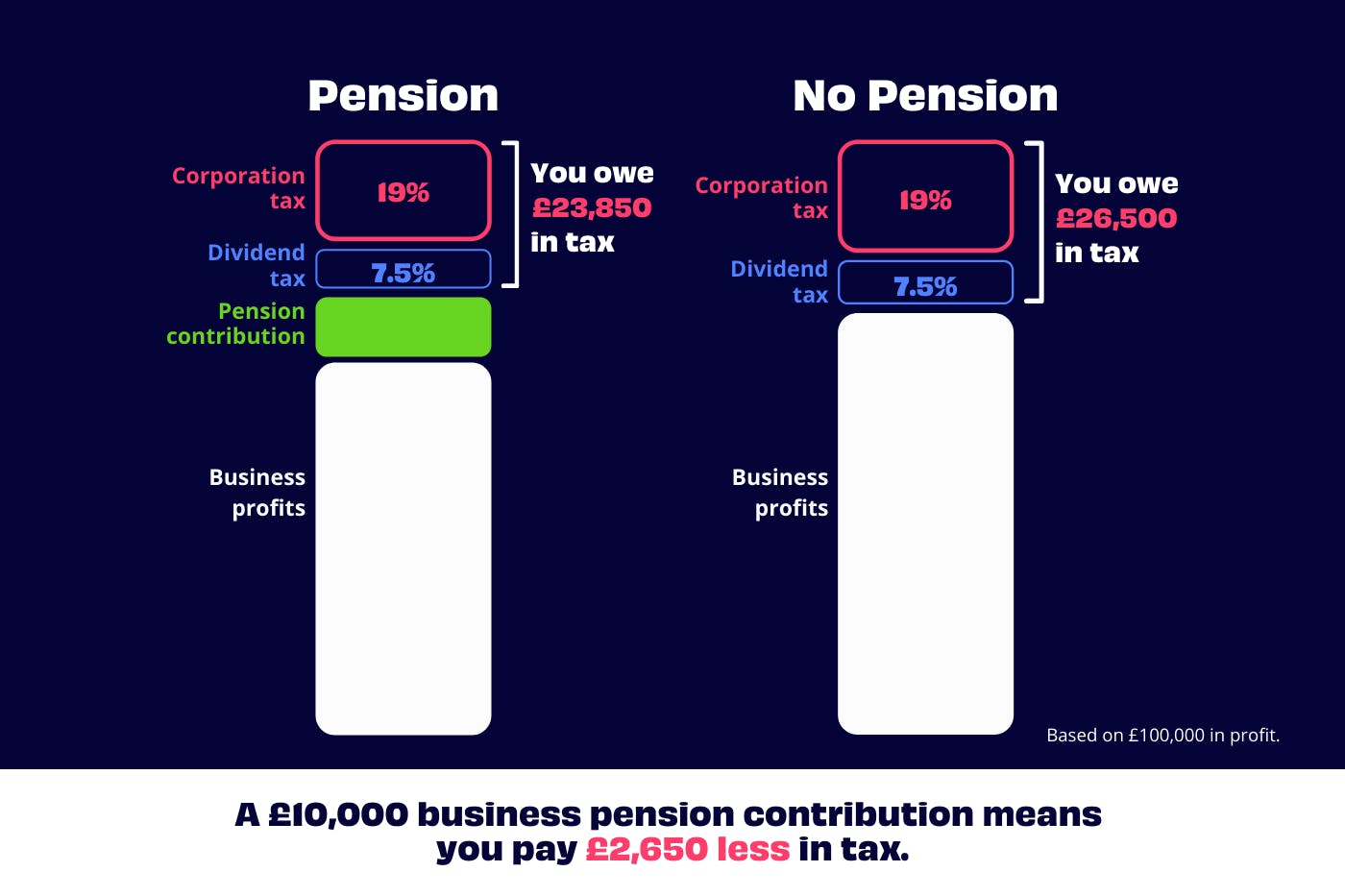

How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years You can claim an extra 20 tax relief on 10 000 the same amount you paid higher rate tax on through your Self Assessment tax return

If you ve previously missed out on claiming higher rate pension tax relief you can make backdated claims for the past four tax years A personal tax accountant can advise on this process helping you gather You can claim the tax relief on your Self Assessment tax return by stating the gross amount of your total pension contributions for the tax year i e including the 20 basic rate relief already added

How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years

How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years

https://www.corpademployeebenefits.com/wp-content/uploads/2023/03/dreamstime_xxl_99178319-1920x1280.jpg

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

10 Easy Ways To Save Income Tax Wealth And Tax Management

https://wealthandtax.co.uk/wp-content/uploads/2022/05/shutterstock_550337110-scaled.jpg

Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief If you re a higher rate taxpayer you can claim further tax relief at your higher rate from HMRC This is usually claimed through your self assessment tax return Or you can

How far back can I claim higher rate tax relief on pension contributions You can claim back tax relief from the previous four years Your claim must be made within four years of the end of the tax year you are claiming from Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme Members will get tax relief based on their residency

Download How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years

More picture related to How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased

https://storage.googleapis.com/unbiased-www-production-backend/uploads/media/news/0001/03/7ad9be186f6a08e8ae17b1ab65fcbe7eb3049b9a.jpeg

How To Claim Higher Rate Tax Relief On Pension Contributions

https://images.prismic.io/penfold/6e6a73fb-f3b3-4804-8ae8-96e6f7f2d8c5_filing-taxes.jpg?auto=compress,format&rect=0,232,4460,2509&w=1536&h=864

Pension Contributions How To Claim Higher Rate Tax Relief

https://rd-prod.twic.pics/2024-02-16/hQq9lR1reQa51oAgU44v0jdmsMlbT9KAY0lOulAg.jpg?twic=v1/resize=1280/quality=73/focus=auto

You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes How do I claim higher rate pension tax relief Under PAYE there is a timescale of four tax years to claim or you will miss out To claim for previous tax years you ll have to make a direct claim to HMRC This has to be done in writing with supporting evidence for each tax year and posted to PAYE and Self Assessment HMRC BX9 1AS

Higher rate taxpayers can claim an extra 20 tax relief on earnings they pay 40 tax on totalling up to 40 in pension tax relief This means 10 000 of pension contributions could cost as little as 6 000 How to claim higher rate tax relief on pension contributions If you are a higher rate taxpayer you can claim back a further 20 of your payments but it s

How To Claim Higher Rate Tax Relief On Pension Contributions

https://images.prismic.io/penfold/b814df70-55e3-4dbe-ba29-7e5e1b617b34_Claim+higher+rate+tax+relief+-+Penfold+Pension+Blog.png?auto=compress,format&rect=462,0,4075,2292&w=1536&h=864

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

You can claim an extra 20 tax relief on 10 000 the same amount you paid higher rate tax on through your Self Assessment tax return

https://www.mytaxaccountant.co.uk/post…

If you ve previously missed out on claiming higher rate pension tax relief you can make backdated claims for the past four tax years A personal tax accountant can advise on this process helping you gather

Self Employed Pension Tax Relief Explained Penfold Pension

How To Claim Higher Rate Tax Relief On Pension Contributions

How To Claim Higher Rate Tax Relief On Pension Contributions 2024

How To Claim Pension Higher Rate Tax Relief

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

What Is Pension Tax Relief Moneybox Save And Invest

What Is Pension Tax Relief Moneybox Save And Invest

Self Employed Pension Tax Relief Explained Penfold Pension

Personal Taxation HA

Do You Know How Tax Relief On Your Pension Contributions Works 2023

How To Claim Higher Rate Tax Relief On Pension Contributions For Previous Years - Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief