How To Find Out Property Tax Amount If you re considering buying a home look on the real estate listing for assessment and tax information or go to the county website to find out the annual property tax

Calculate property taxes including California property taxes Most annual property taxes include a computation based on a percentage of the assessed value To calculate property tax find out the value of the land and the value of whatever is built on the land by contacting your local assessor s office Add those values

How To Find Out Property Tax Amount

How To Find Out Property Tax Amount

https://i.ytimg.com/vi/FV6AGRiLuLk/maxresdefault.jpg

Ad Valorem Tax Calculator KristenOlaf

https://rethority.com/wp-content/uploads/2020/12/910459_Property-Tax-Calculator_5_120820.jpg

About Your Property Tax Statement Anoka County MN Official Website

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

Property tax is a tax on real estate and some other kinds of property See how to calculate property tax where to pay property tax and how to save money Use SmartAsset s property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment

There are two formulas that could be used Assessed home value x tax rate property tax For instance if your home s assessed value is 400 000 and your Information about property taxes that are charged when you own lease purchase or gain an interest in a property

Download How To Find Out Property Tax Amount

More picture related to How To Find Out Property Tax Amount

How To Calculate Property Tax 10 Steps with Pictures Wiki How To

https://www.wikihow.com/images/thumb/a/a6/Calculate-Property-Tax-Step-05.jpg/aid1073850-v4-728px-Calculate-Property-Tax-Step-05.jpg

How To Find Out If You Can Sell Your Tickets Today Ticketmaster Blog

https://blog.ticketmaster.com/wp-content/uploads/Sell-Instantly-Blog-Image-1-1.jpg

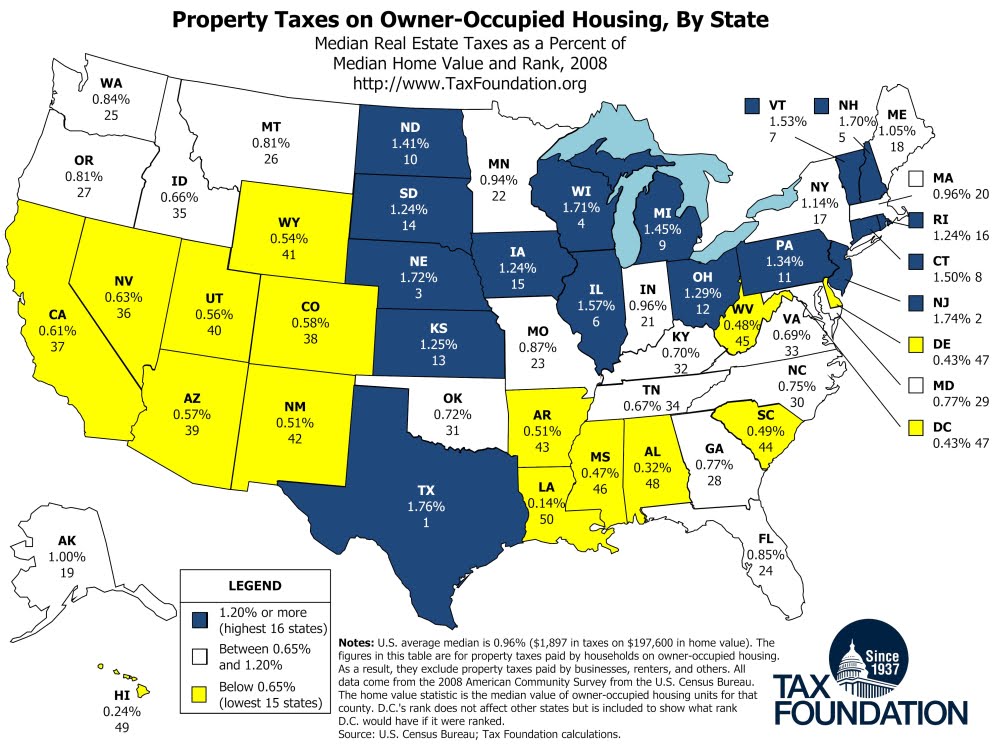

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation That number on the ground grew to 700 on Friday and swelled to 4 500 by Saturday as Walz activated the full Guard for the first time since WWII More than 7 000

With our Property Tax Calculator you can predict how much tax you re likely to pay depending on its location This can be essential in budgeting ensuring you aren t left Your property value is shown on a property assessment notice from MPAC as well as on your annual property tax bill Property values are reassessed every four years In 2016

Property Taxes By State County Median Property Tax Bills

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

Application Letter For Change Of Name In Property Tax Bill Name

https://i.ytimg.com/vi/RGST6K7r6t4/maxresdefault.jpg

https://www.realtor.com/guides/homeo…

If you re considering buying a home look on the real estate listing for assessment and tax information or go to the county website to find out the annual property tax

https://www.calculatorsoup.com/calculators/...

Calculate property taxes including California property taxes Most annual property taxes include a computation based on a percentage of the assessed value

How High Are Property Taxes In Your State Tax Foundation

Property Taxes By State County Median Property Tax Bills

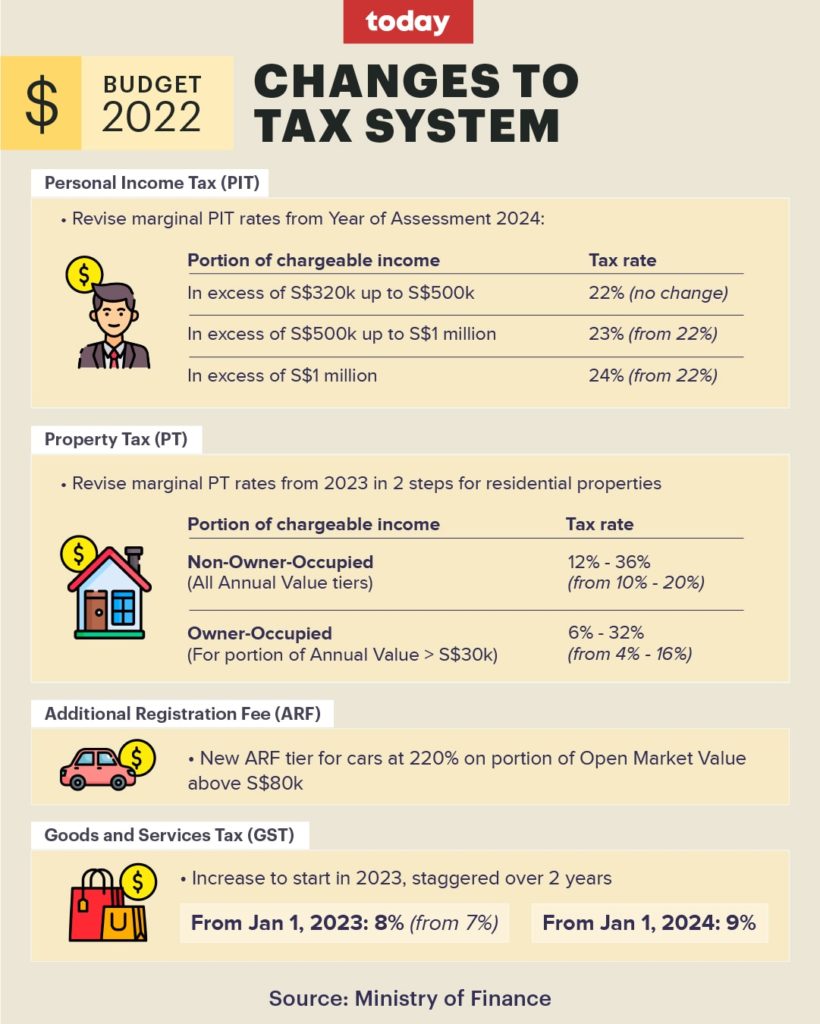

How Do The Changes In Property Taxes Affect You Finansdirekt24 se

Mysore City Corporation Property Tax How To Pay House Tax Online

Top 14 La County Property Tax Payment Inquiry 2022

How Do The Changes In Property Taxes Affect You Finansdirekt24 se

How Do The Changes In Property Taxes Affect You Finansdirekt24 se

What Is An Assessment And How Does It Related To Property Taxes Watch

Decatur Tax Blog Georgia s Median Property Tax Rate

How To Find Out Property Tax In Australia Pherrus Financial Services

How To Find Out Property Tax Amount - Property taxes are typically calculated by multiplying the property s assessed value by the local tax rate However the exact process used by your local