Sars Rebate 2023 22 February 2023 Today the Minister of Finance is announcing the National Budget for 2023 including changes in tax rates duties and levies To see the changes visit the Budget 2023 and Tax Rates webpages The highlights for this year are Granting tax relief by adjusting personal income tax brackets and rebates for the

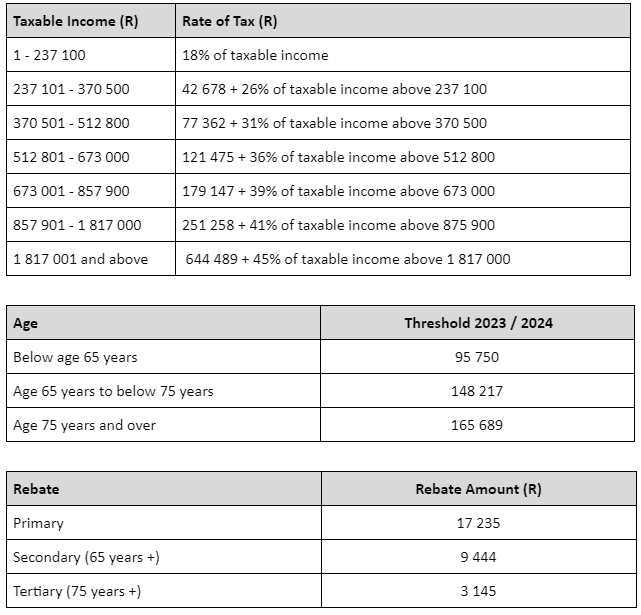

Rebates 2023 2024 2022 2023 Primary R17 235 R16 425 Secondary Persons 65 and older R9 444 R9 000 Tertiary Persons 75 and older R3 145 R2 997 Age Tax threshold Below age 65 R95 750 R91 250 Age 65 to below 75 R148 217 R141 250 Age 75 and over R165 689 R157 900 The period from 1 March 2023 to 29 February 2024 PAYE taxpayers will be able to claim the rebate on assessment during 2023 24 filing season Provisional taxpayers will be able to claim the rebate against provisional and final payments WHY ONLY SOLAR PANELS AND NOT DIESEL GENERATORS INVERTERS BATTERIES AND INSTALLATION COSTS

Sars Rebate 2023

Sars Rebate 2023

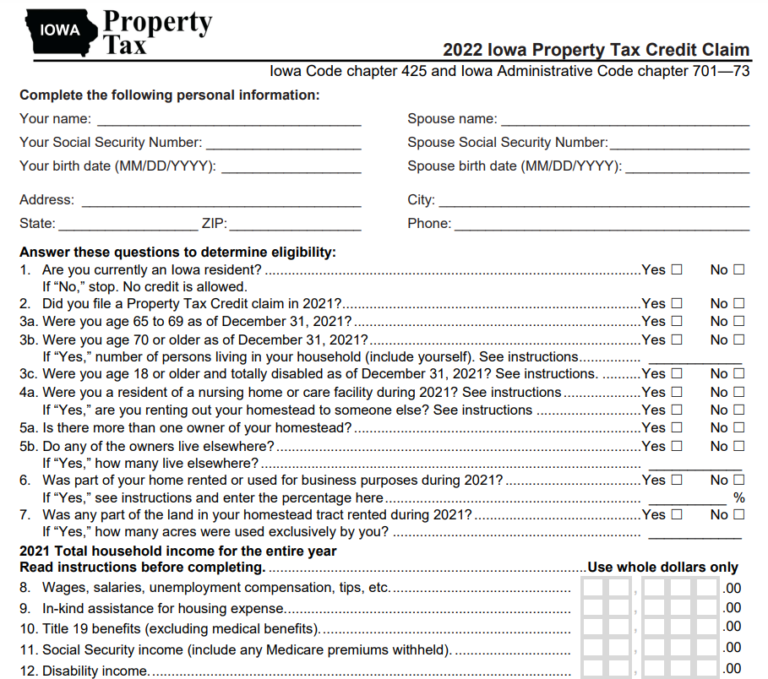

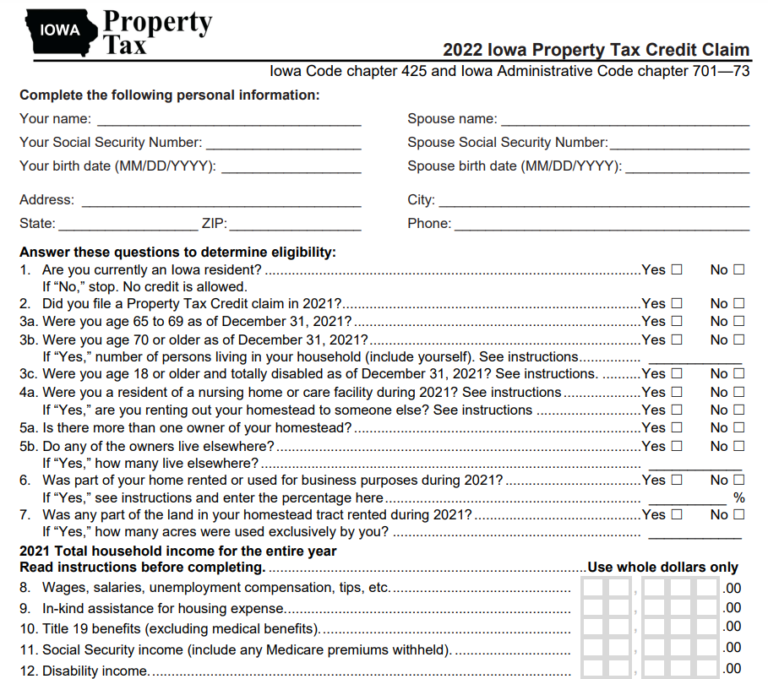

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

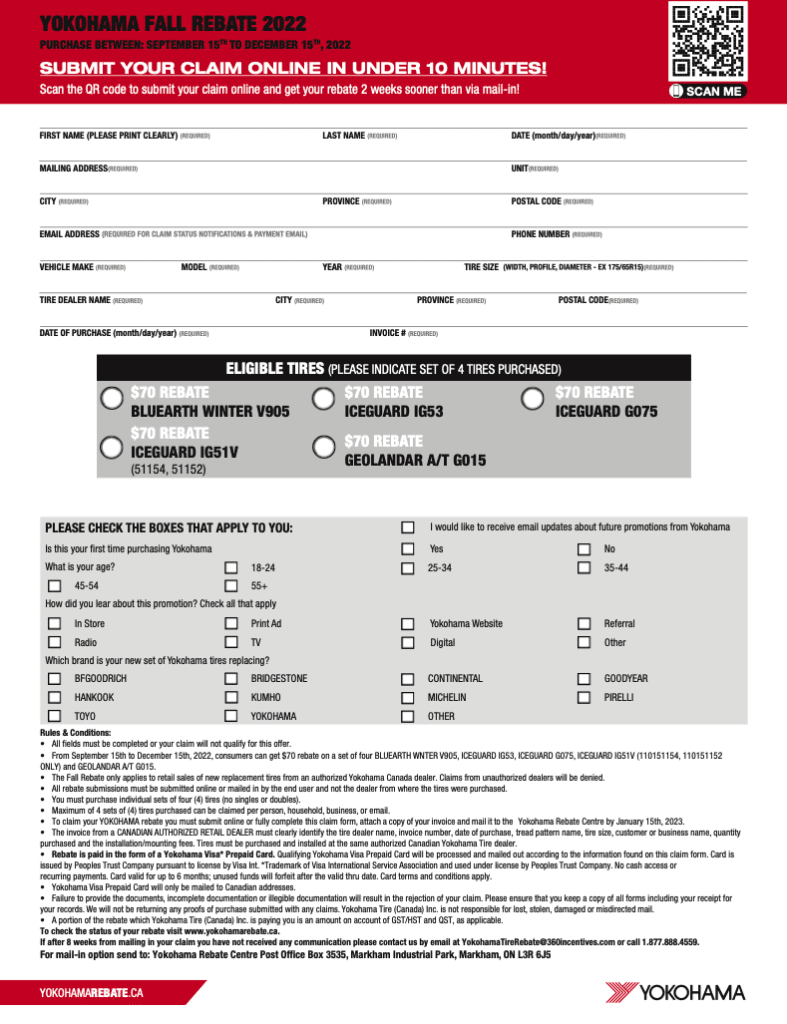

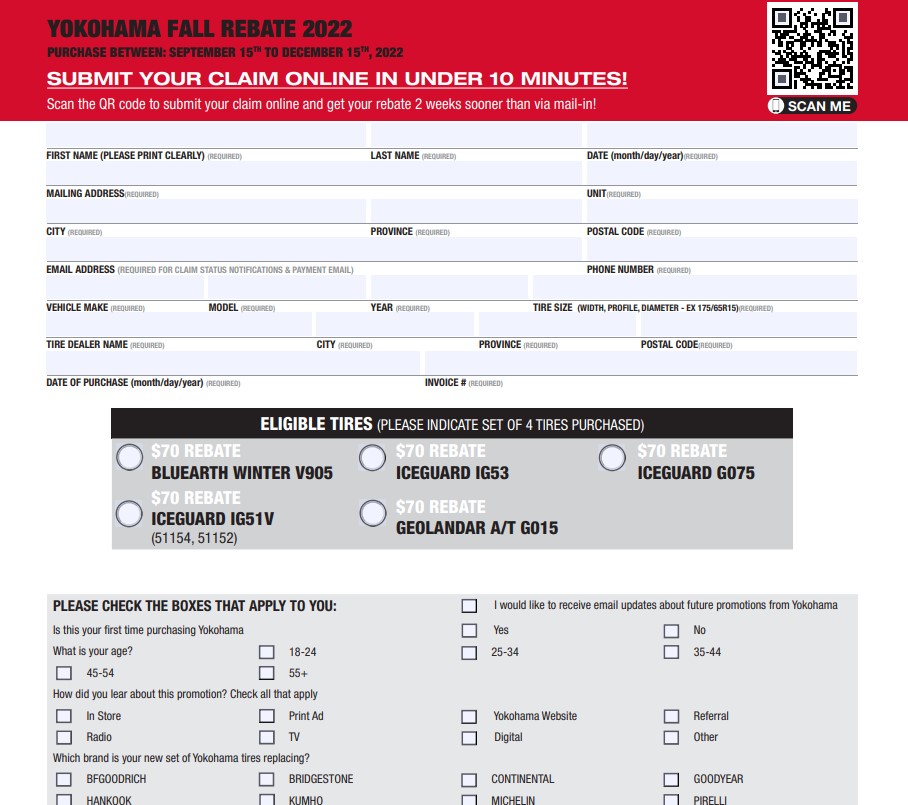

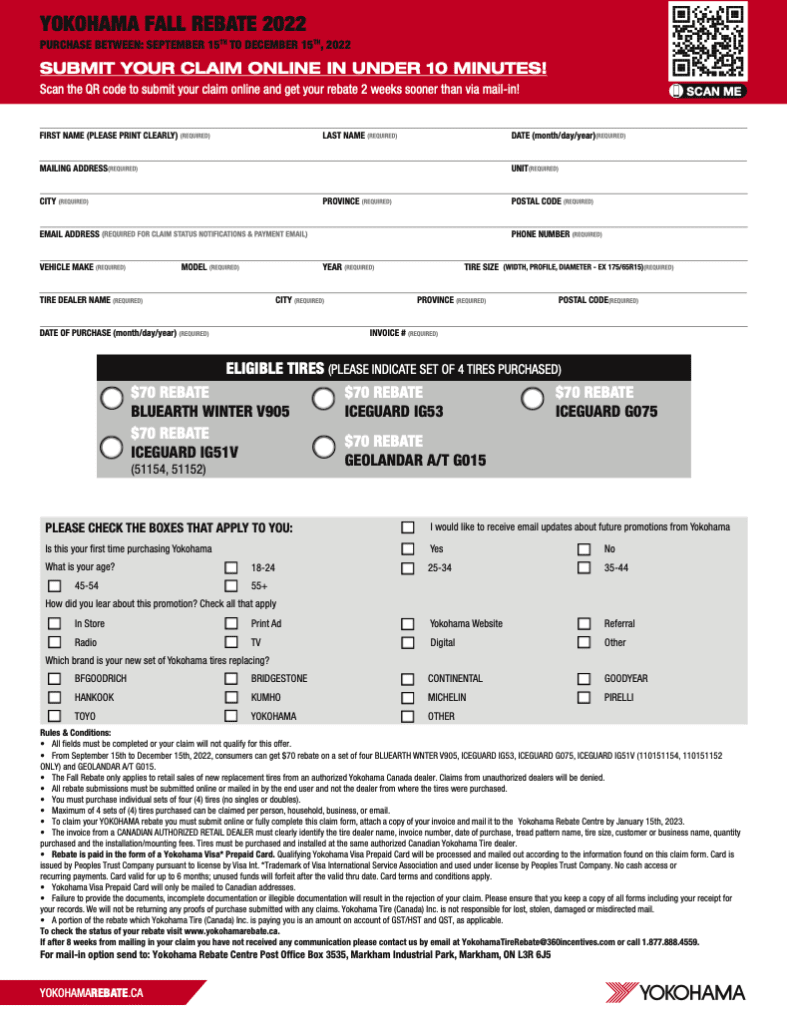

Yokohama Tire Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Yokohama-Rebate-Form-2023-787x1024.png

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Yokohama-Tire-Rebate-2023.jpg

Medical Tax Credit Rates 21 February 2024 No changes from last year Per month R 2025 2024 2023 2022 For the taxpayer or for a dependant who is a member of a medical scheme or fund where the taxpayer him or herself is not a member of a medical scheme or fund R364 What s new 3 October 2022 Invitation to webinar on Allowable Medical Expenses During this year SARS started contacting taxpayers who were selected for a verification audit due to medical expenses claimed on their 2021 income tax return

Tax rates from 1 March 2022 to 28 February 2023 Individuals and special trusts Trusts other than special trusts rate of tax 45 Rebates Primary R16 425 Secondary Persons 65 and older R9 000 Tertiary Persons 75 and older R2 997 Age Tax Threshold Below age 65 R91 250 Age 65 to below 75 R141 250 Age 75 and over R157 900 As from 1 March 2023 through to 28 February 2025 Section 12B of the Income Tax Act South Africa was amended by SARS from a one year accelerated depreciation allowance on renewable energy to include an additional 25 rebate on the cost of renewable energy assets

Download Sars Rebate 2023

More picture related to Sars Rebate 2023

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

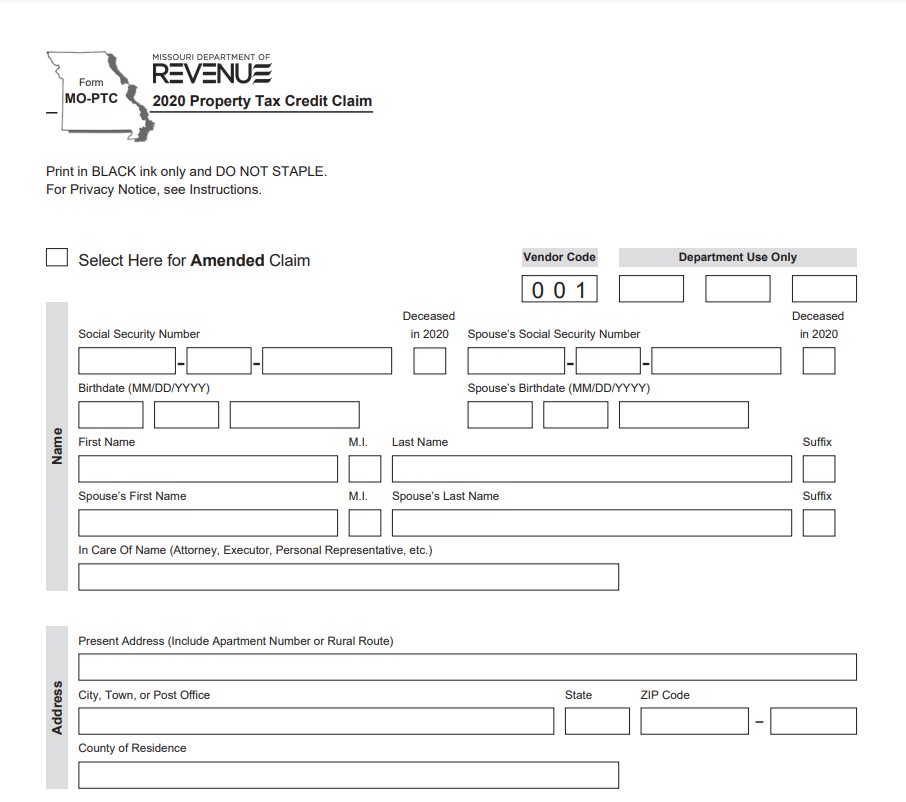

Missouri Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

01 March 2022 28 February 2023 Income Tax Tables Car Allowance Fixed Cost Income tax tables with rebates and car allowance fix cost tables for the 2023 tax year as provided by SARS The solar energy tax credit will only apply to the following solar panels New and unused solar PV panels acquired by the individual and brought into use for the first time by the individual on or after 1 March 2023 and before 1 March 2024 Solar PV panels with a minimum generation capacity of each being not less than

Yes for years 2023 2024 SARS has set the primary rebate at R17 235 The Secondary for persons 65 and over is R9 444 Meanwhile the Tertiary Persons 75 and older is at R3 145 The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2025 tax year i e the tax year commencing on 1 March 2024 and ending on 28 February 2025 the following rebates apply Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over

The Ultimate Guide To Sentinel Spectrum Rebate Code 2023 How To Save

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-sentinel-rebate-form-2022-acceptance-rate-printable-rebate-form-from-sentinel-spectrum-rebate-code-2023-post.png?w=680&h=451&ssl=1

P G Rebate 2023 Get The Best Deals On Eligible Products Save Big

https://printablerebateform.net/wp-content/uploads/2023/03/PG-Rebate-2023.png

https://www.sars.gov.za/latest-news/budget-2023...

22 February 2023 Today the Minister of Finance is announcing the National Budget for 2023 including changes in tax rates duties and levies To see the changes visit the Budget 2023 and Tax Rates webpages The highlights for this year are Granting tax relief by adjusting personal income tax brackets and rebates for the

https://www.taxconsulting.co.za/tax-guide-2023-2024

Rebates 2023 2024 2022 2023 Primary R17 235 R16 425 Secondary Persons 65 and older R9 444 R9 000 Tertiary Persons 75 and older R3 145 R2 997 Age Tax threshold Below age 65 R95 750 R91 250 Age 65 to below 75 R148 217 R141 250 Age 75 and over R165 689 R157 900

SARS Tax Rates For Individuals South African Tax Consultants

The Ultimate Guide To Sentinel Spectrum Rebate Code 2023 How To Save

Oral B Rebate 2023 Get Money Back On Your Toothbrush Purchase

Elanco Rebates Form 2023 How To Access Fill Out And Track Your

Elanco Rebates 2023 Seresto ElancoRebates

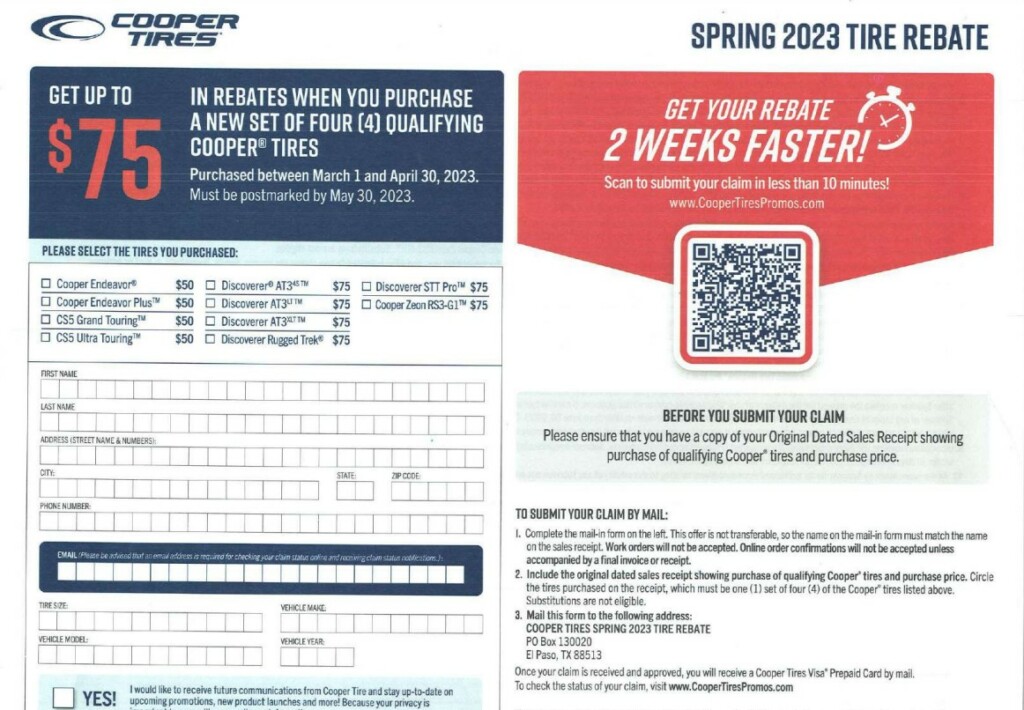

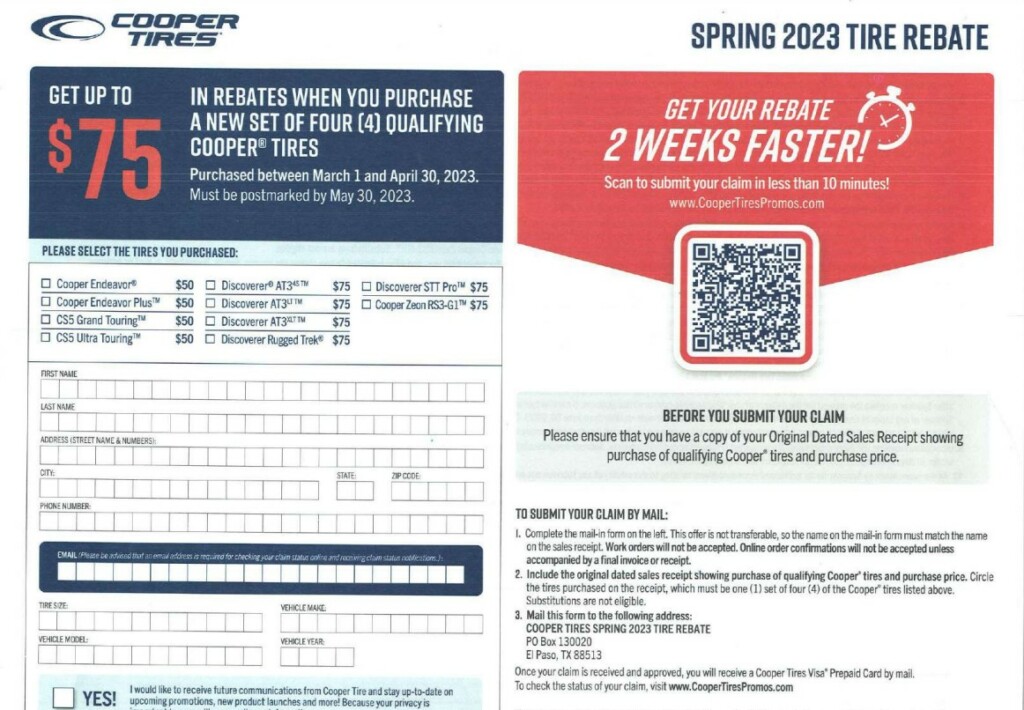

Cooper Tire Rebate 2023 Eligibility Criteria Rebate Process And

Cooper Tire Rebate 2023 Eligibility Criteria Rebate Process And

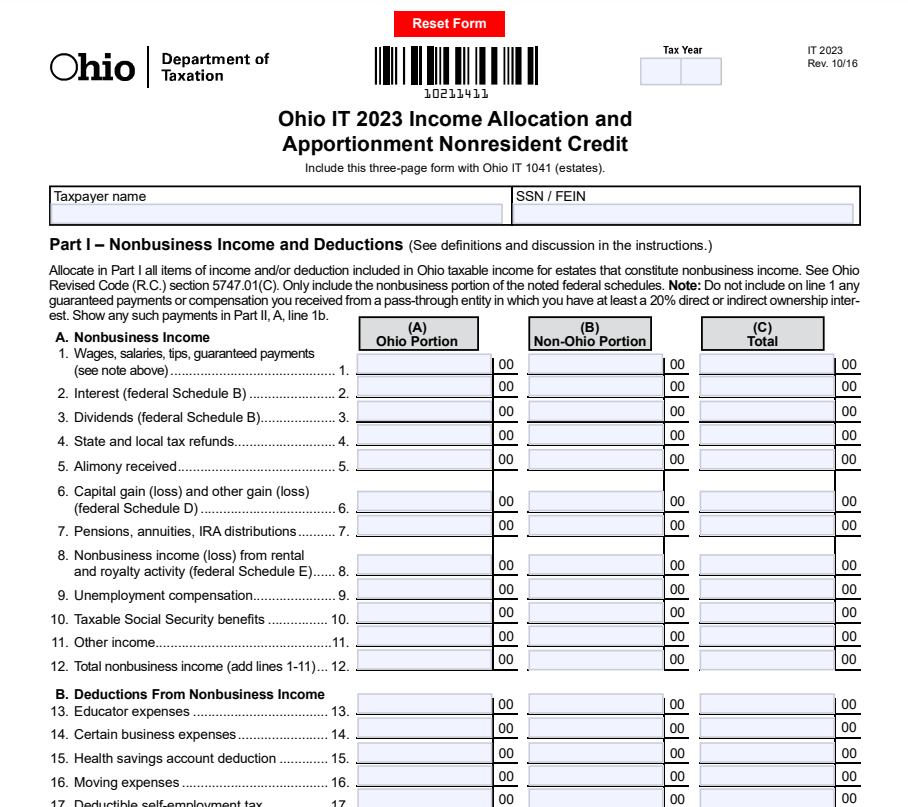

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

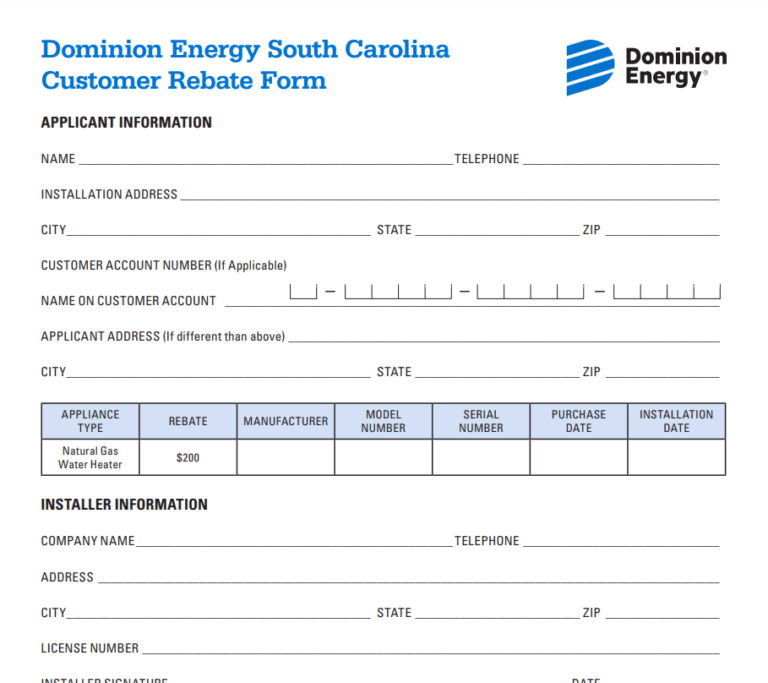

Dominion Energy Rebate Form 2023 Printable Rebate Form

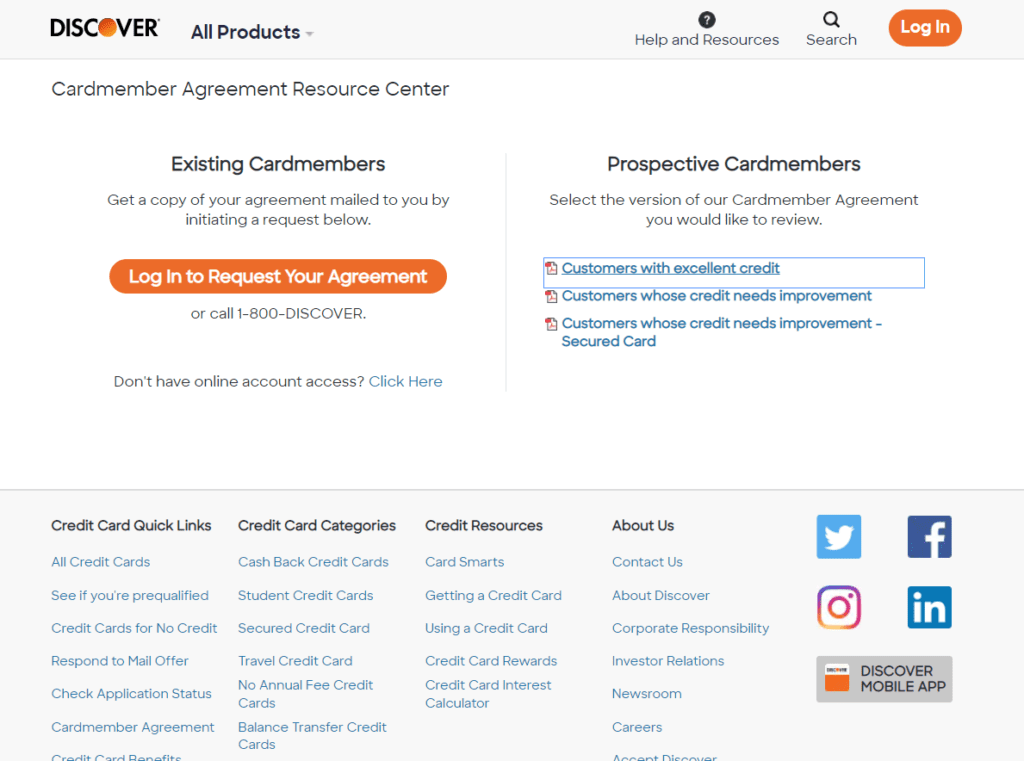

Discover Rebate 2023 Cash Back Rewards Program Printable Rebate Form

Sars Rebate 2023 - What s new 3 October 2022 Invitation to webinar on Allowable Medical Expenses During this year SARS started contacting taxpayers who were selected for a verification audit due to medical expenses claimed on their 2021 income tax return