Rebates And Reliefs As Per Income Tax Act Web REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the total income of an

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F

Rebates And Reliefs As Per Income Tax Act

Rebates And Reliefs As Per Income Tax Act

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

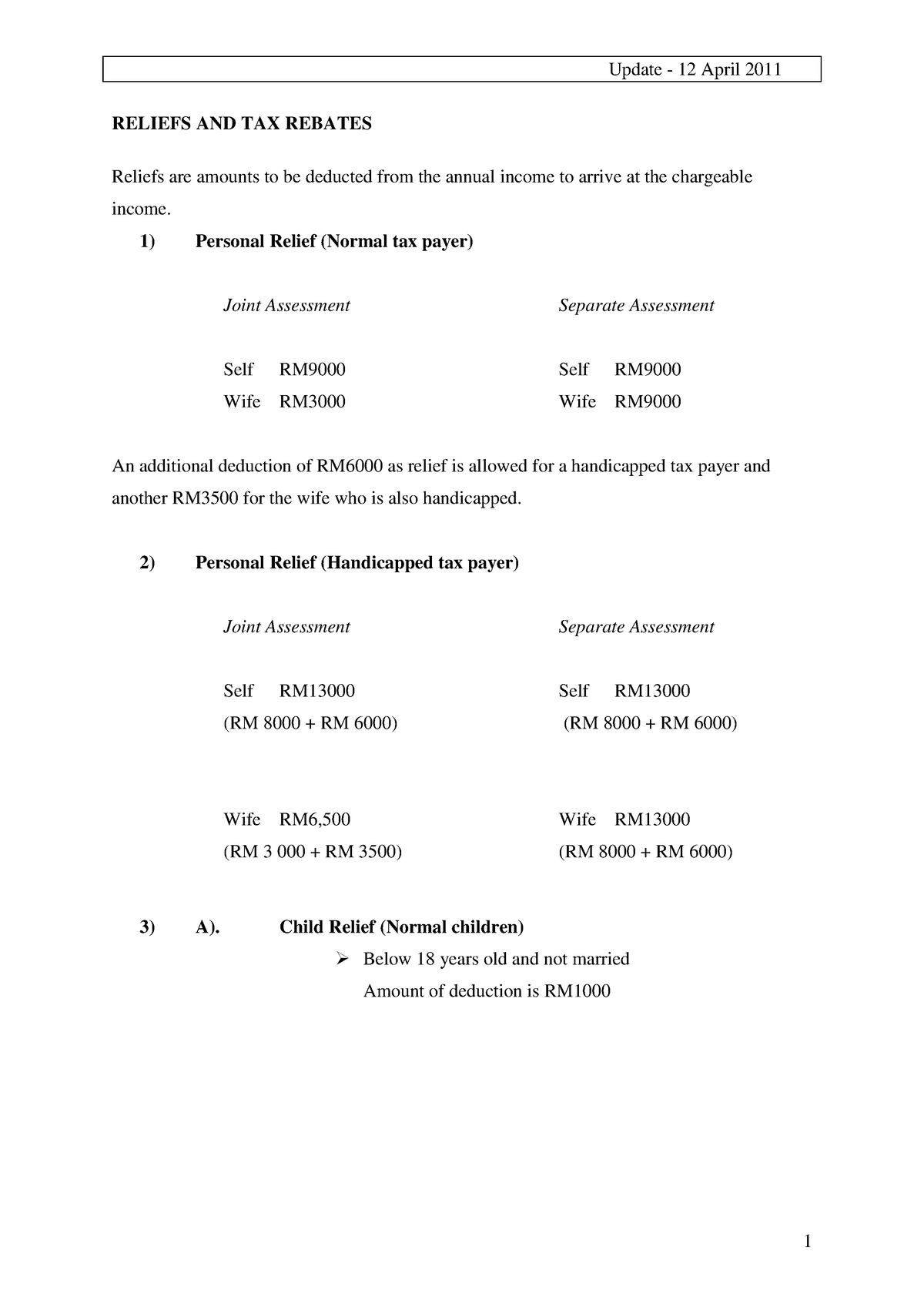

Income TAX reliefs And Rebates RELIEFS AND TAX REBATES Reliefs Are

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/282139760885f52ec10c99459eb6f12f/thumb_1200_1697.png

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

https://studycafe.in/wp-content/uploads/2019/12/Rebate-under-Section-87A-of-Income-Tax-Act.jpg

Web Income tax rebates have been provided in the Income tax Act with a view to allow a rebate or relief from the income tax payable which is determined with reference to total Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to

Web 19 oct 2021 nbsp 0183 32 Rebate under section 87A of the Income Tax Act is a provision that helps taxpayers to reduce their tax liability This section is available to the person whose Web Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of

Download Rebates And Reliefs As Per Income Tax Act

More picture related to Rebates And Reliefs As Per Income Tax Act

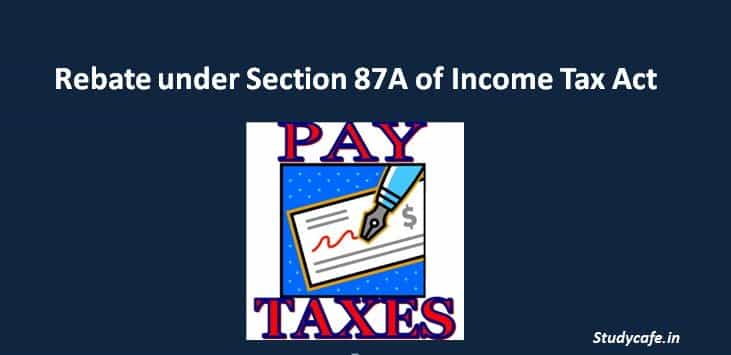

Residential Status As Per Income Tax Act 1961 TOP CHARTERED

https://kmgcollp.com/wp-content/uploads/2022/05/source-f-income-residential-income1-768x381.jpg

REBATE AND RELIEFS UNDER INCOME TAX

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2021/10/REBATE-AND-RELIEFS-UNDER-INCOME-TAX.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 11 avr 2023 nbsp 0183 32 As per Section 87A of the Income Tax Act if the total income of an individual does not exceed a certain threshold currently Rs 5 lakh they are eligible for Web 2 mars 2023 nbsp 0183 32 Various types of tax relief can help you lower your tax bill or settle tax related debts Tax deductions let you deduct certain expenses such as home mortgage interest from your taxable income

Web income tax whereon is payable by the State Government the assessee shall be entitled to a deduction from the amount of income tax with which he is chargeable on his total Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum

Understanding Tax Reliefs Loanstreet

https://cdn.loanstreet.com.my/rich/rich_files/rich_files/000/000/139/original/individual-20and-20dependent-20relative.png

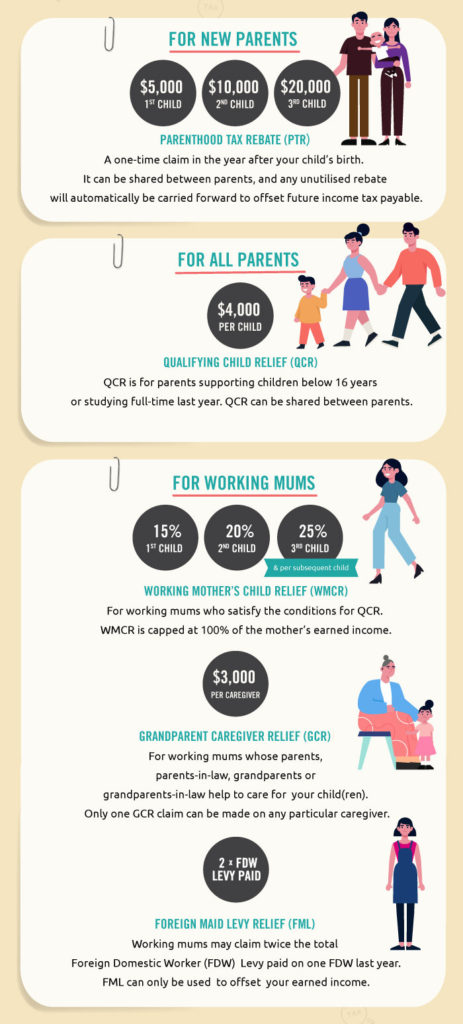

Income Tax Reliefs For Parents Are You Maximising Your Tax Savings

https://singaporemotherhood.com/articles/wp-content/uploads/2020/04/income-tax-reliefs-for-parents-ocbc-infographic-463x1024.jpg

https://taxmacs.com/.../2018/05/8.-Chapter-VIII-Rebates-an…

Web REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the total income of an

https://wirc-icai.org/.../part3/reliefs-under-income-tax-act-1961.html

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

Understanding Tax Reliefs Loanstreet

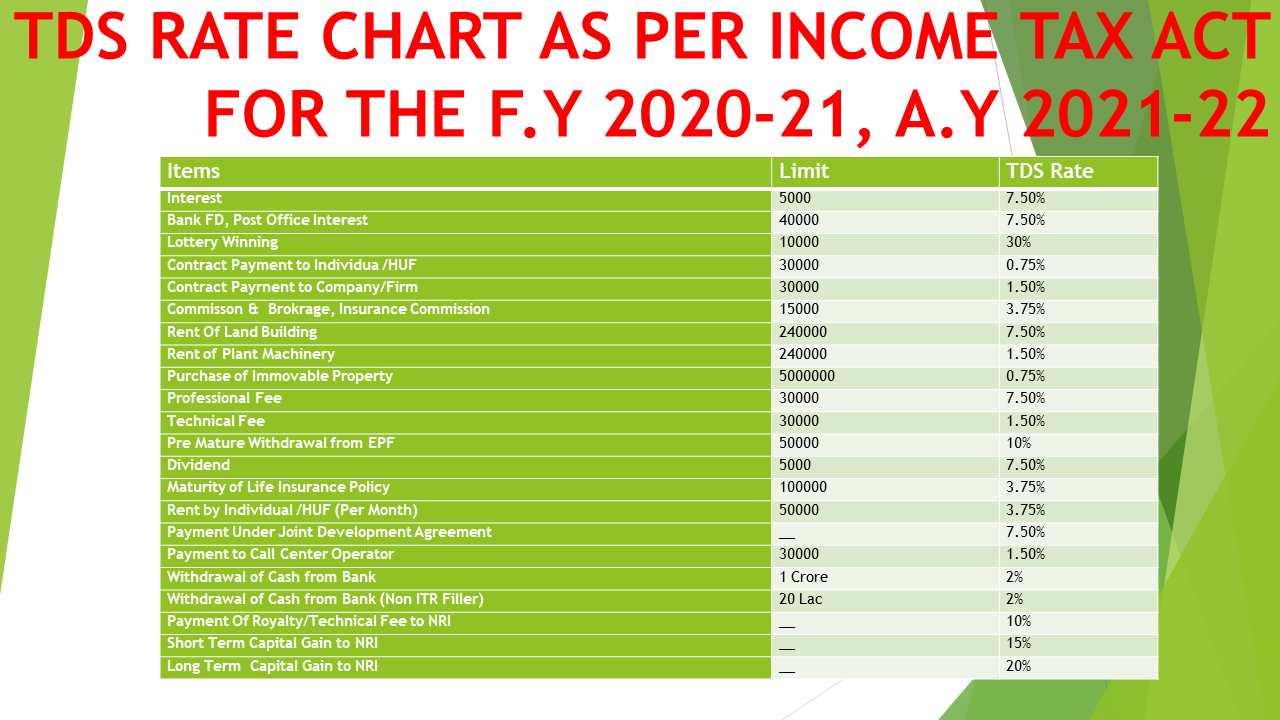

TDS RATE CHART AS PER INCOME TAX ACT FOR THE F Y 2020 21 A Y 2021 22

Deductions U s 80c As Per Income Tax Act 1961

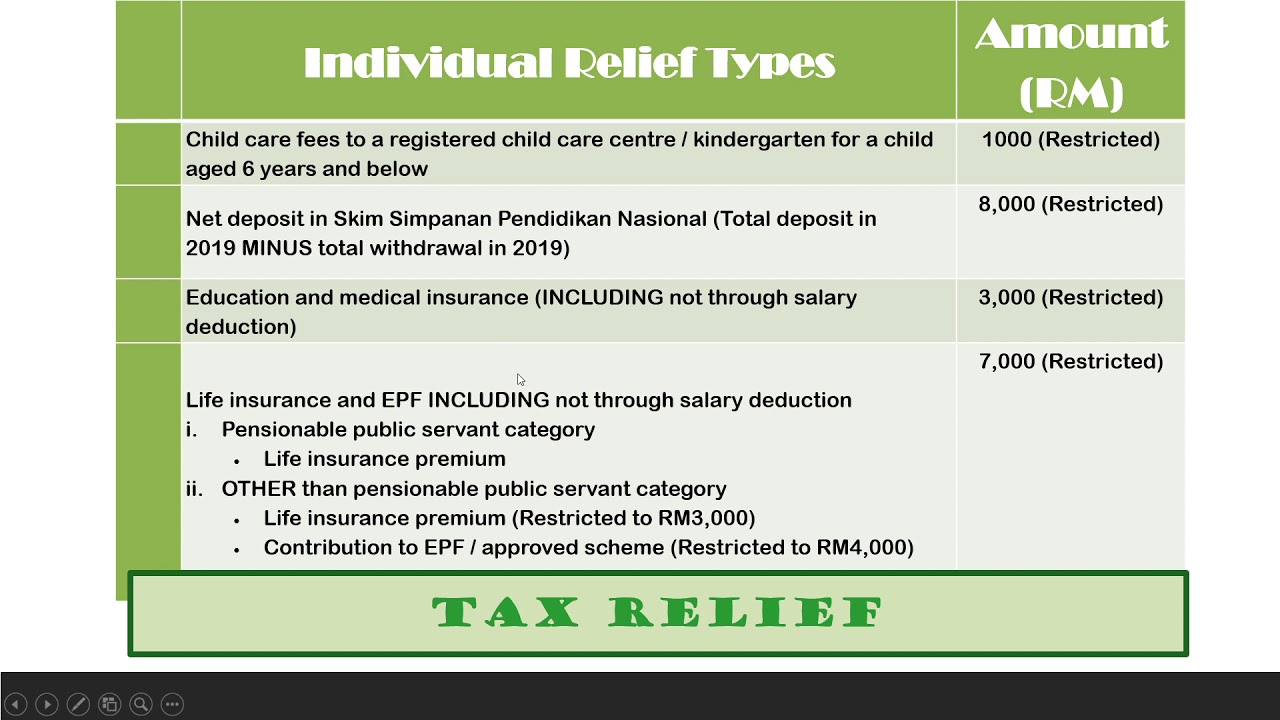

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

ERTL 3 Tax Reliefs And Rebates Part 3 YouTube

B Com Final Year Income Tax 1 Rebate And Reliefs YouTube

Tax Exemption Malaysia 2019

Rebates And Reliefs As Per Income Tax Act - Web Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of