How To Claim Sars Refund Online This online platform allows you to submit your tax returns claim refunds and communicate with SARS electronically Log In and Access Your Return Log in to your eFiling account and navigate to the Returns section Access the relevant tax

You must request an eSTT refund by completing Part A of the REV16 form by emailing it to the following email address lbqueries sars gov za The following documents must be sent together with the signed REV16 To claim a refund from the South African Revenue Service SARS you can follow these general steps Gather supporting documents Collect all relevant documentation related to your tax return such as your income tax certificate IRP5 IT3 a certificate and any other supporting documents like medical expenses retirement annuity contributions

How To Claim Sars Refund Online

How To Claim Sars Refund Online

https://www.signnow.com/preview/100/822/100822082/large.png

BOOK GIVEAWAY How To Get A SARS Refund

https://lh3.googleusercontent.com/keFITsTcseB5JGtisNFsX4KL3j5Fi6BUBB3v15FUpmRnKD8raU1jzm9iG25C6jBDNU5FB_f6DWbNz_cBFnc8POqucjVsfug-FO8=s1000

How To Claim SkillsFuture Credit ACAD Pte Ltd

https://acad.com.sg/web/image/8343/vlcsnap-2022-07-08-14h01m22s288.png

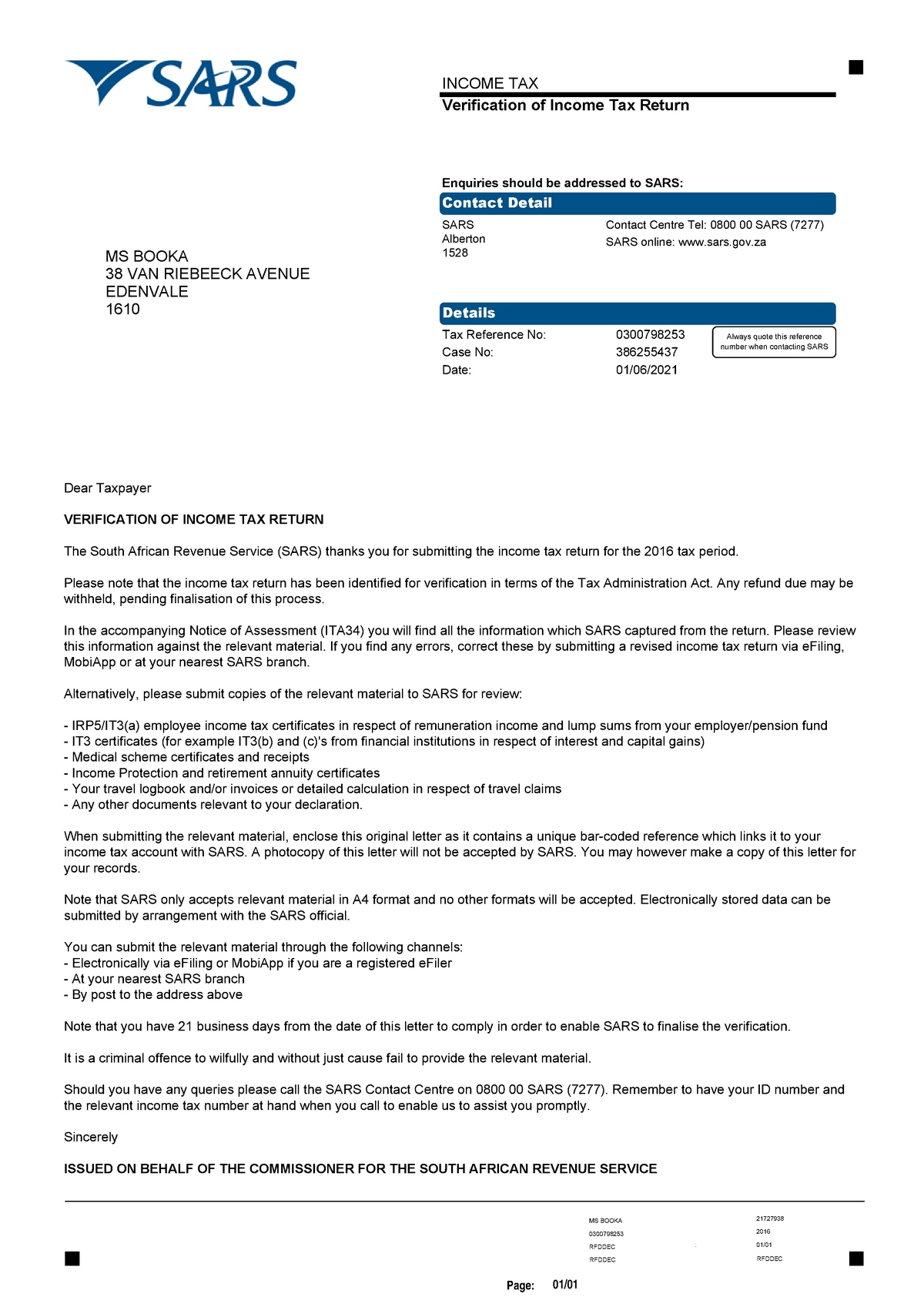

To claim a tax refund from the South African Revenue Service SARS you need to follow a specific process Keep in mind that the process might change so it s recommended to visit the official SARS website or contact them directly for the most up to date information Wait for SARS to say yes to your refund which can take 21 days or less depending on your tax and your info You can see how your refund goes online with eFiling or by calling SARS at 0800 00 7277 Receive the repayment which enters your bank or comes as a cheque if you lack a bank account

Every year South Africans deal with tax season and a way for you to claim tax back from the South African Revenue Services SARS is to do the following You can claim your tax back by either eFiling which is the quickest and easiest way to submit your return To begin visit www sarsefiling co za the SARS eFiling website and click SARS Correspondence from the side menu Your refund status and the expected payment date will be displayed in your Statement of Account ITSA

Download How To Claim Sars Refund Online

More picture related to How To Claim Sars Refund Online

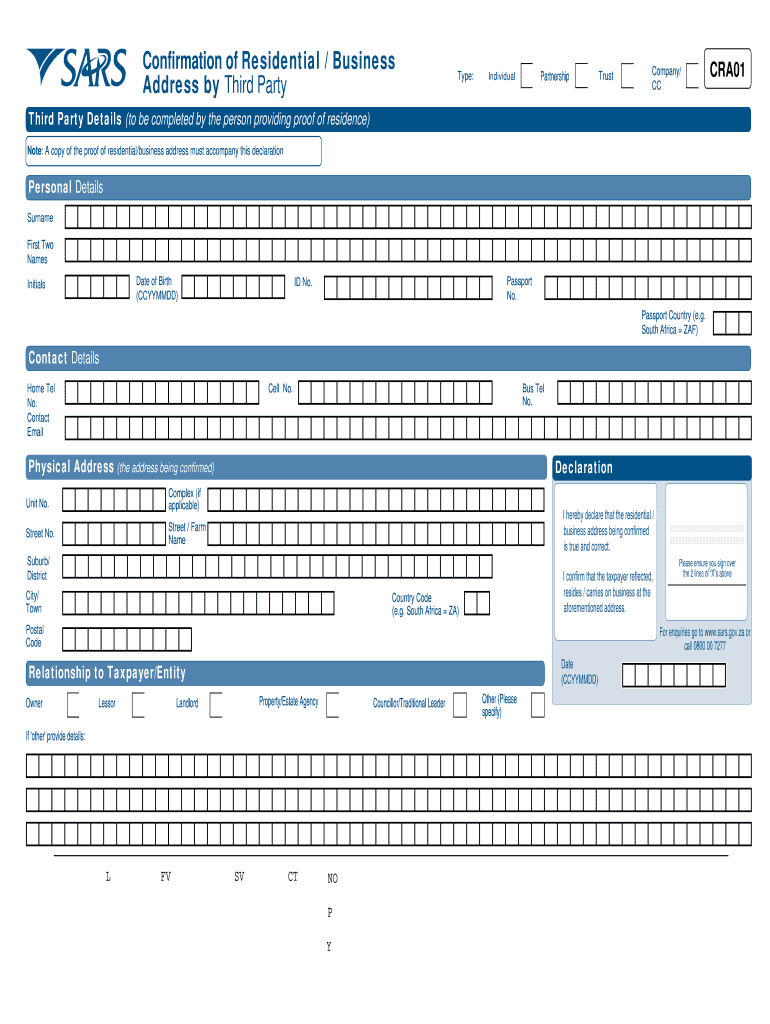

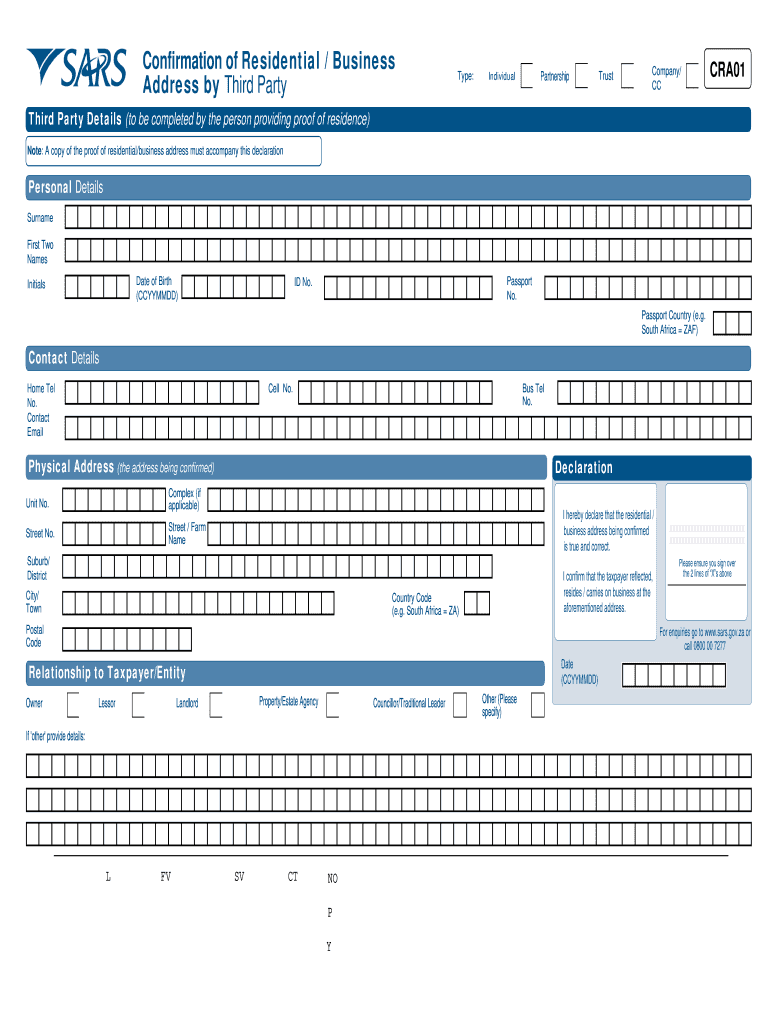

South African Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/528/240/528240189/large.png

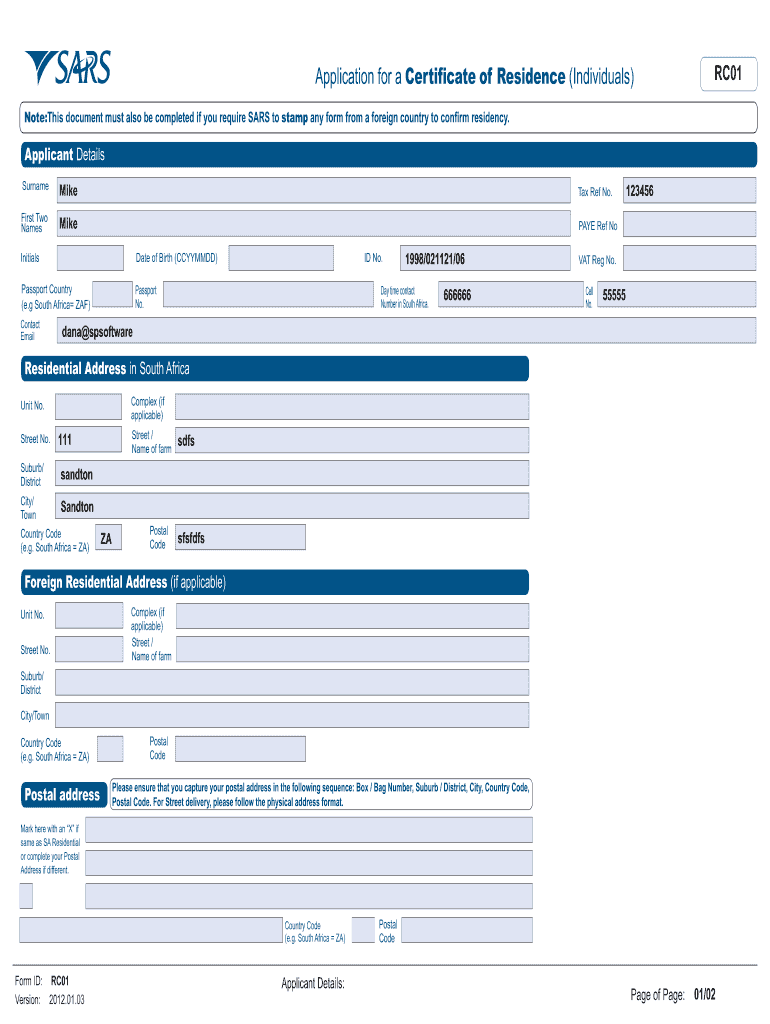

How To Get A Tax Refund From Sars

http://cdn.primedia.co.za/primedia-broadcasting/image/upload/v1531149522/mxtnczfdihgymiywidal.jpg

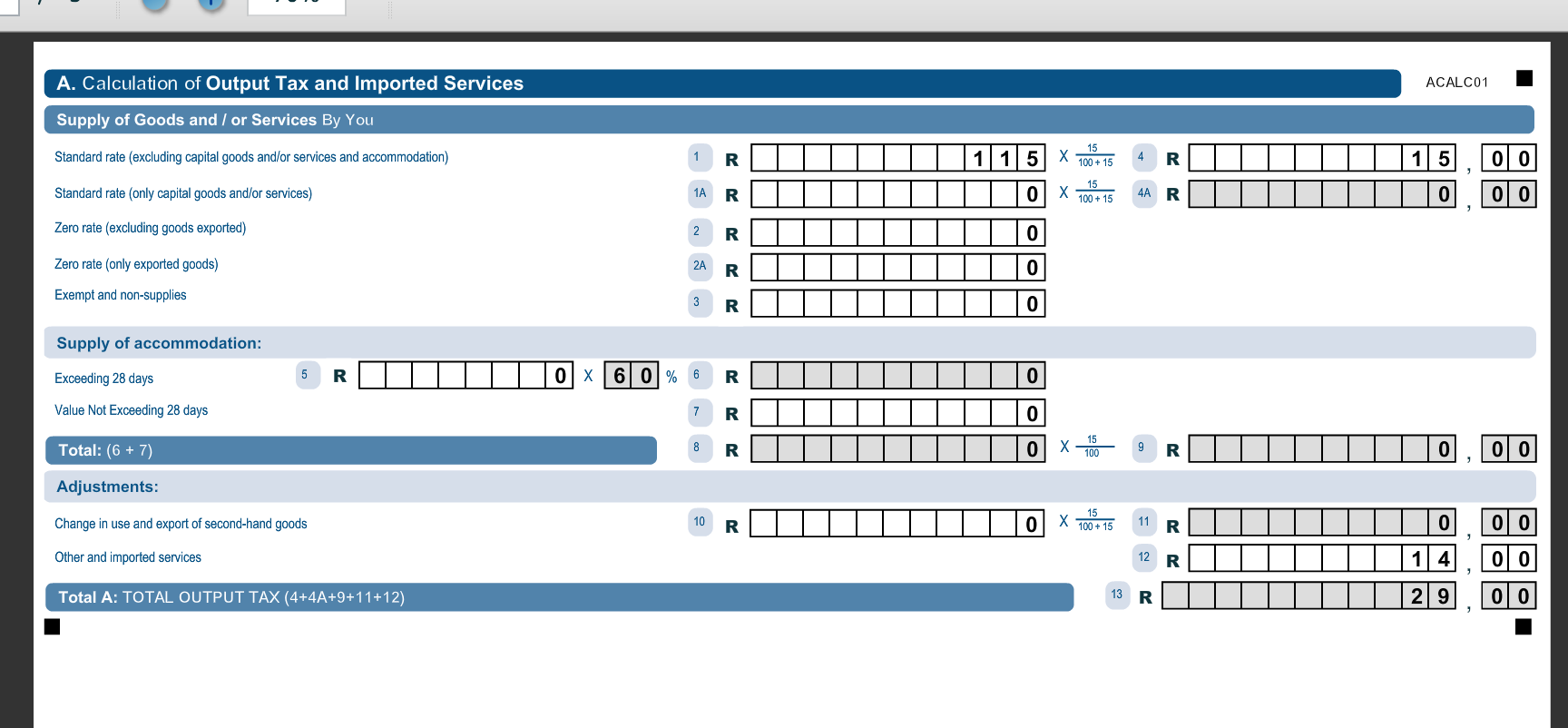

Sars Vat 201 Form Download Greekcaqwe

http://greekcaqwe.weebly.com/uploads/1/3/3/6/133620189/191015509_orig.png

To claim a tax refund from the South African Revenue Service SARS you need to follow a specific process Keep in mind that the process might change so it s recommended to visit the official SARS website or contact them directly for the most up to date information How to claim a tax refund from SARS Before you make your refund application to the SARS it is good to have a rough estimate of what you should expect There are several refund calculators that can help you with that The best way to go about claiming a refund is through consulting a tax professional

[desc-10] [desc-11]

Latest Updates On IRS Where s My Refund Check Status 2022 EEFRI

https://eefri.org/wp-content/uploads/2022/11/IRS-wheres-My-Refund-2048x1015.png

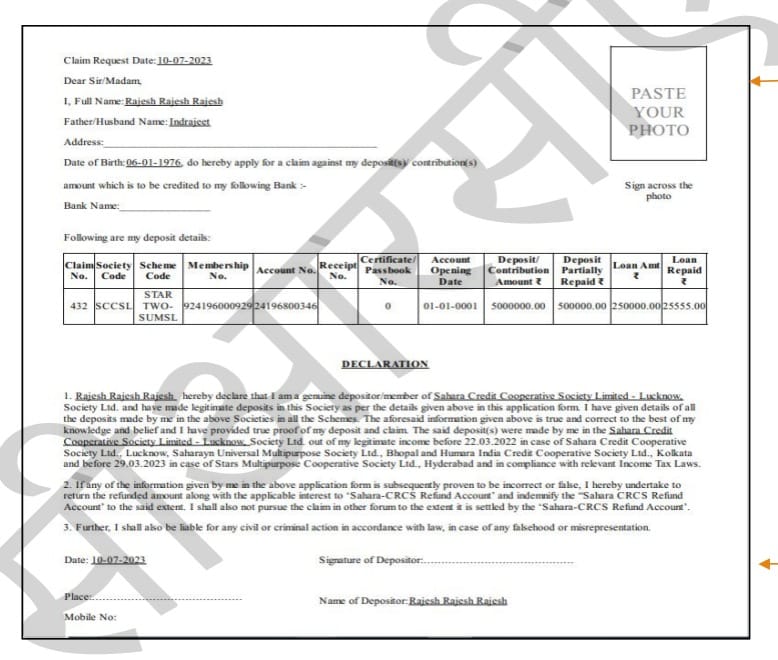

Sahara Refund Portal Claim Form

https://www.workervoice.in/wp-content/uploads/2023/07/sahara-refund-portal-claim-form-declaration.jpeg

https://ufilingguide.co.za › how-do-i-claim-tax-back-from-sars

This online platform allows you to submit your tax returns claim refunds and communicate with SARS electronically Log In and Access Your Return Log in to your eFiling account and navigate to the Returns section Access the relevant tax

https://www.sars.gov.za › ... › request-a-refund

You must request an eSTT refund by completing Part A of the REV16 form by emailing it to the following email address lbqueries sars gov za The following documents must be sent together with the signed REV16

Get Letter 1 Get Get Get Get Page 01 MS BOOKA 0300798253 RFDDEC

Latest Updates On IRS Where s My Refund Check Status 2022 EEFRI

Sars Efiling Registration For Company Dear cousin

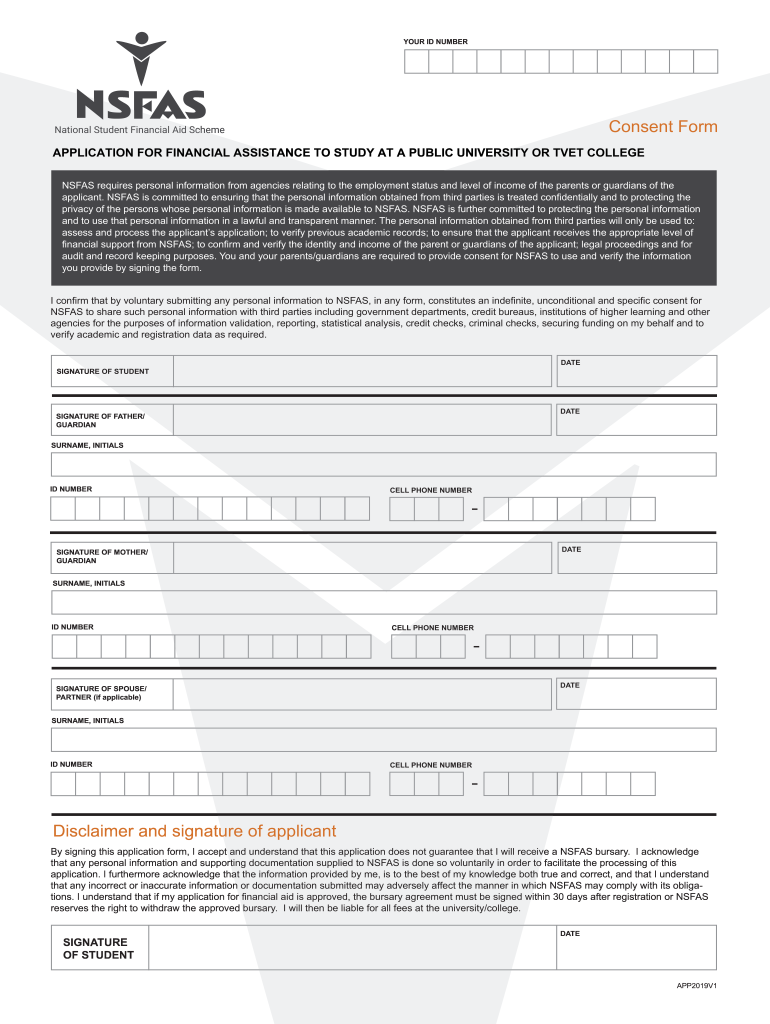

Nsfas Consent Form Complete With Ease SignNow

How To Get A SARS Refund For Small Businesses eBook Business

FAQ Can I See My Refund Amount And Payment Date Or The Payment Due

FAQ Can I See My Refund Amount And Payment Date Or The Payment Due

HOW TO DO YOUR SARS E FILLING STEP BY STEP GUIDE ONLINE E FILLING

How To Use SARS EFiling To File Income Tax Returns TaxTim SA

47 Refund Sample Letter Requesting Deposit Payment Lodi Letter Gambaran

How To Claim Sars Refund Online - [desc-13]