How To Claim Federal Solar Rebate To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your renewable energy tax credit

Find more on who can claim the credit Qualified Expenses Qualified expenses include the costs of new clean energy property including Solar electric For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

How To Claim Federal Solar Rebate

How To Claim Federal Solar Rebate

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

How To Claim SkillsFuture Credit ACAD Pte Ltd

https://acad.com.sg/web/image/8343/vlcsnap-2022-07-08-14h01m22s288.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

To claim the solar tax credit you ll have to fill out IRS Form 5695 You can claim the tax credit if you receive other clean energy incentives for the same project although this might Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house

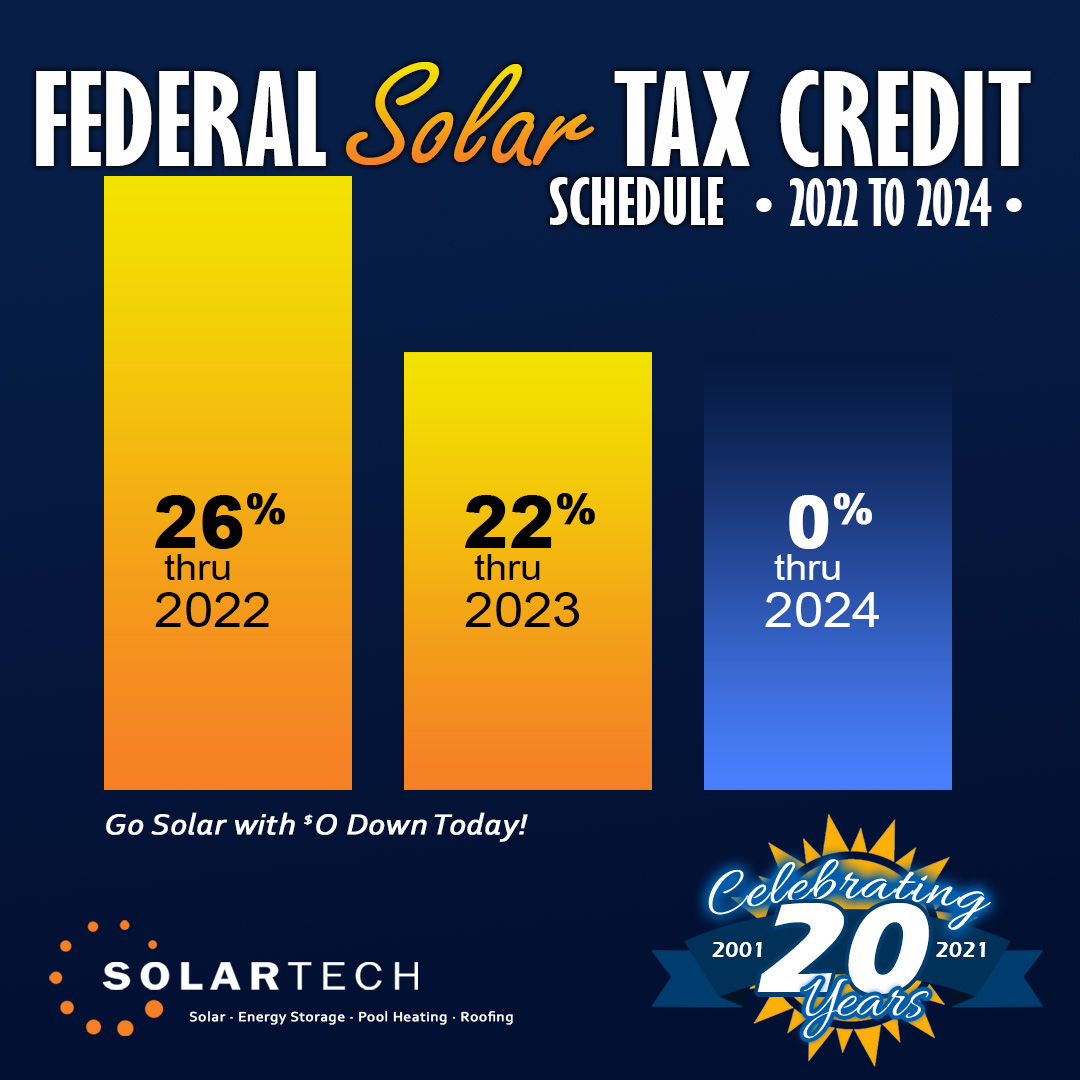

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements

Download How To Claim Federal Solar Rebate

More picture related to How To Claim Federal Solar Rebate

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Your Guide To Federal Solar Rebate And Incentive Programs PONBEE

https://ponbee.com/wp-content/uploads/federal-solar-rebate-and-incentive-programs-768x399.jpg

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have income tax liability which is what this incentive reduces We ll cover how to claim

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a

How To Apply For A Rebate On Your Solar Panels REenergizeCO

https://www.reenergizeco.com/wp-content/uploads/2021/07/applying-for-solar-panel-rebate.jpg

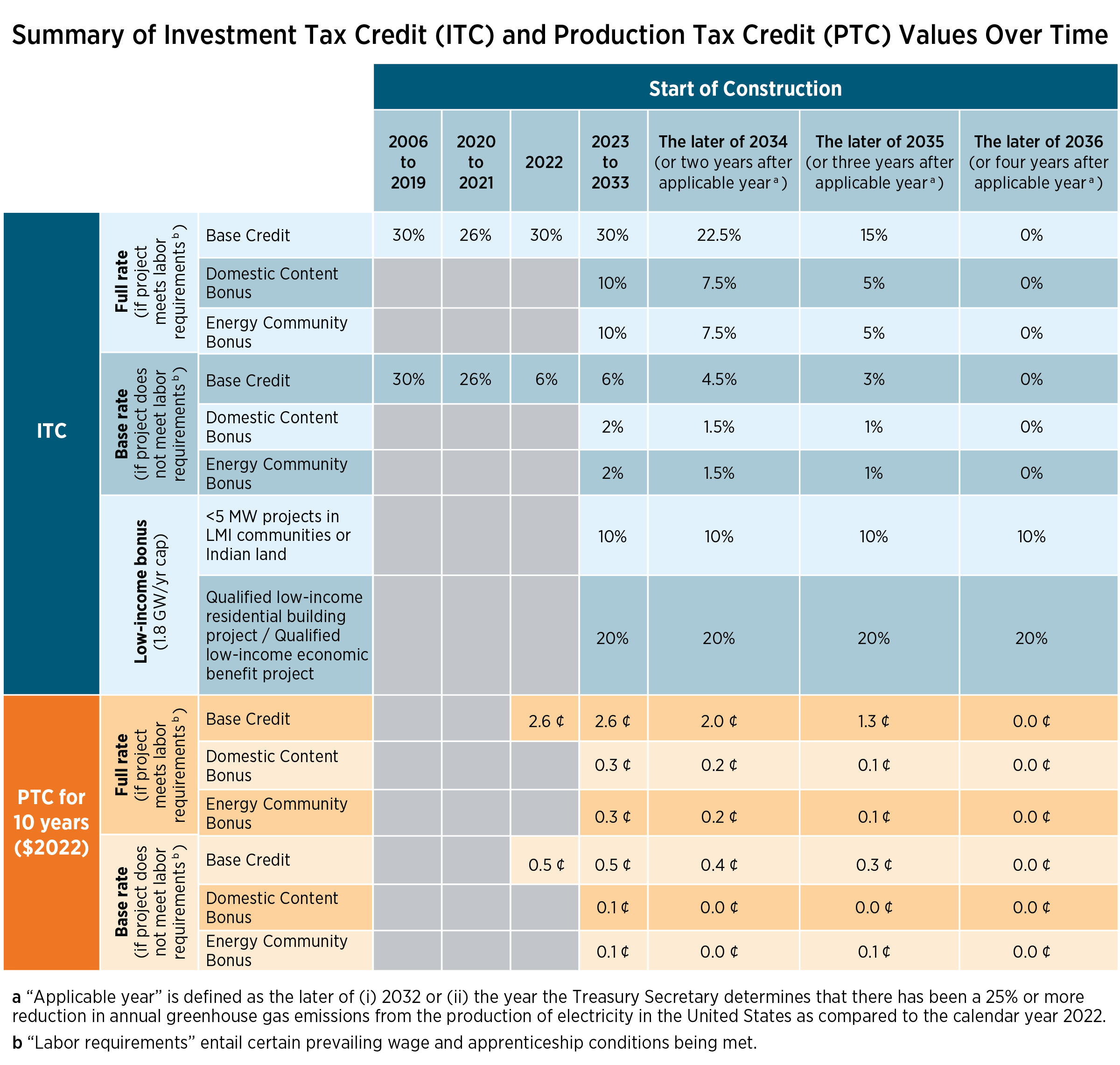

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

https://www. energysage.com /solar/how-do-i-claim...

To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your renewable energy tax credit

https://www. irs.gov /credits-deductions/residential-clean-energy-credit

Find more on who can claim the credit Qualified Expenses Qualified expenses include the costs of new clean energy property including Solar electric

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How To Apply For A Rebate On Your Solar Panels REenergizeCO

Government Solar Rebate QLD Everything You Need To Know

How To Claim The STC Solar Rebate VIC NSW QLD WA SA

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

The Federal Solar Tax Credit What You Need To Know 2022

The Federal Solar Tax Credit What You Need To Know 2022

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

How To Claim Tax Benefits On Joint Home Loans

How To Claim Overpaid Tax From HMRC For Current Tax Year CruseBurke

How To Claim Federal Solar Rebate - To claim the solar tax credit you ll have to fill out IRS Form 5695 You can claim the tax credit if you receive other clean energy incentives for the same project although this might