Where Can I Find My Tax Refund Amount Check your refund Information is updated once a day overnight What you need Your Social Security or individual taxpayer ID number ITIN Your filing status The exact refund amount on your return Check your refund Find your tax information in your online account or get a copy transcript of your tax records

2022 2021 Filing Status Select the filing status shown on your tax return Single Married Filing Joint Return Married Filing Separate Return Head of Household Qualifying Widow er Surviving Spouse Refund Amount Enter the exact whole dollar refund amount shown on your tax return It s available anytime on IRS gov or through the IRS2Go App Taxpayers can start checking their refund status within 24 hours after an e filed return is received Refund timing Where s My Refund provides a personalized date after the return is processed and a refund is approved

Where Can I Find My Tax Refund Amount

Where Can I Find My Tax Refund Amount

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

How To Find Out When I Get My Tax Return Theatrecouple12

https://www.mlive.com/resizer/Nk2-c9_emvBIhFCkNTxjuI4fsws=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/U5ZKCLAWGZGYDHIRBVWW63F5PY.JPG

IRS Check My Refund Check All The Necessary Details Here Eduvast

https://www.eduvast.com/wp-content/uploads/2023/08/Untitled-design_20230822_002740_0000.jpg

Taxpayers can check the status of their refund easily and conveniently with the IRS Where s My Refund tool at IRS gov refunds Refund status is available within 24 hours after the taxpayer e filed their current year return The tool also gives the taxpayer a personalized refund date after the IRS processes the return and approves the refund Your filing status Your exact refund amount Be aware of processing delays Again this year some tax returns with errors or items on the return that need an IRS correction due to a tax law change are taking longer than the normal timeframes to process so expect delays

Use the IRS Where s My Refund tool or the IRS2Go mobile app to check your refund online This is the fastest and easiest way to track your refund The systems are updated once every 24 hours You can contact the IRS to check on the status of your refund If you call wait times to speak with a representative can be long Your filing status Your exact refund amount You will need this information to use the first two refund status tools below Use one of these IRS refund status tools to check on the status of your return and refund Where s My Refund IRS2Go mobile app

Download Where Can I Find My Tax Refund Amount

More picture related to Where Can I Find My Tax Refund Amount

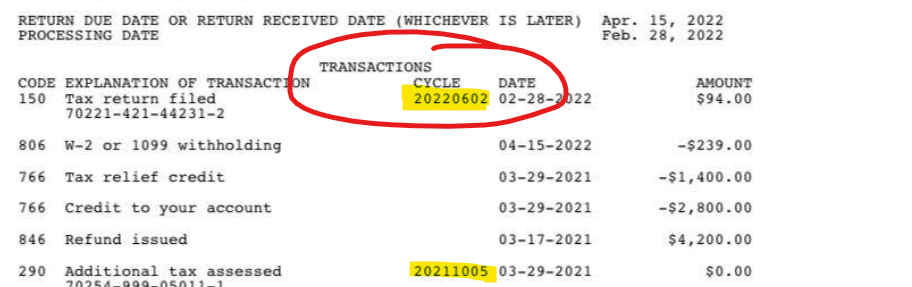

2022 IRS Cycle Code Using Your Free IRS Transcript To Get Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image-2.png?is-pending-load=1

Can You File Your Taxes With Your Last Pay Stub This Is What To Know

https://estilo-tendances.com/wp-content/uploads/2020/02/df7477343e18ae41cf296e4b62f1d931.jpeg

Check Refund Status Browserguide

https://i.ytimg.com/vi/WcXz5-Udsgk/maxresdefault.jpg

If you re looking for your tax refund use the Where s My Refund tracker first To check your refund s status you ll need your Social Security number filing status and the amount of Tax Refund Processing Start checking status 24 48 hours after e file Once you have e filed your tax return you can check your status using the IRS Where s My Refund tool You will need your Social security number or ITIN your filing status and your exact refund amount

Home Get help Refunds Locating a Refund Published January 10 2022 Last Updated October 24 2023 Locating a Refund If you filed a tax return and are expecting a refund from the IRS you may want to find out the status of the refund or at least get an idea of when you might receive it The IRS issues most refunds in 21 calendar days You can easily check your refund status online using the IRS Where s My Refund portal The average tax refund amount is approximately 3 182 which is approximately 5 higher than it was

Tax Refund Tips For Getting More Money Back From The IRS With Write

https://i.ytimg.com/vi/HJyWychl2Fw/maxresdefault.jpg

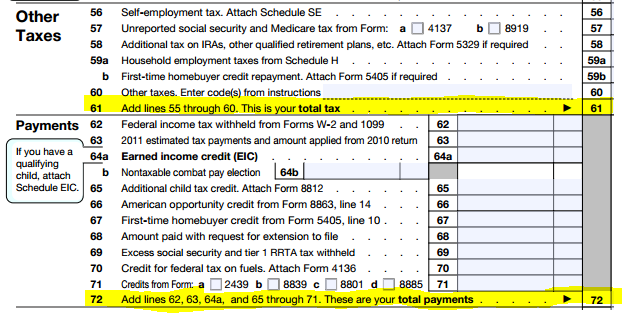

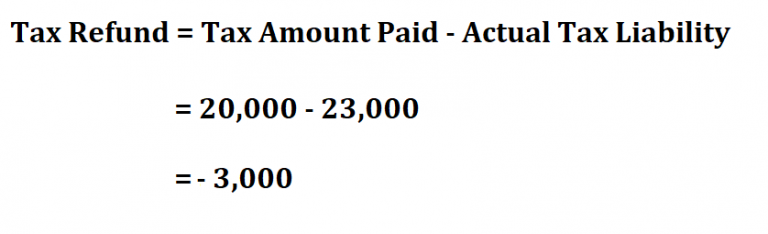

How To Calculate Your Federal Income Tax Refund Tax Rates

https://www.withholdingform.com/wp-content/uploads/2022/08/how-to-calculate-your-federal-income-tax-refund-tax-rates.png

https://www.irs.gov/wheres-my-refund

Check your refund Information is updated once a day overnight What you need Your Social Security or individual taxpayer ID number ITIN Your filing status The exact refund amount on your return Check your refund Find your tax information in your online account or get a copy transcript of your tax records

https://sa.www4.irs.gov/wmr

2022 2021 Filing Status Select the filing status shown on your tax return Single Married Filing Joint Return Married Filing Separate Return Head of Household Qualifying Widow er Surviving Spouse Refund Amount Enter the exact whole dollar refund amount shown on your tax return

Understanding Your Forms W 2 Wage Tax Statement Tax Refund Tax

Tax Refund Tips For Getting More Money Back From The IRS With Write

How To Find Out When I Get My Tax Return Theatrecouple12

How To Check The Status Of Your Tax Refund Online Mental Floss

What Do I Do With My Tax Refund Https www cashthechecks what do

This Was The Average Tax Return Last Year Bankrate

This Was The Average Tax Return Last Year Bankrate

Cara Mendapatkan Tax Identification Number

How To Calculate Tax Refund

Calculating Tax Refund Or Amount Owed YouTube

Where Can I Find My Tax Refund Amount - Bottom line If you file online and set up direct deposit you can expect a refund within 21 days You can check the status of your return and any refund 24 hours after e filing by visiting the