How To Get Vat Refund From Hmrc This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can claim a

How to claim a refund using the EU VAT refund system Check VAT notice 723A for how to make a claim Continue to check this guidance for updates If you re eligible to use the If you meet the conditions you can use the system to claim back VAT on invoices for goods only You will need to use 13 th Directive process for everything else such as VAT on

How To Get Vat Refund From Hmrc

How To Get Vat Refund From Hmrc

https://image.mfa.go.th/mfa/0/4a5AsMHake/ประชาสัมพันธ์_บทความ/VAT_refund.jpg

UAE VAT Refund A Handy Guide For Businesses MBG

https://www.mbgcorp.com/ae/saseraf/2021/12/Blog-7-Image-how-to-get-vat-refund.jpg

How To Get A VAT Refund In The UK With An App London Tips Travel

https://i.pinimg.com/736x/c5/28/1c/c5281c867db2558527372a69fc2ab8b4.jpg

HMRC include an example of an acceptable letter at section 3 7 7 of VAT Notice 723A HMRC suggests any repayments be made using the SWIFT payment mechanism To get a refund you must send your application to the authorities in the EU country where you incurred the VAT Some EU countries will only grant you a refund if the

If you re registered for VAT you can claim that back You do this by reporting how much VAT you paid during a period of time HMRC balances the amount you ve paid against Online You can make changes online via your VAT online account To change your details online follow the following steps Sign in to your Government Gateway Go to Manage

Download How To Get Vat Refund From Hmrc

More picture related to How To Get Vat Refund From Hmrc

How To Get VAT Refund In UK Amazon Business Prime VAT Refund From

https://i.ytimg.com/vi/Iwfr_BB7ISs/maxresdefault.jpg

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

How To Understand And Review Your VAT Return Bokio

https://www.bokio.co.uk/media/40400/2-1_review_submit_vat.png?width=810&height=570.5375139977604&format=webp

How to claim a UK VAT refund If you d like to make a VAT refund application here are the things you need to do Fill out your VAT return form Every quarter you must submit a If you re claiming a VAT refund HMRC will usually pay it directly into your bank account within a few weeks If you owe VAT to HMRC you ll need to make a payment

You must submit a VAT return to HMRC every three months to claim your refunds As well as showing the VAT you ve paid you need to show the VAT you ve charged your Guidance Refunds of VAT paid in the UK on or before 31 December 2020 by EU businesses Reclaim VAT you ve paid on goods and services bought in the UK on or

VAT Return Template

https://www.easybooksapp.com/hubfs/VAT-Return-LP_2x.png#keepProtocol

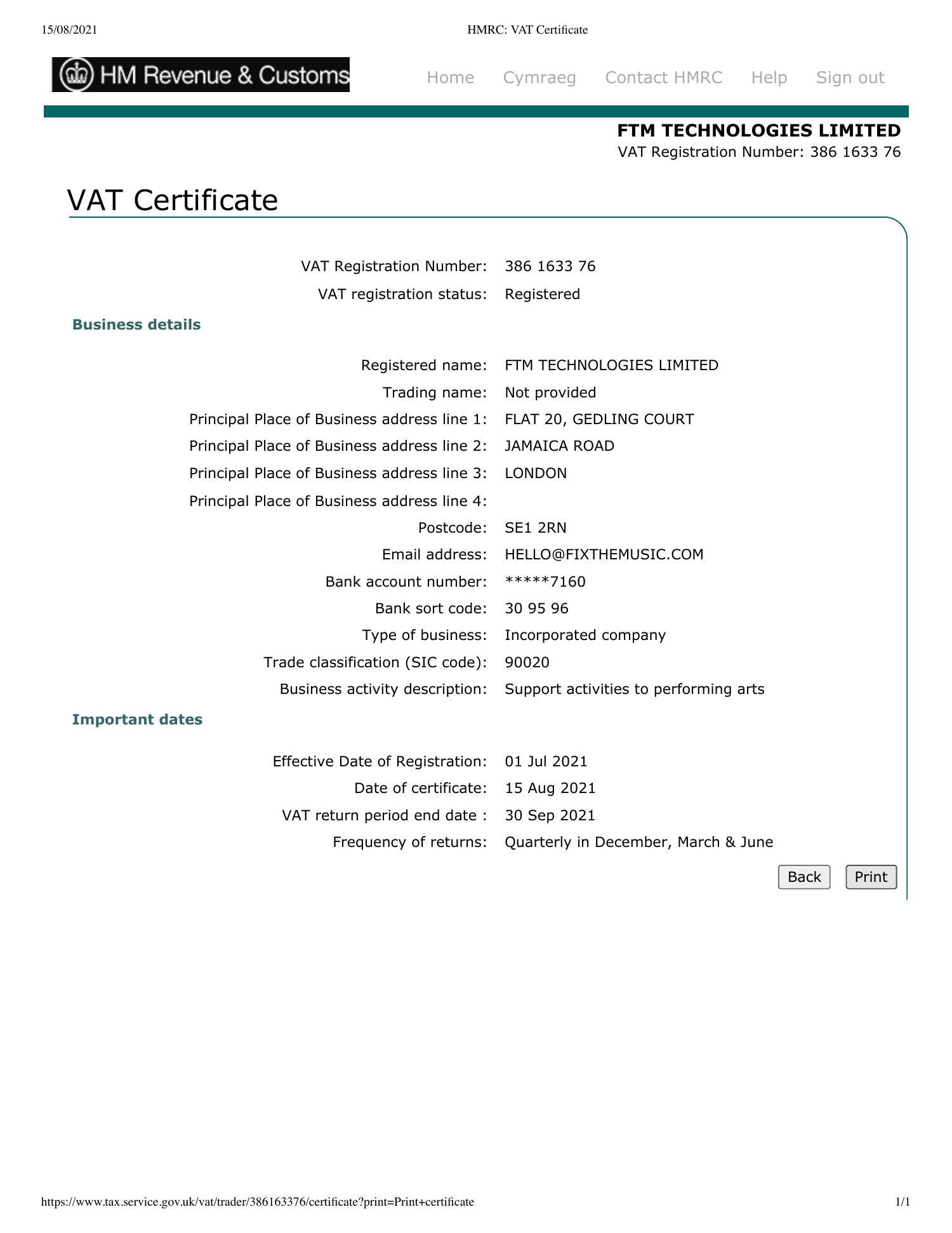

HMRC VAT Certificate pdf DocDroid

https://www.docdroid.net/file/view/6Vz7Tly/hmrc-vat-certificate-pdf.jpg

https://www.gov.uk/guidance/refunds-of-uk-vat-for...

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can claim a

https://www.gov.uk/government/publications/...

How to claim a refund using the EU VAT refund system Check VAT notice 723A for how to make a claim Continue to check this guidance for updates If you re eligible to use the

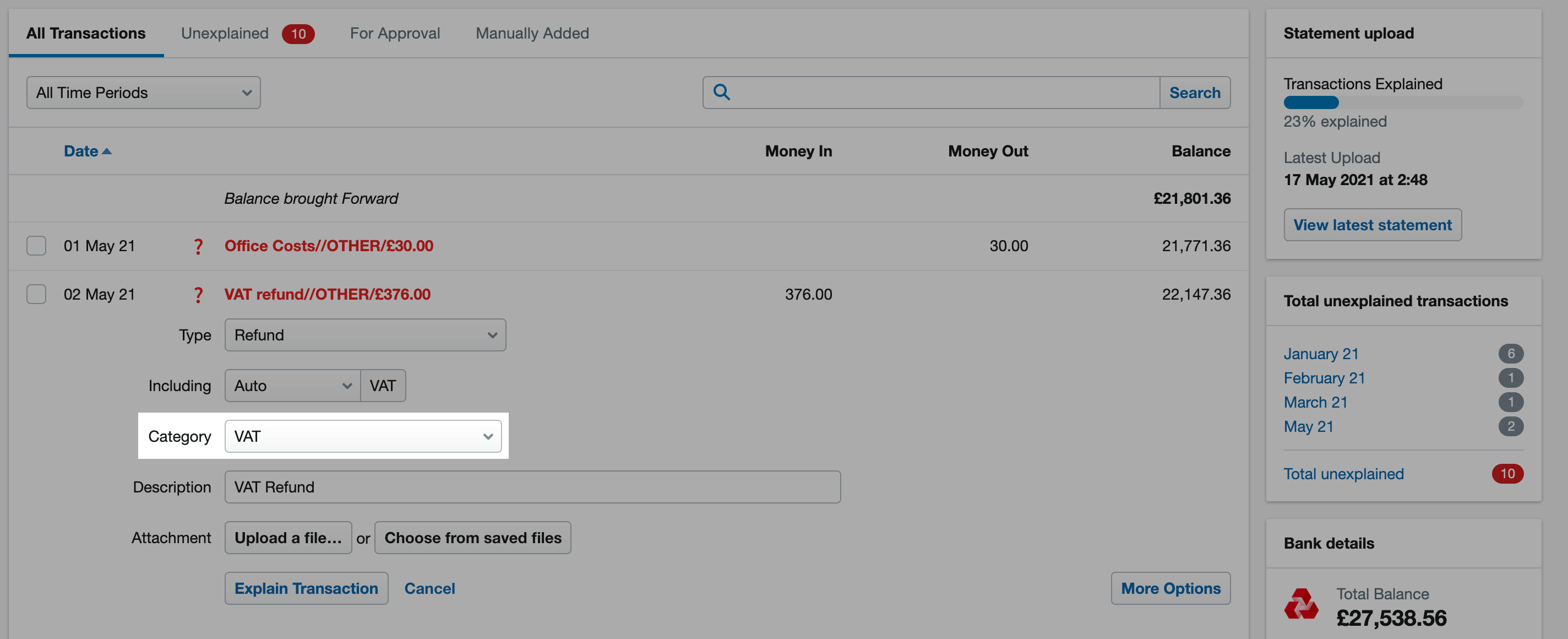

How To Explain A VAT Refund From HMRC FreeAgent

VAT Return Template

How To Compute VAT Payable Business Taxes Can Be Either A Percentage

UK VAT Return After Brexit Vatcalc

How To Get A VAT Refund Italy The Step By Step Process

A Complete Guide To VAT Codes The Full List Tide Business

A Complete Guide To VAT Codes The Full List Tide Business

How To Get VAT Refund For Business AllTopStartups

How To Get A VAT Refund Travelsim

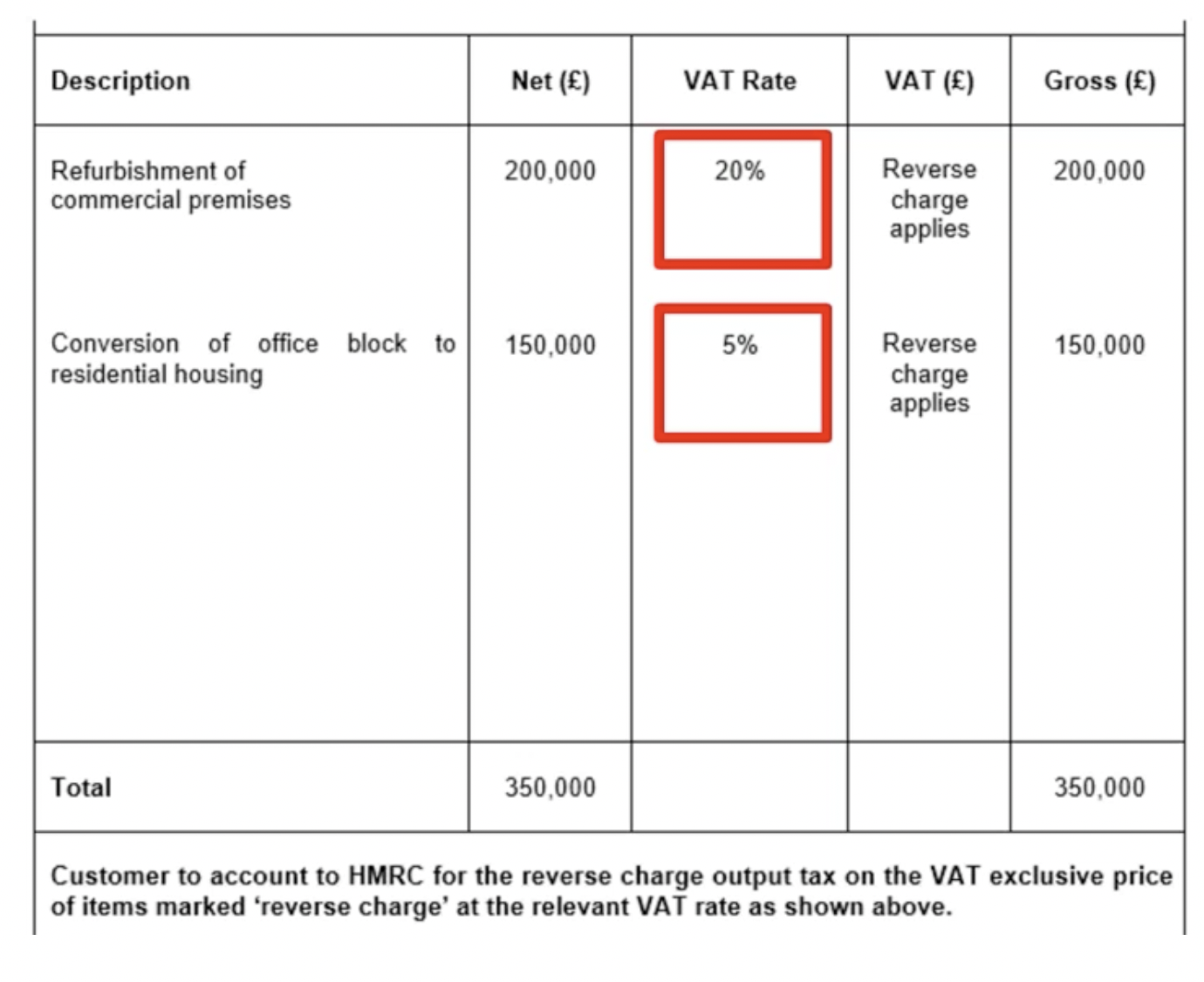

Cis And Vat Reversal Invoice Template SexiezPicz Web Porn

How To Get Vat Refund From Hmrc - This article describes how to explain a VAT refund that has been paid into your bank account by HMRC Once the relevant bank transaction has been imported into your