How To Claim Child Care Tax Credit Without Social Security Number Web 11 Juni 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax

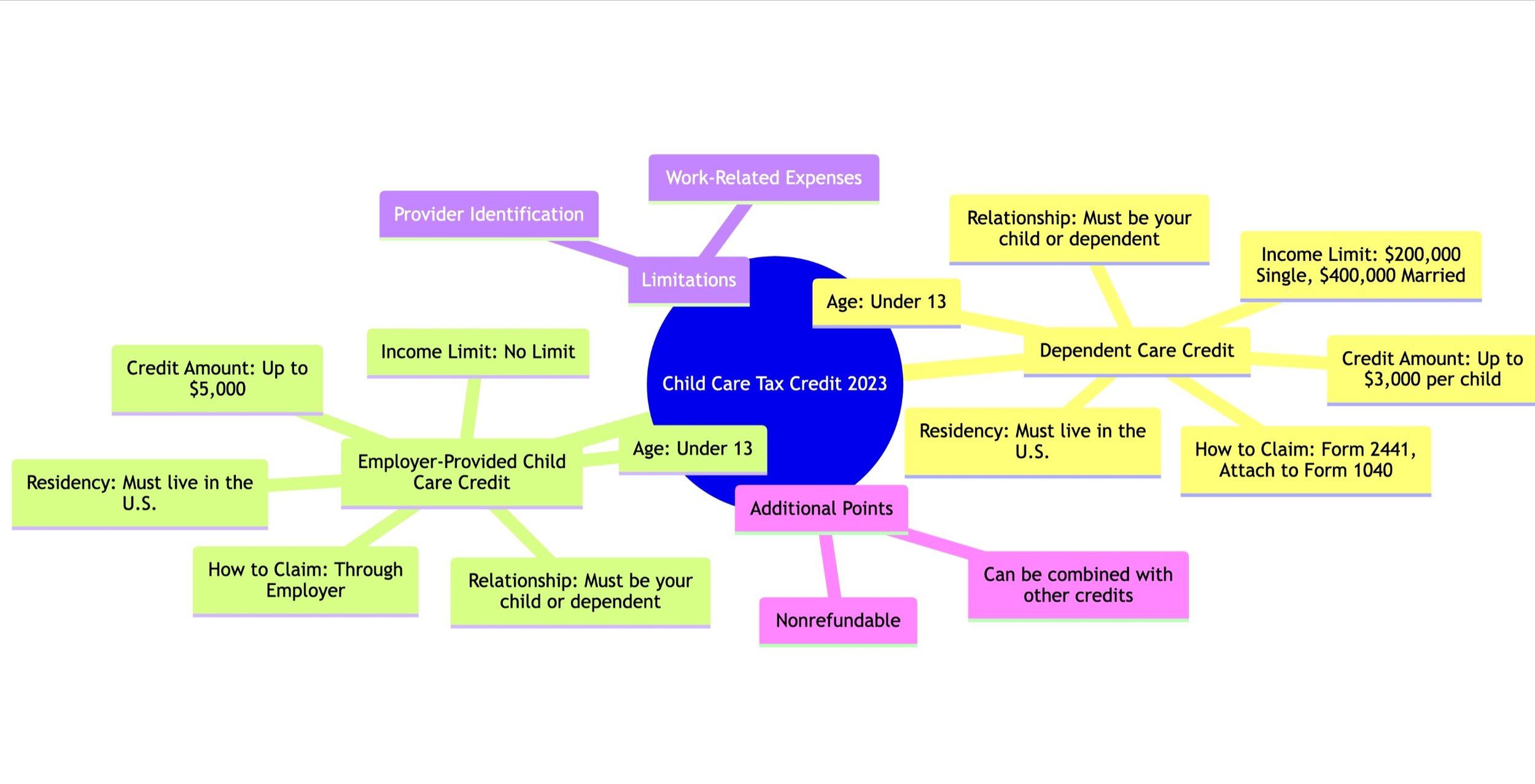

Web Vor 3 Tagen nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or Web 15 Sept 2023 nbsp 0183 32 Yes you may still claim the child and dependent care credit when you re missing the provider s social security number or other taxpayer identification number

How To Claim Child Care Tax Credit Without Social Security Number

How To Claim Child Care Tax Credit Without Social Security Number

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

How To Claim Child Tax Credit A Step By Step Guide YouTube

https://i.ytimg.com/vi/Druuz8nrVzI/maxresdefault.jpg

Tax Credits For Pa Families Worth Billions Of Dollars Are On The Table

https://whyy.org/wp-content/uploads/2023/06/k5599q2kgasyp4ybvk59gb2nfc.jpeg

Web 24 Aug 2023 nbsp 0183 32 You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a Web 14 Juli 2022 nbsp 0183 32 For your child to qualify you for the Child Tax Credit your child must have a Social Security number SSN that is valid for employment Therefore if your child

Web 15 Juni 2023 nbsp 0183 32 May I claim the child tax credit for a child who has an individual taxpayer identification number ITIN rather than a social security number SSN Answer No Web Yes you may still claim the child and dependent care credit when you re missing the provider s social security number or other taxpayer identification number by

Download How To Claim Child Care Tax Credit Without Social Security Number

More picture related to How To Claim Child Care Tax Credit Without Social Security Number

Child Tax Credit

https://media.licdn.com/dms/image/D4D12AQEJ6g7sbguzMA/article-cover_image-shrink_600_2000/0/1685985653667?e=2147483647&v=beta&t=L-iJZq6Dr19ZhNkoU5jUQePYi9wHteLlcPV_-uaWGhY

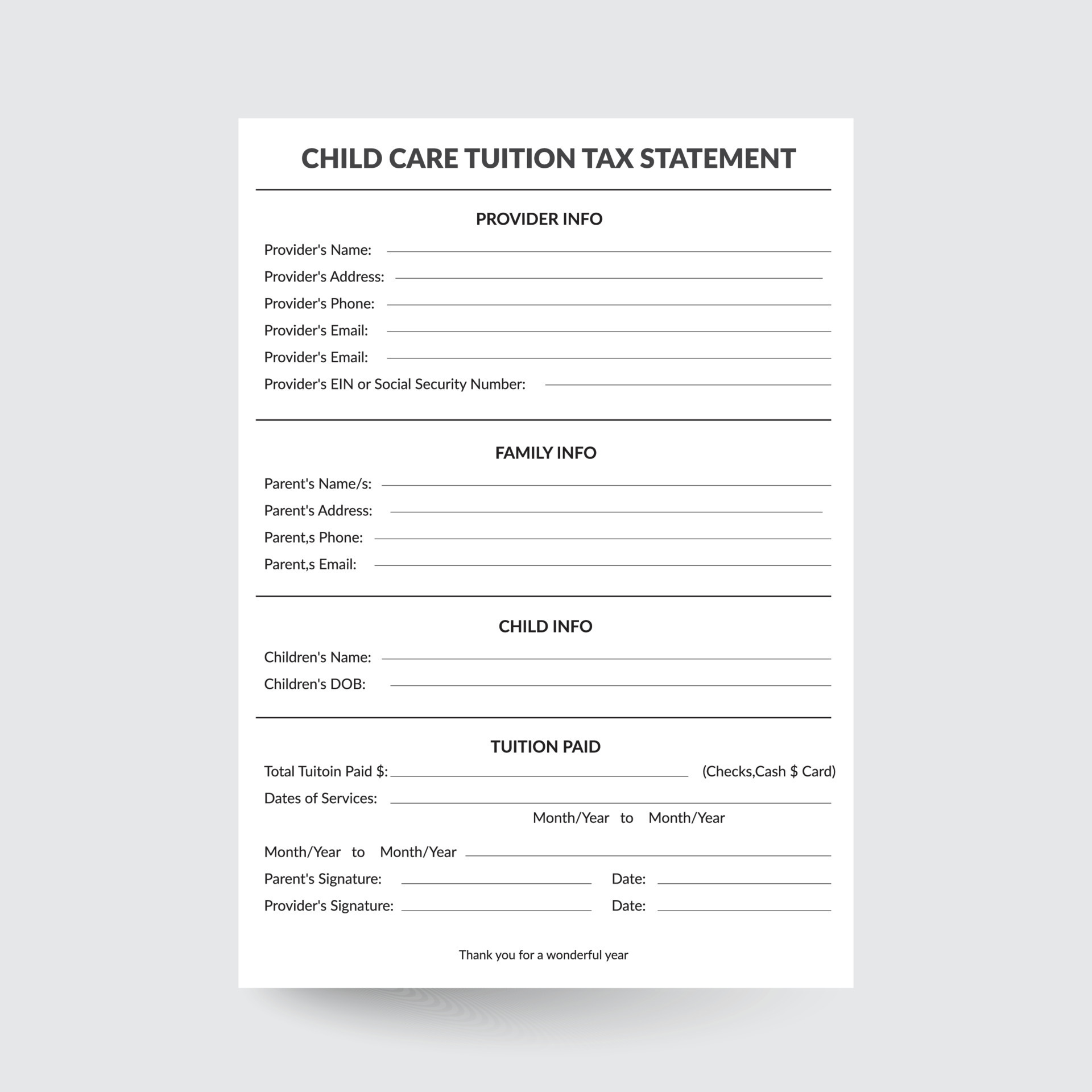

ChildCare Tax Statement Child Tax Statement Daycare Tax Form Daycare

https://static.vecteezy.com/system/resources/previews/022/464/124/original/childcare-tax-statement-child-tax-statement-daycare-tax-form-daycare-tax-childcare-form-printable-daycare-daycare-provider-daycare-payment-form-tuition-receipt-free-vector.jpg

Claim Child Tax Credit West Adams Neighborhood Council

https://i0.wp.com/westadamsnc.org/wp-content/uploads/get-ctc-blog.jpg?resize=1080%2C675&ssl=1

Web 19 Okt 2023 nbsp 0183 32 You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of Web 9 Nov 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses such as day care for a child under 13 a

Web The most effective way to avoid paying more income tax than is really necessary is to file an application on Form SS 5 with the Social Security Administration for a new SSN for Web 15 Juni 2023 nbsp 0183 32 If you don t have and are unable to obtain the child s social security number SSN you should request an adoption taxpayer identification number ATIN

ChildCare Tax Statement Daycare Tax Form Graphic By Watercolortheme

https://www.creativefabrica.com/wp-content/uploads/2023/01/25/ChildCare-Tax-StatementDaycare-Tax-Form-Graphics-58840833-2.jpg

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Web 11 Juni 2021 nbsp 0183 32 To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax

https://www.nerdwallet.com/.../taxes/qualify-…

Web Vor 3 Tagen nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or

T22 0194 Repeal Child Tax Credit CTC Earned Income Threshold And

ChildCare Tax Statement Daycare Tax Form Graphic By Watercolortheme

Child Tax Credit 2024 Income Limits What Is The Income Limits For This

Understanding The 2023 Child Care Tax Credit Types Eligibility And

Tax Statement Customize Child Care Business Daycare Parents Tuition

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Child Tax Credit State s New Child Care Tax Credit Allows Up To 6 000

Adding Dependents Without Social Security Number On VA R Veterans

How To Claim Child Tax Credit Worth 3 600 Per Child If You Missed The

How To Claim Child Care Tax Credit Without Social Security Number - Web If the care provider is a not for profit you don t need the taxpayer identification number Instead write exempt where the form asks for the number Keep a Form W 10 that the