How To Claim Tax Credit For Mortgage Interest Uk Mortgage interest tax relief in 2024 25 an example Assuming a landlord takes in 950 per month rental income and makes mortgage interest payments of 600 per month They ll pay tax on the

Yes you can claim tax relief on mortgage interest However the changes over the past few years mean that you will be taxed on all your rental income and then be able to claim a limited amount of tax credit They ll still pay 7 200 in mortgage interest They ll get a tax credit of 1 440 7 200 x 20 A basic rate taxpayer will pay 840 no increase A higher rate taxpayer will pay

How To Claim Tax Credit For Mortgage Interest Uk

How To Claim Tax Credit For Mortgage Interest Uk

https://image.isu.pub/220927133100-1b8703482174ad97c1c03877a3b01982/jpg/page_1.jpg

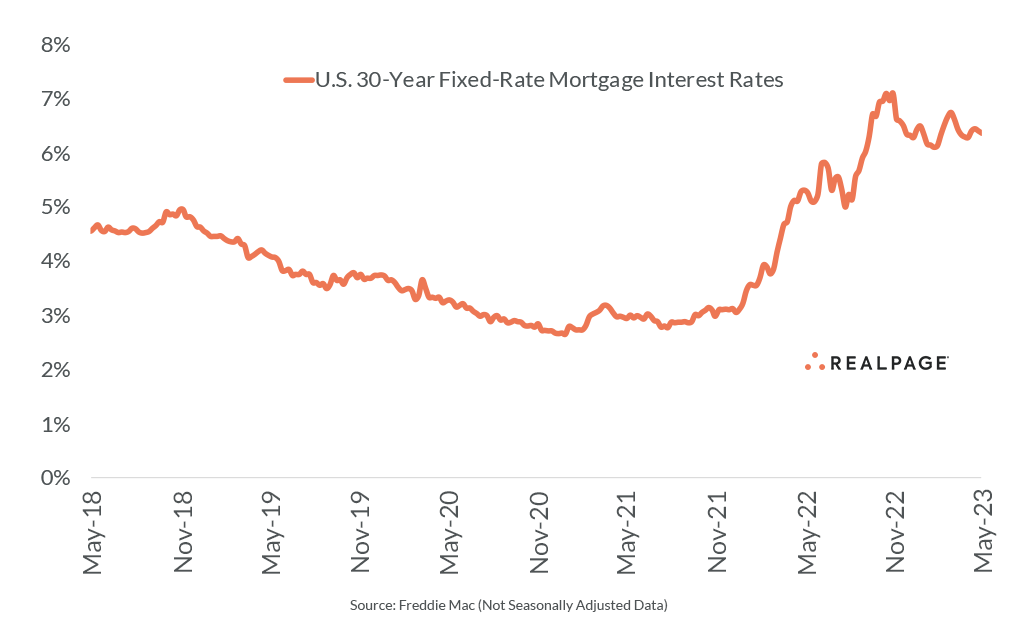

Mortgage Rates History Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/06/Mortgage_rates_history.jpg

How To Claim The Solar Tax Credit YouTube

https://i.ytimg.com/vi/FdpzrQVkn2M/maxresdefault.jpg

Is your total income without allowable expenses and mortgage interest above 50 270 pushing you into the higher tax band Will you invest a significant A higher rate taxpayer landlord with mortgage interest payments of 400 a month on a property rented out for 1 000 a month now pays tax on the full 1 000 but

A mortgage interest tax deduction in the UK was announced in 2021 meaning that you can earn a credit to your account based on what your mortgage may be Currently that tax break for buy 1 Remember to deduct your expenses As the video explains above HMRC allows you to deduct legitimate expenses from your taxable income A range of which can be taken from your tax bill so

Download How To Claim Tax Credit For Mortgage Interest Uk

More picture related to How To Claim Tax Credit For Mortgage Interest Uk

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

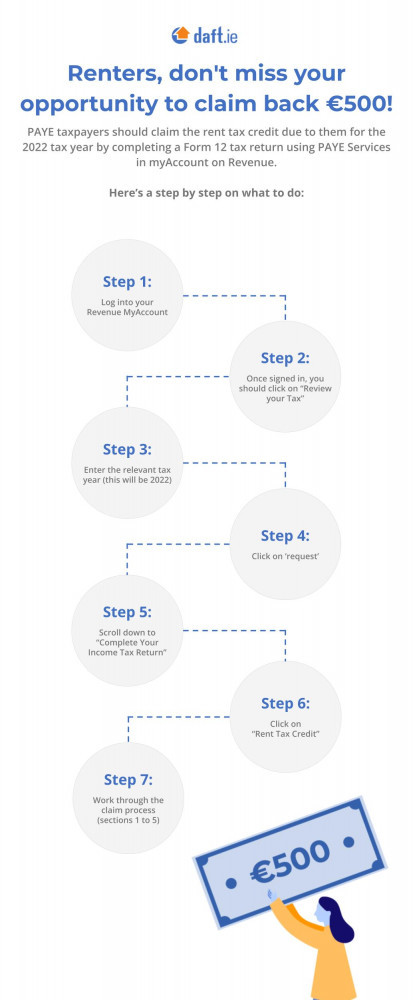

Learn How To Claim The New Rental Tax Credit With This Handy Guide From

https://img2.thejournal.ie/inline/5982430/original/?width=413&version=5982430

Mortgage Rates Payments By Decade INFOGRAPHIC Blog WestMark

https://www.westmarkrealtors.com/blog/wp-content/uploads/sites/152/2020/08/Mortgage-Rates-Payments-by-Decade-INFOGRAPHIC.jpg

FROM APRIL 6th 2020 MORTGAGE INTEREST IS FULLY DISALLOWED AND REPLACED WITH A MAXIMUM OF A 20 TAX CREDIT In summary Residential buy to let Landlords are no Tax credits which came into full effect from April 2020 mean that landlords can no longer deduct any of their mortgage interest from their rental income when calculating their taxable profit Instead

GOV UK GOV UK HMRC Community British citizen stateless from a tax residency status David McNay David McNay Sat 25 May 2024 07 26 35 GMT 2 Can I claim mortgage interest as a deduction on my rental property accounts TaxAssist Accountants Questions and Answers Can I claim mortgage

Mortgage Interest Tax Deduction What Is It How Is It Used

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Authorization Letter To Claim Documents PDF

https://imgv2-1-f.scribdassets.com/img/document/493727451/original/a5c7a51e20/1659172064?v=1

https://www. which.co.uk /money/tax/income-tax/t…

Mortgage interest tax relief in 2024 25 an example Assuming a landlord takes in 950 per month rental income and makes mortgage interest payments of 600 per month They ll pay tax on the

https://www. income-tax.co.uk /mortgage-inte…

Yes you can claim tax relief on mortgage interest However the changes over the past few years mean that you will be taxed on all your rental income and then be able to claim a limited amount of tax credit

Authorization Letter Tax Map PDF

Mortgage Interest Tax Deduction What Is It How Is It Used

Interest Rates Fall To A Four Week Low RealPage Analytics Blog

How To Claim Tax Benefits On More Than One Home Loan

Rental Expenses Guide

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Arizonans Who Want To Claim Charitable Donations Tax Credit For 2019

Chapter 13 Bankruptcy Mississippi Consumer Help Blog

3 Ways To Claim Tax Back WikiHow

How To Claim Tax Credit For Mortgage Interest Uk - Basically since April 6 2020 the mortgage interest is not claimed as an expense at all and instead a 20 tax credit is applied 20 on the mortgage interest