How To Get Tax Refund In Australia Select the down arrow to display your estimated assessment issue date Issued Outcome We have processed your tax return you ll be able to see your refund or amount owing tax debt For amounts owing select the Notice of assessment link to view the due date for payment

Enquiry form Telephone If you are calling the TRS from within Australia 1300 555 043 If you are calling the TRS from outside Australia 61 2 6245 5499 You can claim a refund of the goods and services tax GST and wine equalisation tax WET that you pay on goods you buy in Australia Claiming GST and WET refunds You may be able to claim a refund of the goods and services tax GST and wine equalisation tax WET included in the price of goods you bought in Australia You do this at the airport or seaport when you actually leave To find out more see The tourist refund scheme External Link

How To Get Tax Refund In Australia

How To Get Tax Refund In Australia

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

How To Get Tax Refund In USA As Tourist Resident For Shopping FAQs

https://redbus2us.com/wp-content/uploads/2019/02/US-CBP-Tax-Refund-Clarification-US-Govt-does-not-refund-tax.png

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

To claim tax back in Australia you can utilise the Tourist Refund Scheme TRS to get a refund on Goods and Services Tax GST and Wine Equalisation Tax WET for certain goods purchased However there are certain conditions that you must fulfil to be eligible for these To get a tax refund you will need to lodge an end of year tax return You will need to submit your tax return to the Australian Tax Office ATO and this can be done in three ways Online By post Through a registered tax agent Tax returns must be completed and lodged no later than 31 October following the end of the most recent tax year

The Department does not give cash refunds You can choose from the following refund options deposit to an Australian bank account payment to a credit card cheque Refunds will usually be paid within 60 days of the claim being lodged Claims for imported goods A condition of making a TRS claim is that goods must be supplied within Australia Get a claim form from an ABF officer at the TRS Facility complete the form with your name address total number of invoices submitted refund payment option and signed declaration failing to complete this form accurately may result in your claim being partially or wholly rejected place the white TRS copy of the form and ALL original paper

Download How To Get Tax Refund In Australia

More picture related to How To Get Tax Refund In Australia

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs

https://i.pinimg.com/736x/25/84/14/258414a9ba63687de99d431af3bce628.jpg

How To Get Tax Refund In Nigeria

https://media.licdn.com/dms/image/C4D12AQFm5CmoU2GrZQ/article-cover_image-shrink_600_2000/0/1571665412967?e=2147483647&v=beta&t=MynyGZ5PnronJT8aP9uARynMyAgYLRl6KC64IV_RNeU

How To Get Tax Refund In Japan How To Japan

https://howjpn.com/wp-content/uploads/2023/02/how-to-get-tax-refund-in-japan.jpg

The Tourist Refund Scheme TRS allows travellers to claim a 10 rebate on the price paid for almost anything bought in Australia That 10 is initially paid up front in the form of the broad based 10 GST Goods and Services Tax but when you leave Australia on a flight or cruise you can get that 10 back in full as an Australian GST 4 Ways to Get Your Tax Refund Fast By H R Block 4 min read Waiting to get your tax refund is a lesson in patience once you ve lodged you want to see a result You might be looking forward to purchasing that something special you ve had your eye on or maybe you re just excited to see your savings shoot up

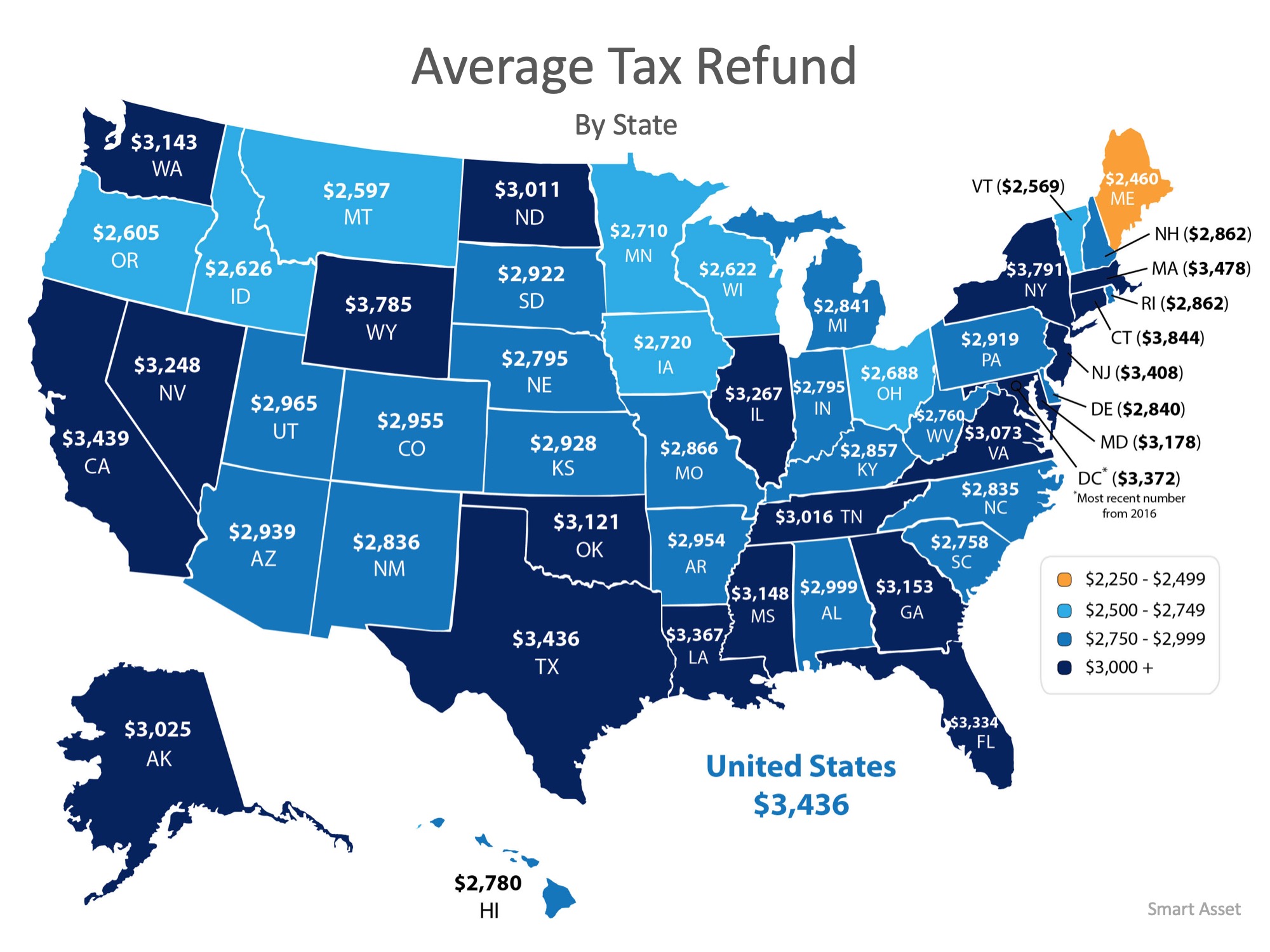

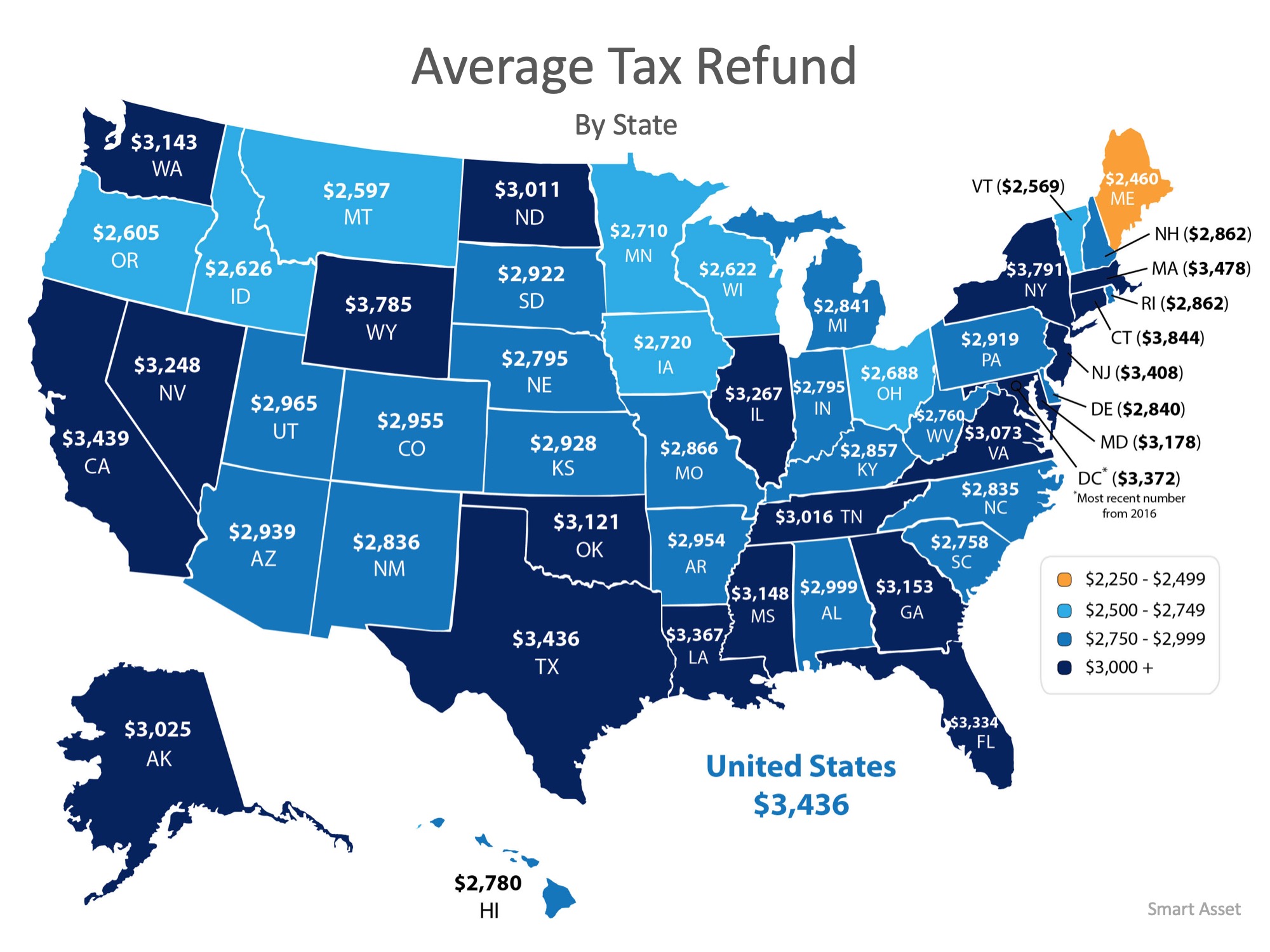

And changes in the 2022 23 financial year mean that many tax return refunds could be lower this year with some actually having to owe the Australian Taxation Office ATO money Here what you If you hate doing your tax perhaps knowing the average refund is almost 3 000 will make the chore a little easier Last year the ATO refunded more than 30 billion to 10 8 million Australians

What Is The Quickest Tax Refund In Australia

https://www.taxback.com/resources/blogimages/20200812155308.1597236788804.34f18f17f94483461c634b5c273.jpg

Tax Cut 2019 How To Get Tax Refund How Much Money Will You Get Back

https://cdn.newsapi.com.au/image/v1/5053bc09ad076181705730319f081cd9?width=1024

https://www.ato.gov.au/individuals-and-families/...

Select the down arrow to display your estimated assessment issue date Issued Outcome We have processed your tax return you ll be able to see your refund or amount owing tax debt For amounts owing select the Notice of assessment link to view the due date for payment

https://www.abf.gov.au/.../tourist-refund-scheme

Enquiry form Telephone If you are calling the TRS from within Australia 1300 555 043 If you are calling the TRS from outside Australia 61 2 6245 5499 You can claim a refund of the goods and services tax GST and wine equalisation tax WET that you pay on goods you buy in Australia

How To Reduce Tax In Australia Taxes Investing Stocks In Australia

What Is The Quickest Tax Refund In Australia

Taxes What To Do If You Really Need Your Tax Refund Fast

Tax Back Come Ottenere Il Rimborso Delle Tasse In Australia

How To Fill Out Your Tax Return Like A Pro The New York Times

Your Tax Refund Is The Key To Homeownership

Your Tax Refund Is The Key To Homeownership

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Get The Most Out Of Your Tax Refund NFM Lending

Explainer Video How To Get Tax Refund In 1 Hour Australia YouTube

How To Get Tax Refund In Australia - 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000 29 467 plus 37 cents for each 1 over 120 000 180 001 and over 51 667 plus 45 cents for each 1 over 180 000 Medicare levy is not included in income tax rates above