How To File Tuition Tax Credits An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees

Whether you re a student or the parent of a student if you paid for college you may be eligible for an education tax credit Who can claim education tax credits can depend on factors such as where you go to school your criminal history and whether you re a dependent Here s what you need to know about education tax credits how to You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan If you pay the expenses with money from a loan you take the credit for the year you pay the expenses not the year you get the loan or the year you repay the loan

How To File Tuition Tax Credits

How To File Tuition Tax Credits

https://d2zhlgis9acwvp.cloudfront.net/images/articles/0072-what-are-college-tuition-tax-credits.jpg?time=202207251442

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/Unused-Tuition-Tax-Credit-Options.jpg

How To Claim Tuition Tax Credits In Canada

https://maplemoney.com/wp-content/uploads/tuition-tax-credits-pin.jpg

This interview will help you determine if your education expenses qualify for a tax benefit Information you ll need Filing status Student s enrollment status Your adjusted gross income Who paid the expenses when the expenses were paid and for what academic period If any expenses were paid with tax exempt funds Request a tax card in MyTax See the instructions How to request a tax card when you receive a study grant and wages in MyTax How to request a tax card for trade income in MyTax general information on tax card for wages Ask your employer how to

OVERVIEW There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student but it s typically only available for the first four years of college or trade school Key Takeaways The Tuition and Fees Deduction was extended through the end of 2020 and allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents

Download How To File Tuition Tax Credits

More picture related to How To File Tuition Tax Credits

How To File A Gross Receipts Tax GRT Return In Taxpayer Access Point

https://i.ytimg.com/vi/CqmaHRNPcfA/maxresdefault.jpg

How To File Taxes With DoorDash 2024 DoorDash Taxes Made Easy With

https://i.ytimg.com/vi/YDe0jK4GqVU/maxresdefault.jpg

How To File Back Taxes Yourself In 2023 Guide On Filing Back Taxes

https://i.ytimg.com/vi/xj8XfQDbRmc/maxresdefault.jpg

You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education Education tax credits can help those who pay for higher education reduce their tax bill and in some cases get more money in their refund There are two main types of education tax credits the American opportunity tax

Education tax credits help offset the cost of going to college by reducing how much you owe on your tax return And if the credit reduces your tax bill to less than zero you could even There are several options for deducting college tuition and textbooks on your federal income tax return including the American Opportunity Tax Credit Lifetime Learning Tax Credit Tuition and

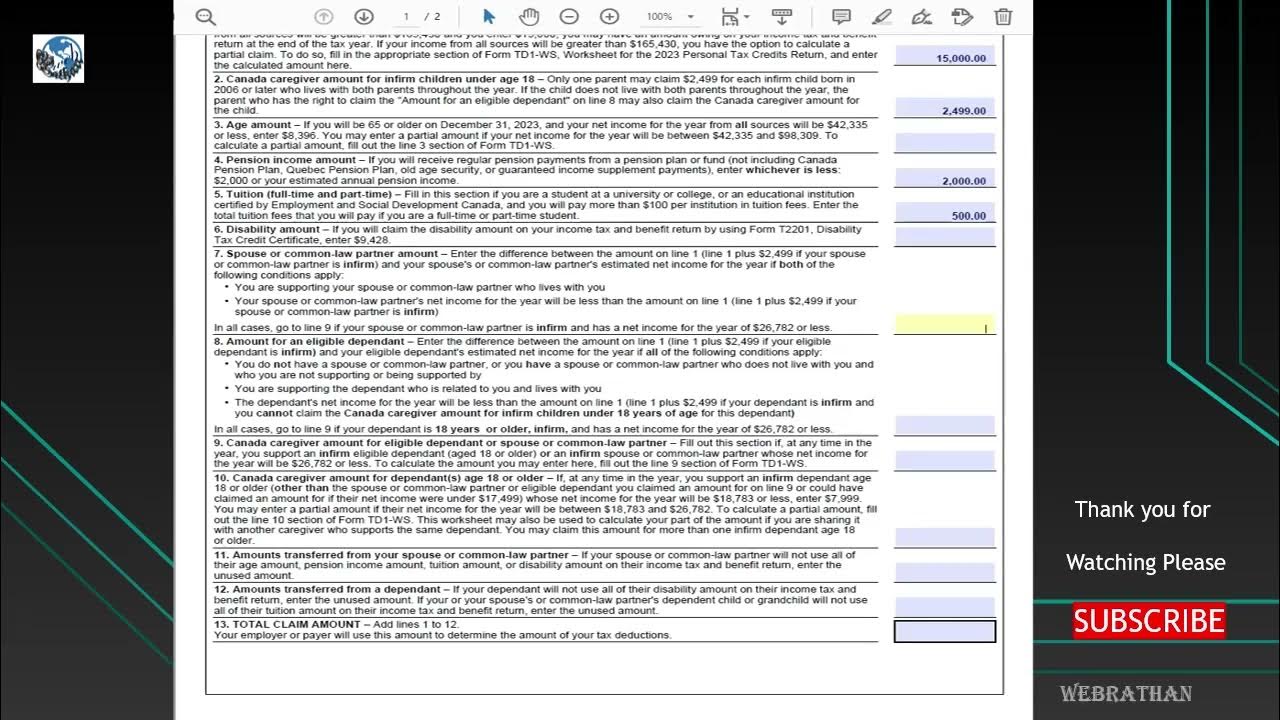

TUITION TAX CREDITS Explained For Canadian Students T2202 TD1 T1213

https://i.ytimg.com/vi/fq7uBQmlrkc/maxresdefault.jpg

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/GhVvNvHpO9M/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLA1GWVUtAc4s-DKgsChFuSuhonPog

https://www.forbes.com/advisor/taxes/tuition-and-fees-deduction

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees

https://www.lendingtree.com/student/education-tax-credits

Whether you re a student or the parent of a student if you paid for college you may be eligible for an education tax credit Who can claim education tax credits can depend on factors such as where you go to school your criminal history and whether you re a dependent Here s what you need to know about education tax credits how to

Learn How To Calculate Tuition Tax Credits Family Budgeting

TUITION TAX CREDITS Explained For Canadian Students T2202 TD1 T1213

What Are Tuition Tax Credits Gallo LLP Chartered Professional

How To File Income Tax Return AY 23 24 ITR 1 Salary ITR File ITR

How To File Company Income Tax Return Online YouTube

How To File TAXES In CANADA As International Student In 2023 Get

How To File TAXES In CANADA As International Student In 2023 Get

How To File Itr For Salary Person How To File Income Tax Return Itr

Tuition Tax Credits UEA

How To File A Complaint With The CFPB To Fix Your Credit Score YouTube

How To File Tuition Tax Credits - Tuition and fee deductions If you qualify based on income you can deduct up to 4 000 from your gross income for the money you spent on eligible education expenses such as tuition fees books supplies and other purchases your school requires This deduction is available to students and parents who earned less than 65 000 or 130 000 if