How To Find Income Tax Refund Amount Check Refund Status User Manuals User Manual E filing Services type Filing your Return

Yes you can see both on eFiling The refund amount if any and refund payment date can be seen on the Income Tax Statement of Account ITSA and the payment date for the amount owed by you to SARS can IRS Tax Tip 2022 26 February 16 2022 Tracking the status of a tax refund is easy with the Where s My Refund tool It s available anytime on IRS gov or through the IRS2Go

How To Find Income Tax Refund Amount

How To Find Income Tax Refund Amount

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Saving Some Of Your Tax Refund Could Win You A Cash Prize A E

https://ae-taxfinancial.com/wp-content/uploads/2018/10/How-Saving-Some-of-Your-Tax-Refund-Could-Win-You-a-Cash-Prize.jpg

They can check the status of their refund easily and conveniently with the IRS Where s My Refund tool at IRS gov refunds and with the IRS2Go app Refund status is available Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an

Income tax refund means a refund amount that is initiated by the income tax department if the amount paid in taxes exceeds the actual amount due either by way of TDS or TCS or Advance Tax or Self Assessment Tax Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks

Download How To Find Income Tax Refund Amount

More picture related to How To Find Income Tax Refund Amount

3 Reasons You Shouldn t Receive A Tax Refund Next Year

https://s.yimg.com/ny/api/res/1.2/JIoLoNr_QJe3C1icuE0MAg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/gobankingrates_644/b7a1d2b2c529af141deffd558b1cb65b

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

Average Tax Refund In Every U S State Vivid Maps

https://vividmaps.com/wp-content/uploads/2019/02/Taxes.jpg

However here are the best ways to find the status of a refund Where s My Refund IRS2Go mobile app Also see Tax Season Refund Frequently Asked Questions for When a taxpayer makes an excess payment of income tax to the government against its actual income tax liability for a given year the income tax department refunds the excess amount paid after due

Check your federal tax refund status Before checking on your refund have the following ready Social Security number or Individual Taxpayer Identification Number ITIN Filing You ll need your Social Security number or Individual Tax Identification Number to use either service as well as your filing status and the exact amount of the refund you are

Help My Tax Refund Was Taken To Pay My Student Loan Debt Some

https://i.pinimg.com/originals/6a/32/46/6a3246ae4fc834c2b2af4404627e4731.jpg

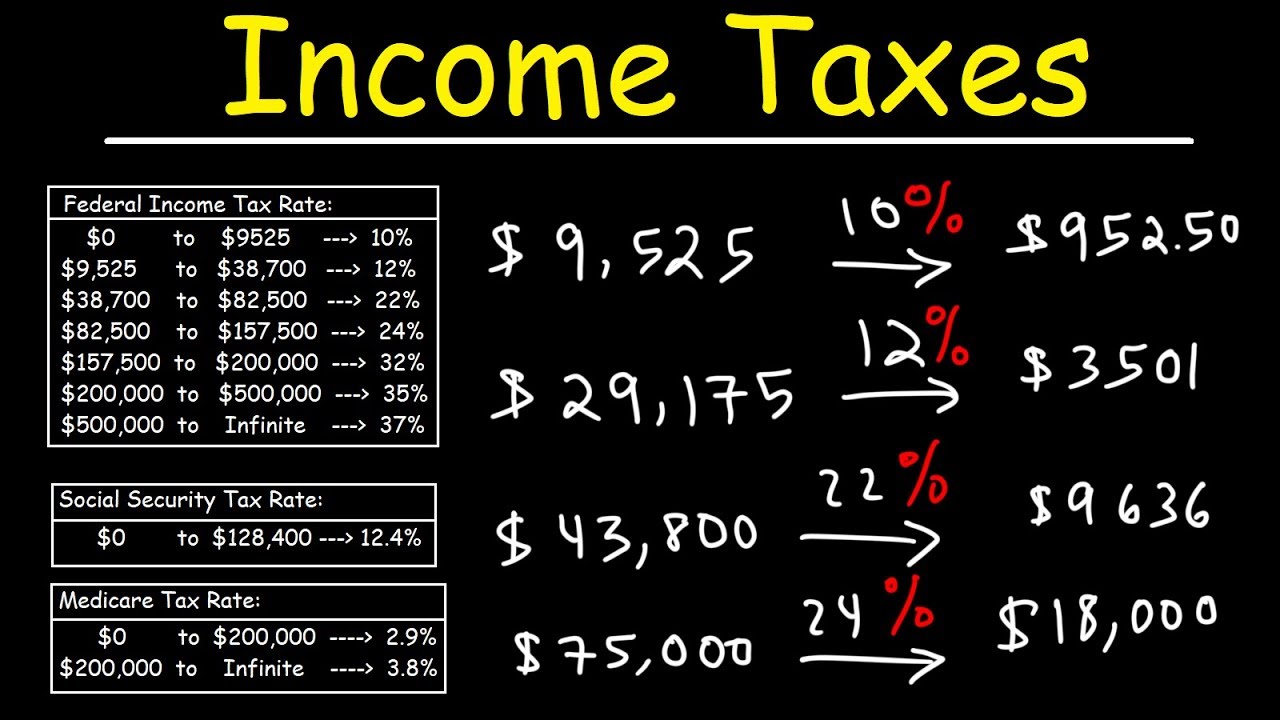

Form Used To Calculate Employee S Income Tax 2023 Employeeform Net

https://www.employeeform.net/wp-content/uploads/2022/06/w2-withholding-calculator-tax-withholding-estimator-2021.png

https://www.incometax.gov.in/.../check-refund-status

Check Refund Status User Manuals User Manual E filing Services type Filing your Return

https://www.sars.gov.za/faq/faq-can-i-see-…

Yes you can see both on eFiling The refund amount if any and refund payment date can be seen on the Income Tax Statement of Account ITSA and the payment date for the amount owed by you to SARS can

How To Check Income Tax Refund Status Online

Help My Tax Refund Was Taken To Pay My Student Loan Debt Some

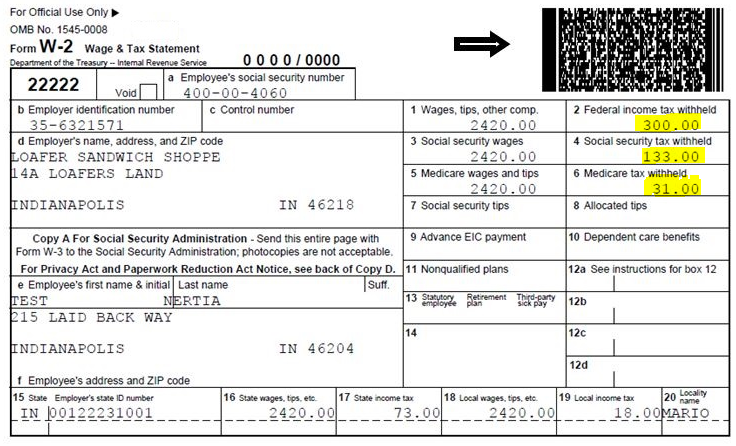

How To Calculate Income Tax Formula

Tax Bill Or Tax Refund Find Out Why Charles Schwab

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

Income Tax Expense On Income Statement Formula Calculation

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Income Tax Refund Claiming IT Refund Schedule Process Status GST

How To Find Income Tax Refund Amount - Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an