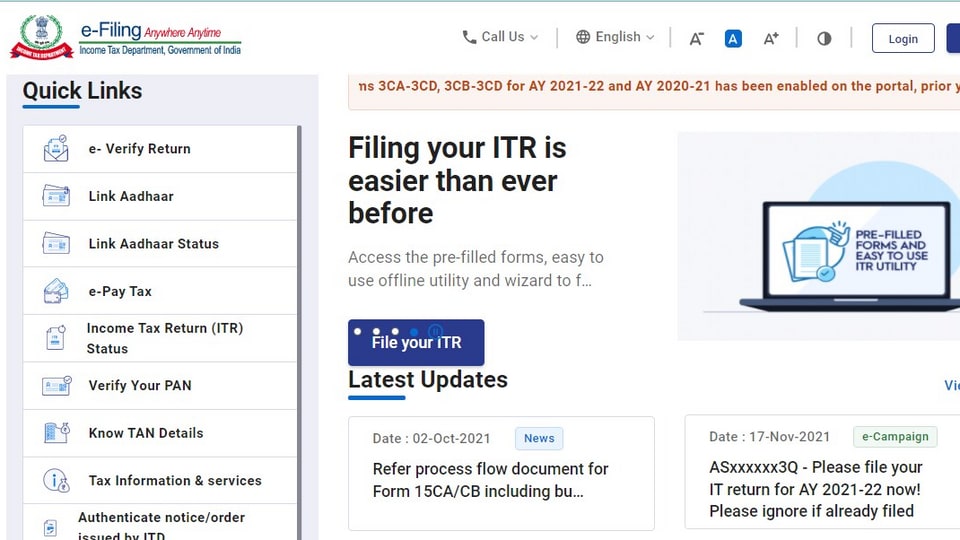

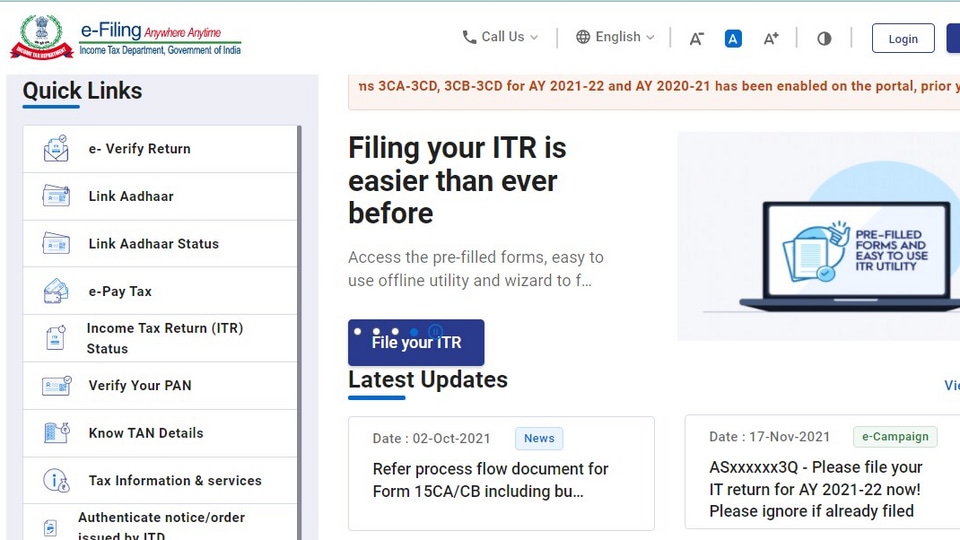

How To File Income Tax Return For Central Government Employees Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your

All the necessary ITR concepts including deductions are explained in very easy language for salaried persons New Income Tax Portal Link https www incometax gov in Contact for Paid Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number

How To File Income Tax Return For Central Government Employees

How To File Income Tax Return For Central Government Employees

https://images.hindustantimes.com/tech/img/2022/07/15/960x540/itr_1638249050262_1657879361820_1657879361820.PNG

Income Tax Return How To File Online For Income Tax Return Know Step

https://resize.indiatv.in/resize/newbucket/715_-/2022/12/6-dec-image-9-1670333556.jpg

How To File Income Tax Return Online For Salaried Employees 2022 2023

https://www.businessinsider.in/photo/93055356/how-to-file-income-tax-return-online-for-salaried-employees-2022-2023.jpg?imgsize=88484

Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number This ITR filing guidelines for salaried employees aim to simplify the complex process of online tax filing specifically for salaried employees We ll walk you

ITR 1 can be filed by a Resident Individual whose Total income does not exceed 50 lakh during the FY Income is from salary one house property family pension income Tax information for employees Learn specific tax situations that may apply to employees Get general information about how to file and pay taxes including many

Download How To File Income Tax Return For Central Government Employees

More picture related to How To File Income Tax Return For Central Government Employees

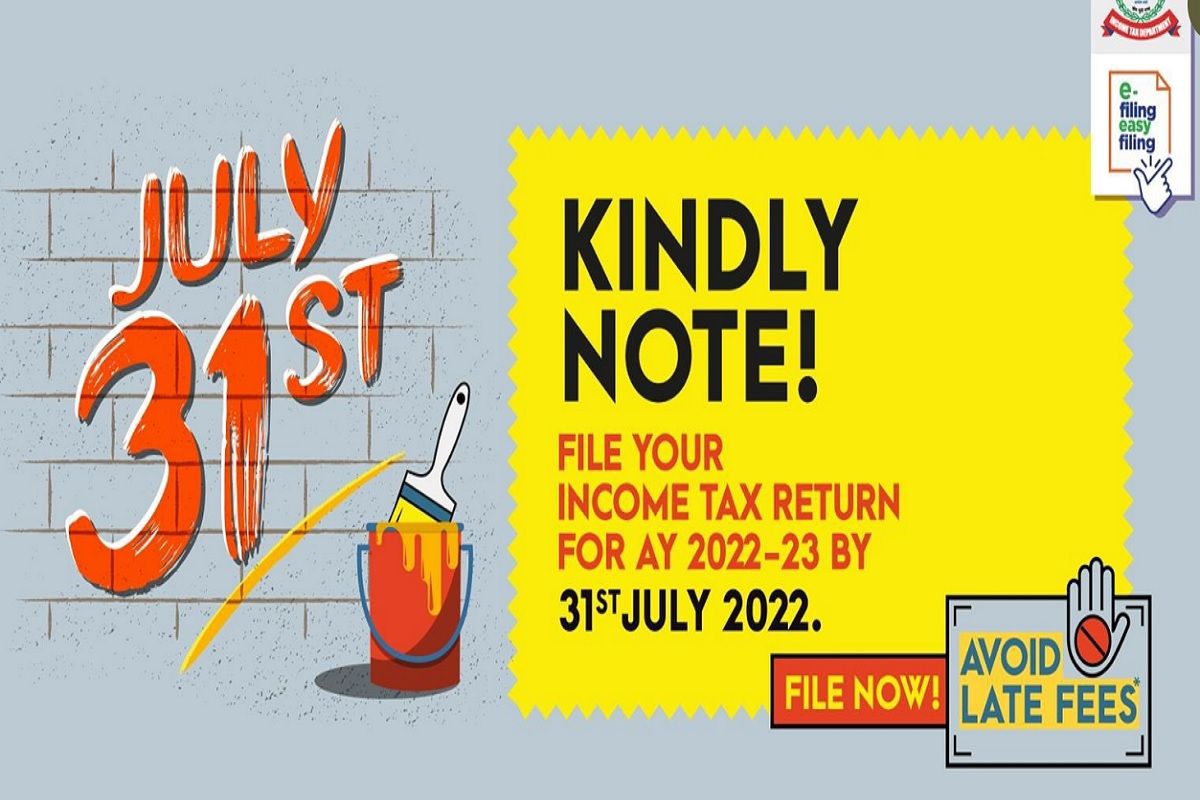

ITR How To File Income Tax Return In Just 30 Minutes

https://static.india.com/wp-content/uploads/2022/07/ITR-1.jpg

A Complete Guide On How To File Income Tax Return Online For Salaried

https://investorgyan.in/wp-content/uploads/2022/12/ITR-for-employees-1024x512.jpg

File Income Tax Return How To E File Your Income Tax Return Online

https://www.jagranimages.com/images/newimg/04072020/04_07_2020-income_tax_20472981.jpg

Upload your Form 16 to E File ITR Learn about Income Tax for salaried employees Tax slabs how much tax do you need to pay how to save money on tax Learn about HRA Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your

Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number Income tax return ITR is a crucial process where individuals or entities inform the government about the total income earned in the previous financial year and

How To File Income Tax Return Online In Hindi YouTube

https://i.ytimg.com/vi/KG6fme5psps/maxresdefault.jpg

How To File ITR Guide To File Income Tax Returns Online HDFC Life

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/How-to-File-Income-Tax-Return.png

https://cleartax.in/s/section-80-ccd-1b

Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your

https://www.youtube.com/watch?v=eHx9GkcTYWE

All the necessary ITR concepts including deductions are explained in very easy language for salaried persons New Income Tax Portal Link https www incometax gov in Contact for Paid

How To File Income Tax Return For Mutual Funds On New Income Tax Portal

How To File Income Tax Return Online In Hindi YouTube

How To File Income Tax Return Online For Salaried Employee

How To File Income Tax Return For Salaried Employee A Y 2018 19 E

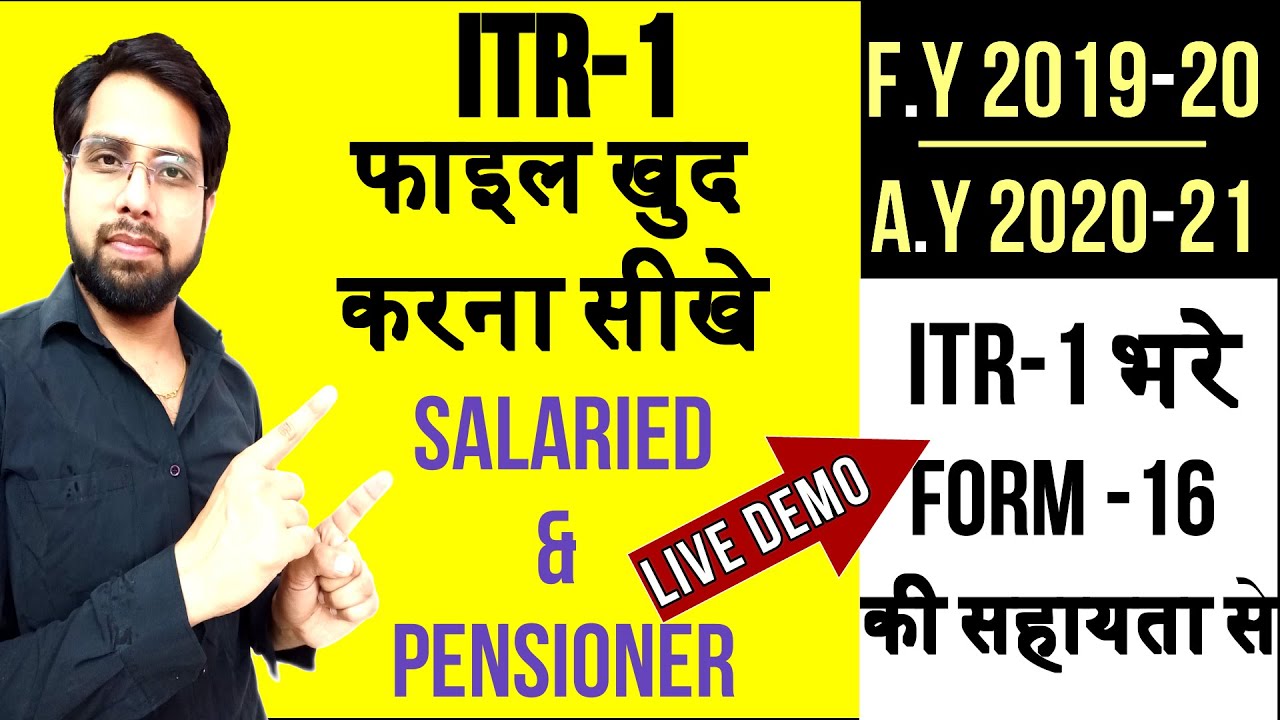

ITR Filing Online 2019 20 Last Date How To File Income Tax Return For

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

HOW TO FILE INCOME TAX RETURN FOR PENSIONERS FAMILY PENSION FD

How To File Income Tax Return Live Tutorial In Hindi INCOME TAX

HOW TO FILE INCOME TAX RETURN FOR A Y 2020 21 HOW TO FILE ITR 1 A Y

How To File Income Tax Return For Central Government Employees - Income Tax for Central Government Employees and Pensioners Table of Contents show What is Salary As per section 15 of the Act the following incomes are