Income Tax Rebate On Nps Tier 1 Web 21 sept 2022 nbsp 0183 32 Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of the Income Tax Act 1961 NPS tax benefits for annual contributions are as

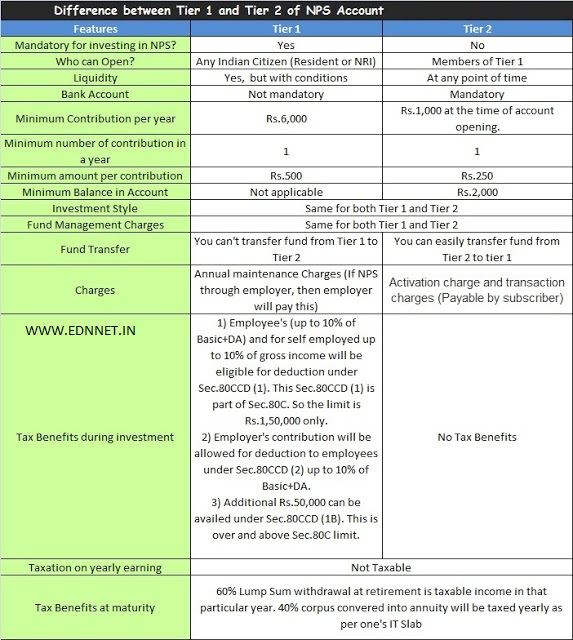

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS Web 16 sept 2022 nbsp 0183 32 Tax Benefits on NPS Tier 1 amp Tier 2 Returns The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any

Income Tax Rebate On Nps Tier 1

Income Tax Rebate On Nps Tier 1

https://www.basunivesh.com/wp-content/uploads/2019/05/NPS-Returns-for-2019-Tier-1-C-Scheme.jpg

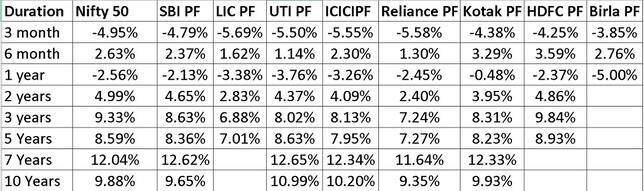

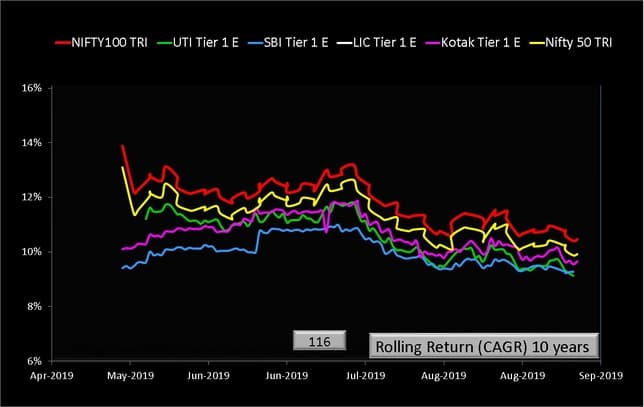

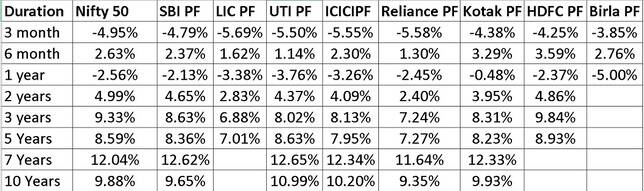

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

https://freefincal.com/wp-content/uploads/2019/09/NPS-Tier-1-Equity-Scheme-Returns-as-on-31-July-2019-new.jpg

NPS Returns For 2018 Who Is Best NPS Fund Manager BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2018/05/NPS-Returns-for-2018-Tier-1-Scheme-C-Best-Fund-and-Fund-Manager.jpg

Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of Web 6 avr 2023 nbsp 0183 32 In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional deduction of up to

Web Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual

Download Income Tax Rebate On Nps Tier 1

More picture related to Income Tax Rebate On Nps Tier 1

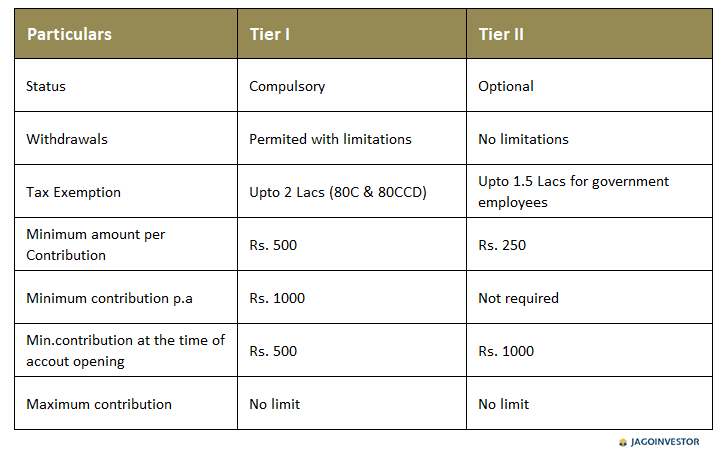

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

https://freefincal.com/wp-content/uploads/2019/09/NPS-Tier-1-E-all-schemes-ten-year-performance.jpg

NPS National Pension Scheme A Beginners Guide For Rules Benefits

https://www.jagoinvestor.com/wp-content/uploads/files/National-Pension-Scheme-TierI-TierII.png

Web 24 f 233 vr 2020 nbsp 0183 32 Income Tax Benefits under NPS Tier 1 Account for AY 2021 22 Tax Deduction under 80CCD 1 on NPS investment by Salaried individual except Central Govt employees An Employee can Web VDOM DHTML tml gt Is NPS Tier 1 eligible for an extra 50k tax benefit Quora

Web 21 sept 2021 nbsp 0183 32 In the existing regime an individual can claim tax benefit on a maximum self contribution of Rs 1 5 lakh in a financial year to the Tier I NPS account The amount Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate NPS tax benefits are offered under section 80C Section 80 CCD 1 amp Section 80 CCD 1B and Section

Your Employer s Contribution To NPS Can Make A Huge Difference

https://4.bp.blogspot.com/-ARdbRhlLIVQ/WRwDcrdb2HI/AAAAAAAAQrM/V_MeDWhbAvkaflKs7FCZ8-tNMIR3uupFQCLcB/s1600/nps-tier1-tier2-difference.jpg

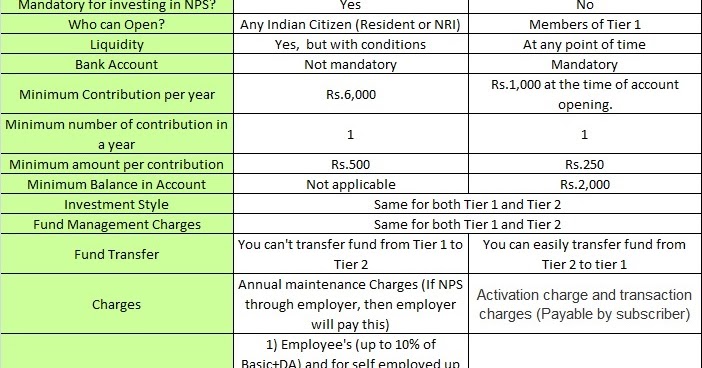

Difference Between Tier 1 And Tier 2 Account In New Pension Scheme NPS

https://1.bp.blogspot.com/-sgKENG4d_ZU/WKZvq6YZceI/AAAAAAAAe5g/iHYuzTR0XAgMKcbn_AnidG4vd8z3q18FACLcB/w1200-h630-p-k-no-nu/Difference-between-NPS-Tier-1-and-Tier-2.jpg

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of the Income Tax Act 1961 NPS tax benefits for annual contributions are as

https://www.hdfcbank.com/personal/resources/learning-centre/invest/how...

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

NPS NPS TYPE NPS TAX BENFITS HOW TO INVESTMENT IN NPS NPS TIER 1 TIER

Your Employer s Contribution To NPS Can Make A Huge Difference

Taxation Of NPS Return From The Scheme

How To Make Online Contributions To NPS Tier I And Tier II Accounts

GURUKULAM Difference Between Tier 1 And Tier 2 Account In New Pension

Best NPS Funds 2019 Top Performing NPS Scheme

Best NPS Funds 2019 Top Performing NPS Scheme

Did You Know That You Can Still Save Taxes On NPS Tier 1 In The New Tax

NPS Performance Debt Schemes Give Double digit Returns Equities

NPS Performance Debt Schemes Give Double digit Returns Equities

Income Tax Rebate On Nps Tier 1 - Web 6 f 233 vr 2023 nbsp 0183 32 NPS Tax Benefits 2023 under the new tax regime Tier 1 If you adopted the new tax regime then as I mentioned in my older post New Tax Regime Complete