Rebates And Relief Allowed Under Income Tax Act Web Income tax rebates have been provided in the Income tax Act with a view to allow a rebate or relief from the income tax payable which is determined with reference to total income calculated as per provisions of Income tax Act Income tax reliefs are provided to grant relief in specific cases and not as a general relief to all the assessees

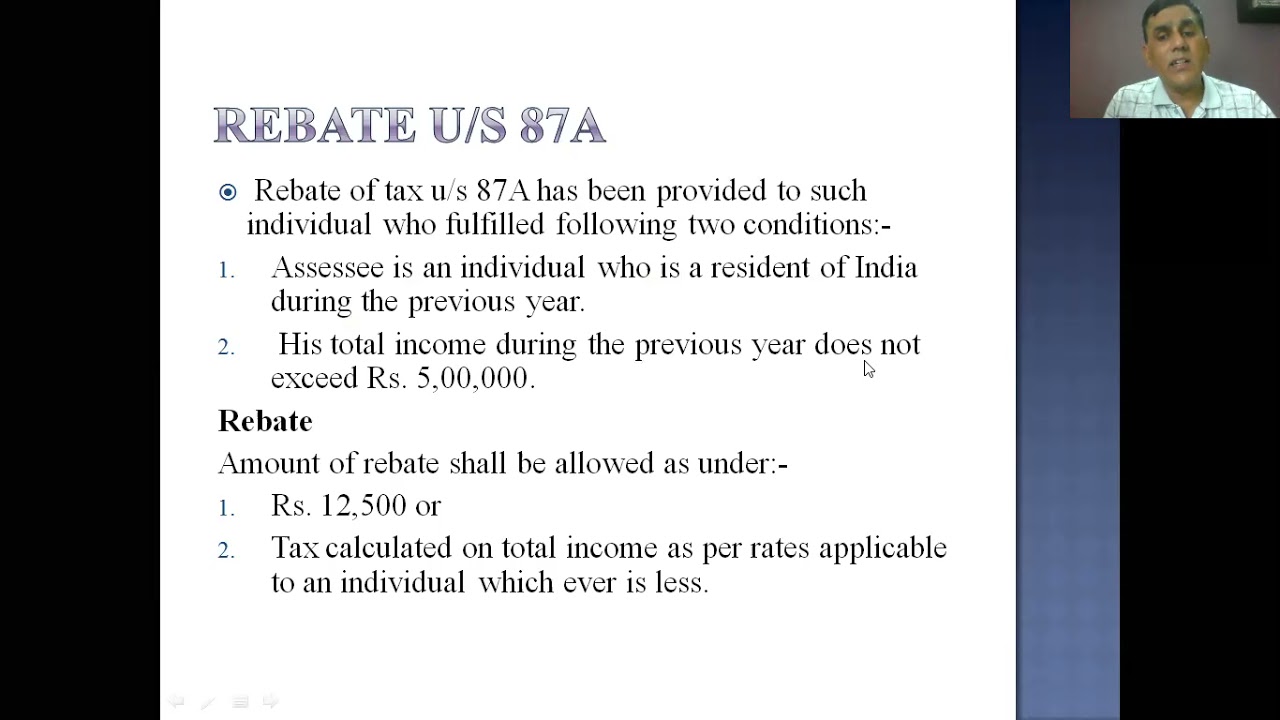

Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F Proper officer F What if party not submitted required documents to the department F Personal Hearing under GST F GST on Incentive amount to insurance agent F E Way Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh

Rebates And Relief Allowed Under Income Tax Act

Rebates And Relief Allowed Under Income Tax Act

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2021/10/REBATE-AND-RELIEFS-UNDER-INCOME-TAX.jpg

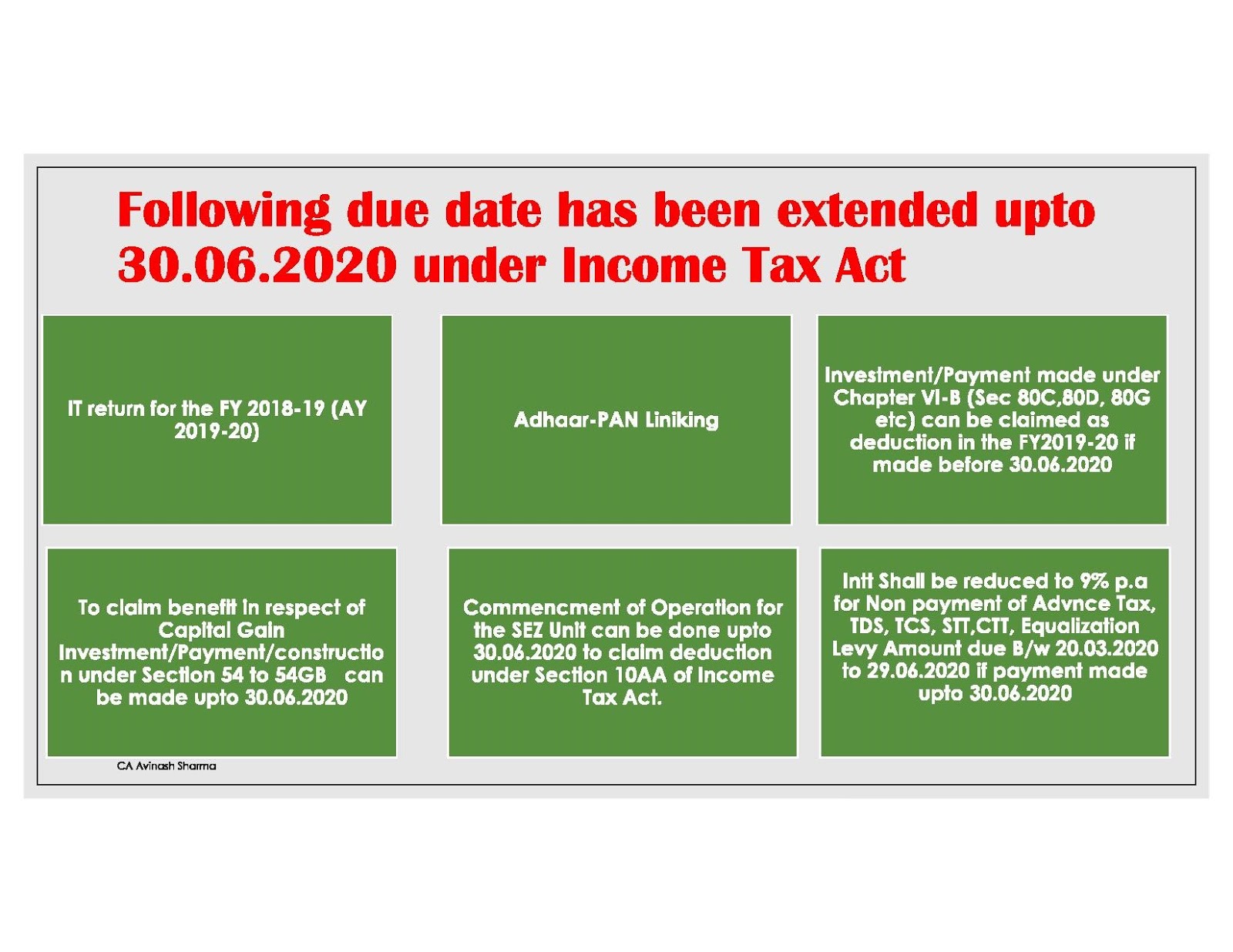

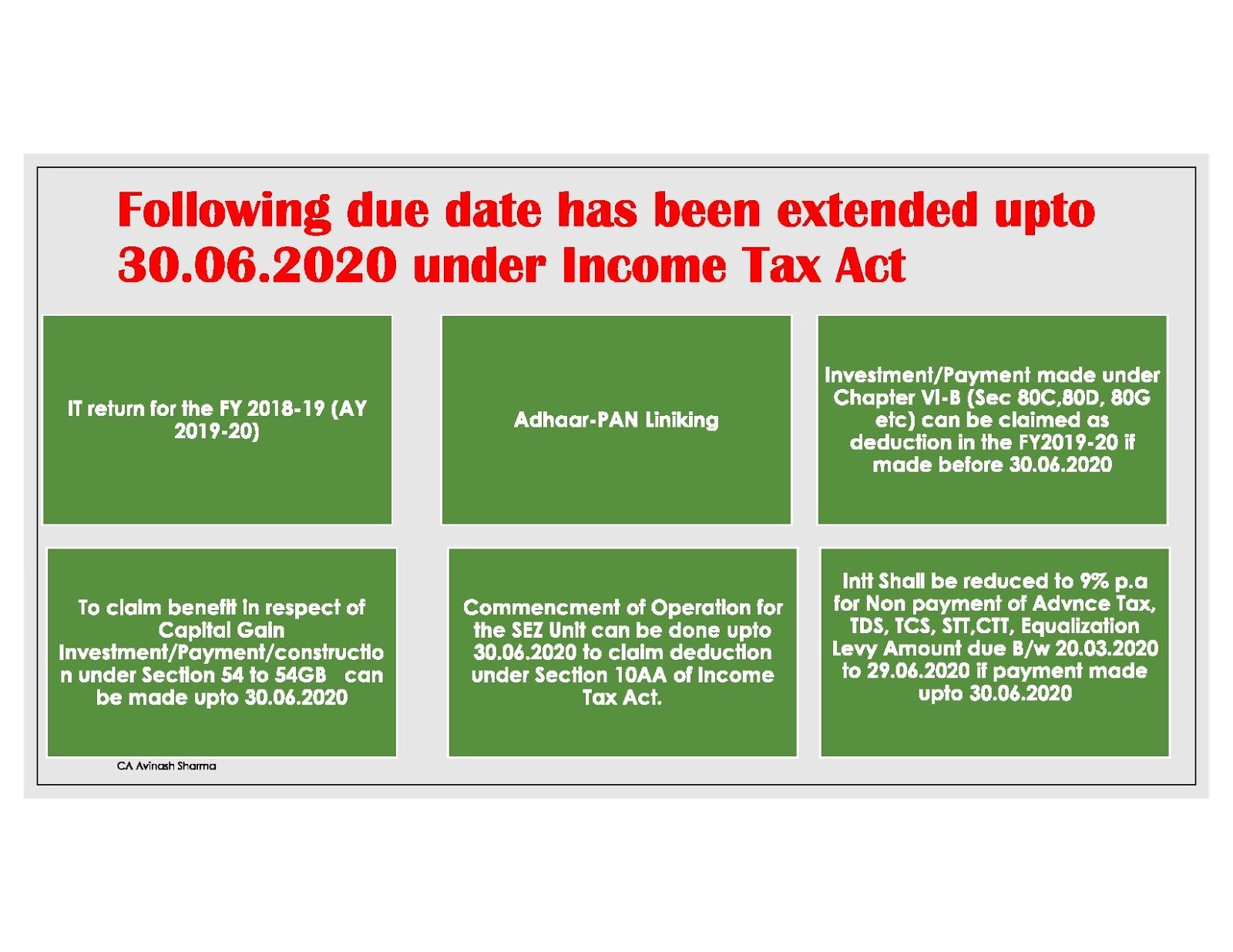

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

https://1.bp.blogspot.com/-URwzarptYIA/XoXVUKy1nII/AAAAAAAAES8/NcAK7-qJ7fMV0VJNLHF0q7oD77USiDU2QCLcBGAsYHQ/s1600/RG2-page-002.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 5 d 233 c 2017 nbsp 0183 32 REBATES AND RELIEFS A Rebate of income tax 87 Rebate to be allowed in computing income tax Web 2 mars 2023 nbsp 0183 32 Tax Relief Basics Tax relief programs and initiatives help taxpayers reduce their tax bills through tax deductions credits and exclusions Other programs help taxpayers who are behind on

Web 5 janv 2021 nbsp 0183 32 The Joint Committee on Taxation JCT estimated that the COVID Related Tax Relief Act of 2020 would reduce federal revenue by 167 3 billion from FY2021 through FY2030 Table 2 4 The Taxpayer Certainty and Disaster Tax Relief Act of 2020 enacted as Division EE of P L 116 260 contains numerous additional tax provisions Web 1 d 233 c 2022 nbsp 0183 32 OVERVIEW Tax rebates encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly by getting cash into consumers hands TABLE OF CONTENTS Getting

Download Rebates And Relief Allowed Under Income Tax Act

More picture related to Rebates And Relief Allowed Under Income Tax Act

Rebates And Reliefs Of Income Tax Law

https://taxguru.in/wp-content/uploads/2022/08/Rebates-and-Reliefs-of-Income-Tax-Law.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Computation Of Tax Liability Rebates Reliefs YouTube

https://i.ytimg.com/vi/NjK-0HX6alg/maxresdefault.jpg

Web 8 sept 2023 nbsp 0183 32 WASHINGTON Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Service announced today the start of a sweeping historic effort to restore fairness in tax compliance by shifting more attention onto high income earners partnerships large corporations Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT INDIVIDUAL IS NOT EXCEEDING Rs 5 00 000 The rebate under this section is allowed only to the resident individual whose net total income is not exceeding Rs 5 00 000

Web CHAPTER VIII REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 Web 1 In computing the amount of income tax on the total income of an assessee with which he is chargeable for any assessment year there shall be allowed from the amount of income tax as computed before allowing the deductions under this Chapter in accordance with and subject to the provisions of sections 87A 88 88A 88B 88C 88D

Section 4a Income Tax Act KaydenqiLewis

https://enterslice.com/learning/wp-content/uploads/2021/06/Some-Common-Penalties-under-Income-Tax-Act-1961.jpg

Tax Reliefs Available Under The Personal Income Tax Act Taxaide

https://taxaide.com.ng/wp-content/uploads/2022/09/methods-for-determining-personal-income-tax_0709135752.png

https://aiftponline.org/journal/2019/february-2019/tax-rebate...

Web Income tax rebates have been provided in the Income tax Act with a view to allow a rebate or relief from the income tax payable which is determined with reference to total income calculated as per provisions of Income tax Act Income tax reliefs are provided to grant relief in specific cases and not as a general relief to all the assessees

https://www.taxmanagementindia.com/visitor/acts_rules_chapter...

Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F Proper officer F What if party not submitted required documents to the department F Personal Hearing under GST F GST on Incentive amount to insurance agent F E Way

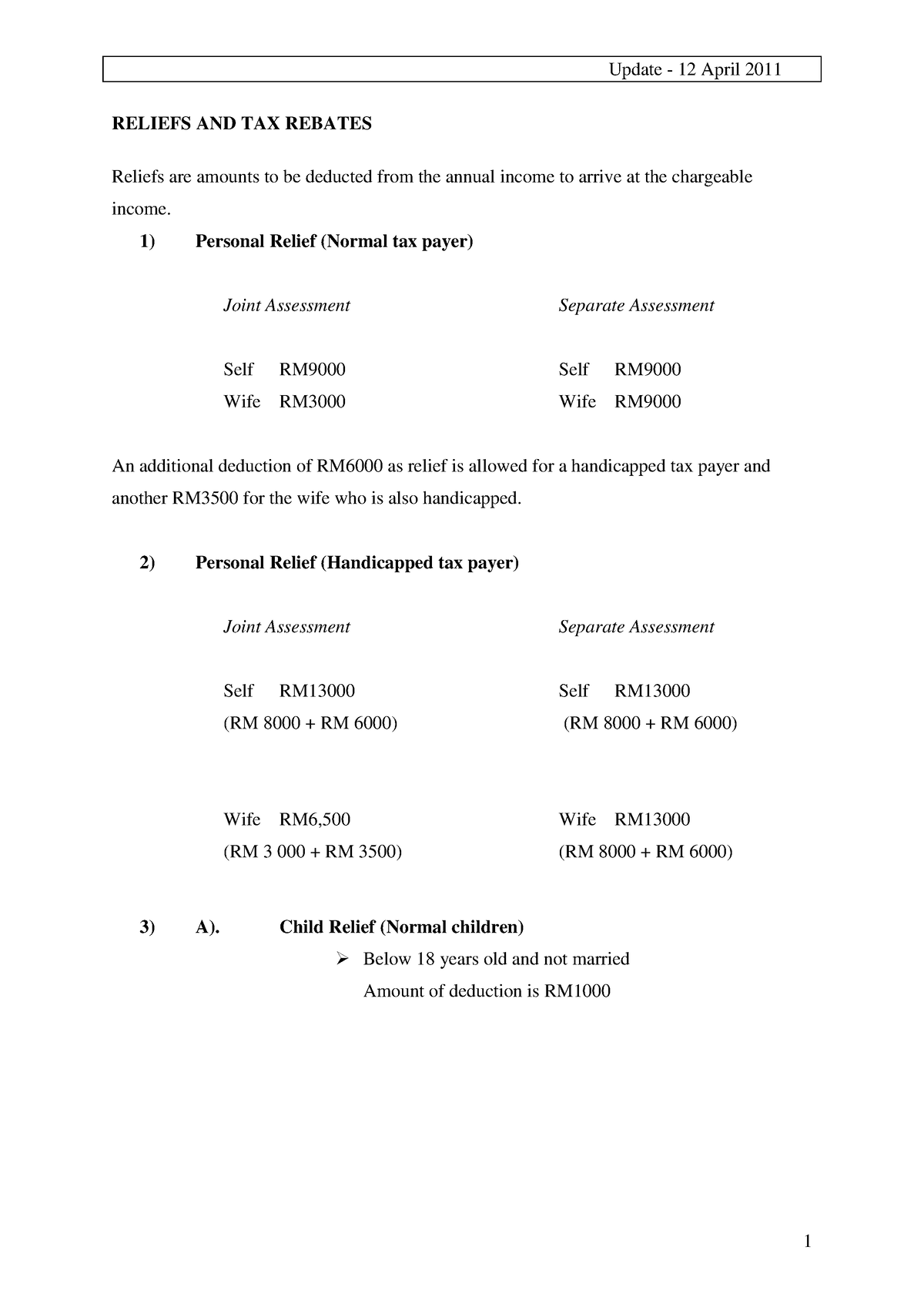

Income TAX reliefs And Rebates RELIEFS AND TAX REBATES Reliefs Are

Section 4a Income Tax Act KaydenqiLewis

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

Understanding Tax Reliefs Loanstreet

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Rebates And Relief Allowed Under Income Tax Act - Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to an income tax rebate and the additional tax amount will be refunded at