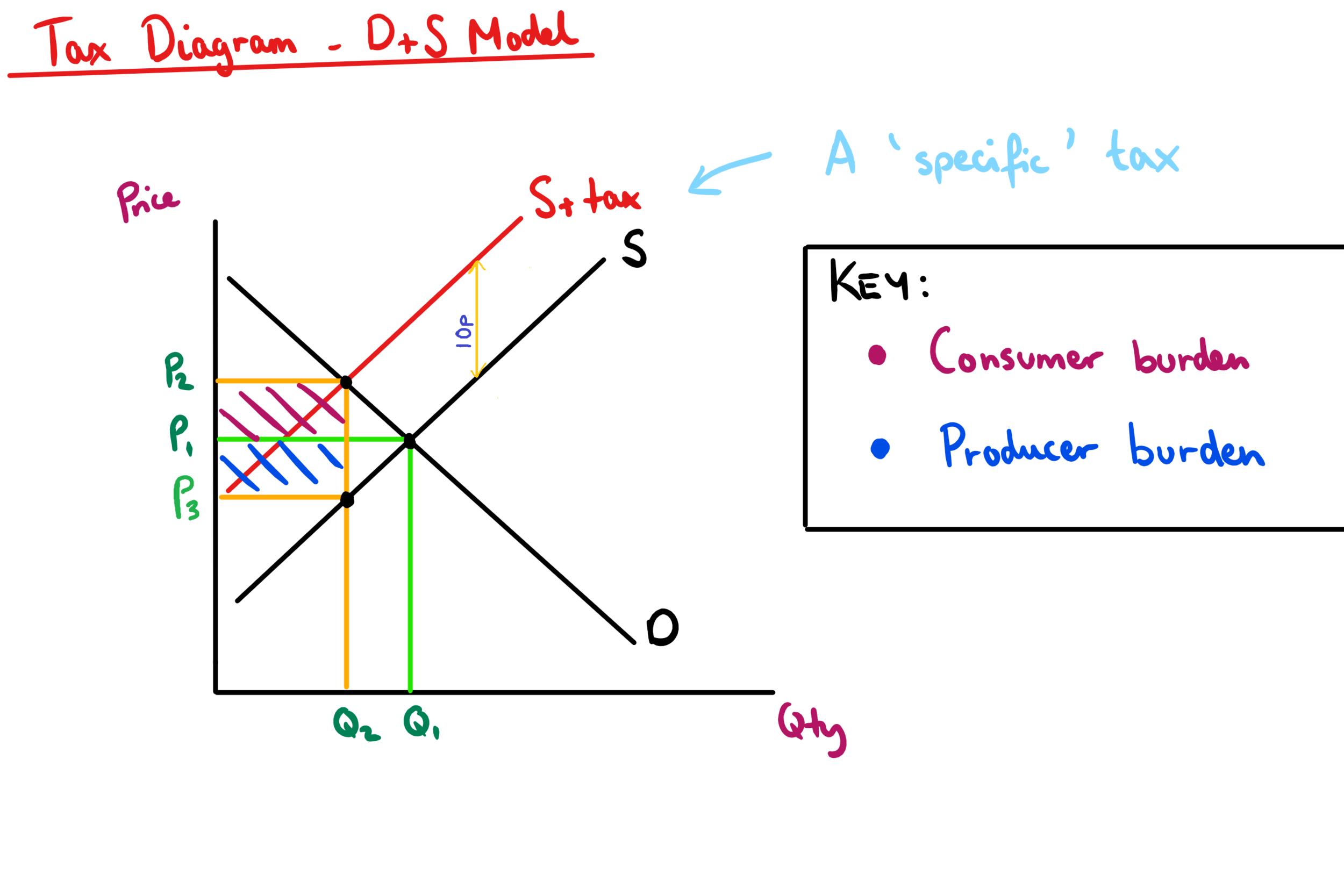

Taxation Graph Hot Sex Picture

https://images.squarespace-cdn.com/content/v1/55b690f2e4b076db679cd340/1481202309202-R4HFI0P9UHTBU0M8BYVY/tax+diagram+-+specific+unit+tax

Effective Tax Rates Table Hot Sex Picture

https://www.researchgate.net/publication/272299693/figure/tbl1/AS:667930853400586@1536258533716/Average-Effective-Tax-Rates-Excluding-Corporate-Tax-on-Retained-Profits-a-Rates.png

Verkko 19 jouluk 2022 nbsp 0183 32 Clothing You may be able to claim the below tax deductions for some common clothing items you donated These values are according to The Salvation Army and Goodwill You can also use the Goodwill Fair Market Value calculator Verkko How Sales Tax on Clothing Works In the US sales tax is charged at the point of sale when selling tangible personal property Most items like toothbrushes or coffee tables are taxable But some states exempt necessities like

Verkko 31 toukok 2022 nbsp 0183 32 How to complete the work related clothing expenses section of your return using myTax Last updated 31 May 2022 Print or Download On this page Things to know Completing this section Complete this section if you incurred work related clothing expenses such as protective clothing uniforms occupation specific clothing Verkko 19 lokak 2023 nbsp 0183 32 Learn how to estimate the value of clothing for IRS tax deductions as charitable donations The value of clothing donations to charity are based on published lists of retail values or current thrift store prices List your donation values on the Form 8283 with the help of TurboTax in this video on filing annual taxes

What Is Sales Tax And How Do I Calculate It Sellercloud

https://sellercloud.com/a/2023/04/What-is-Sales-Tax-And-How-Do-I-Calculate-it_What-is-Sales-Tax-And-How-Do-I-Calculate-it_-01-2048x1152.png

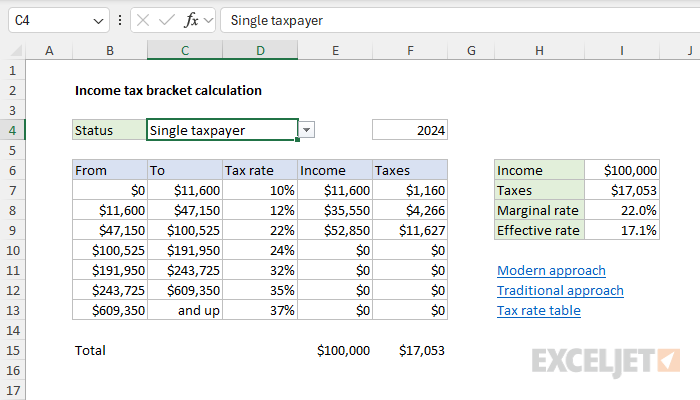

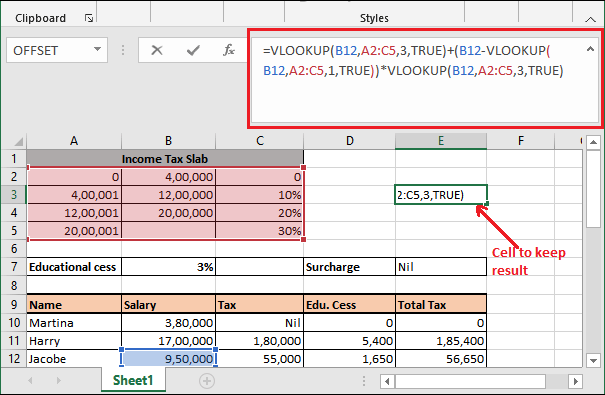

Income Tax Bracket Calculation Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/income tax bracket calculation_0.png

https://www.simplyduty.com/import-

Verkko Calculate import duty and taxes in the web based calculator It s fast and free to try and covers over 100 destinations worldwide

https://www.wikihow.com/Calculate-Clothing-Donations-for-Taxes

Verkko 28 syysk 2023 nbsp 0183 32 To calculate clothing donations for taxes calculate the fair market value which is the price the item would currently sell for in its present state To make this process easier some donation centers have valuation guides on their websites

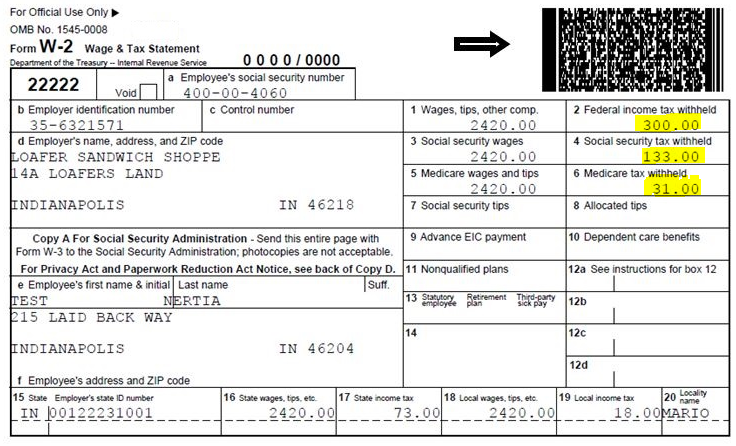

Form Used To Calculate Employee s Income Tax 2024 Employeeform

What Is Sales Tax And How Do I Calculate It Sellercloud

Calculating Taxes In SamCart SamCart Knowledge Base

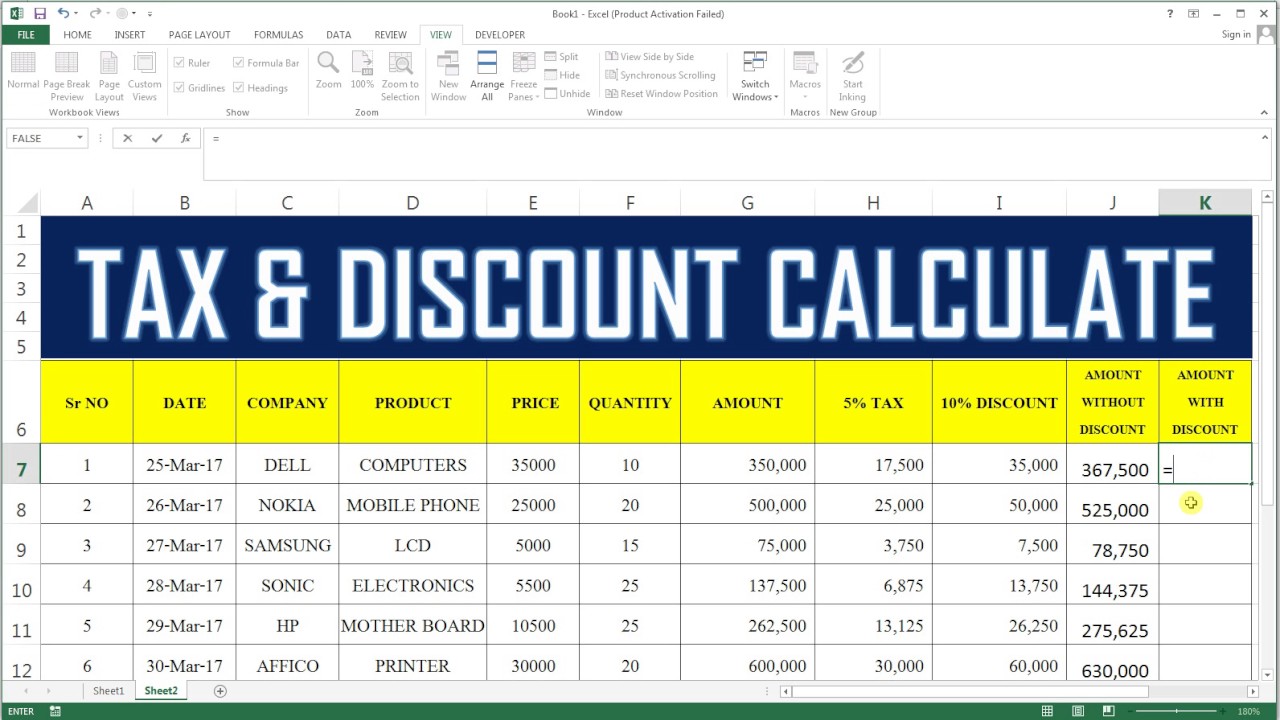

How To Calculate Tax Discount In Excel 36 YouTube

Calculate My Income Tax SuellenGiorgio

How To Calculate Tax On An Item The Tech Edvocate

How To Calculate Tax On An Item The Tech Edvocate

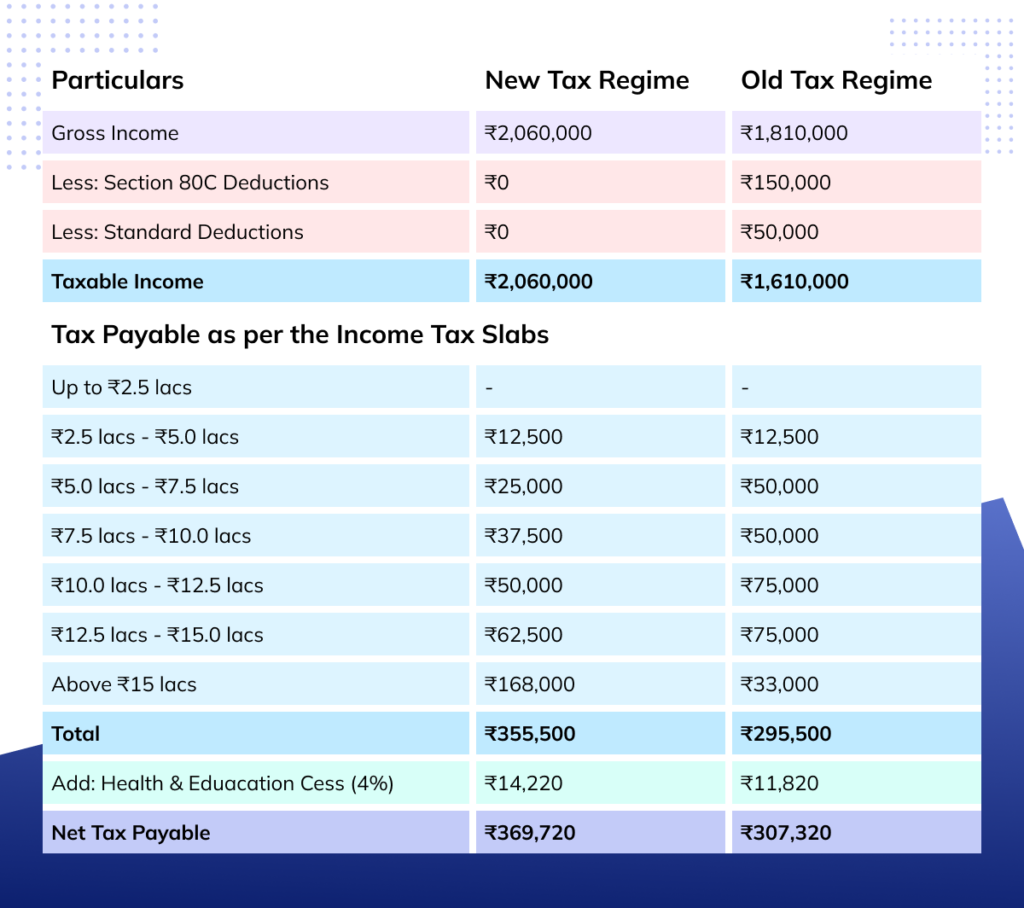

How To Calculate Income Tax FY 2022 23 Salary Example FinCalC Blog

Pre Tax Contribution Calculator BettinaLeela

T ml Rejtett tutal s Tax Payable Calculator Megfejt Tengerpart Kinyit

How To Calculate Tax On Clothes - Verkko 6 maalisk 2023 nbsp 0183 32 These are Connecticut imposes a 7 75 luxury tax on sales of apparel handbags luggage umbrellas wallets and watches with a sales price exceeding 1 000 This is significantly higher than the state s general rate of 6 35 The sales and use tax on clothes is subject to limited exceptions in several states For