How To Get The Rebate Tax Credit A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs Topic B Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit on your tax return you will need to know the amount of any third

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax refund is to file electronically and have it direct deposited contactless The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

How To Get The Rebate Tax Credit

How To Get The Rebate Tax Credit

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

Recovery Rebate Tax Credit En Tax Season Professional Software YouTube

https://i.ytimg.com/vi/Kbu02Z7YXRU/maxresdefault.jpg

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-ss-1.jpg

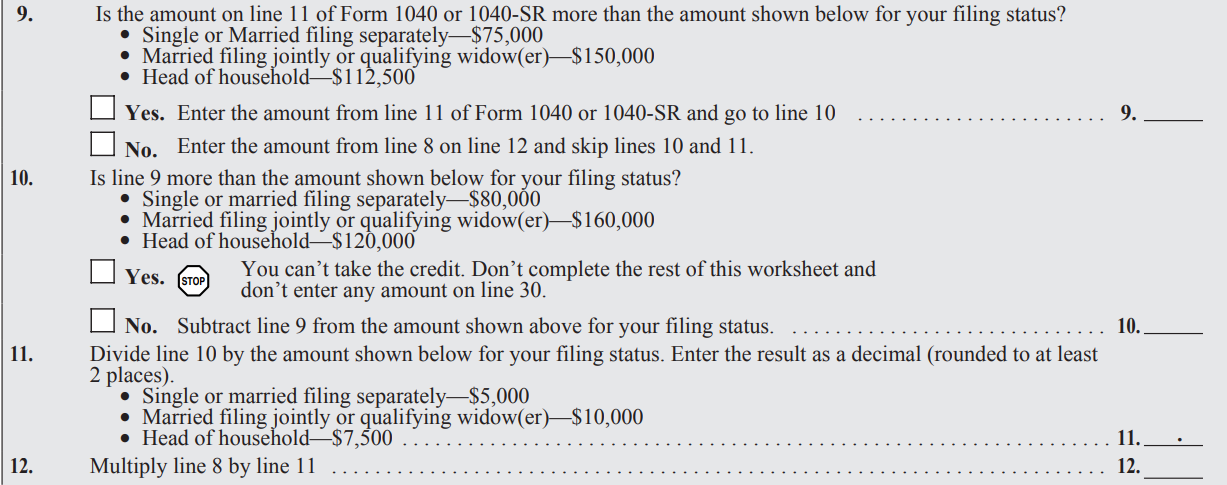

Key Takeaways The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year 2021 You have a Social Security Number valid for employment that is issued before the due date of your 2021 tax return including extensions

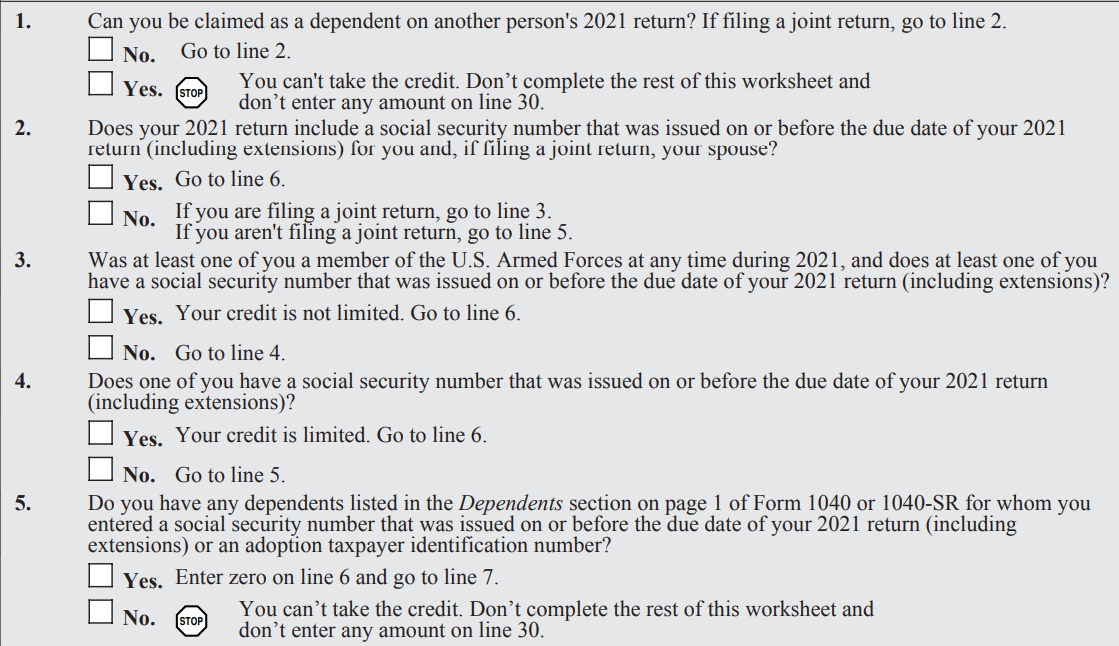

As with the stimulus checks calculating the amount of your recovery rebate credit starts with a base amount For most people the base amount for the 2021 credit is 1 400 For married couples The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020

Download How To Get The Rebate Tax Credit

More picture related to How To Get The Rebate Tax Credit

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Qu Es Un Cr dito De Recuperaci n De Reembolso TurboTax Blog Espa ol

https://blog.turbotax.intuit.com/es/wp-content/uploads/sites/2/2021/01/what-is-a-recovery-rebate-tax-credit.jpg?w=2880&h=1200&crop=1

The deadline to file a 2020 tax return and claim the Recovery Rebate Credit is May 17 2024 This is three years from the original deadline of May 17 2021 which is consistent with the IRS policy that gives taxpayers three years to file a return and claim a refund For the 2021 Recovery Rebate Credit taxpayers have until April 15 2025 to file Scenario 3 Recovery Rebate Credit and a new baby Jo and Nic married in January 2020 and had a baby in October 2020 They were both single on their 2019 returns and they each received 1 200 in first round of stimulus checks in 2020 When they file their 2020 return they will claim their child on the return and determine they should

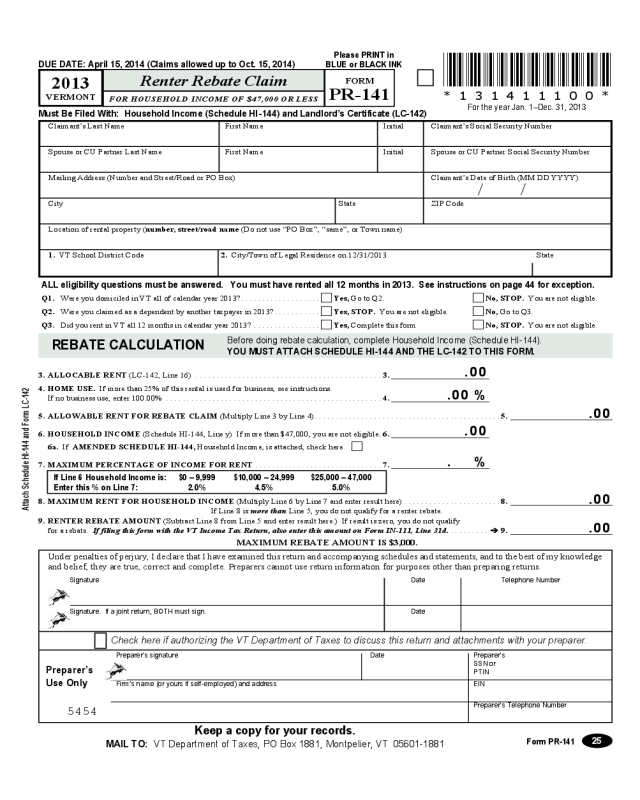

The amount of the credit is 20 of your rent payments in the year up to a maximum credit of 750 for an individual 1 500 for a couple who are jointly assessed for tax If a smaller amount would reduce your income tax to zero that amount is the maximum credit you can get For 2022 and 2023 the credit was 500 for an individual and If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

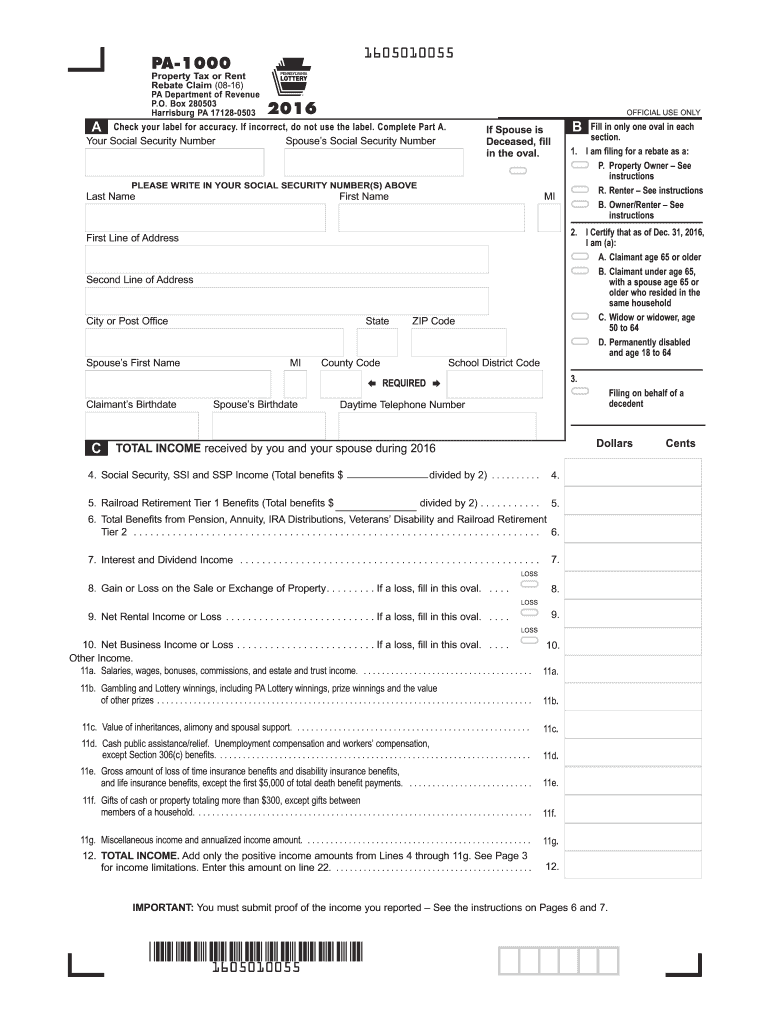

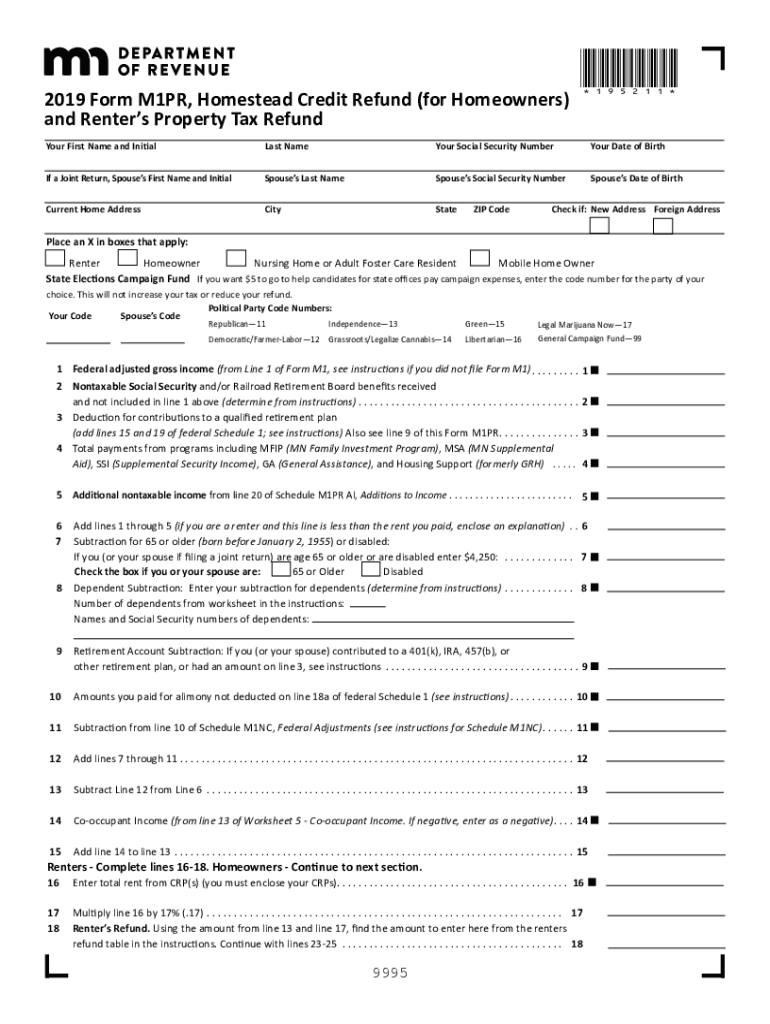

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

https://www.signnow.com/preview/101/125/101125610/large.png

https://www.irs.gov/newsroom/2021-recovery-rebate...

A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs Topic B Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit on your tax return you will need to know the amount of any third

https://www.irs.gov/newsroom/2021-recovery-rebate...

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax refund is to file electronically and have it direct deposited contactless

When Will I Get My Stimulus Check By Mail StimulusTalk

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

The Recovery Rebate Credit Calculator MollieAilie

Alconchoice Com Printable Rebate Form Printable Word Searches

When Are We Getting Second Stimulus Check StimulusProTalk

STIMULUS How To Claim YOUR Recovery Rebate Tax Credit Non Filers

STIMULUS How To Claim YOUR Recovery Rebate Tax Credit Non Filers

Bargain Barton How To Use Menards Rebates

What Is The Recovery Rebate Credit CD Tax Financial

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

How To Get The Rebate Tax Credit - The program provides rebates of 500 750 for the purchase of an e bike and a refundable tax credit of 30 of the cost of a qualified electric bicycle One of the benefits is that the rebate for electric bicycle customers would be up to 500 while it would be 750 for low and moderate income consumers The Healey Administration says they