How To Get A Tax Deduction For Charitable Donations Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes The amount of

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of For your charitable contribution to be eligible for a deduction the recipient must be registered with the IRS as a 501 c 3 nonprofit

How To Get A Tax Deduction For Charitable Donations

How To Get A Tax Deduction For Charitable Donations

https://i.pinimg.com/736x/56/c2/f8/56c2f82c540b892c04e5c20f94e392ad.jpg

The Complete Charitable Deductions Tax Guide 2023 Updated

https://daffy.ghost.io/content/images/size/w2000/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022-2.png

Charitable Donation Tax Credits Tax Tip Weekly YouTube

https://i.ytimg.com/vi/swRobMRG4fw/maxresdefault.jpg

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have Generally you can claim a charitable donation on your taxes only if you itemize your deductions If your itemized deductions are greater than the standard deduction for your

How to deduct charitable donations 1 Keep Donation Records Maintain records of all contributions including bank statements receipts and checks 2 Document How to Claim Charitable Donations When You File Your Tax Return For tax year 2024 and most tax years you are required to itemize your deductions to claim your charitable gifts and contributions

Download How To Get A Tax Deduction For Charitable Donations

More picture related to How To Get A Tax Deduction For Charitable Donations

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

How Much Do You Need To Donate For Tax Deduction

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

Guide To Tax Deduction For Charitable Donations Backpacks USA

https://cdn.shopify.com/s/files/1/0533/2241/6308/files/guide-to-tax-deductions-for-charitable-donations-infographic.jpg

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings Charities based in the To deduct donations you make to your church you must itemize your expenses on Schedule A when you file your personal tax return You will only benefit from itemization when your deductions exceed the Standard

With your Giving Account at Fidelity Charitable you can become eligible for a charitable tax deduction and improve the world 7 charitable tax deduction questions are answered in our If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations According to the Internal Revenue Service IRS a

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

https://fthmb.tqn.com/WTZF3eXFhZ0fX5VLuL9VwzDfneY=/1500x1000/filters:fill(auto,1)/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg

How To Legally Claim A Tax Deduction For Charitable Giving From Your

http://www.wealthsafe.com.au/wp-content/uploads/2015/02/charity-hand.jpg

https://www.nerdwallet.com › article › taxe…

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes The amount of

https://money.usnews.com › money › pers…

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of

Get 300 Tax Deduction For Cash Donations In 2020 2021

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

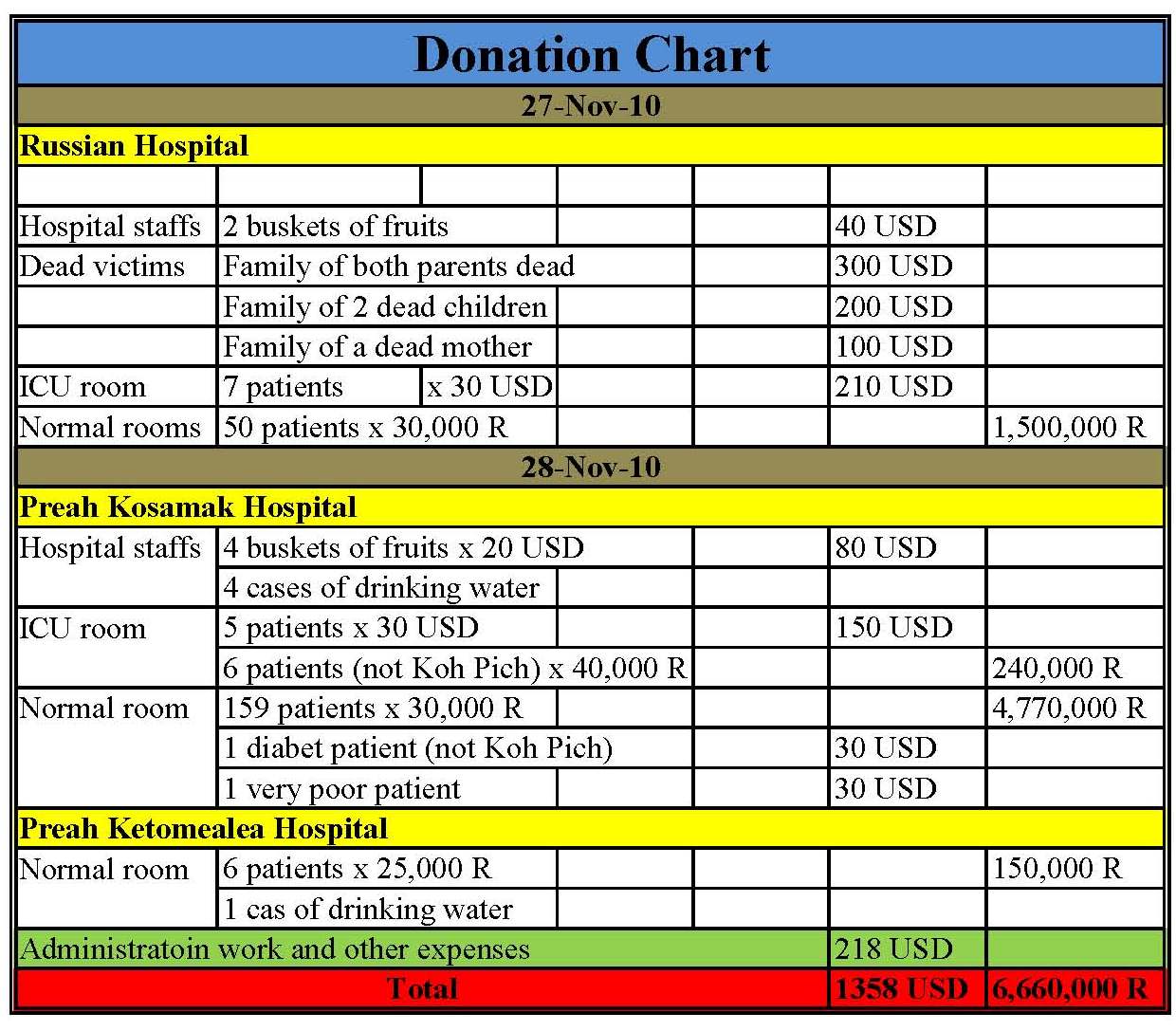

Donation Chart Template

13 Tips For Making Your Charitable Donation Tax Deductible Giving Compass

How To Maximize Your Charity Tax Deductible Donation WealthFit

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Printable Itemized Deductions Worksheet

12 Tax Smart Charitable Giving Tips For 2023 Retirement Plan Services

Record Of Charitable Contribution Is A Must For Claiming Deduction

How To Get A Tax Deduction For Charitable Donations - How to Claim Charitable Donations When You File Your Tax Return For tax year 2024 and most tax years you are required to itemize your deductions to claim your charitable gifts and contributions